Eloi_Omella/E+ via Getty Images

Canadian Solar (NASDAQ:CSIQ) operates in a growing industry, which many governments all over the world intend to promote right now. Management also gave very beneficial guidance for the year 2022. In my view, if the company’s battery storage evolves as promised by management, free cash flow will likely trend north. Using very conservative figures, the company’s fair price looks significantly higher than the current price mark.

Canadian Solar

Founded in 2001, Canadian Solar manufactures solar PV modules, and runs large-scale solar projects.

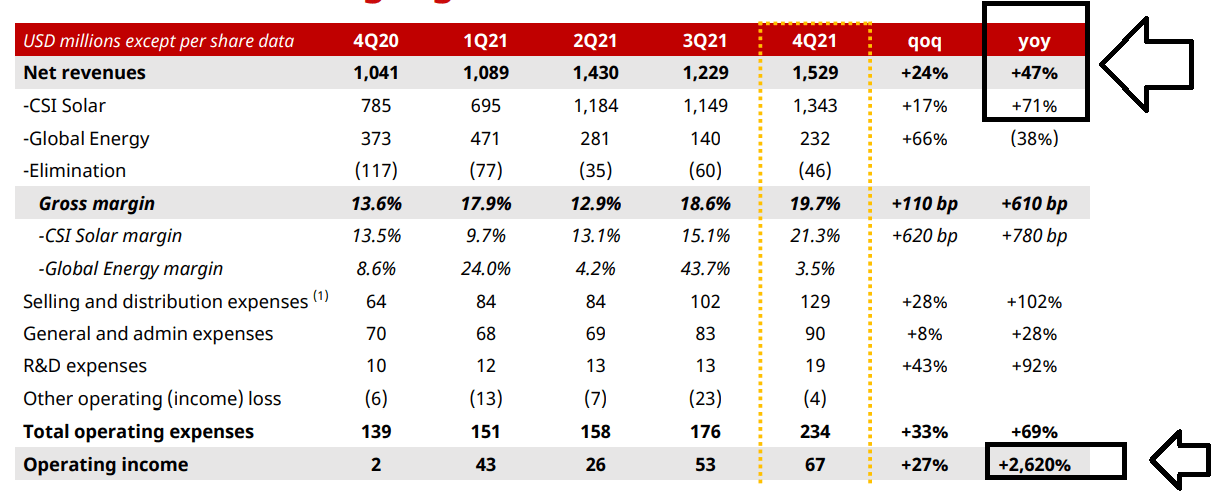

With massive investments in the solar industry worldwide, in my view, it is a great time to have a look at the manufacturer of solar panels. If we also add the most recent commentary from management, Canadian Solar becomes even more interesting. Management noted double-digit sales growth and double-digit gross profit margin, and billed itself as one of the top 5 global module manufacturers. In my view, if management successfully delivers more innovations, free cash flow will likely trend north:

We ended 2021 on a high note, delivering 47% year-over-year revenue growth and a nearly 20% gross margin in the fourth quarter. Over the past decade, we have consistently been a top 5 global module manufacturer and have pioneered numerous solar crystalline PV technology advancements as well as business model innovations. Source: 10-Q

Management is also investing in other fast-growing business models to boost growth even more. Keep in mind that the company expects its battery storage business to deliver two times more MWh than that in 2022:

This includes our fast growing battery storage business, where we delivered nearly 900 MWh in our first year of launching, and which we expect to double in 2022. While we continue to manage challenging market conditions, we remain focused on leveraging the competitive advantages of our integrated business model to build greater long-term value for our shareholders. Source: 10-Q

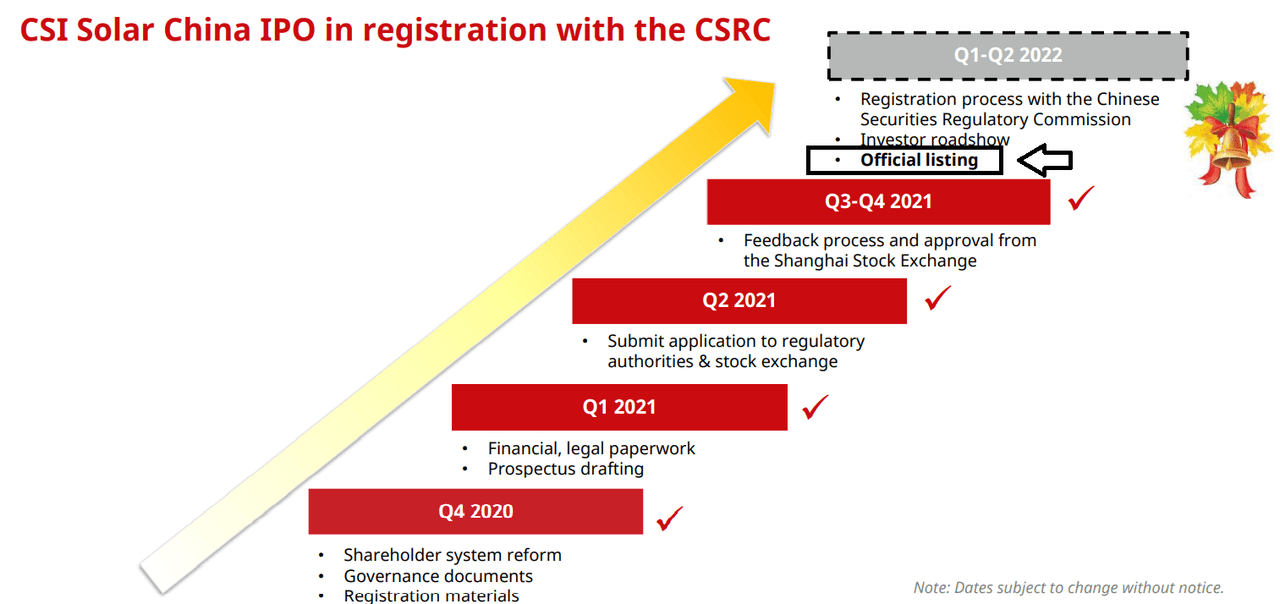

Finally, management mentioned that obtaining recurring revenue is among the company’s core strategies. The following words will likely be music for the ears of most investors. If recurring revenue is reported, management will likely be able to sell more equity in its announced IPO in China:

Our focus remains on growing our base of recurring revenue both from retained assets and contracted services. Source: 10-Q

Presentation

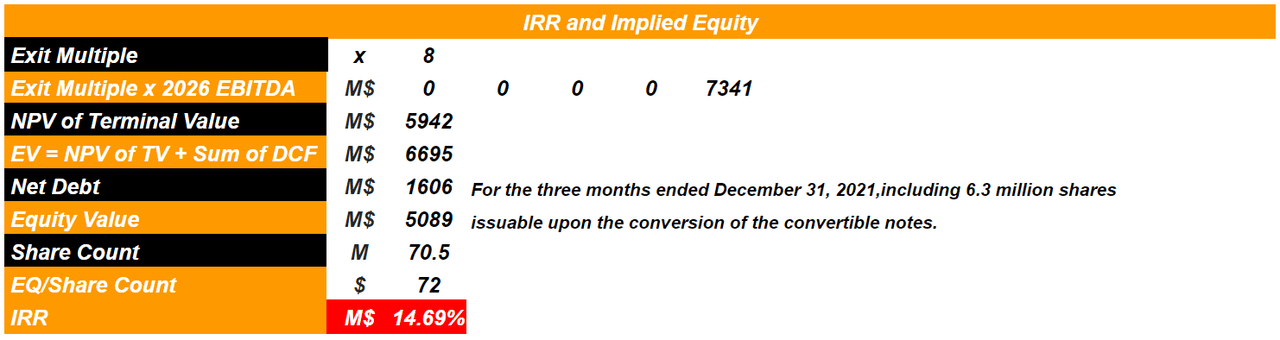

With The Guidance Given Recently, In My View, The Implied Price Is $72

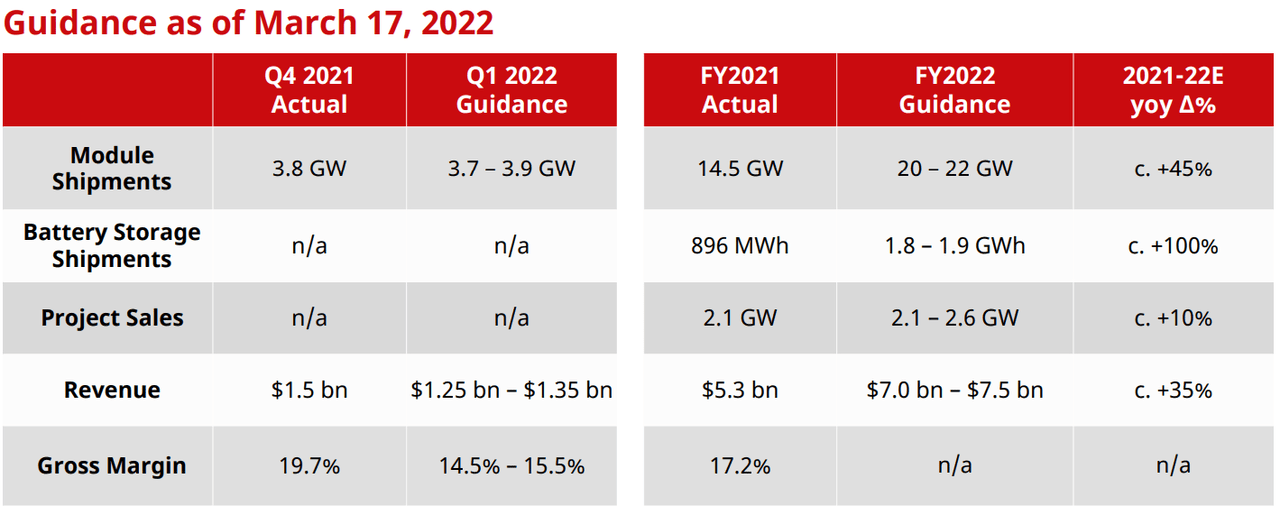

Canadian Solar has given fantastic guidance for 2022, which is why I am starting my research about the company. Management reported a 45% increase in module shipments, and 100% battery storage shipments in 2022 y/y. Canadian Solar believes that it could reach 35% sales growth in 2022.

Presentation

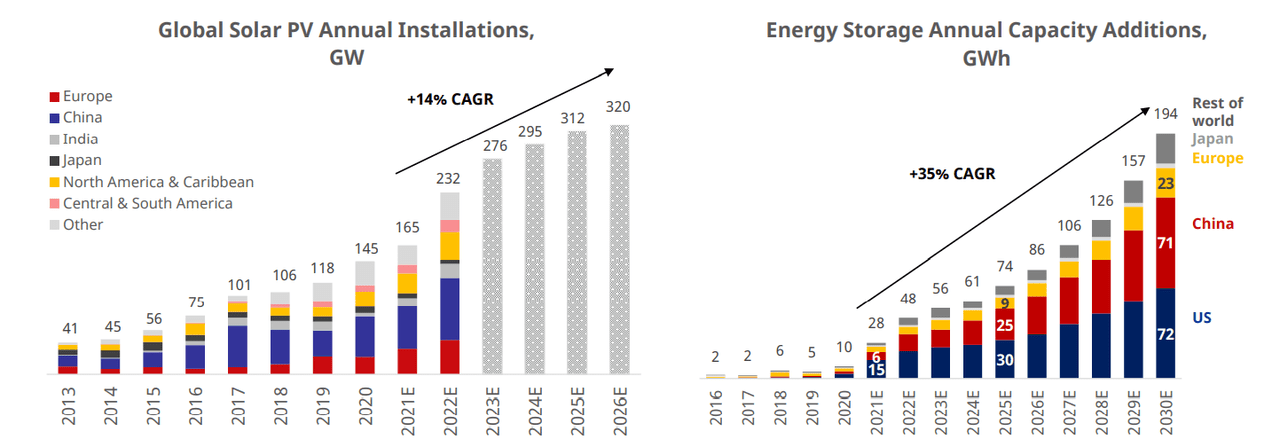

I also noted that the global solar annual installations could grow at a CAGR of 14% from 2022 to 2026. If we also assume a 35% CAGR in energy storage capacity additions, in my view, Canadian Solar really becomes a must-follow stock:

Presentation

I also expect an eventual increase in the subsidies from governments worldwide. Canadian Solar, with more than twenty years’ operation in the industry, has obtained a significant amount of expertise and know-how. In my view, it will be easy for management to receive government subsidies and economic incentives.

Governments in some of our largest markets have expressed their intention to continue supporting various forms of “green” energies, including solar power, as part of broader policies towards the reduction of carbon emissions. The governments in many of our largest markets, including the United States, Japan and the European Union, continue to provide incentives for investments in solar power that will directly benefit the solar industry. We believe that the near-term growth of the market still depends in large part on the availability and size of such government subsidies and economic incentives. Source: 20-F

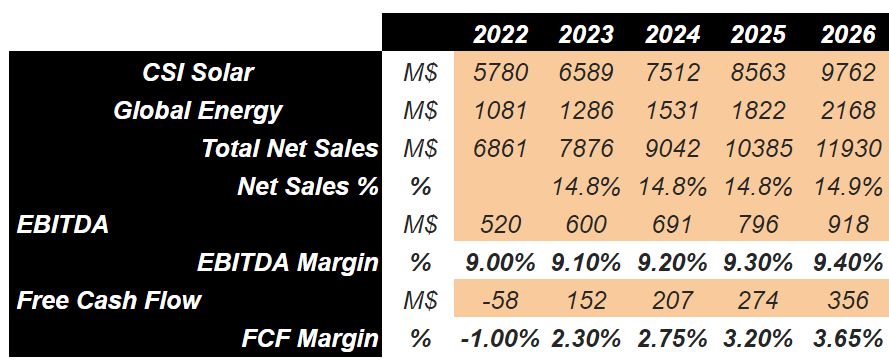

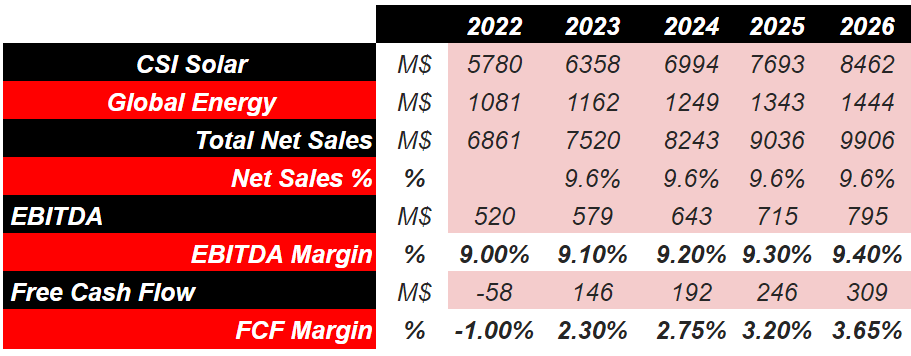

With the previous assumptions, I expect CIS Solar business segment to report $9.7 billion in 2026. Besides, the Global Energy business segment will likely grow from $1 billion in 2022 to around $2.1 billion in 2026. Notice that my figures are mostly related to what I saw in 2021 and 2020.

Presentation

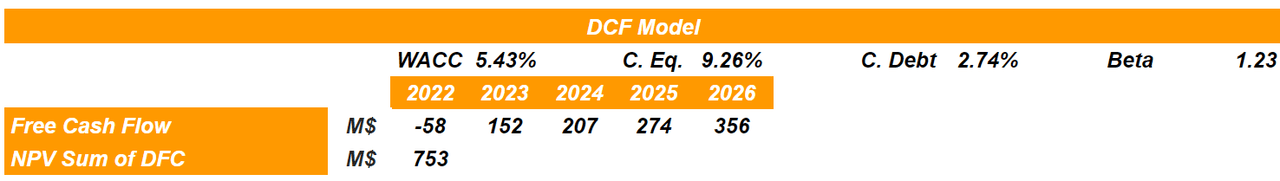

I also assumed an EBITDA margin of 9% and growing free cash flow margin from 2023 to 2026. Like other analysts, I used a weighted average cost of capital of 5.43% with cost of debt close to 9.26%, cost of debt of 2.74%, and beta of 1.23. If we sum the free cash flows from 2022 to 2026, the net present value should stand at $753 million.

Author’s Compilations

Author’s Compilations

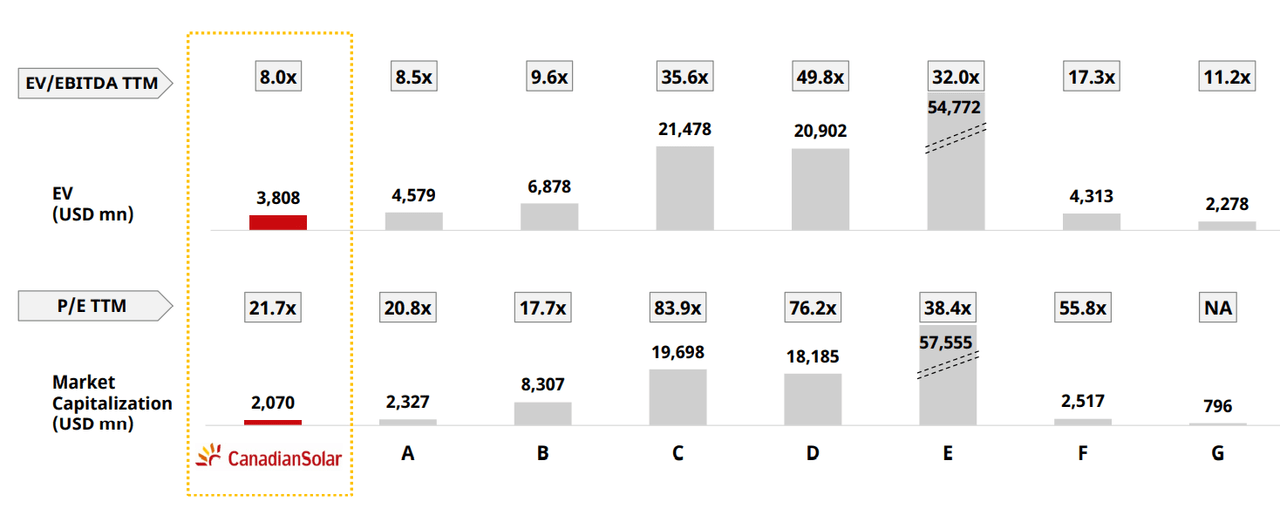

Canadian Solar reports that there are peers that are trading at much more than 8x EBITDA, which is more than the company’s current valuation. With that, I tried to be as conservative as possible, and used an exit multiple of 8x in this case scenario:

Presentation

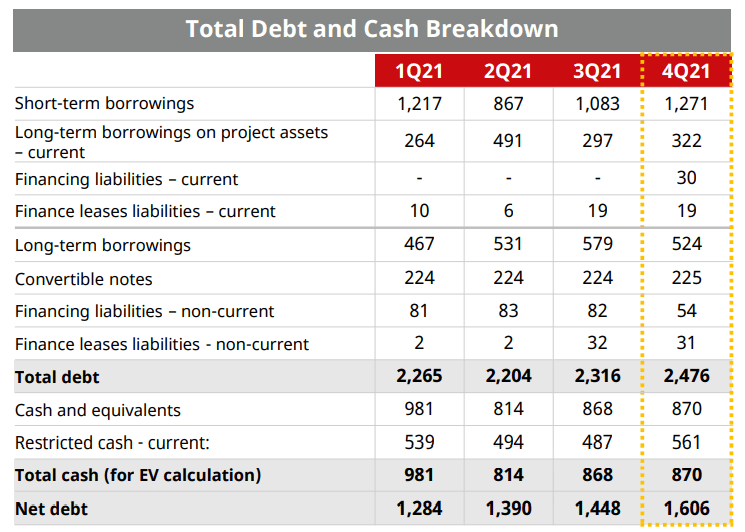

I also assumed net debt of $1.606 billion, which includes the company’s convertible debt, the long-term borrowings, and Canadian Solar’s cash in hand of $870 million:

Presentation

Putting the previous figure together, I obtained an equity value of $5.08 billion and an implied share price of $72.

Author’s Compilations

Risks From Oversupply

Canadian Solar warned in the most recent annual report about potential oversupply of solar power products. As a result, suppliers and manufacturers like Canadian Solar may lower their prices, which may lead to a decline in sales, and perhaps a decline in the free cash flow. In sum, as soon as equity researchers notice, the company’s stock price could decline substantially:

Our business is affected by conditions in the solar power market and industry. We believe that the solar power market and industry may from time to time experience oversupply. When this occurs, many solar power project developers, solar system installers and solar power product distributors that purchase solar power products, including solar modules from manufacturers like us, may be adversely affected. Source: 20-F

Canadian Solar operates all over the world and usually changes the origin of its revenue. It means that changes in tax structures and regulatory conditions will likely occur in the future. As a result, financial modelling may be a bit challenging. Our assumptions may not be correct if effective tax increases:

Our revenue sources have fluctuated significantly over recent years. For example, in 2008, 89.5% of our revenues were attributable to Europe, while only 4.6% and 5.9% were attributable to the Americas and to Asia and other regions, respectively. In 2020, Europe and other regions contributed 18.3% while the Americas contributed 35.1% and Asia contributed 46.6% of our revenues. Source: 20-F

Canadian Solar may also suffer from class action lawsuits regarding its financial statements. Even if the claims are not proven, the company’s reputation may be damaged, which may affect Canadian Solar’s stock valuation. Canadian Solar suffered a similar situation in 2009:

Our company and certain of our directors and executive officers were named as defendants in class action lawsuits in the U.S. and Canada alleging that our financial disclosures during 2009 and early 2010 were false or misleading and in violation of U.S. federal securities laws and Ontario securities laws, respectively. Source: 20-F

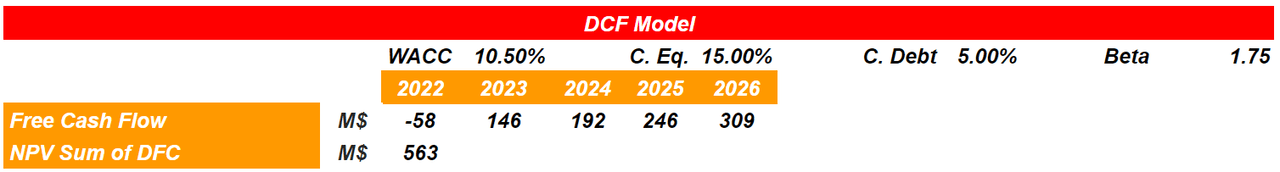

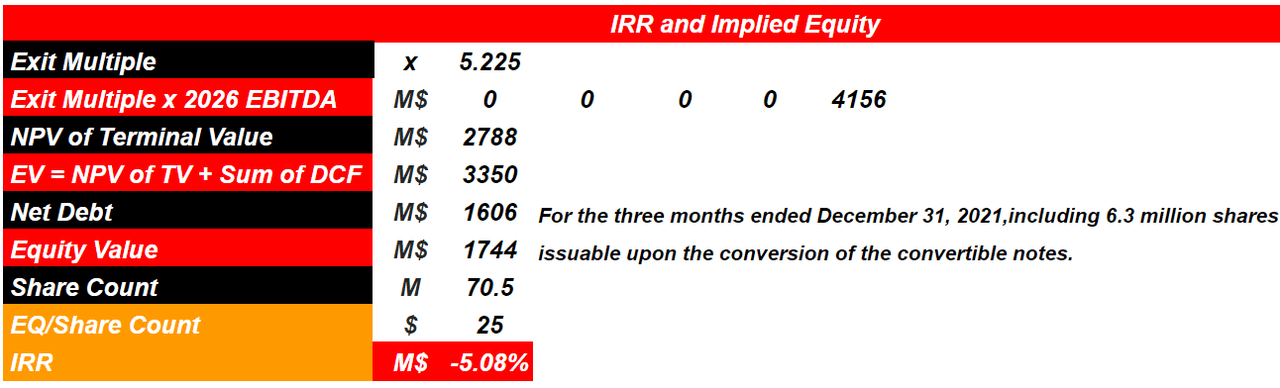

Under the previous assumptions, I included total net sales of almost $10 billion in 2026, and 2023 free cash flow margin close to 2.3%. My results include 2026 free cash flow of $309 million, which is significantly lower than that in the previous case scenario.

Author’s Compilations

I also assumed a weighted average cost of capital of 10.5%, which implied a sum of free cash flows close to $550 million.

Author’s Compilations

With the results assumed in this case scenario, the general sentiment about the company could deteriorate. As a result, certain investors may sell their stakes, so we cannot use the same exit multiple reported in the previous case scenario. With an exit multiple of 5.225x, the equity value should be close to $1.75 billion, and the implied stock price would be $25.

Author’s Compilations

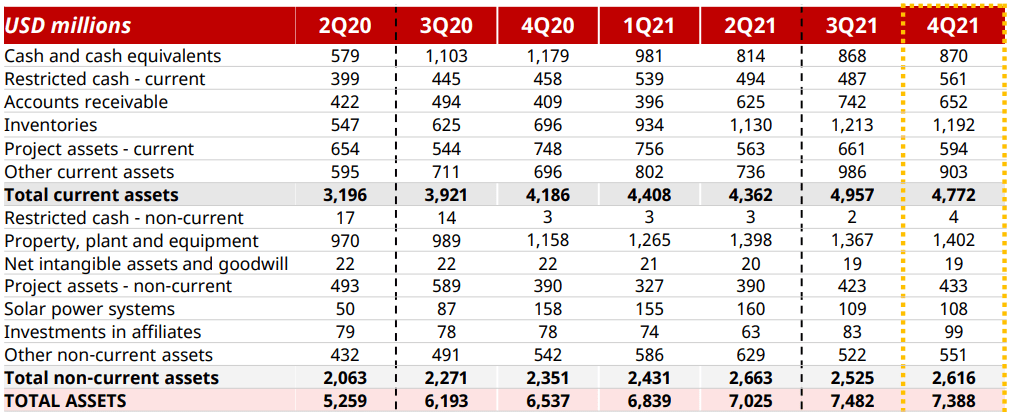

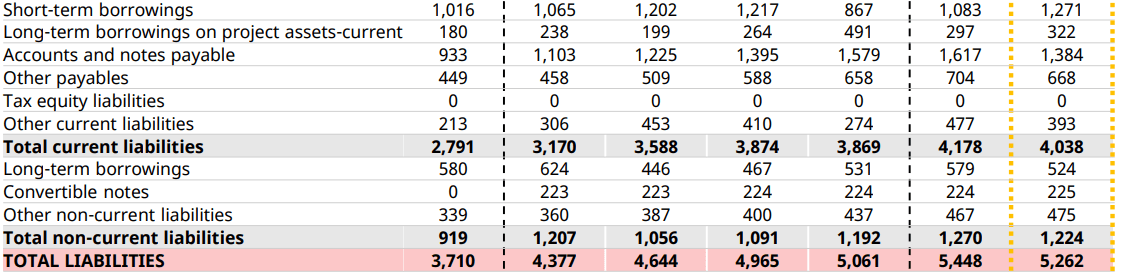

Balance Sheet: The Recent Increase In Assets Is Quite Appealing

With $870 million in cash, close to $7.5 billion in total assets, and only $5 million in liabilities, in my view, the balance sheet looks healthy.

Presentation

Given the growth in the solar industry and the total amount of net debt, I believe that financial institutions will likely give Canadian Solar more money if needed. I don’t like the total amount of convertible notes and the fact that holders may increase the share count. However, in my view, if Canadian Solar successfully delivers the expected free cash flow, the debts will be repaid:

Presentation

Conclusion

Canadian Solar reports double-digit sales growth and double-digit gross profit margin in the fast-growing solar industry. The guidance given for the year 2022 and the expectations until 2026 are quite appealing. In my view, with sufficient innovations, recurrent revenue, and cash from the new IPO in China, Canadian Solar will likely be able to sell and manufacture many more solar panels. Besides, if the battery storage business grows as expected, revenue growth could go even beyond my expectations. I do see some risk from oversupply of solar power products. However, the upside potential appears more significant than Canadian Solar’s downside risk.

Be the first to comment