porcorex

There is room for debate on externally versus internally managed BDCs, and which structure is better for investors. On one hand, large externally managed ones such as Ares Capital (ARCC) benefit from their affiliation to “big brother” asset management advisors, but they also come with higher cost structures as well.

On the other hand, internally managed ones such as Main Street Capital (MAIN) may not have the backing of a large asset manager, but have far more efficient cost structures which ensure that more dollars flow to the bottom line for their shareholders.

This brings me to the up-and-coming internally-managed BDC, Capital Southwest (NASDAQ:CSWC). In this article, I highlight why this growing BDC is an attractive buy at present for income investors, so let’s get started.

Why CSWC?

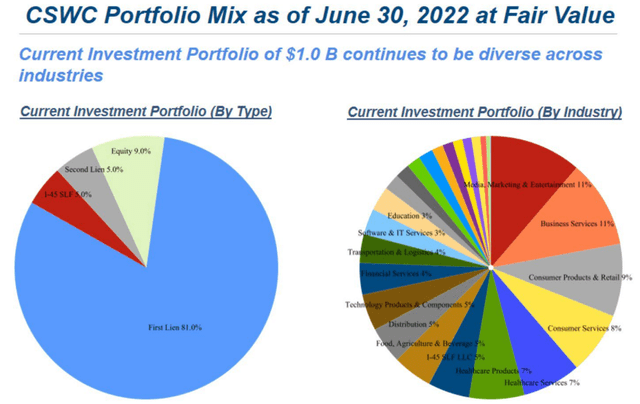

Capital Southwest is a BDC that’s based in Dallas, Texas, and at present, carries an investment portfolio with a $1.0 billion fair value. The portfolio is well-diversified across 39 investments, with each investment averaging just 2.6% of the total portfolio.

It’s focused on the highly fragmented and less competitive lower middle market, and the investments are spread across everyday industries, with media/marketing, business services, consumer products & services, and healthcare comprising its top sectors, representing 46% of portfolio fair value.

Notably, CSWC also partners with Main Street Capital to manage the I-45 Senior Loan Fund (in a reference to the highway that runs between Dallas and Houston, where MAIN is based). The I-45 SLF portfolio represents 5% of CSWC’s portfolio, and consists of $173.5 million in invested capital with an average hold size of just 2.6% and is 95% comprised of first lien senior secured debt.

CSWC also maintains 9% exposure to equity investments, giving it upside potential to its NAV per share and continued funding potential for its special dividends. As shown below, much of the remainder of CSWC’s portfolio is comprised of senior secured debt (81% first lien, and 5% second lien).

CSWC Portfolio Mix (Capital Southwest)

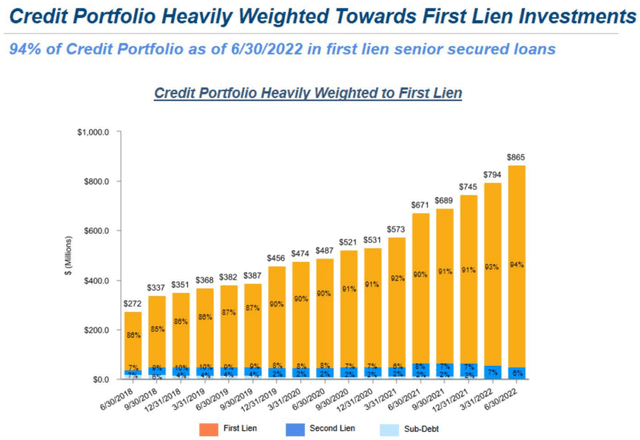

Moreover, management has increasingly positioned the credit portfolio towards safer first lien debt investments. As shown below, the ratio of first lien debt has increased by 800 basis points over the past 4 years, from 86% in 2018 to 94% at present.

CSWC Debt Portfolio (Capital Southwest)

Meanwhile, CSWC just reported strong fiscal first quarter 2023 results (ended June 30th), with net investment income of $0.50 per share, representing 11% YoY growth from the $0.45 last year. Also encouraging, management just raised the regular quarterly dividend to $0.50, which matches the aforementioned fiscal Q1 NII per share. This represents an impressive 16% growth over the $0.43 paid out during the September quarter of last year.

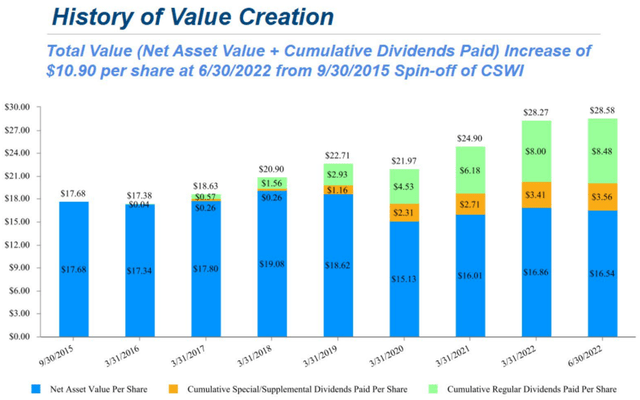

CSWC has an impressive track record of increasing its regular dividend and paying out special dividends. As shown below, it has a history of strong total returns since spin-off from CSWI in 2015.

CSWC Value Creation (Capital Southwest)

Moreover, CSWC’s portfolio is growing well, and has now surpassed the $1.0 billion mark representing 7.5% growth on a sequential basis, and 26% growth year-on-year. This was driven by $148 million in new commitments across 6 new portfolio companies.

Importantly, CSWC is growing in an accretive manner as it raised $46.8 million in equity proceeds through its ATM (at-the-market) program last quarter at an average price of $20.60, equating to a 123% premium to NAV per share.

Non-accruals remain low, representing 1.6% of portfolio fair value, and since the end of Q1 FY23, CSWC has restructured one of its non-accruing loans that resulted in Capital Southwest equitizing a portion of its debt, providing it significant participation in the company’s turnaround.

NAV per share did decline by 1.9% YoY to 16.54, but this was more of a function of the special dividend of $0.15 that was paid out and depreciation on its I-45 portfolio, stemming from mark-to-market activity in the syndicated market, likely due to wider credit spreads, rather than realized losses.

Importantly, CSWC’s increasing scale has led to positive operating leverage. As shown below, CSWC’s operating expense as a % of total assets has decreased every year, and now sits at 2.1%, thereby ensuring that more capital flows to the bottom line for the benefit of shareholders.

Looking forward, CSWC appears to be well-positioned for growth, as shares are currently trading at a premium to NAV and it carries reasonably low leverage with a debt to equity ratio of 1.1x, sitting well below the 2.0x regulatory limit. It also maintains strong liquidity, with $180 million in cash and undrawn capacity on its revolving credit facilities.

While BDCs are generally valued based on their price to book values, I believe well-run internally managed should be valued based on earnings. That’s because their lower cost structures enable higher capital returns despite them trading at a premium to NAV.

As such, I see value in CSWC at the current price of $19.90 with a forward PE of just 9.7x, based on analysts’ FY23 EPS estimate of $2.05. Sell side analysts have a consensus Buy rating on CSWC with an average price target of $23.67, translating to a potential one-year 29% total return including the regular dividends alone.

Investor Takeaway

Capital Southwest Corporation is a well-run internally managed BDC that has delivered strong risk-adjusted returns for shareholders since its inception. It has a diversified portfolio with a focus on first lien debt investments, and its shares are trading at a reasonably low valuation.

It also continues to make progress towards lowering its cost structure as a percent of total assets, thereby helping to ensure more capital flows to benefit shareholders. This is a key reason for why CSWC offers a high yield despite trading at a premium to NAV. For these reasons, I believe CSWC is an attractive investment for income-oriented investors.

Be the first to comment