RHJ

Investment Thesis

Cameco (NYSE:CCJ) is one of few western producers of uranium with sufficient size to attract institutional investors. I have covered the company several times in the past even if it has been more than a year since the last time. In this article, I will go over some recent developments in the industry, my thoughts on the contracting strategy, and comment on the valuation.

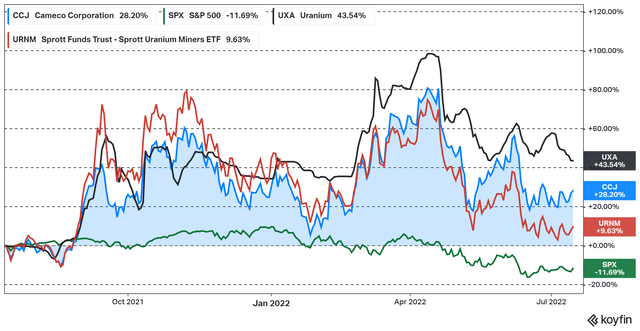

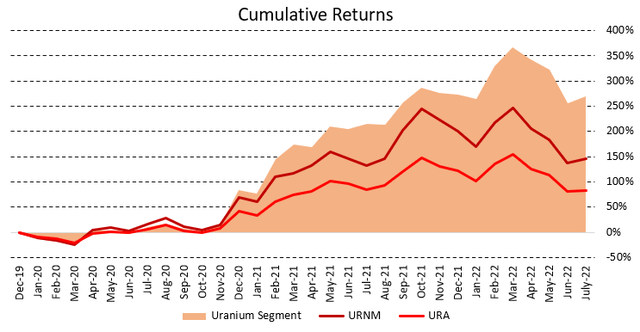

The stock price has over the last year outperformed the overall market and uranium equities in general. That the stock price is up almost 30% over the last year is not that big of a surprise given that we have seen the spot price of uranium climb more than 40%. It is probably more surprising how poorly the rest of the uranium equities have performed in relation to the price of uranium. The positive industry developments do, however, bode well for the future.

Figure 1 – Source: Koyfin

Given the Canadian jurisdiction, larger size, and partly price hedged production, Cameco is a lower risk investment in the uranium industry which will likely do very well once institutional investor demand picks up again.

Market Developments

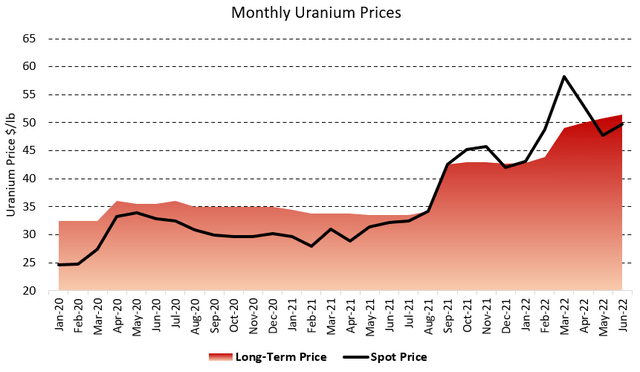

Both the spot and long-term contract price of uranium have increased substantially over the last year, where the most recent spot price is at $45.75/lb according to Numerco. The long-term price was according to Cameco in the end of June $51.50/lb.

While we are still some ways from levels where most uranium miners can sustainably produce, we are talking about a significant increase over the last year. The heavy buying from the Sprott Physical Uranium Trust (OTCPK:SRUUF) and some other companies in the industry has likely been the main reason for the price increase, at least in the spot market.

Figure 2 – Source: Cameco

We have also seen very positive developments for the overall nuclear industry lately, where South Korea has now joined France and the UK in a list of countries which were not too long ago planning to shut down nuclear reactors but are now actively looking to expand the reliance on nuclear.

Japan is another country where reactor restarts now appear to be happening with more urgency to deal with the ongoing energy crisis.

The European Union has also classified nuclear energy as green and even if that fact was self-evident to some of us. It will likely help with the perception over time together with investment flows and the availability of financing for nuclear projects.

It has over the last few months also become clearer that western countries are working on banning uranium from Russia, which will likely be positive for western producers and the price of uranium. Uranium is turning into a bifurcated market, where we were already before this looking at record annual supply deficits.

We did recently see the U.S. government finally issue the RFP for the Uranium Reserve, which has been due for a year or two. While the amount is relatively small at up to 1Mlbs of uranium presently and will in the short term probably just be positive for some U.S. producers. It is still an important signpost.

All these positive developments have in my view yet to be priced into uranium equities.

Cameco Contracts

Everyone has an opinion on Cameco’s contracting strategy, and these are some of my thoughts. I have heard some less than serious claims that higher uranium prices would be bad for Cameco given that the company relies on spot market purchases for some of the contract commitments.

A massive spike in the spot price of uranium might cause some margin compression in the very short term, but the company would in such a scenario a year or two after be producing all the pounds needed to deliver in the contracts. Also, one should not forget that the current contracts cover about 20Mlbs of uranium per year over the next few years, while Cameco has just over 30Mlbs of capacity. So, a price spike would likely lead to more contracting by Cameco, it has also been communicated that we will see more market related prices on future contacts. So, higher prices would no doubt be a positive for Cameco as a company is valued on all future cash flows and not just one year where we might see some margin compression.

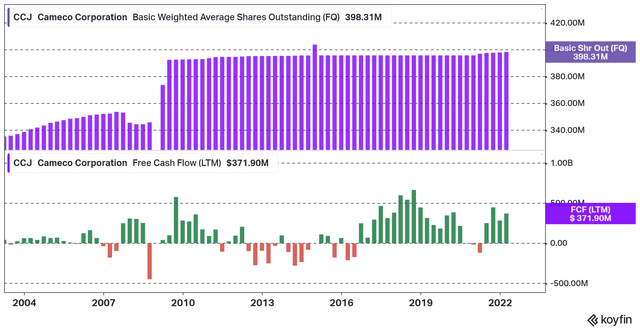

A conservative contracting strategy together with relatively low-cost-assets is why Cameco has over the decade long bear market been able to produce decent cash flows and kept the share count stable. Most other uranium companies which have survived from the last bull market have had larger negative cash flows and seen their share count grow massively.

Figure 3 – Source: Koyfin

However, as well as the contracting strategy has worked for Cameco in the long run, I do think there is an argument to made for the company being overly conservative during the last year or two. Cameco has many times during this period claimed the primary risk is to supply and not demand for uranium, which I agree with.

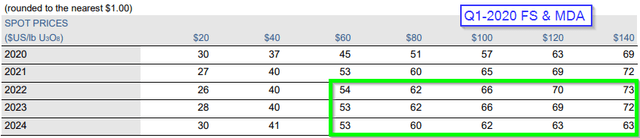

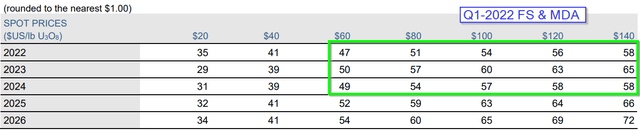

If that is truly the case, why do the new contracts appear to have been signed with price caps that have lowered the realized uranium price at higher uranium prices, as seen by comparing the uranium sensitivity table over the last two years? This strikes me as overly conservative given the industry developments, for a company with a solid balance sheet and a negative net debt.

Figure 4 – Source: Cameco Q1-20 FS & MDA

Figure 5 – Source: Cameco Q1-22 FS & MDA

Cameco does as mentioned earlier have more production capacity, which can increase the numbers in the table, but 20Mlbs is still a large portion of Cameco’s total production capacity.

Valuation & Conclusion

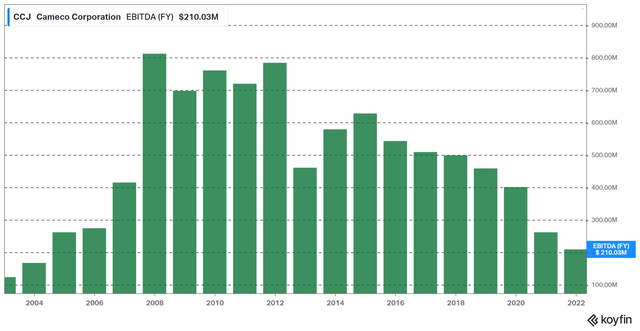

Cameco has a market cap is $9.1B and an enterprise value of $8.8B. In Canadian dollars, we are talking about an enterprise value of C$11.4B. If we look at the EBITDA during the last uranium bull market, the company had a maximum EBITDA around C$800M back then and we are far from that level today.

Figure 6 – Source: Koyfin

We would consequently be looking at an EV to EBITDA of 14 if we went back to historically peak level of earnings. Now, Cameco did hedge a lot of production last time around which is why earnings did not spike more, but there is an argument for that being at least partly the case again.

If we consider the fact that Cameco has just above 30Mlbs of annual uranium capacity, some earnings from fuel services & Inkai, and the price caps on part of production. To arrive at an objectively cheap valuation for Cameco, one must be rather aggressive with the uranium price assumptions.

I do think the likelihood is very high for higher uranium prices given the list of developments mentioned above, but the valuation for Cameco is not cheap enough for me to buy the stock. Especially when we have other lower risk investment in the industry, like the investment vehicles, Sprott Physical Uranium Trust & Yellow Cake (OTCQX:YLLXF) that are presently trading with a 10-15% discount to NAV using a uranium price of $45.75/lb. Cameco probably has much lower political, permitting, mining, financing, and operational risks than other uranium miners. We are still talking about a mining company which is not without risk.

Given that Cameco is the only larger uranium miner, with western production, a consistent operating history, and a good balance sheet, a premium valuation can certainly be justified. Once larger investment flows come back to the industry, Cameco will likely do quite well. However, timing when to buy companies around NAV expecting them to go to 2x or more times NAV is beyond my investment skills. Focusing on companies trading below NAV using relatively conservative assumptions has instead served me well in the uranium industry over the last few years.

Figure 7 – Source: Uranium Segment of My Portfolio

Be the first to comment