8vFanI

Looking for investments which leverage rising rates? Take a look at the BDC industry, where certain companies’ investments are mostly floating rate, while their liabilities are fixed rate.

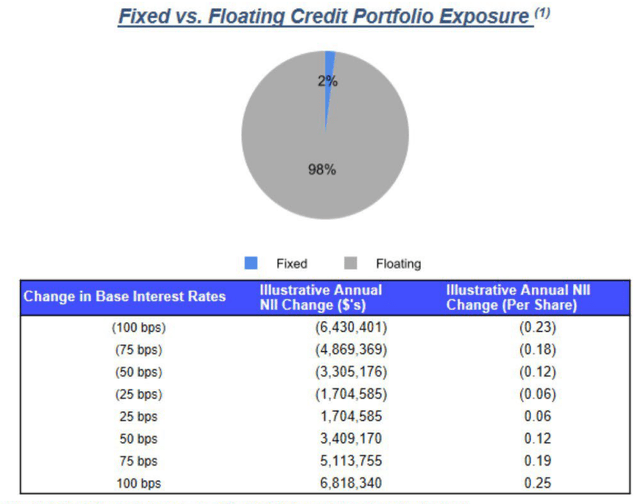

Capital Southwest Corporation (NASDAQ:CSWC) is a good example of this beneficial situation – 98% of its investments have floating rates. Management estimates that the company will gain $.25/share in NII for a 100 basis point rise in rates.

89% of CSWC’s investments in companies are co-sponsored by hedge funds and venture funds, which also give support to these companies during tough times, such as during the pandemic lockdowns.

Profile:

CSWC is an internally managed BDC, specializing in credit and private equity and venture capital investments in lower and middle market companies with EBITDA between $3M and ~$20M; and leverage of 2X to 4X Debt/EBITDA through CSWC’s debt position.

Holdings:

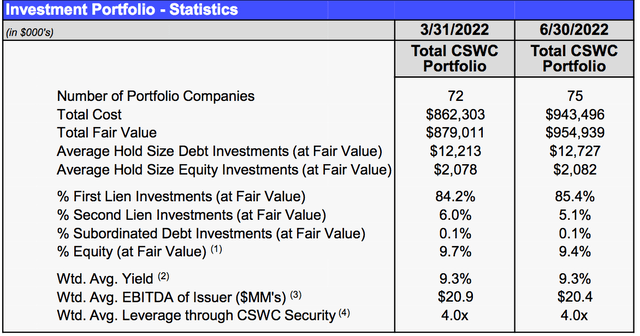

Management added 3 companies to the portfolio in Fiscal Q1 (Quarter ending 6/30/22), which raised the total fair value by 8.6%, to $954M. 1st Lien fair value increased from 84.2% to 85.4%, with 2nd Lien decreasing to 5.1%. The companies’ average yield was steady, at 9.3%, as was their leverage, at 4X.

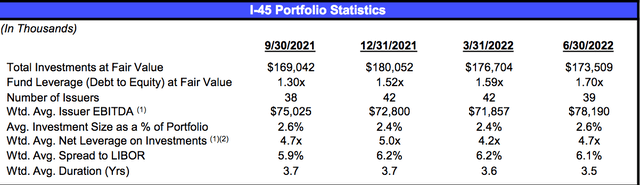

In addition to its controlled investments, CSWC also manages a JV – its I-45 Senior Loan Fund (“I-45 SLF”), in partnership with Main Street Capital. As of 6/30/22, that portfolio held ~$173.5M in debt investments in 39 companies, with an average issuer EBITDA of ~$78M, and a 6.1% LIBOR spread:

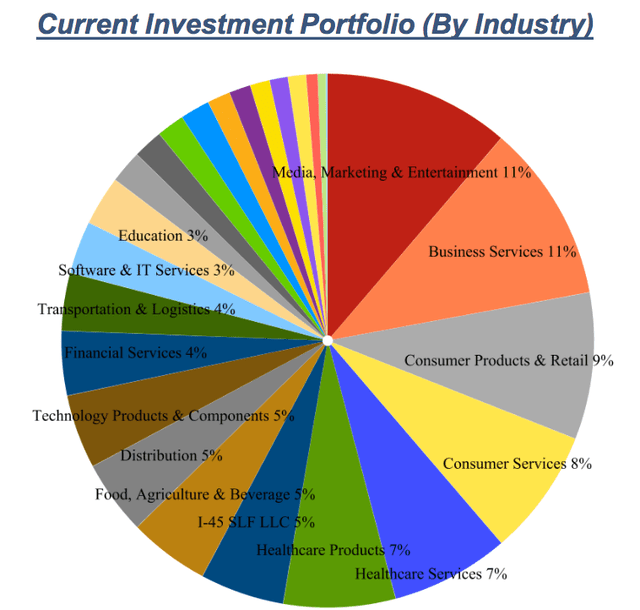

Management increased CSWC’s exposure to Media & Entertainment from 5% to 11% in Fiscal Q1 (Quarter ending 6/30/22). Business Services dropped 200 basis points, from 13% in the previous quarter, to 11% during Fiscal Q1 (Quarter ending 6/30/22). Healthcare also dropped 100 basis points to 9%, while Consumer Products & Retail fell 1%, to 9%. Overall, CSWC’s industry exposure looks diverse.

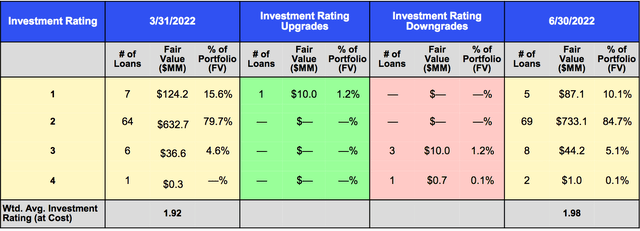

Portfolio Ratings:

CSWC’s management reviews and rates its holdings quarterly, using a 4-tier system, with 1 being the highest rating, and 4 being the lowest. As of 6/30/22, ~95% of CSWC’s holdings were in the top 2 tiers, stable vs. the quarter ending 3/31/22.

There was 1 loan downgraded in the quarter, worth $2.2M, just 0.3% of the portfolio. There are 4 debt investments currently on non-accrual with a fair value of $16.6M, representing ~1.6% of the total investment portfolio, with 1 additional debt investment placed on non-accrual during the quarter.

On 7/1/22, one of the non-accruing loans with a fair market value of ~$13M was restructured- CSWC took an equity position as a portion of its debt, giving it more participation in a company turnaround.

Earnings:

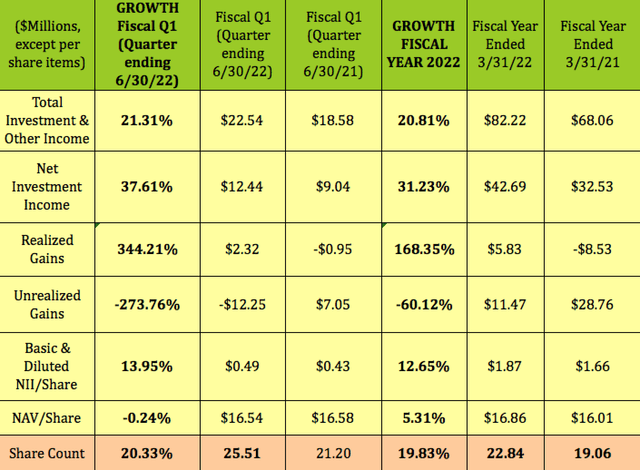

Fiscal Q1 (Quarter ending 6/30/22) earnings were strong, with total Investment Income up 21%, NII up over 37%, and NII/share up ~14%. That follows on CSWC’s strong fiscal year ending 3/31/22 growth, which had similar double-digit gains in total Investment Income, NII, and NII/share.

The share count jumped 20% in Fiscal Q1 (Quarter ending 6/30/22) vs. a year ago. CSWC sold 2,262,852 shares of its common stock during the quarter, under its Equity ATM Program at a weighted-average price of $20.66/share, raising $46.8 million of gross proceeds.

New Business:

CSWC originated $148.3M in new commitments in Fiscal Q1 (Quarter ending 6/30/22), consisting of investments in six new portfolio companies totaling $139M, and add-on commitments in eight portfolio companies totaling $9.3M.

It also received full prepayments on 3 debt investments totaling $47.9M, with a weighted average IRR on the exits of 19.6%; and proceeds from the sale of 1 equity investment totaling $1.7M.

Dividends:

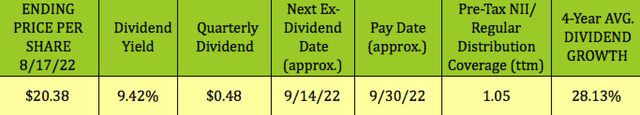

At its 8/17/22 closing price of $20.38, CSWC yields 9.42%.

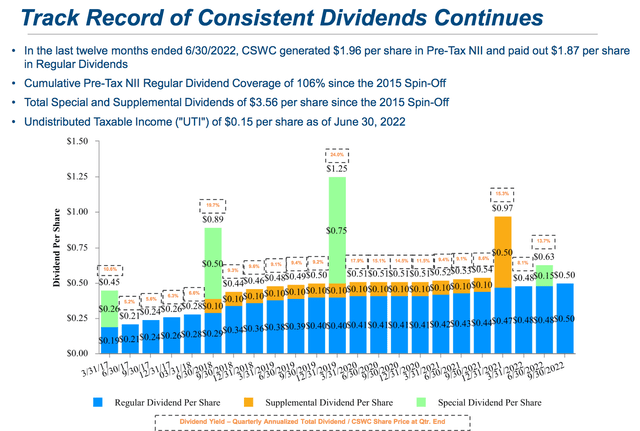

Although there was no $.15 supplemental dividend declared, management did raise the regular dividend by 4%, from $.48 to $.50. It goes ex-dividend on 9/14/22, with a 9/30/22 pay date. CSWC has one of the best dividend growth rates in the BDC industry, growing from $1.16 in 2016 to $2.56 in 2021.

In addition to growing its regular quarterly dividends, CSWC has also paid many smaller supplemental dividends and some occasional large special dividends.

CSWC’s trailing pre-tax NII/regular dividend coverage factor is 1.05X, as of 6/30/22. It had $.15 in Undistributed Taxable Income/Share, as of 6/30/22.

Profitability & Leverage:

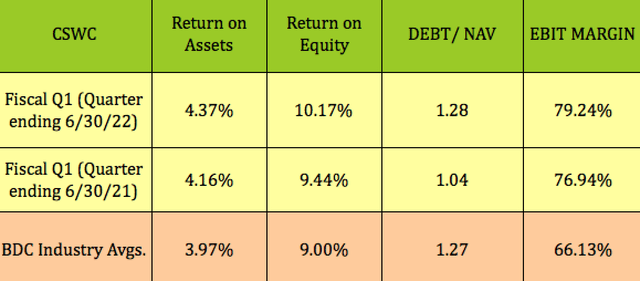

CSWC’s ROA, ROE, and EBIT Margin all improved a bit during the past year and remained above BDC industry averages. Its Debt/NAV rose, as management increased the investment portfolio, and is in line with industry averages.

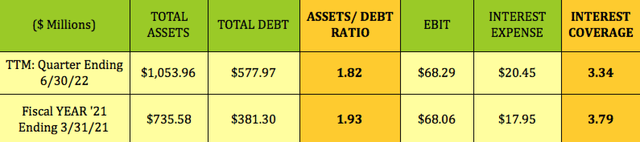

The Asset/Debt ratio was slightly lower this quarter, as was the EBIT/Interest coverage ratio.

Debt & Liquidity:

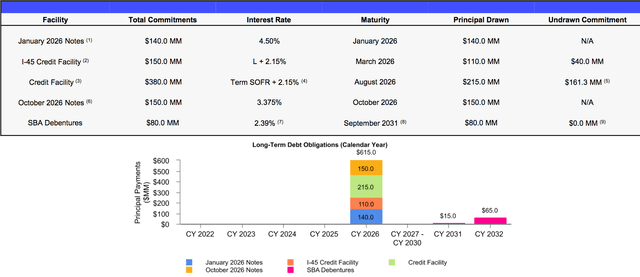

As of 6/30/22, CSWC had $18.8M in unrestricted cash and money market balances, $161.3M in available borrowings under the Credit Facility.

It has no debt maturities until January 2026, when $140M in Notes come due. Its two credit facilities also come due in 2026:

Performance:

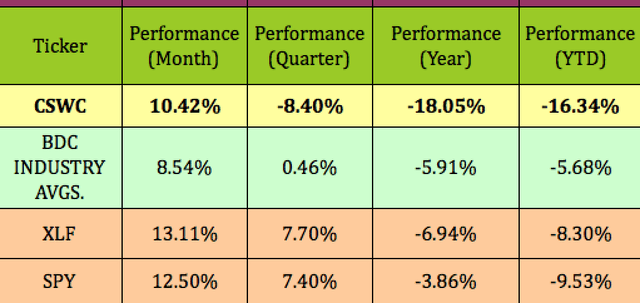

CSWC has trailed the BDC industry, the broad Financial sector, and the S&P 500 over the past quarter, year, and so far in 2022. It has outperformed the BDC industry over the past month.

Valuations:

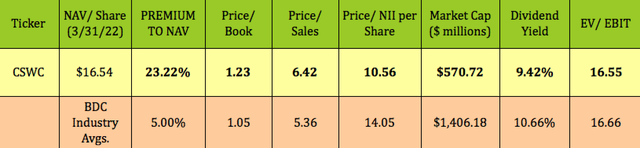

Its 8/17/22 closing price of $20.38, CSWC was selling at a 23.22% premium to its 6/30/22 NAV/Share of $16.54, much higher than the current BDC industry average premium of 5%. However, on a Price/NII basis of 10.56X, CSWC looks much cheaper than its industry’s 14.05X average valuation.

Analysts’ Price Targets:

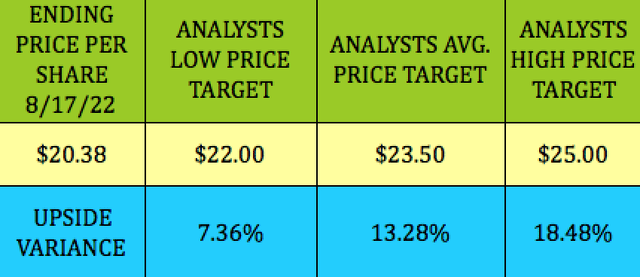

At $20.38, CSWC is 7.36% below analysts’ $22.00 lowest price target, and 13.28% below the $23.50 average price target.

Parting Thoughts:

We rate CSWC a BUY, based upon its very attractive yield, its continued strong earnings, its lower than industry P/NII valuation, and its expected tailwinds from rising interest rates.

If you’re interested in other high-yield vehicles, we cover them every weekend in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment