8vFanI/iStock via Getty Images

The Fed just raised its rate by 75 basis points this week, and the market had a hissy fit, sending most everything south. The Fed also is set on a pathway for further rate increases, in its bid to squash inflation, which has reared its head after a long respite.

Many companies will see their interest expenses rise, but the ones whose management was savvy enough to lock in debt at fixed rates should do just fine. Moreover, companies whose income is tied to floating rates should do even better.

Such is the case with certain BDC’s, such as Capital Southwest Corporation (NASDAQ:CSWC), an internally-managed business development company, a BDC.

Profile:

CSWC is an internally managed BDC specializing in credit and private equity and venture capital investments in lower and middle market companies with EBITDA between $3M and $20M, and leverage of 2X to 4X Debt/EBITDA through CSWC’s debt position.

Rising Rates Are A Tailwind For CSWC:

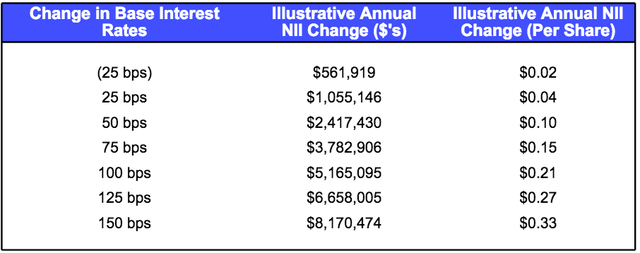

98% of CSWC’s income is tied to floating rates, while only 38% of its liabilities are floating rate securities.

Management estimates that a 75 basis point hike, like the one that the Fed just did, will add ~$.15 in annual NII/share, while a 150 basis point hike will ad ~$.33/share annually. With the Fed for another hike at its next meeting, we could to 150 basis points sooner than later.

CSWC site

Another plus for CSWC is that 89% of its investments in companies are co-sponsored by hedge funds and venture funds, which also give support to these companies during tough times, such as during the pandemic lockdowns.

Ratings:

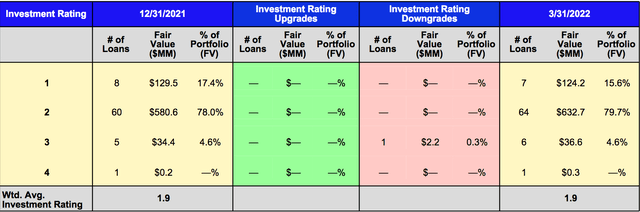

CSWC’s management reviews and rates its holdings quarterly, using a 4-tier system, with 1 being the highest rating, and 4 being the lowest. As of 3/31/22, over 95% of CSWC’s holdings were in the top 2 tiers, stable vs. Q4 2021. There was one loan downgraded in the quarter, worth $2.2M, just 0.3% of the portfolio.

There are three debt investments currently on non-accrual with a fair value of $14.0 million, representing 1.5% of the total investment portfolio, with no additional debt investments placed on non-accrual during the quarter.

CSWC site

Portfolio:

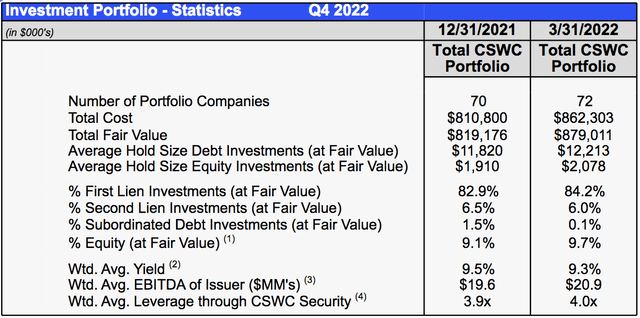

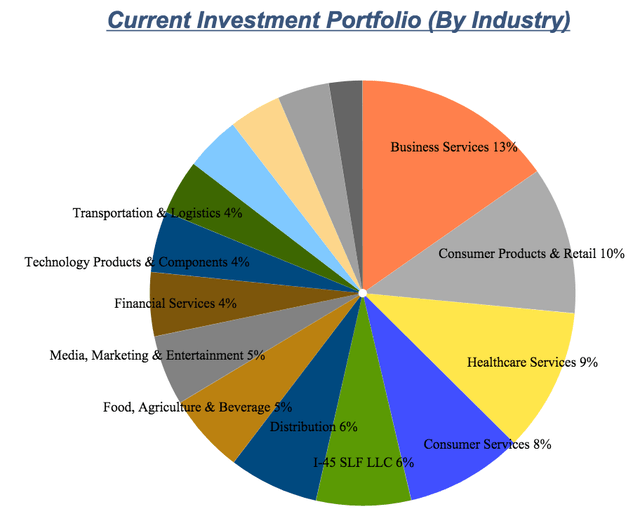

CSWC has a Credit Portfolio of $793.8M, with investments in 72 companies, up 2 vs. Q4 ’21. 84.2% of the investments are 1st Lien, 6% are 2nd Lien, and there is 9.7% in Equity investments. The weighted average yield is 9.3%.

The average annual EBITDA of these companies is $20.9M, with average leverage being 4X.

CSWC site

Management grew CSWC’s total portfolio at fair value by 36% year-over-year to $937M from $688M during the fiscal year.

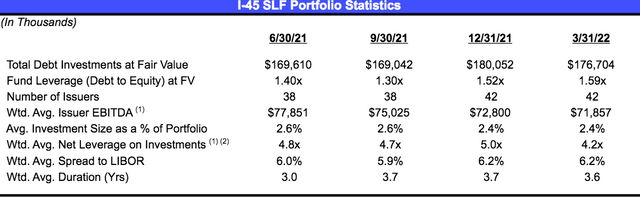

In addition to its controlled investments, CSWC also manages a JV – its I-45 Senior Loan Fund (“I-45 SLF”), in partnership with Main Street Capital. As of 3/31/22, that portfolio held ~$176M in debt investments in 42 companies, with an average issuer EBITDA of ~$78M, and a 6.2% LIBOR spread:

CSWC site

Business Services remains CSWC’s biggest industry investment, dropping 100 basis points to 13% in Q1 ’22, vs. 14% in Q4 ’21. Healthcare also dropped 100 basis points to 9%, while Consumer Products & Retail rose 1% again, to 10%. Media & Entertainment dropped from 6% to 5%, after declining from 9% to 6% in Q4 ’21. Overall, CSWC’s industry exposure looks diverse.

CSWC site

Earnings:

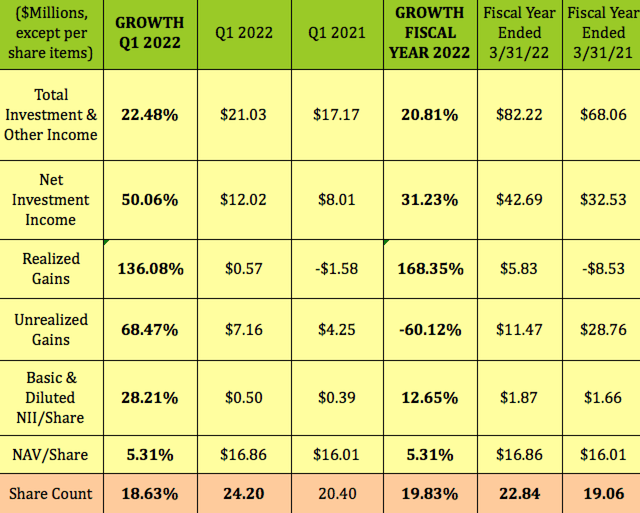

CSWC had strong earnings in its fiscal year ending 3/31/2022, with double-digit growth in total and Net Investment Income, and in NII/share.

The good times continued to roll in Q1 2022, with Total Investment & Other Income up 22.5%, NII up 50%, and NII/share up 28.2%, even with an 18.6% rise in the share count. CSWC raised $25.2M in its ATM program during Q1 ’22.

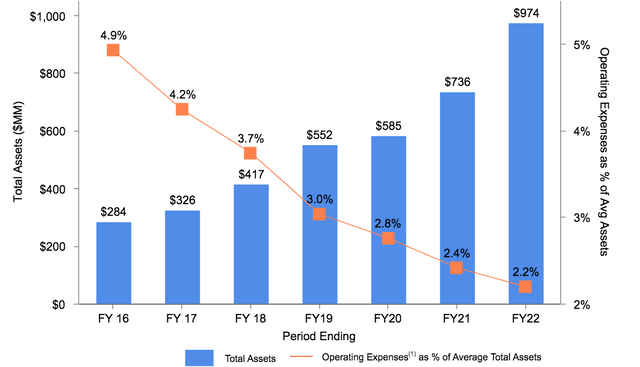

Hidden Dividend Stocks Plus

On the expense side, being internally managed has helped CSWC whittle down its operating expenses % over the past several years, which have improved all the way from 4.9% in 2016, to 2.2% in fiscal year 2022, (fiscal year ended 3/31/22).

CSWC site

New Business:

In Q1 ’22, management originated $102.8M in new commitments, with investments in three new portfolio companies totaling $50M, two refinancing transactions totaling $40.9M, and add-on commitments in eight existing portfolio companies totaling $11.9M.

It received four debt prepayments generating total proceeds of $49.2M, with a weighted average IRR of 12.9%. CSWC has a cumulative IRR of 14.4% on 60 portfolio company exits, generating $694.4 MM in proceeds since its spin-off in September 2015

Dividends:

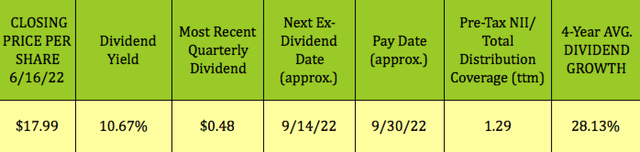

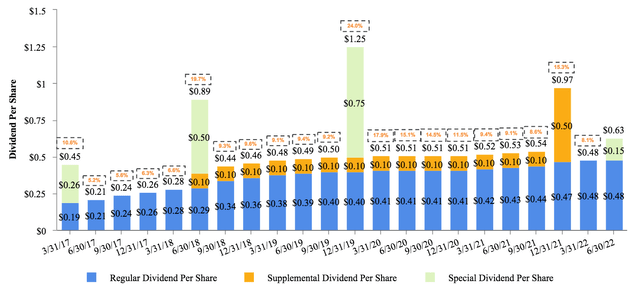

The most recent quarterly dividend was $.48, giving CSWC a forward dividend yield of 10.67%. It has a very impressive four-year dividend growth rate of 28.13%. You’ll see an even higher dividend growth five-year rate for CSWC, simply because it only paid $.38 in 2016, and then jumped 205% in 2017, paying $1.16. It should go ex-dividend next on ~9/14/22.

Hidden Dividend Stocks Plus

In addition to growing its regular quarterly dividends, CSWC also has paid many smaller supplemental dividends, and some occasional large special dividends:

CSWC site

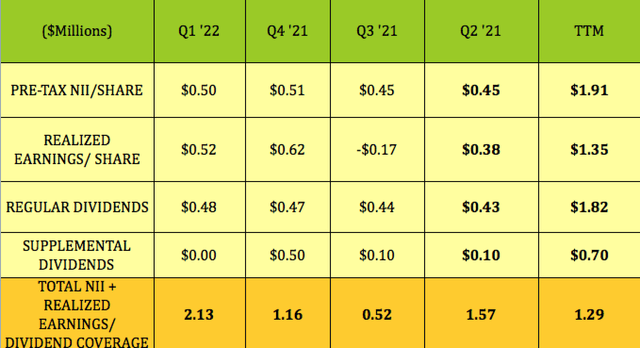

The dividend coverage consists of pretty steady pre-tax NII/share and Realized Earnings, which can be lumpy on a quarterly basis, due to timing issues.

Dividend coverage was a very strong 2.13X in Q1 ’22, and has averaged 1.29X over the past four quarters. CSWC’s Undistributed Taxable Income, UTI balance as of 3/31/22 was $0.47/share.

Hidden Dividend Stocks Plus

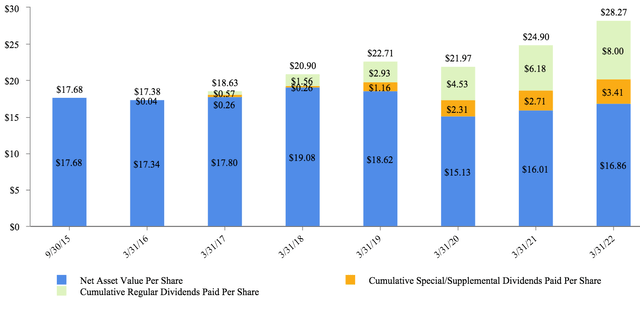

CSWC has paid cumulative total dividends of $11.41/share, comprised of $8.00 in regular dividends and $3.41 in special/supplemental dividends, as of 3/31/22. That more than compensates for the 3/31/22 NAV/share of $16.86 being lower than the 9/30/15 NAV of $17.68.

CSWC site

Profitability and Leverage:

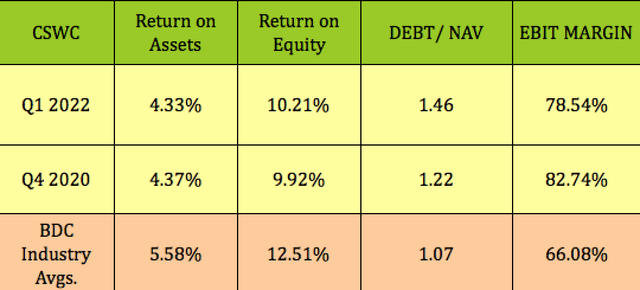

ROE rose a bit in Q1 ’22 vs. pre-pandemic Q4 ’20, while ROA was steady. Management ramped up debt in order to fund new business, which is a normal practice in the BDC industry, since these companies must pay out 90% of their taxable income each year. The trick is finding BDCs with management who can properly handle debt, without getting over-leveraged. CSWC’s management has a targeted leverage range of ~1.2 to 1.4X.

Hidden Dividend Stocks Plus

Debt and Liquidity:

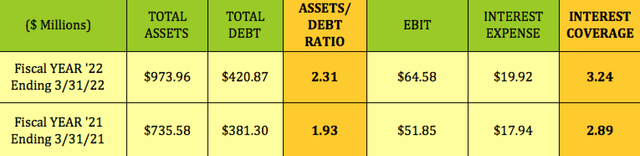

CSWC’s Assets/Debt ratio improved in the fiscal year ending 3/31/22 to 2.31X, vs. 1.93X the prior year, while its EBIT/Interest coverage also improved, rising to 3.24X, vs. 2.89X the prior year.

Hidden Dividend Stocks Plus

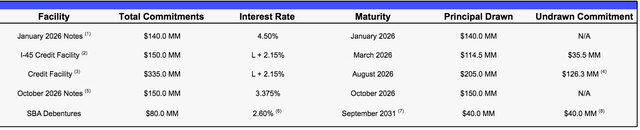

CSWC received approval for an additional $40M of leverage from the SBA in May ’22, increasing the total average commitment from the SBA to $80M. The total leverage expected from its current SBIC license is $175M.

As of 3/31/2022, CSWC had ~$11.4M in unrestricted cash and money market balances, and $126.3 million in available borrowings under its credit facility and $40.0 million in undrawn SBA Debenture commitments. The regulatory debt to equity ratio at the end of the quarter was 1.16 to 1.

CSWC site

Valuations:

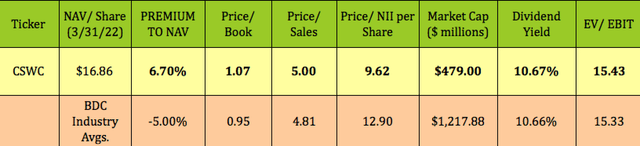

In an industry where dividend growth is weak, companies like CSWC which have strong dividend growth get rewarded with higher premiums. Hence, even in this pullback, CSWC is selling at a 6.7% premium to NAV/share.

For example, in early February, CSWC was selling at a ~61% premium to NAV/share. In November 2021, it sold at a ~65% premium. In August 2020, with pandemic effects on its portfolio unclear, it sold at just 0.40% above its NAV/share.

An important point to remember about Price/NAV is that NAV is decreased by the amount of dividends paid out, so a BDC like CSWC, which has paid out major dividends over the past several years, would actually have a much higher NAV, if it had paid lower dividends.

Looking at price to earnings, or P/NII as it’s known in the BDC industry, shows that CSWC, with a P/NII of 9.62X, is actually undervalued vs. the BDC industry’s average of 12.9X.

Hidden Dividend Stocks Plus

Performance:

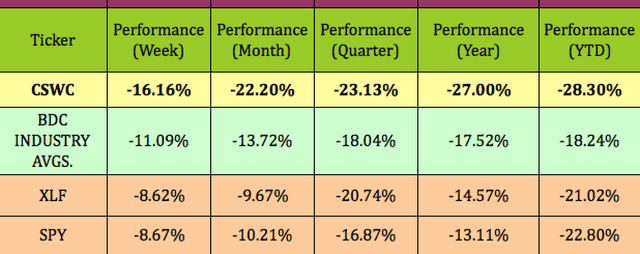

In spite of all the solid financial performance and positive features for CSWC, Mr. Market has given it the cold shoulder – it’s down -16% over the past week, and now also lags the BDC industry, the broad Financial sector, and the S&P 500 over the past month, quarter, year, and so far in 2022.

Hidden Dividend Stocks Plus

Parting Thoughts:

We rate CSWC a long term BUY, based upon its well-covered dividends, its very attractive yield, lower than industry P/NII, and expected tailwinds from rising interest rates.

All tables by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment