CAD Price Analysis & News

- Canadian Dollar Spikes on Hawkish BoC

- QE Tapered

- Inflation Seen at Target in H2 2022

QE TAPER: The Bank of Canada left the overnight rate unchanged as expected. However, more importantly, the BoC tapered its QE purchases to C$ 3bln/week from the prior of C$ 4bln. Now while this would have been a near certainty a few weeks ago, the recent rise in Covid cases had cast doubt on this action taking place and hence the Canadian Dollar has jumped on the move. As a reminder, I highlighted earlier that risks to CAD had been asymmetrically tilted to the upside, given that fast money accounts were bearish CAD (long USD/CAD) heading into the meeting.

Recommended by Justin McQueen

Trading Forex News: The Strategy

OUTLOOK: The BoC’s outlook was also notably hawkish with the central bank expecting economic slack to be absorbed in 2022 and as a result sees inflation returning sustainably to its target H2 2022, having previously expected to reach this in 2023.

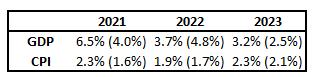

ECONOMIC FORECASTS

Source: BoC

MPR APRIL ASSUMPTIONS

Brent close to $65 (Prior $50)WTI close to $60 (Prior $50)WCS close to $50 (Prior $35)

MARKET REACTION

Source: Refinitiv

Be the first to comment