piranka/E+ via Getty Images

Investment Thesis

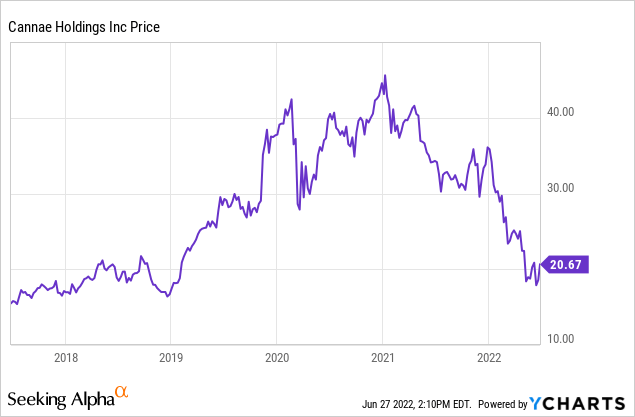

Cannae Holdings (NYSE: NYSE:CNNE) is a simple thesis: an investment holding company run by a smart allocator that is trading at a discount to a conservative NAV. The stock price has fallen ~55% since its high in January 2021 and insiders have been buying consistently in the $17-40 range.

Background

Cannae Holdings is a holding company that acquires interests in operating companies and seeks to actively manage and operate a core group of those companies with a long-term view. The primary assets are ownership interests in:

-

Dun & Bradstreet Holdings: global provider of business decisioning data and analytics (20.3% ownership or 88.3M shares)

-

Ceridian: American provider of human resources software and services (4% ownership or 6.2M shares)

-

Alight: cloud-based provider of integrated digital human capital and business solutions (9.7% ownership or 6.2M shares)

-

Paysafe Limited: multinational online payments company (8.3% ownership or 59.8M shares)

-

Sightline Payments: U.S. sports betting and casino gaming markets digital payments provider and mobile app developer (~33% ownership)

-

System1: global marketing research and effectiveness company that predicts marketing outcomes to help brands grow (24% ownership or 27.2M shares)

-

AmeriLife Group: health, life and annuity marketing organization, primarily focused on the senior market and agents (19.6% ownership)

-

Restaurant Group:

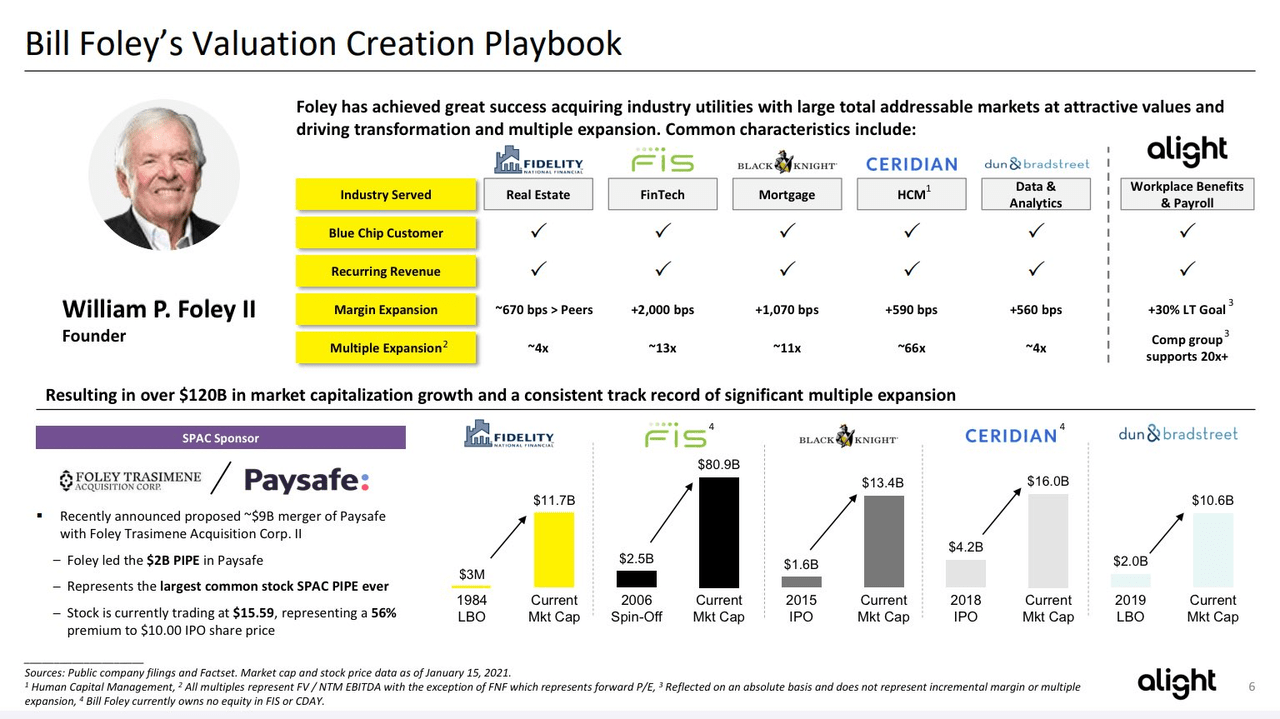

The chairman is William P. Foley II, who has had a very successful track record as a businessman, investor and capital allocator. His “Valuation Creation Playbook” has created over $120B in market capitalization growth. He’s a board member on several companies (e.g. Cannae, Dun & Bradstreet, Black Knight, Ceridian, Alight, Fidelity National Information Service, Fidelity National Financial) and has raised several SPACs (e.g. Foley Trasimene I/II, Austerlitz I/II/III). In short, CNNE is Foley’s investment vehicle.

Bill Foley’s Value Creation Playbook

Valuation

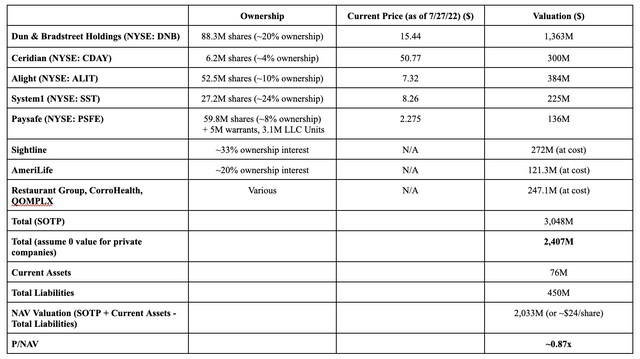

With 85.9M shares outstanding and at a current price of $20.74, the market cap is ~$1.8B.

As a holding company, it makes sense to value it based on a sum-of-the-parts analysis:

SOTP (CNNE)

Of course, the P/NAV calculation above assumes that the private investments (Sightline, AmeriLife, Restaurant Group, CorroHealth, QOMPLX) are valued at a draconian $0, which is probably not the case. But since a conservative valuation suggests that CNNE is trading a discount to NAV, the discount provides us with a decent margin of safety going forward.

The next logical step would be to see if the companies used in the NAV calculation are fairly valued, as the SOTP valuation is rendered useless if all the companies trade at sky-high valuations. Quickly browsing through the valuations on QuickFS:

- Dun & Bradstreet Holdings (DNB): 1.8x P/B, 4.6x EV/S, 12.8x EV/EBITDA, 47.6x EV/FCF

- Ceridian (CDAY): 3.7x P/B, 8.1x EV/S, 278.2x EV/EBITDA, -919.6x EV/FCF

- Alight (ALIT): 0.76x P/B, 2.16x EV/S, 12.61x EV/EBITDA (yahoo finance)

- System1 (SST): 0.9x P/B, -2.4x EV/S, -20.4x EV/EBITDA, -28.4x EV/FCF

- Paysafe (PSFE): 1.1x P/B, 2.8x EV/S, 10.4x EV/EBITDA, 6.2x EV/FCF

At first glance, the companies seem fairly valued (with the exception of Ceridian and System1). The bulk of the value in CNNE is derived from Dun & Bradstreet, which at 12.8x EV/EBITDA; one could argue it could be trading at a higher valuation, as revenues have been growing the underlying business itself seems critical and sticky.

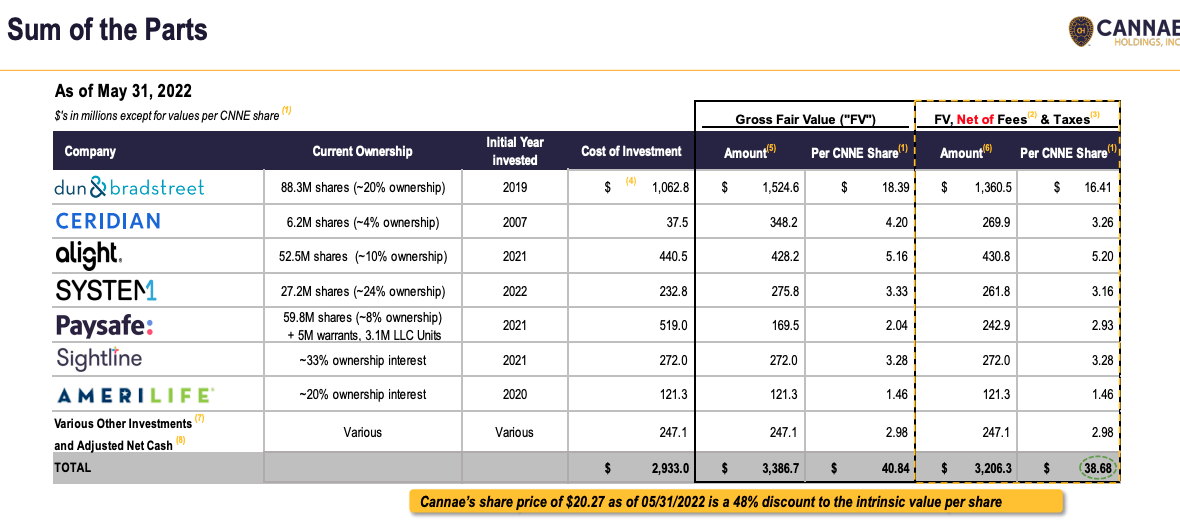

Just for a reference point, the company also puts out their own SOTP calculation (as of May 31, 2022) and they figure that their intrinsic value is ~$39/share (implying a 47% discount):

Company SOTP ((CNNE)

Insider Ownership and Buying

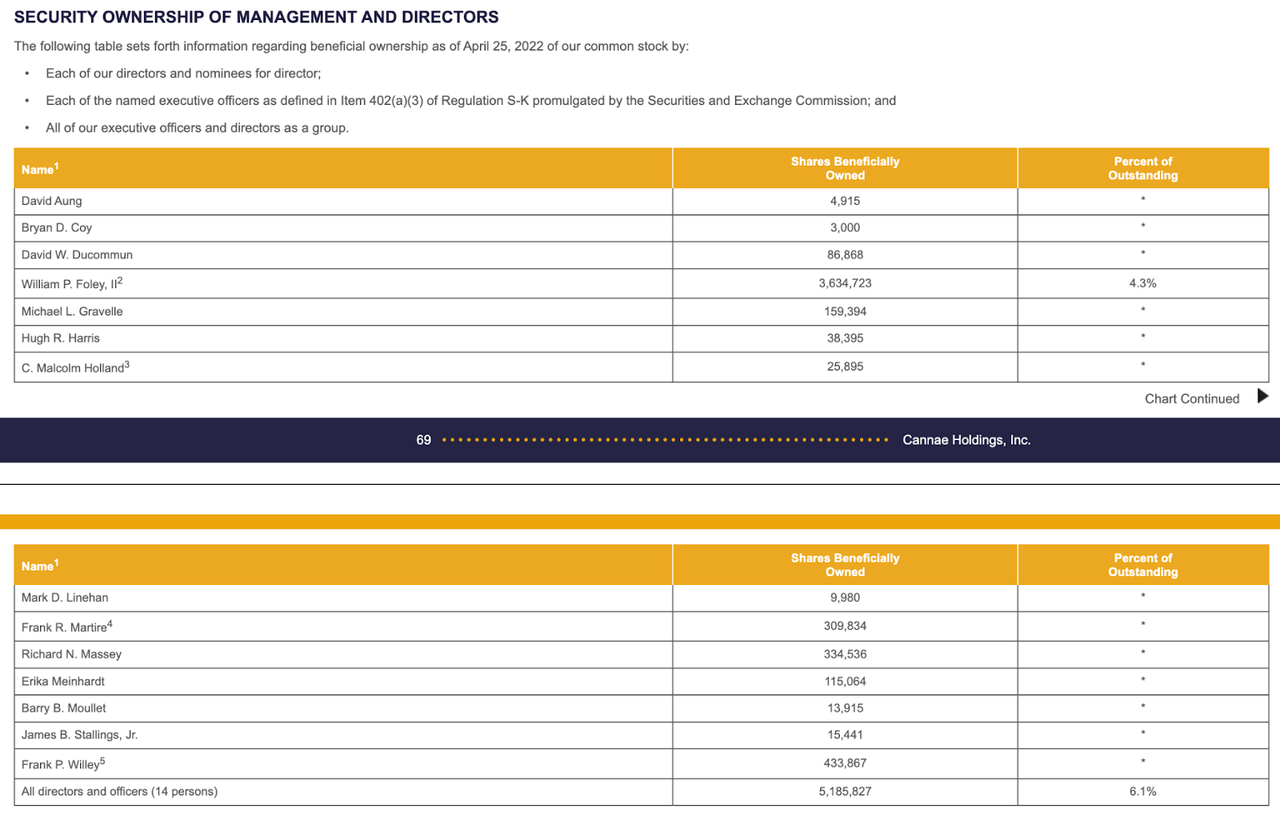

Insider Ownership (CNNE)

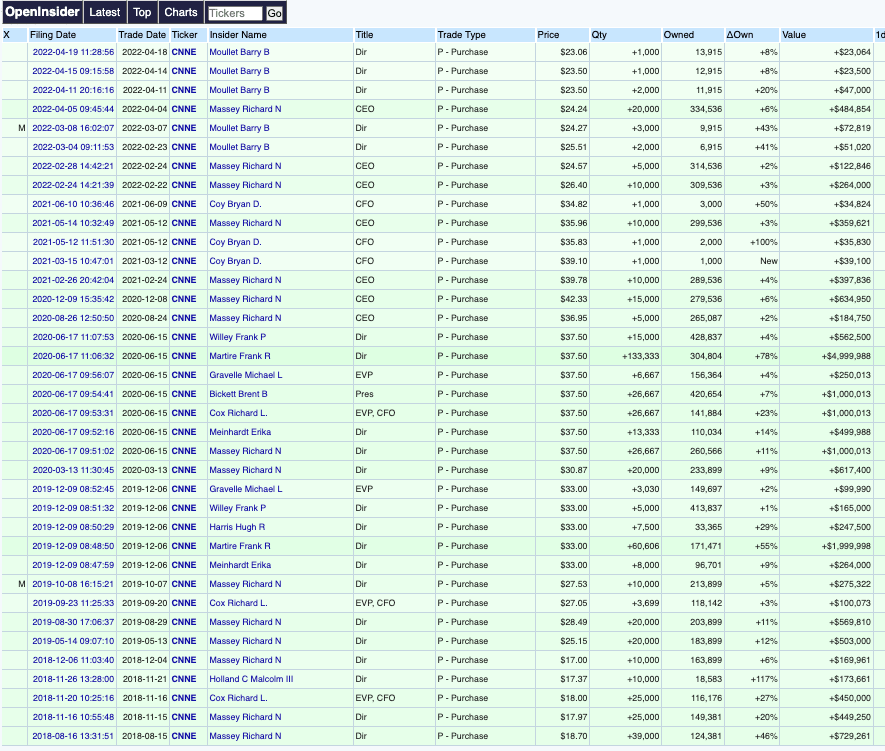

Insiders own ~6.1%, which is a decent amount (I personally prefer to see at least 5%). They have also been consistently buying since 2018 (prices range from $17 to almost $40) with zero sales. In short, the insiders seem aligned with the shareholders.

Insider Buying- Openinsider (CNNE)

Catalysts

-

Repurchase of Shares: the company has a 3-year repurchase plan in place since February 26, 2021 (allows them to repurchase up to 10M shares); in Q1 2022, the company repurchased 2M shares for $54M (an average of $26.96)

-

Increase in Underlying Companies’ Value: the underlying businesses execute and grow, which will help increase both the underlying business value as well as CNNE’s NAV value

Risks

-

Discount to NAV Persists: there’s no guarantee that the NAV gap will close (some would argue that holding companies deserve a discount), but the repurchase plan should help to narrow the gap

-

Deterioration of Underlying Companies’ Value: there’s also no guarantee that the underlying companies will perform well, but since CNNE has a vested interest in helping them execute, there’s an added layer of protection as CNNE will probably do what they can to make their investments successful

Takeaway

CNNE presents a very interesting opportunity to invest (at a discount) in the investment vehicle of William Foley, who has had a pretty successful history of creating value. The conservative valuation provided above shows that CNNE is trading at ~0.87x P/NAV, which provides a decent margin of safety and assumes the private investments are valued at zero. In short, you are getting them at zero cost as free call options. Insiders own 6% of the company and have been consistent buyers of their own stock.

Based on the analysis above, I recommend a long position in CNNE.

Be the first to comment