SzB CapitaLand Investment logo (CapitaLand website)

Investment thesis

In April last year, I wrote an article titled “Go Big Or Go Home” on the proposed split of the property giant CapitaLand in Singapore.

The split took the property development portion of the company private and merged their property management and investment into CapitaLand Investment Ltd (OTCPK:CLILF). It started trading under this name on the 20th of September 2021.

It has a market capitalization of SGD 19.7 billion and has assets under management of SGD 124 billion, which equated to USD 89.4 billion.

Part of this is 5 REITs that they started and are sponsors of with stakes between 18% and 39%. They are CapitaLand Integrated Commercial Trust, Ascendas REIT, Ascot Residence Trust, CapitaLand China Trust, Ascendas India Trust, and CapitaLand Malaysia Trust. These REITs own 375 properties spread across the globe but mostly focused on Singapore and China. The sponsor’s stake has a market value of SGD 7.7 billion.

It has a goal to reach around SGD 100 billion by 2024 of funds under management.

CLILF can be bought in the U.S., but I am unsure about which brokers execute trades in this name. My suggestion would be to consider buying the stock on the Singapore Stock Exchange through your broker.

The stock has been off to a very good start.

CLILF up 30% since commencement of trading (SA)

Let us take a look under the hood to see if it is a good investment.

Financials

As CLILF only published financial results twice a year, an interim report after FH and a final report for FY. They do however give some guidance on the development as they reported the revenue.

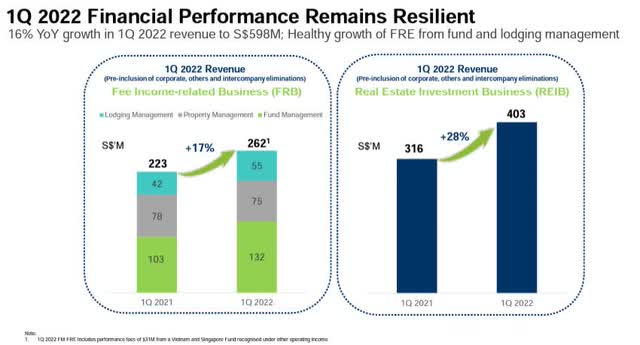

CapitaLand Investment – Revenue 1st Q of 2022 (CapitaLand Investment 1st Quarter Update)

I always like to see a company’s profitability, its balance sheet, and its ability and willingness to return some of the money they make back to all its shareholders.

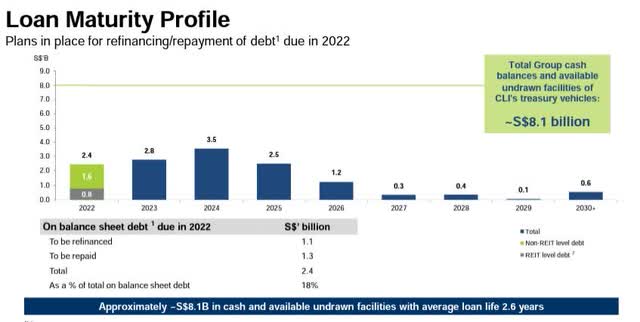

As of 31st March 2022, the company held SGD 8.1 billion in the group’s cash and undrawn facilities which is plenty to support the operation and still have dry gunpowder should new investment opportunities arise.

Their gearing is healthy, with a net debt to equity of 0.48x and net debt to total assets of just 0.29x

The implied interest cost is 2.6% with an interest coverage ratio of 6.2x. Here is their loan maturity schedule.

CapitaLand Investment – Loan Maturity Profile (CapitaLand Investment – 2nd Q of 2022 Update)

In terms of profitability, the ROE was 8.7% in 2021 which is acceptable.

The NAV per share was SGD 3.123 which gives us a Price/NAV of 1.23

EPS for FY 2021 was Singapore cents 26.23

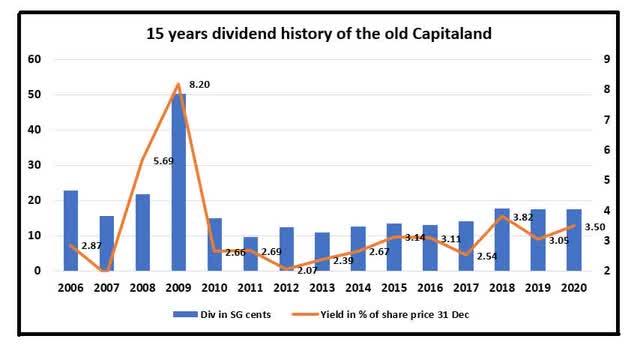

The “old” CapitaLand did not have a very good track record in terms of a stable dividend.

CapitaLand – 15 year dividend and yield history (Data from SA and CapitaLand. Graph by author)

Nevertheless, it says in the gospel that “the old life is gone, and a new life has begun!” However, judging from their first year where they declared and paid out a dividend of Singapore cents 15, it gives investors a dividend yield of 3.92% which is not fantastic.

Time will tell if they will distribute more in the coming years.

Business development

Although they do not report financial results each quarter, they do give investors and shareholders business updates every quarter.

In their first quarter of 2022 business update, they reported good news as the reopening of economies from the COVID-19 pandemic was starting to benefit the company. One example of this was the increased activities both in Singapore and China which are important markets for the company.

However, it has also come with new challenges as inflation is taking its toll on consumer sentiment and a rising interest rate environment. We have also seen an uptick in COVID-19 cases in China so it will be interesting to see the response from the government. I do believe it might be somewhat less draconian.

Conclusion

I do like their business philosophy of recycling capital as this is one of the more profitable sides of property investments.

After all the leasing out activities is competitive as capitalization rates, referred to as just cap rates, are usually very low. As I pointed out in my book on value investing, the reference to this book is below, you do not get rich from renting out a property. Most of the money lies in the appreciation of an asset. Therefore, if one is clever in recycling capital, it makes all the difference.

Investors are clearly pleased with the “new” CapitaLand Investment. Not only has it gone up 30% since it started trading, but it has been able to beat the Straits Times Index and the S&P 500 so far this year.

CLILF against STI and the S&P 500 (Yahoo Finance)

The sixty-four-thousand-dollar question is whether all the “good news” is already priced in?

It will depend a lot on whether we are in for a long period of stagflation, which is what I would like to call it, or if it is a short-lived one.

I do believe CLILF is conservatively funded and well positioned. Nevertheless, I believe the share price is fair and leaves little safety margins.

As such I place a Hold stance on CLILF at this moment.

Be the first to comment