putilich/iStock via Getty Images

There is a lot to like about The Trade Desk (NASDAQ:TTD): they are a fast growing company in a very important industry, and led by a serial entrepreneur and founder who owns a significant percent of the company relative to its size. Their proprietary software enables advertisers on the buy side to easily control digital ad campaigns. They don’t compete directly with the advertising giants Google (GOOGL, GOOG) or Meta (META), they serve a niche that is built alongside of what are referred to as “walled gardens.”

Most direct competitors are private, such as MediaOcean and Quantcast. We can compare other SAAS companies of similar market cap, but TTD is pretty unique as a pure play on programmatic advertising. The closest public competitor would be PubMatic (PUBM), but even then it’s not an exact replica. TTD deals solely with the buy side of digital advertising, whereas PUBM deals only with the sell side. From a portfolio perspective, TTD shouldn’t be looked at as an alternative to GOOG or META, it’s more like a supplement.

Below are margins and return metrics:

|

Year |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Revenue (MIL) |

45 |

114 |

203 |

308 |

477 |

661 |

836 |

1,196 |

|

Gross Margin |

71.8% |

79.8% |

80.3% |

78.5% |

76% |

76.3% |

78.6% |

81.4% |

|

Operating Margin |

1.7% |

33.3% |

28.3% |

22.5% |

22.4% |

16.9% |

17.2% |

10.43% |

|

FCF (MIL) |

-17 |

-43 |

66 |

18 |

61 |

20 |

325 |

319 |

|

Net Margin |

0 |

13.9% |

10% |

16.4% |

18.4% |

16.3% |

28.9% |

11.5% |

|

ROIC |

0 |

18.1% |

11.3% |

18.7% |

22.1% |

13.6% |

18.9% |

7.8% |

As you can see, this isn’t a tech company that has many years of money-losing growth ahead. The fact that free cash flow is growing along with revenue is very impressive. There’s no doubt that this is a high quality growth company, the key question for investors is whether the price is too high right now? First let’s assess the potential downside.

Risk

One might think that macro issues which caused GOOG and META to contract advertising would affect TTD, but this is now shown to not be the case. A deeper and more prolonged recession is a bigger risk, and certainly could happen. I’m not making any call on the broader market or the economy though. They have proven their resiliency so far by growing revenue in an economy when ad spend is down. TTD deserves credit for not losing revenue so far, and for not laying off employees the way practically every other tech company has this year.

The fundamental risk of growth slowing to a halt is very low considering the momentum they have right now.

Valuation

To pay such a high multiple means that you must be dead on with the future growth of the business. You would have to count on it being a dominant company for the duration of your holding period for the stock. Not every fast grower deserves an optically high multiple. The ones that end up being great companies will pay off even if the multiple is high, but even many growth investors don’t have a multi decade time frame to enable outperformance.

For me personally, the holy grail of investing is when high quality growth stocks become so cheap that they become value stocks as well. This convergence of value and growth doesn’t happen very often and is usually only clear in hindsight.

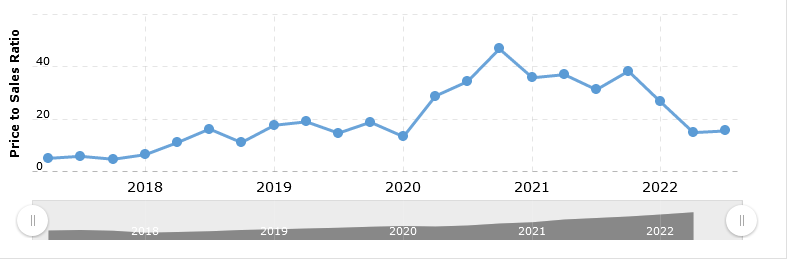

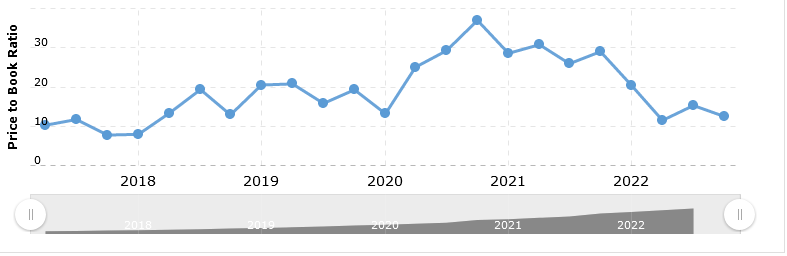

Just because TTD is down 57% from its 2021 high doesn’t mean it has become a value stock by any means. This is not one of those rare, fat pitch moments. There will basically be a permanent premium baked into the multiples of this stock no matter how bad the share price gets. Below is the historical P/S and P/B:

macrotrends macrotrends

Below is the multiples comp with its closet public peer:

|

Company |

EV/Sales |

EV/EBITDA |

EV/EBIT |

EV/FCF |

P/B |

|

TTD |

16.3 |

264.7 |

569.7 |

47 |

13.4 |

|

PUBM |

2.7 |

7.9 |

11.8 |

10.5 |

3 |

The reason I like to use enterprise value over market cap is to try and get an estimate on what a private buyer might reasonably pay to acquire the entire company. In particular, EV/FCF is the closest to showing the bare minimum an acquirer would pay versus the owner’s earnings they will then collect.

The EBITDA and EBIT multiples are skewed because of growth investments will being made along with stock based compensation. So we see that the EV/FCF is more reasonable than earnings based ratios, considering what the buyer is getting. A profitable, fast grower in a growing industry and is at the top of the heap in what it does with a visionary leader who will be in charge for at least another decade.

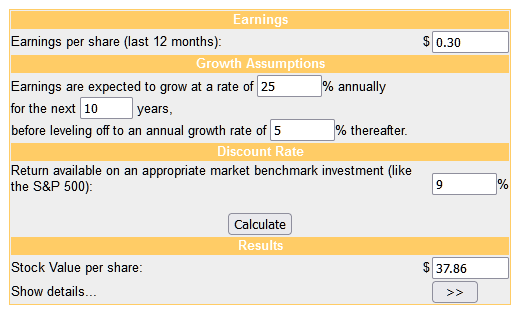

Below is the dcf model, using 2021 EPS:

money chimp

I have fairly high confidence that the company will become a mega cap one day, and I could certainly see it happening within the next decade. Multiple expansion is limited due to the premium that seems to always be priced in, but I do expect some to contribute to returns over the longer term.

Conclusion

TTD has most of the important ingredients that make a high quality growth company. The biggest risk is a prolonged recession, but even in that scenario I still see TTD outperforming other marketing based big tech companies like GOOG and META as it is a much younger company in terms of the level of the growth.

The multiple will never be low in the traditional sense, but now is a decent chance to begin building a position. This is in no way a “back up the truck” moment, so working your way in slowly is the ideal. Things were very hot last year and this has been a cooling-off period which gives us decent, but not incredible, opportunities to buy shares in high quality growth companies of which TTD is a prime example.

Be the first to comment