Editor’s note: Seeking Alpha is proud to welcome Davide Devetak as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Ernesto S. Ruscio/Getty Images Entertainment

Davide Campari-Milano (OTCPK:DVDCF) is an €11.5 billion market cap Italian company headquartered in Sesto San Giovanni, founded in 1860. The firm produces alcoholic and non-alcoholic beverages such as various categories of apéritif, and non-alcoholic apéritif, vodka, liqueurs, bitters, whiskey, tequila, and gin under famous brands such as Aperol, Campari, Wild Turkey, Grand Marnier, SKYY, and many others.

Campari shows very strong competitive positioning, thanks to the leadership in the appetizer sector, the strong ability to build brands, and the exposure to the main trends of the alcoholic beverage sector. In addition, the progressive internationalization of the group’s portfolio is very important, with clear advantages from geographical diversification.

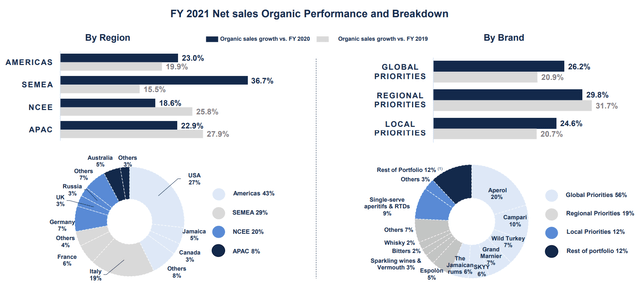

Net Sales by Region (Results Presentation Full year ended 31 December 2021)

Thanks to the notoriety of Campari’s brands and their premium and luxury positioning in the beverage market, the company is able to maintain extremely high margins (profit margin: 13.35%, operating margin: 21.24%).

Therefore, Campari has a good positioning in terms of inflation risk, considering the decent pricing power. Moreover, it is reasonable to think that it will be capable of showing resilience even in a slowing macroeconomic environment. That’s because, as underlined in the Q3 results, the demand for aperitifs does not seem ready to slow down.

To sum up, Campari seems to be an excellent investment opportunity to face the current situation of uncertainty in the markets.

Q3 Results

The good positioning of Campari in a context of high inflation is highlighted in the Q3 FY22 results. Indeed, the firm has shown that not only does it not suffer currency exchange fluctuation, but it’s also able to offset margin pressures.

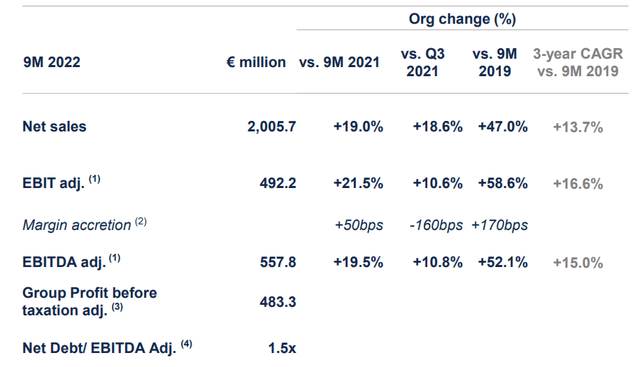

Campari’s Q3 Results (Results Presentation Nine Months ended 30 September 2022 )

Campari closed the first nine months of FY22 with a net PBT (profit before taxes) up 32.7% to €452.7 million, on net sales of €2 billion, up 27.3% in value and with an organic change of +19% (+18.6% in Q3).

The company reported the following:

Strong top-line performance continued in the key summer season thanks to strong brand momentum, continued on-premise strength and favorable weather as well as the initial impact of successful price increases.

Looking at the medium term, we remain confident in the strength of our brands, enabling adequate pricing actions, to navigate through the current challenges.

Wilderness Trail Distillery Acquisition

Campari recently announced that it has entered into an agreement to acquire 70% of Wilderness Trail Distillery, a U.S. alcoholic beverage company with expected revenues for 2022 of $57 million (+39% form 2021), and a gross margin of over 80%. The U.S. company is characterized by strong growth and high margins, as well as cutting-edge production infrastructure and know-how in artisanal bourbon production. Therefore, Campari will enrich its portfolio in this rapidly growing category, which accounts for 11% of the group’s revenue (of which 7% Wild Turkey), by adding a premium brand with strong potential.

The enterprise value of the company is $600 million, equal to approximately 16x the expected EBITDA for 2022. More specifically, an agreement has been signed to buy an initial 70% stake in Kentucky-based super-premium bourbon and rye whiskey brand Wilderness Trail Distillery for $420 million. Then Campari will buy the remaining 30% through a call/put option exercisable in 2031 at a determined enterprise value, applying the highest EBITDA between 2030 and the average of 2028-30.

The management indicated an improvement on EPS of 1% (+3% on operating cash flow, thanks to €6.5 million annual tax savings from goodwill for 15 years), at a borrowing cost of 4.5%. Therefore, we could judge the move positively for its strategic value, thanks to the visibility the group will gain in the medium term. However, this would have a limited positive impact on the valuation of Campari.

Valuation

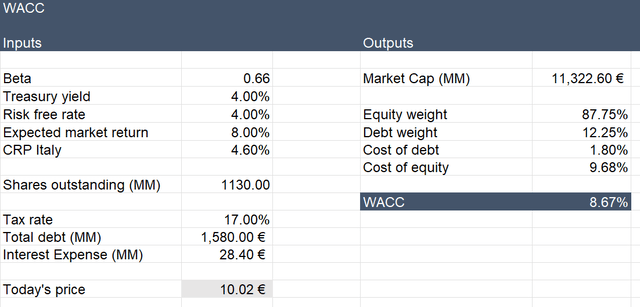

I evaluated the company using a discounted cash flow model. In this specific case I estimated the future free cash flows for the next 10 years by estimating line by line each of the three main financial statements. In order to do this, I made some assumptions: I estimated a risk-free rate of 4.00% (based on Italy government bond 10-year yield) and a country risk premium of 6.4%. I used those to model the weighted average cost of capital (WACC), which resulted in being equal to 8.67%.

WACC Calculation (Personal Excel DCF Model)

Furthermore, I assumed a terminal growth rate of 2.3% based on an estimated CAGR of the global economy between 2% and 2.5% in the next few decades.

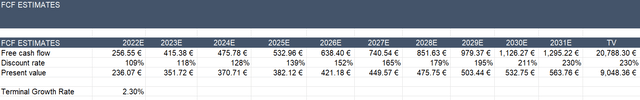

FCF Final Table (Personal Excel DCF Model)

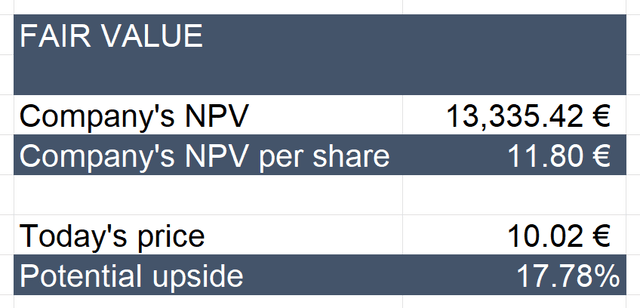

The company’s NPV (net present value) I calculated is €13.3 billion. Therefore, Campari’s NPV per share is €11.80, meaning that – according to the valuation – there is a potential upside in the stock price of 17.78% from the current price.

Fair Value Final Table (Personal Excel DCF Model)

It should be noted that all the results and calculations are in euros.

Risks

Campari’s risks are mainly associated with the possibility of new restrictions due to COVID-19. Indeed, in 2020 during the pandemic the company’s business was hit very hard, with a 3.80% drop in revenue. It has recovered partially only following gradual openings. However, I find a sudden change in the COVID-19 containment policy quite unlikely, unless an unexpected event occurs. Therefore, for this reason I did not give much importance to this scenario modeling the discounted cash flow (see previous section).

Regarding the debt situation, we can see that the current ratio is 1.97, so it’s absolutely sufficient. Furthermore, the total debt/equity ratio is 0.59, so it doesn’t worry me too much.

On the other hand, what could not be convincing is the high participation of institutions and insiders as shareholders, with 22.67% and 54.20%, respectively, of the total outstanding shares. This situation obviously has its pros and cons. Finally, Campari’s new acquisitions might not bring any benefit to the business, thus lowering the valuation in the following years.

Conclusion

Campari is well positioned to face a context of high inflation, by virtue of high margins and the possibility of raising the price list. It’s also well positioned to face a possible recession as the leader in aperitifs, which generally do not slow down in a period of slowing economy. The company has also proved to be very able to recognize emerging brands, as shown by the acquisition of Wilderness Trail Distillery, and therefore improve its business.

On the other hand, Campari’s resilience is largely priced in, meaning there is a limited potential upside. Therefore, lacking an adequate safety margin, I do not consider the company to be a perfect value deal. Rather, I view it as an excellent alternative to diversify a portfolio in a niche sector with high growth potential.

Be the first to comment