JamesBrey

Thesis: Well-Managed Source of High Income

Capital Southwest (NASDAQ:CSWC) is a Dallas, Texas-based business development company (“BDC”) that provides senior loans to a variety of middle-market companies across the United States.

Despite a recent selloff along with the broader market, CSWC reported strong results from its fiscal second quarter of 2022, demonstrating the resilience of its holdings as well as the benefit of an overwhelmingly floating rate loan portfolio.

With only 0.9% of the total portfolio on non-accrual and other metrics showing no signs of financial deterioration at its underlying companies, CSWC looks like a great way for investors to lock in a 10%+ dividend yield, especially if you believe elevated interest rates will stick around for a while.

Review of Capital Southwest

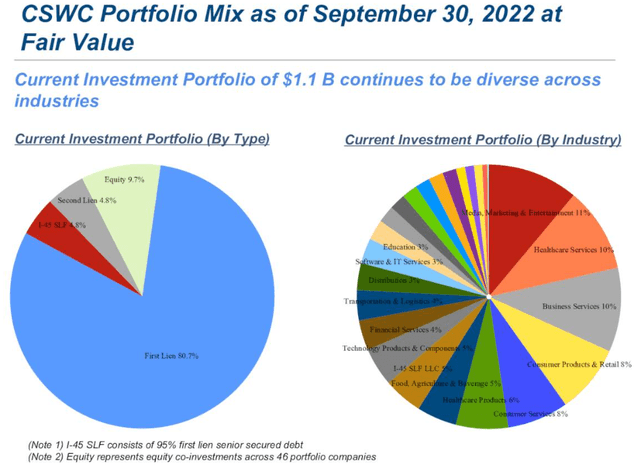

CSWC makes senior-level loans primarily to lower middle-market companies with EBITDA between $3 million and $20 million and with leverage ratios between 2x and 4x, inclusive of CSWC’s loans. Including some upper middle-market loans, for which CSWC allows higher leverage ratios, the BDC’s weighted average portfolio company debt to EBITDA sits at 4.1x.

CSWC’s loans are typically $5 million to $35 million in size (average holding size of $12.9 million) and have terms of 2-4 years. Plus, CSWC often takes equity stakes in its portfolio holdings as well, thereby increasing alignment of interests. Around 10% of total investments are in equity.

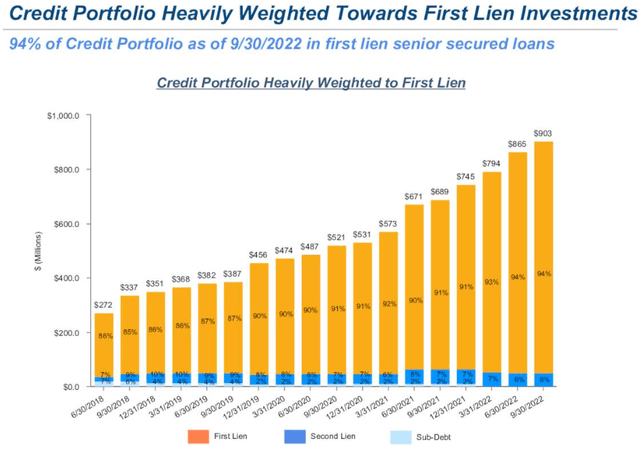

As the loan portfolio has grown, so also has its percentage of first lien credit. This is the most senior form of debt in the capital stack and therefore one of the safest in terms of downside recovery. Currently, 94% of CSWC’s loan portfolio is in first lien loans.

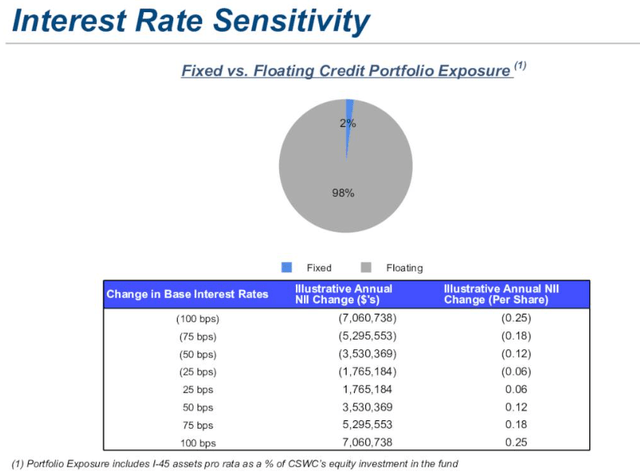

Importantly, the vast majority (virtually all) of CSWC’s loans are floating rate. As such, each successive Federal Reserve interest rate hike increases interest income by more and more.

The Fed’s rate increases through the end of September have already shown up in CSWC’s performance. The weighted average yield on debt investments ticked up from 9.3% in the quarter ending in June to 10.6% in the quarter ending in September.

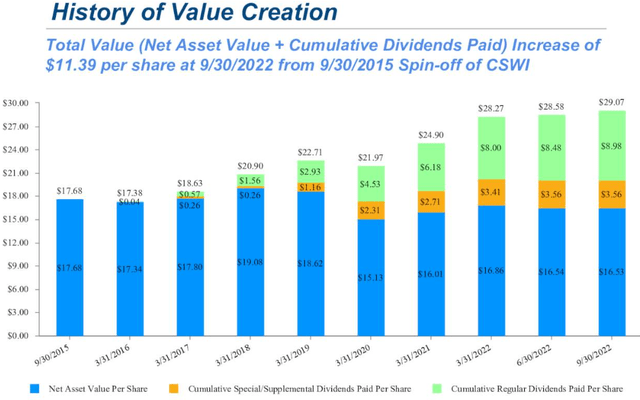

Now, it is important to note a critical difference between CSWC and its fellow blue-chip Texan BDC in Houston-based Main Street Capital (MAIN). While MAIN has a lower payout ratio in order to retain more cash and grow its net asset value per share, CSWC chooses to reward shareholders with higher income by paying out nearly all of its cash flow.

While MAIN’s NAV per share history looks like this:

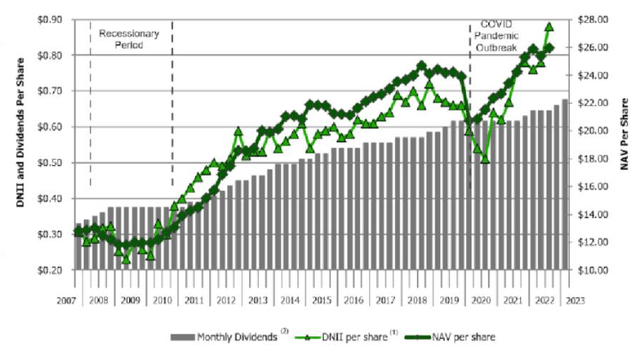

CSWC’s NAV per share is much flatter, like this:

As such, while MAIN is more of a total return investment, CSWC is mostly an income investment. As long as CSWC continues to consistently trade at a premium to NAV, it will be able to issue equity for accretive growth. But don’t expect the stock price to run up much more than 150% to 160% of NAV.

Today, at around $19.40, CSWC trades at a premium to NAV around 17%. That’s significantly lower than the 60%+ premium at which it traded a year ago, but it’s higher than the 10%+ discount to NAV at which CSWC traded during the early stage of the COVID-19 pandemic.

So, it’s probably a good idea to buy CSWC as close to NAV (or a discount to NAV) as possible. It’s mostly about the income.

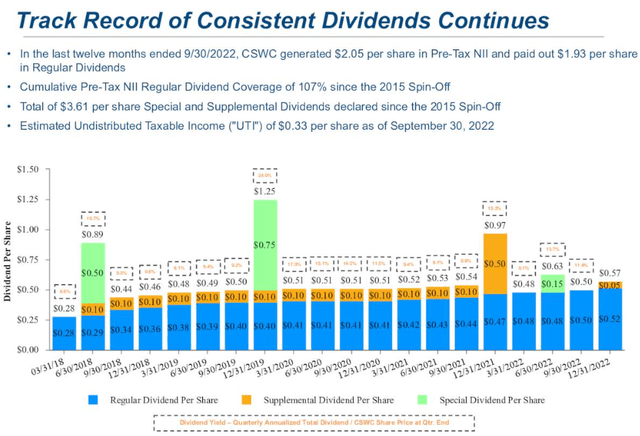

Even with paying out nearly all NII as regular dividends, however, CSWC has still managed to slowly raise its quarterly dividend over time, from $0.28 at the beginning of 2018 to $0.52 today.

CSWC basically has three classes of dividends: regular, supplemental, and special. The regular are about 95% of average NII. The supplemental are a combination of retained cash plus “spillover” from successful portfolio exits and cash on hand. Finally, occasional special dividends come from built up spillover over time.

None of this would be possible, though, without strong underwriting and successful investments. Fortunately, CSWC boasts a good record in this department.

Since 2015, CSWC has achieved a cumulative IRR of 14.7% on 66 portfolio company exits.

That doesn’t mean there aren’t some occasional stinkers. For instance, in the most recent quarter, CSWC exited one second lien loan at an IRR of -5.8%. However, during the quarter CSWC also exited two first lien loans at IRRs of 11.4% and 19.4%, so the weighted average IRR for the quarter was 10.1%.

Fiscal Q2 Results (Ending September 30th)

In the most recently reported quarter (fiscal Q2 ending in September), CSWC reported pre-tax net investment income of $0.54, which easily covered the regular dividend of $0.50. In fact, management displayed confidence in the durability of that higher NII by upping the regular dividend to $0.52 per quarter.

In addition, at quarter end, CSWC had undistributed income of $0.33 per share. This pool of retained cash is what funds the BDC’s supplemental dividend payouts. For this December, management declared a $0.05 supplemental dividend.

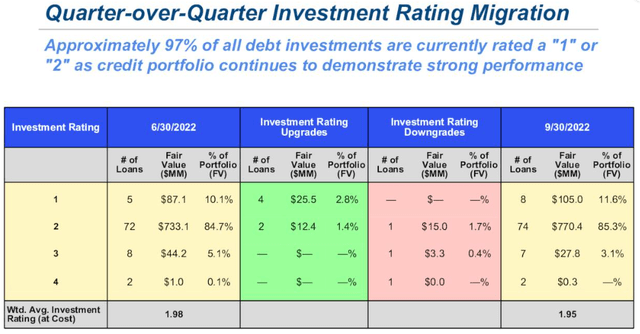

Perhaps part of the reason for optimism about the ability to continually cover the raised dividend comes down to the performance of the loan portfolio. On CSWC’s quality rating scale of 1-4, with 1 being “performing better than expectations,” 2 being “performing as expected,” 3 being the watch list, and 4 being “performing below expectations” or non-accrual, it’s reassuring to note that 97% of the portfolio is performing as expected or better.

This was an improvement on the ratings from the end of the last quarter.

CSWC ended the quarter with $139.4 million available on credit facility plus another $30.2 million in cash (~2.7% of the value of CSWC’s investment portfolio).

Moreover, the BDC has no debt maturities until 2026, and regulatory debt to equity of 1.11x is down from 1.23x at the end of 2021.

All in all, both in terms of the investment portfolio and the balance sheet, CSWC exudes quality and conservatism.

Bottom Line

Based on the regular dividend alone of $2.08 annualized, CSWC currently offers a dividend yield of 10.7%. Though that dividend has a payout ratio of about 96%, it is buffered by a quality investment portfolio, relatively low leverage, and strong liquidity.

At a premium to NAV of around 17%, CSWC still looks buyable today. Personally, I probably wouldn’t buy CSWC at a premium over 20%, which would represent a price of $19.84. As such, that’s my own “buy under” price.

Be the first to comment