grinvalds

Elevator Pitch

I have a Buy rating assigned to Etsy, Inc.’s (NASDAQ:ETSY) stock.

I reviewed ETSY’s financial performance for the fourth quarter of 2021 in my earlier March 1, 2022 article for the company. This latest article focuses on Etsy’s share price outlook in view of recent stock price weakness.

I am of the opinion that Etsy’s stock can rebound to $120, justifying a Buy rating based on the implied 24% upside. ETSY’s current valuation multiples are below historical averages, and there are expectations of a substantial slowdown in the company’s revenue growth for FY 2022. I see Etsy’s 2H 2022 topline surprising on the upside, which will be a key catalyst driving a re-rating of the company’s shares.

ETSY Stock Key Metrics

The key metrics for ETSY are its share price performance and valuation multiples.

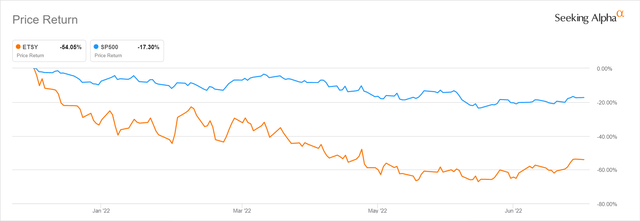

So far this year, Etsy’s shares fell by -54.1%, which is far worse than the S&P 500’s -17.3% correction over the same period.

Etsy’s Stock Price Chart For The 2022 Year-to-date Period

ETSY’s poor year-to-date share price performance is justified by expectations of slower topline growth and a decline in its bottom line for FY 2022.

According to sell-side financial forecasts obtained from S&P Capital IQ, Etsy’s revenue growth is projected to slow considerably from +110.9% in FY 2020 and +35.0% in FY 2021 to +6.2% in the current fiscal year. It is unsurprising that elevated e-commerce demand during the pandemic was unsustainable, and a much more moderate pace of topline expansion for ETSY this year is to be expected.

The Wall Street analysts forecast that ETSY’s EBITDA and normalized earnings per share will decline by -8.9% and -17.8% to $653 million and $3.55, respectively in FY 2022. The lower operating profit and EPS for Etsy this year should be driven by both negative operating leverage and the company’s intention to sustain a high level of investments to support future growth. At its 2022 Annual Meeting of Stockholders Conference on June 15, 2022, ETSY stressed that “Etsy’s dramatic growth has also necessitated that we invest and improve.”

Following its substantial share price correction in 2022 thus far, Etsy’s valuation multiples have de-rated significantly and are now below their historical averages as indicated in the table presented below.

A Comparison Of Current And Historical Valuation Multiples For ETSY

| Etsy’s Valuation Multiples | Current Multiple As Of July 25, 2022 | Five-Year Historical Average Multiple | Five-Year Historical Peak Multiple |

| Consensus Forward Next Twelve Months’ Enterprise Value-to-Revenue Multiple | 5.4 | 7.9 | 16.4 |

| Consensus Forward Next Twelve Months’ EV/EBITDA Multiple | 20.0 | 31.7 | 58.0 |

| Consensus Forward Next Twelve Months’ Normalized P/E Multiple | 26.4 | 52.3 | 111.1 |

Source: S&P Capital IQ

In the subsequent sections of the article, I discuss whether a share price rebound and a positive valuation re-rating for Etsy is likely.

Is Etsy Expected To Grow?

As discussed in the previous section, Etsy is still expected to deliver positive revenue growth for full-year FY 2022, albeit at a much slower pace as compared to what the company achieved in the past. More importantly, if ETSY’s topline growth for fiscal 2022 beats market expectations, this can serve as a re-rating catalyst for the stock.

Based on a July 22, 2022 sell-side research report (not publicly available) published by Raymond James (RJF), a significant proportion of consumers might increase their spending on the Etsy e-commerce platform for 2H 2022 as per a recent consumer survey conducted by RJF in the third week of June. Specifically, the results of the RJF survey indicate that 58% of the 600 consumers surveyed “plan to spend the same or more on ETSY in 2H22 vs 1H22”, while another 23% of them intend to “spend more in 2H22 compared to 1H22.”

As per consensus numbers sourced from S&P Capital IQ, ETSY’s YoY revenue growth is forecasted to accelerate from +5.2% in 1H 2022 to +7.2% in 2H 2022. My view is that Etsy’s actual topline expansion in the second half of 2022 (and full-year FY 2022) might surprise on the upside as compared to what analysts are currently expecting, based on the positive results of the RJF survey.

In summary, there is a good chance of Etsy’s sales growth for 2H 2022 and FY 2022 exceeding expectations, a view which is supported by takeaways from RJF’s recent consumer survey. This could possibly set the stage for a strong rebound in ETSY’s share price in late-2022 and early-2023, when the company’s Q3 2022 and Q4 2022 results are released.

Can Etsy Stock Rebound To $120?

I think ETSY’s shares can recover when the company delivers revenue beats for 2H 2022 as I mentioned in the preceding section.

In my opinion, a rebound in Etsy’s stock price to $120 within a year, implying a decent upside of +24% as compared to its last traded share price of $96.47 as of July 25, 2022, is reasonable.

The sell-side’s current consensus price target for ETSY is $122.10, which is just slightly higher than the $120 price level which I see Etsy’s shares rebounding to. Valuing Etsy at $120 also translates into forward P/E, EV/EBITDA and Enterprise Value-to-Revenue multiples of 32.9 times, 24.3 times, and 6.5 times respectively, which are still below historical averages indicated in an earlier section of the article.

In conclusion, Etsy’s stock can rebound to $120, which is a reasonable price level based on the implied valuation multiples.

Is Etsy A Good Long-Term Stock?

Etsy is a good long-term stock, as the company is still at a very early stage of realizing its full growth potential.

ETSY boasted a mere 2.6% share of its estimated “online TAM (Total Addressable Market) for Etsy marketplace GMS (Gross Merchandise Sales)” of $466 billion, according to its May 2022 investor presentation.

Just looking at gender and geography, ETSY has substantial room for growth. Only a tenth of adult men in the US and UK markets have spent money on Etsy’s e-commerce platform in the past year, as compared to 30% of adult women who have done the same. Separately, the average buyer penetration rate for Etsy’s two largest markets, the US and UK, is about five times that of the penetration rate for the company’s next 15 biggest markets. These metrics are also sourced from ETSY’s May 2022 investor presentation.

In a nutshell, ETSY has a long growth runway.

Is ETSY Stock A Buy, Sell, Or Hold?

I rate ETSY stock as a Buy. In the short term, a better-than-expected financial performance for Etsy will be a key re-rating catalyst. Looking ahead, it is important to appreciate that ETSY has only just scratched the surface of its full long-term growth potential.

Be the first to comment