CemSelvi/iStock via Getty Images

Consumer discretionary names continue to be sold by investors as fears of a recession remain high on the long list of things to worry about. However, not all consumer discretionary stocks are created equal, and some look quite good, in my opinion. Of course, we must exercise risk management and have stops in place, just in case we’re wrong. But with that risk management in mind, I think RV-centric retailer Camping World (NYSE:CWH) looks quite attractive from a risk/reward perspective today.

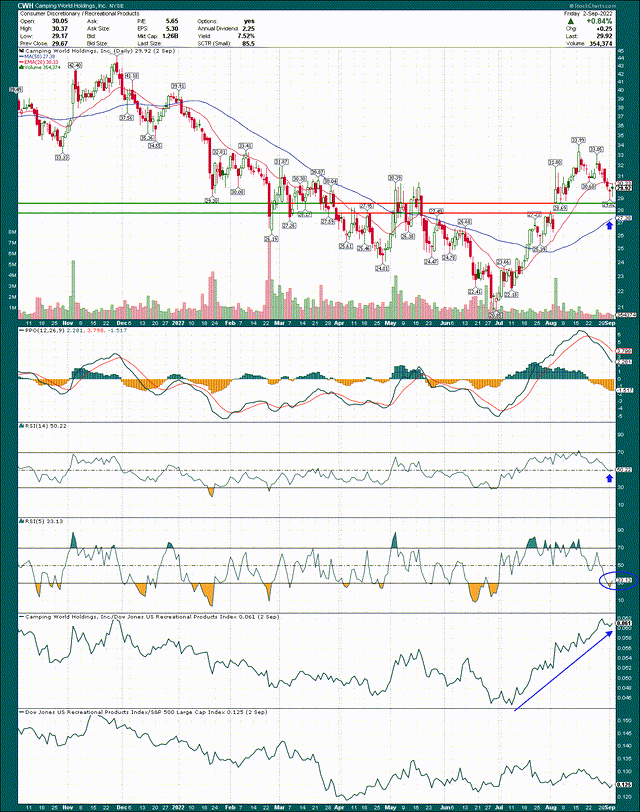

Let’s begin with the daily price chart, which is one of the primary reasons I think it’s worth a look from the long side.

We can see I’ve annotated a zone of support that corresponds roughly to $28 and $29, which is the gap from the early-August earnings report. The stock shot up to new relative highs after the report, but we are now able to buy the stock at essentially the same level today. Gap support tends to be quite strong, so I’m looking for this zone to hold on this pullback.

The 50-day simple moving average is also lurking just below at $27 and change, but rising rapidly. Should this pullback linger a bit, the 50-day SMA will double the support in the area of 28/29, so again, it should be rock solid. If we fail the bottom of gap support and fail the 50-day SMA, that would be an indication that this trade isn’t going to work and I’d advise considering getting out at that point. But the risk you’re willing to take is entirely up to you; I just urge you to use price levels to determine that risk.

The PPO is pulling back, but that’s expected given the massive rally that was super overbought. It’s still very much in bullish territory so we’re fine there.

The 14-day RSI is pulling back into centerline support just as we reach price support, which is ideal. And the 5-day RSI is at oversold levels, so on a short-term basis, the stock needs to bounce, which is corresponding to price support and bullish looks to the longer-term momentum indicators.

Finally, relative strength for Camping World has been truly outstanding, as the group it’s in has been treading water against the S&P 500. You want to see group and individual outperformance, but the extent to which Camping World is blowing past its peers is impressive.

The TL;DR on the chart is that we’re right at what should be strong, key support, right as momentum has had a chance to reset. I like it for a buy here based on the chart.

Do the fundamentals support a buy?

I can already hear people screaming through their computers about what a terrible idea it is to recommend an RV dealer heading into a recession. According to the BEA, we’re already in a recession, and have been for some time. The good news is – and something I don’t think a lot of investors understand – is that stocks bottom well ahead of the government telling us we’re out of a recession. In other words, stocks that are highly discretionary like Camping World will bottom a long time before we ever hear the recession is ending.

My personal belief is that this recession is going to be rather shallow and short, and that means stocks that rely on consumer spending will do fine from these lower levels. If you disagree, Camping World is not a stock for you, and that’s totally fine. Wall Street seems to agree, because if it didn’t, Camping World would be making new lows, not soaring to new relative highs and pulling back into strong support.

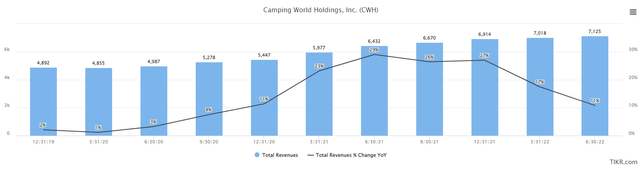

Let’s now turn our attention to trailing-twelve-months revenue in millions and the year-over-year change in revenue for the past few years.

Camping World was a huge beneficiary of the pandemic, as consumers looked to gain experiences away from other people. Revenue growth soared, but has obviously pulled back sharply. Revenue growth of nearly 30% was very obviously unsustainable and I’d argue even the 11% print for the most recent four quarters is likely unsustainable. The point, however, is that Camping World’s model resonates with customers and it just works.

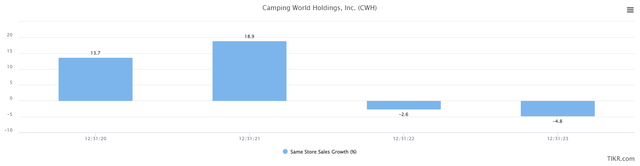

Comparable sales growth soared during the pandemic, which drove the vast majority of the results we saw above. Two-year-stack comps came in at 32.6% for 2021, but we’re going to see some of that worked off this year and next. That’s okay, because there was a bumper crop of sorts in terms of RV-related sales from the pandemic. Negative comp sales always seem to panic investors but in this case, how could you expect anything different after +32.6% over two years? We’re not seeing -20% comp sales or something like that so it’s okay.

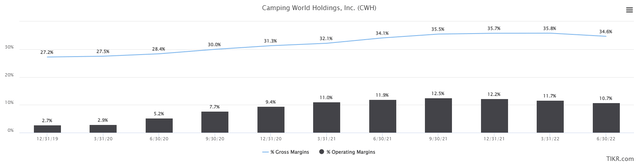

Margins are absolutely critical for any business, but especially retailers, so below we have gross and operating margins on a trailing-twelve-months basis.

Gross margins have moved up gradually, and taken operating margins much higher. One thing higher revenue affords a retailer is leveraging down occupancy, labor, and other big cost items. That creates better operating margins, and we can see Camping World has significant operating leverage. That is, small moves in gross margins have outsized moves in operating margins.

Operating margins are falling, but again, that’s expected as the company works off the excesses of the pandemic bump. Eleven percent operating margins for this kind of business is quite good, in my opinion. I will still feel that way if we see 8% or 9% margins at the bottom of this cycle.

Final thoughts

One thing I want to cover is the company’s balance sheet, because Camping World has always had a significant amount of debt. It has just under a billion dollars of operating leases on its balance sheet, but that’s not actual debt; it’s an operating expense that is parked on the balance sheet. I’ve disliked that rule from the minute it was introduced a few years ago, because it makes a company’s balance sheet look more leveraged than it actually is.

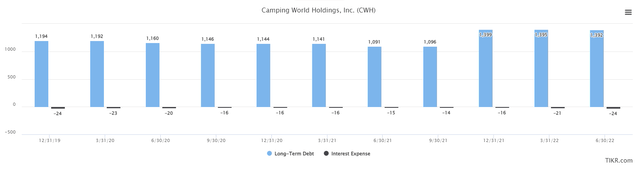

Let’s instead focus on actual debt, in the form of long-term debt in millions of dollars. I’ve also plotted quarterly interest expense in millions of dollars.

LT debt has been pretty stable for years, which is great, and so has interest expense. Camping World paid $24 million in interest expense last quarter, which is a small fraction of operating earnings. While $1.4 billion in debt sounds like a lot (and it is), it’s cheap enough that we shouldn’t see it impacting earnings in a significant way anytime soon. And remember, Camping World is presumably generating more than $24 million in additional returns each quarter from that debt, or it would be a better idea to pay it off. I think the capital structure is fine as it is.

The stock’s valuation has risen sharply as the share price spiked. That has taken Camping World from a stock that was inexplicably cheap to one that looks fairly valued to me.

Shares go for just over 7X forward earnings today, and that’s about where it normally trades. It was cheap earlier this year at 4X and 5X earnings, but I wouldn’t say that any longer. I don’t see a lot of upside from the valuation as a result, but we could see 8X or perhaps 9X. Keep in mind also that when Wall Street is satisfied that the recession is ending, stocks like Camping World can see outsized valuations for a short period of time as they initially rally, before the analyst community catches up with higher estimates. That could certainly happen again, but as I said before, you have to believe this recession is going to be short and shallow.

There’s undoubtedly recession risk in Camping World. However, I’m following the price action and it looks quite bullish here. All we have to do is respect price levels and manage risk, and the upside potential is much larger than the downside. I see the stock as roughly fairly valued, but Wall Street has clearly crowned it as a relative winner, and that’s what I care about. Time will tell but if Wall Street is buying CWH stock, we should consider it as well.

Be the first to comment