hapabapa/iStock Editorial via Getty Images

2021 was a pivotal year for AMD’s stock (NASDAQ:AMD) as well as the underlying business, emerging as one of the top performers across the semiconductor industry. Accelerating digitization trends fast-tracked by unprecedented COVID disruptions had created a surge in demand for chips used in everything from connected vehicles to high-performance computers and data centers over the past 20 months. The strong demand environment translated into a robust acceleration in sales growth for AMD, pushing the stock towards gains of as much as 127% from peak to trough last year.

But 2022 has been tough on the stock since day one. The stock has lost more than 20% of its value so far this year (YTD peak to trough losses: -35%), underperforming key market benchmarks like the S&P 500 and the tech-heavy Nasdaq 100. AMD’s latest declines have been largely influenced by mounting macroeconomic headwinds, sprawling from rising inflation risks and borrowing costs, to escalating geopolitical tensions with the onset of Russia’s assault on Ukraine. There also appears to be little sign of a resolution to protracted supply chain constraints, which have yet to see material recovery from pandemic-era impacts and are now faced with additional challenges stemming from the ongoing Russia-Ukraine war. All of these factors stand as unfavourable trends for the broader semiconductor industry, stoking risks of deceleration as consumer sentiment also dampens in response to uncertainties in the economic outlook ahead while stubborn supply chain woes continue to wreak havoc on costs.

Yet, AMD has continued to press forward with its technology roadmap with recent deployment of new innovations and upgrades to existing product offerings. The company has also actively engaged in expanding key customer relationships this year to maximize its market share ahead of growing high-performance computing (“HPC”), hyperscale data center, gaming and PC momentum. AMD’s latest developments are set to bolster its prospects of defying weak economic sentiment and outperforming expectations once again.

Even under today’s challenging macroeconomic climate, which has triggered broad-based contraction across market valuations, especially for growth stocks, AMD has continued to exhibit quality by reinforcing its increasing prominence within the growing semiconductor industry. Considering the company’s strong demand environment, as well as expectations for further easing of supply chain woes and clarity on the evolving geopolitical and economic climate in the latter half of the year, there is still a tremendous runway for AMD’s stock to run higher. Even under today’s highly-contracted valuation environment, we believe the stock has real potential for returning to the $160-level within the next 12 months given AMD’s increasing market leadership and bullish demand environment ahead.

Why Did AMD’s Stock Drop This Year?

The markets saw increased rotation out of growth stocks earlier this year, stoked by investors’ concerns over potential erosion of future upsides ahead of a “Fed lift-off” to tame the hottest inflation in 40 years. AMD’s steep declines earlier this year were essentially an extension of related impacts stemming from the broader market rout that began in late November/early December when the resurgence of Omicron outbreaks and an increasingly hawkish Fed added uncertainties to the global economic outlook. Consumer sentiment also dampened following the release of record-setting inflation data that showed price increases of nearly 8% – the highest in four decades – which further blurred the growth prospects of chip stocks that indirectly rely on retail demand.

But AMD’s stock went on a tear after releasing fourth quarter results that beat consensus estimates and guiding stronger-than-expected growth for the current period. The stellar results came at a time when investors “sold aggressively at the first hint of weakness” to reward high-quality stocks instead.

However, AMD’s early-February rally was short-lived. The onset of Russia’s assault on Ukraine fanned heightened volatility across the markets, further weakening momentum across global equities. Subsequent economic sanctions imposed by the U.S. and its allies against Russia also drew fears of additional threats to already-weak chip supplies and other impacts on industry sales. The stock’s performance has been fluctuating since, as investors ponder on how to price the impacts of an evolving geopolitical situation into the company’s valuation. And volatility looks to be a longstay theme for the stock, as markets try to digest Federal Reserve Chair Jerome Powell’s hawkish comments raised during Monday’s speech to the “National Association for Business Economics”. It seems the Federal Reserve is now willing to risk growth by tightening the economy into a downturn in favour of “restoring price stability” and quelling inflation, which could spell further headwinds for global equities within the near term.

Is AMD Stock Expected to Go Back Up?

From a fundamental perspective, AMD has posted a strong track record in delivering consistent outperformance. And this trend is expected to persist through the current year, which will be a key driver for the stock once looming macroeconomic headwinds subside.

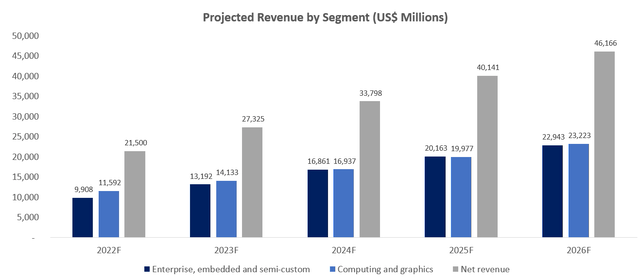

For the current period and year, the company has guided year-over-year revenue growth of 45% and 31%, respectively, buoyed by robust PC and server chip market share gains. As discussed in our recent review on AMD’s Q4’21 results and Xilinx acquisition, our base case forecast expects the company to grow total revenues from $21.5 billion in the current year as guided by management, towards $46.2 billion by 2026 considering the company’s growth opportunities ahead (covered here).

AMD Forecasted Revenues (Author)

Despite escalating geopolitical tensions and a looming economic drawback, we see little material change to AMD’s growth forecast above. Specifically, the ongoing Russia-Ukraine war and related sanctions are not expected to drive significant impacts to AMD’s topline growth nor worsen the protracted chip supply shortages. According to the Semiconductor Industry Association, sanctions imposed on Russia by the U.S. and its allies are not expected to result in material impacts to industry sales, considering the region accounts for “less than 0.1% of global chip purchases” and is not a “significant direct consumer of semiconductors”. On the supply front, some are raising concerns that prolonged conflict in Ukraine could sever a major source of neon and krypton, which are essential gases used in the semiconductor production process – the embattled country accounts for “70% of the world’s neon gas capacity”. Sanctions imposed on Russia also threaten palladium supply, a metal used in making “sensor chips and certain types of computing memory” – the aggressor currently accounts for 37% of global palladium production. However, learning from experience acquired during the 2014 Russia annexation of Crimea, many industry leaders, including AMD, have since diversified their supply chains, providing partial insulation from immediate impacts of the ongoing Russia-Ukraine crisis today.

In addition to geopolitical risks, AMD is also expected to weather economic uncertainties ahead. better than industry peers. The increasingly critical role that AMD’s processors play in enabling key emerging technologies, from hyperscale data centers and HPC to next-generation gaming and PC workstations, is expected to bolster the company’s market share gains despite signs of slowing consumption within an already competitive environment. And AMD’s recent achievements in its technology roadmap also corroborate its growth prospects ahead.

Gaming

As discussed in a previous coverage, growth momentum within the broader gaming industry has continued to be a boon for AMD’s computing and graphics business. Growing popularity of leisure gaming, eSports, digital gaming content creation and streaming, paired with improved gaming graphics and performance has renewed interest within the broader gaming segment in recent years. Recognizing the opportunities at hand, AMD has continued to innovate its gaming offerings in recent years.

The company’s most recent gaming-focused developments include the introduction of “AMD Software: Adrenalin Edition 2022” and “AMD Ryzen 7 5800X3D“. The upgraded AMD Software suite, which includes new features like “AMD Fidelity FX Super Resolution” and “AMD Radeon Super Resolution”, promises next-generation graphics technology aimed at “elevating gameplay to new levels of performance, responsiveness and visual fidelity”.

Meanwhile, the all-new AMD Ryzen 7 5800X3D processor, which is the first desktop gaming CPU of its kind to feature “AMD 3D V-Cache” technology, enables “15% more gaming performance compared to processors without stacked cache technology”. With both innovative offerings hitting the shelves in the second quarter, AMD is expected to draw greater interest from gaming enthusiasts ahead.

HPC/Data Center CPUs

AMD introduced an upgraded “3rd Gen AMD EPYC” server processor earlier this week, which features AMD 3D V-Cache technology, similar to the all-new Ryzen processors mentioned above. The latest innovation solves the “physical limitations on the amount of cache that can be effectively built on [legacy 2D chip designs”, and enables up to 66% better performance compared to non-stacked 3rd Gen AMD EPYC server processors. The 3rd Gen AMD EPYC processors featuring AMD 3D V-Cache technology are designed to address “technical computing workloads such as computational fluid dynamics, finite elements analysis, electronic design automation and structural analysis”, and allow AMD to further penetrate into rising HPC and data infrastructure opportunities.

The company has also recently introduced the all-new “AMD Instinct MI210” data center GPU processors. Powered by its “CDNA 2” architecture and “ROCm 5” open software platform, the AMD Instinct MI210 offers “exascale-class technology”, and is designed to address “growing demand for compute-accelerated data center workloads and reducing the time to insights and discovery” for mainstream users. As mentioned in one of our previous coverages on the stock, AMD has drawn increased prominence within the HPC realm in recent years – its processors can now be found in 73 supercomputers on the latest TOP500 list and holds 70 HPC world records. The latest addition to the AMD Instinct ecosystem is expected to further fuel AMD’s reputation across HPC and AI applications, underpinning greater market share gains ahead.

PC Workstations

Earlier this month, AMD introduced the “AMD Ryzen Threadripper PRO 5000 WX-Series” workstation processors. The series’ latest upgrade enhances the performance and power consumption of the preceding “Ryzen Threadripper PRO 3000 WX-Series” workstation processors. Specifically, the Ryzen Threadripper PRO 5000 WX processors are capable of delivering “43% higher graphics performance and up to 2.2x the storage performance of competing solutions”. It can also outperform competing workstation processors by 95% in performance, while also consuming up to “67% lower power per core…, driving industry-leading performance”.

AMD’s latest and greatest workstation processors will be deployed through the “Lenovo ThinkStation P620”, which continues to see “tremendous market demand [from customers seeking] professional-grade workstations” for handling increasingly complex workflows like “cutting-edge virtual production work”. The ThinkStation P620 is currently one of the most popular and most reliable professional workstations in the market. With initial deployment through the ThinkStation P620, AMD’s newest workstation processor is set to benefit from expanded market exposure and pave the way for greater application ahead of continued PC momentum in coming years.

In addition to the continued expansion of its technology roadmap, AMD’s recent acquisition of Xilinx is also expected to propel the company towards greater opportunities in data centers and cloud computing, while also bolstering its race against leading rival Intel (Nasdaq: INTC). As analyzed in our review of the AMD-Xilinx deal, the merger allows AMD to consolidate Xilinx’s leadership “field-programmable gate arrays” (“FGPA”) and adaptive system-on-chips (“SoCs”). These programmable solutions are widely used in emerging technologies like cloud data center and communications infrastructure applications, extending AMD’s foray into two of the fastest-growing sectors ahead. Global FGPA demand is expected to expand at a compounded annual growth rate (“CAGR”) of 8.5% over the next five years to support 5G and cloud transition. Xilinx also boasts a strong pipeline of communications accounts in which it provides 5G-specific solutions to, forging a clear path for AMD’s penetration into a rapidly expanding, $10 billion market opportunity in coming years.

The company’s latest expansion of existing partnerships also complements its growth story ahead, while also mitigating risks of slowing consumer sentiment. Google Cloud (Nasdaq: GOOG/GOOGL), a long-time user of AMD server processors, has recently extended the application of 3rd Gen EPYC processors in powering its all-new C2D virtual machine offerings (“instances“). Google has commended AMD’s EPYC processors for enabling its delivery of “strong performance and compute power for HPC memory-bound workloads”, while also providing “up to 30% better performance…compared to previous generation EPYC-based virtual machines”. The extended partnership continues to showcase AMD’s strength in acquiring additional business through proven technological competency, further propelling its prominence within the field of HPC and cloud computing.

A similar deal was recently extended by Amazon Web Services (“AWS”) (Nasdaq: AMZN) as well. The e-commerce giant’s cloud computing unit has also chosen AMD’s 3rd Gen EPYC processors for powering its all-new “EC2 C6a instances“. AWS’ C6a instances mark the second type of EC2 instance after M6a to be powered by the 3rd Gen EPYC processors. The deal further corroborates AMD’s continued strength in maximizing value from existing customer relationships and driving robust adoption of core AMD technologies across the growing cloud computing sector.

Can AMD Stock Reach $150 in 2022?

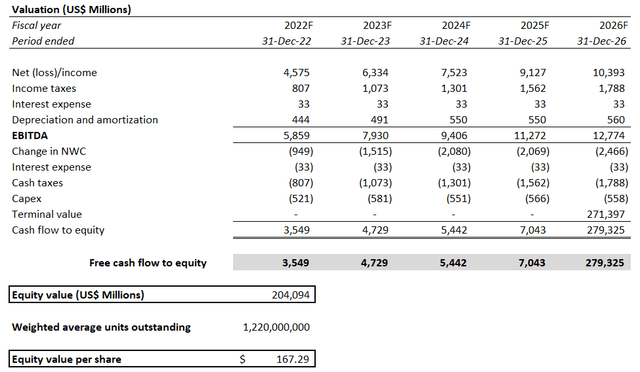

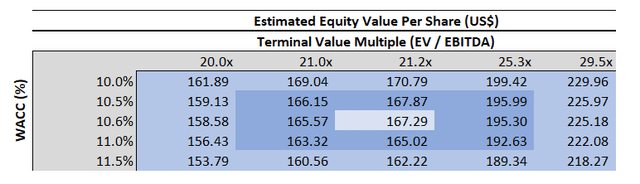

In our latest valuation analysis on AMD’s stock following its release of fourth quarter results in February, we had maintained a 12-month price target of $200. While our view on AMD’s growth outlook has not changed, we have decided to lower the stock’s near-term price target to $167.29 based on consideration of further broad-based multiple contraction observed across AMD’s peer group. This would represent an upside potential of 46% based on the last traded share price of $114.49 at the time of writing (March 23rd).

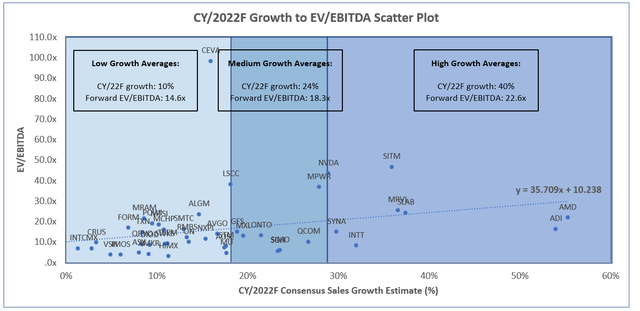

The revised price target is derived by adjusting the exit multiple of 25.3x used in our previous valuation analysis to 21.2x. The adjusted exit multiple applied to our base case valuation analysis, while holding all other valuation assumptions constant (i.e., 10.6% WACC with unchanged cash flow streams drawn from our base case financial forecast), is determined based on the semiconductor peer group’s implied growth-valuation correlation:

Even under the latest valuation adjustment on global equities, we believe AMD remains undervalued compared to its peer group given consensus expectations for continued growth outperformance. Based on the above scatterplot, which determines the relationship between CY/2022 consensus sales growth estimates and EV/EBITDA valuation multiples for chip stocks, AMD presents itself in the high-growth cohort but falls short of the average valuation multiple. Considering the current average analyst estimate for AMD’s 2022 revenue growth of 55%, the stock should trade at an EV/EBITDA of 30.0x instead of the current 21.9x based on the peer group’s implied growth-valuation correlation above. But considering our base case forecast’s assumption of 31% revenue growth for the current year, which aligns with management’s guidance, we have applied a 21.2x EV/EBITDA in our adjusted valuation analysis based on the implied growth-valuation correlation above.

Revised AMD 12-Month Price Target (Author) AMD Sensitivity Analysis (Author)

Is AMD Stock a Buy, Sell or Hold?

Based on the foregoing analysis on AMD’s growth outlook and consistent track record of outperformance, the stock remains an attractive buy. Even under the current contracted valuations environment, AMD’s stock remains undervalued compared to its industry peers and continues to exhibit promising potential in surpassing the $150-level again within the near term.

We expect the stock to regain momentum in the latter half of the year. Following the violent sell-off of global equities observed over the past four months, investors’ growth expectations have increased as part of a mechanism to reduce risk exposure under the current macroeconomic climate. They are now likely expecting several quarters of sustained fundamental growth to determine whether the stock can really defy and weather impending market headwinds, and emerge in the forefront, which should not be a challenge to AMD given its strong demand environment. The company’s recently approved $8 billion share repurchasing program also implies “robust expectations for future free cash flow generation” and continued financial outperformance ahead, which is a strong plus. Paired with improving supply chains and further clarity on the evolving economic and geopolitical situation expected in the latter half of the year, the AMD stock should start to see some more rebound action then.

Author’s Note: Thank you for reading my analysis. Please note that I am in the process of planning a subscription service with Seeking Alpha’s Marketplace. The service will allow you to follow my model portfolio, interact with me directly, and participate in chat rooms with other subscribers. I’ll be launching in the near future with a legacy discount for early subscribers and I’ll be sharing more details as we ramp up to launch in the coming months.

Be the first to comment