ArtistGNDphotography/E+ via Getty Images

It’s easy to believe that an energy crisis will supplement alternative energy stocks, especially those that hold exposure to materials with “new-era” demand. However, there are two sides to the coin, and it’s reasonable to doubt Cameco’s (NYSE:CCJ) ability to deliver adequate short-run supply. We’re not saying this company/stock doesn’t have long-term potential, but instead, we’ve concluded that its short-run value is overhyped; here’s why.

The Systemic Environment

Much of the world’s entering an energy crisis, given the numerous COVID-19 supply lags and Europe’s ex-Russia energy supply line. Therefore, the nuclear power debate is being self-settled, forcing many nations to adopt nuclear. As such, the demand for Uranium as a nuclear fuel composite is skyrocketing.

Cameco itself has recognized the rise in global demand and recently stated: “We believe the fundamental shift in the supply-demand balance is still underway, with an illusion of endless secondary supply, creating ongoing opportunities for Kazatomprom as a primary supplier that maintains a disciplined approach,”.

Recent events corroborate the firm’s claim. For instance, Liz Truss, the U.K.’s new Prime Minister, has made her intentions clear to increase investment in nuclear power. Another example is Germany, which is keeping nuclear reactors on standby to backfill the natural gas shortage.

The consequence of recent systemic events is a prolonged surge in the price of Uranium, bolstering interim revenues for Cameco, which supplies approximately 18% of the world’s Uranium.

Cameco’s Operational Status

Most of Cameco’s recent topline growth is due to price support. We see a few obstacles occurring when commodity prices fade during an economic contraction.

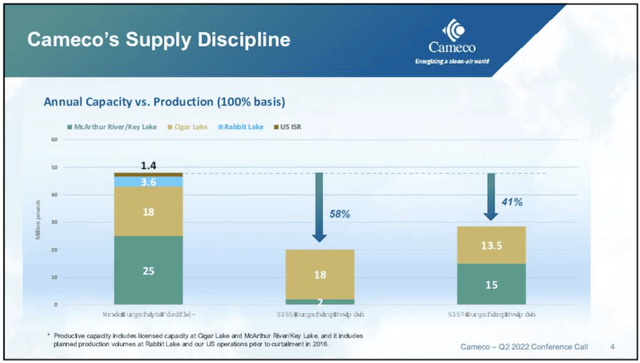

The main obstacle for Cameco is its low capacity utilization, stemming from Covid-19-induced events and the war in Ukraine, which has impacted its operations in Kazakhstan.

In 2020, the uranium miner suspended operations in Canada due to Covid-19 risk. Its Rabbit Lakes and Crow Butte assets both remain landlocked, with aggressive maintenance CapEx spending (cumulatively up to $51 million for 2022) dragging down the company’s income statement.

Cameco’s Smith Ranch-Highland mine has also been stationary, with a $17 to $19 million maintenance CapEx spend projected for this year. However, recent reports suggest that the company’s McArthur River/Key Lake mine/milling unit will be revitalized soon and might reach an annual production output of approximately 15 million pounds by 2024.

Furthermore, Cameco’s flagship Inkai mine in Kazakhstan has suffered severe disruptions due to the war in Ukraine. The big issue isn’t production obstacles (it was initially), but instead, transportation issues as freight insurance premiums have skyrocketed; additionally, cargo cancellations have been a recurring trend since the start of the Russia-Ukraine conflict. Since the start of the war, Cameco’s not been able to deliver any of its Inaki-derived deposits, which could impact its general valuation and dividend payouts moving forward.

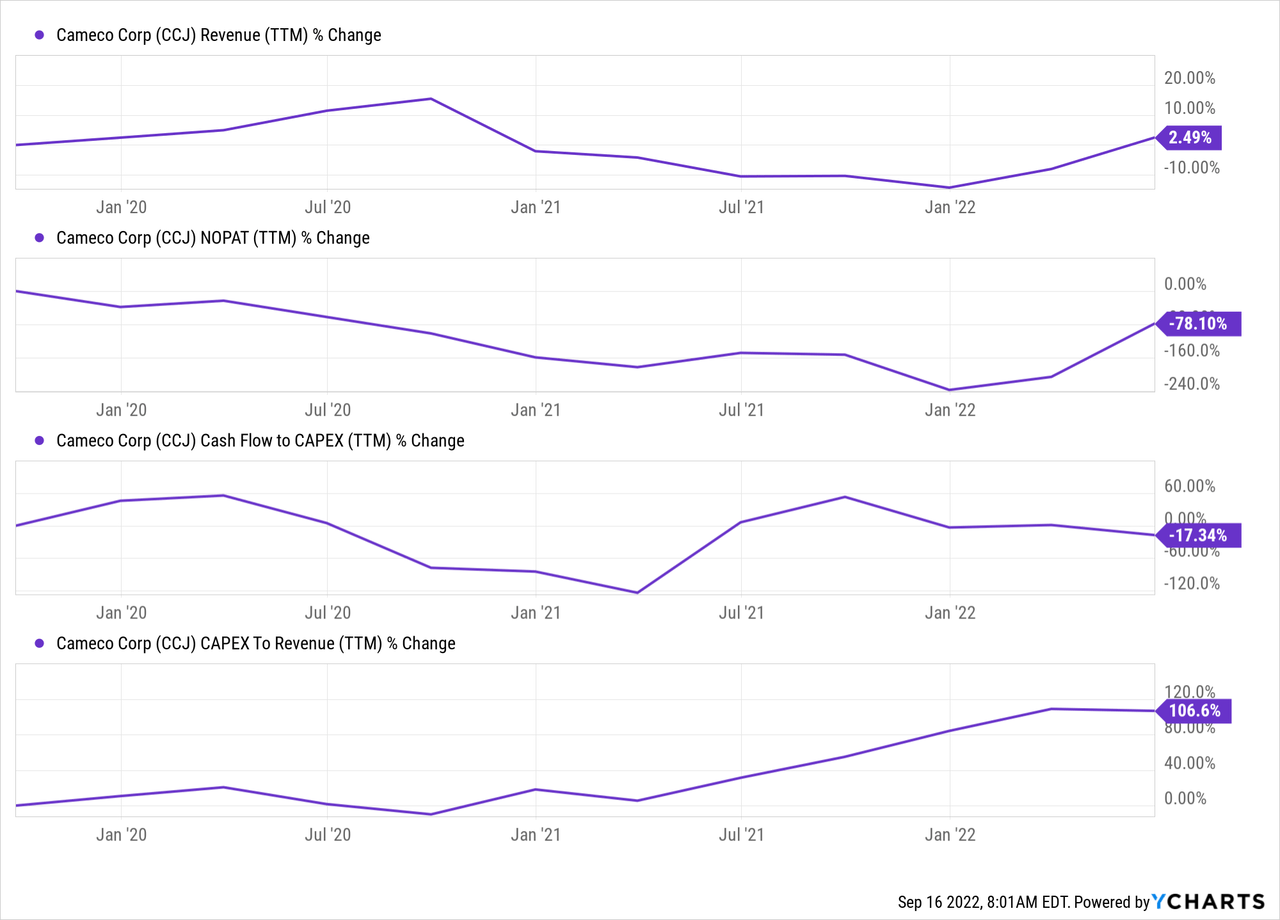

Cumulatively, the data points in the figures below convey the qualitative factors I outlined for you. There’s been a significant decrease in revenue and cash flow relative to maintenance CapEx, resulting in receding residual value for Cameco’s shareholders. Additionally, the firm’s operating profits after tax (NOPAT) have faded significantly over the past two years, diluting shareholder value.

Valuation & Dividends

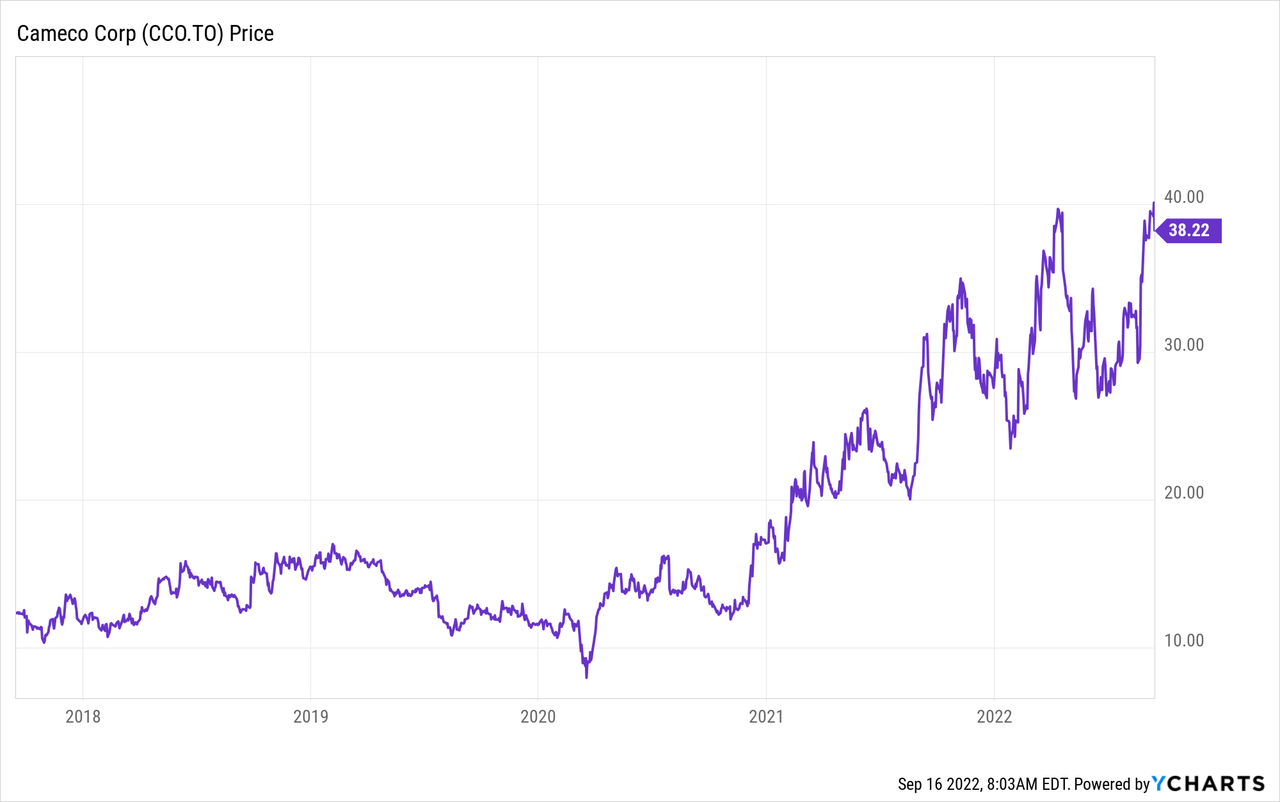

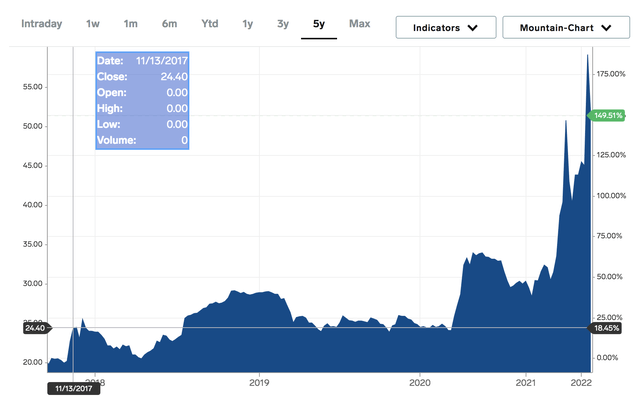

The valuation of natural resource companies is best observed by monitoring their price-book ratios as their inventory (deposits) are quoted and traded. According to Cameco’s relative valuation metrics, the stock’s overvalued relative to both its book value and its earnings, suggesting the stock market has gotten ahead of itself.

These ratios will likely worsen over the coming quarters amid a pending recession. A recession would devalue the firm’s tangible value considerably as commodity prices could tank.

| Price-Book | 3x |

| Price-Earnings | 246x |

| Price-Cash Flow | 27.7x |

Source: Seeking Alpha

Cameco doesn’t pay a lucrative dividend. Although its payout’s well-covered by a coverage ratio of 3x and cash flow from operations, its yield lacks attraction.

| Dividend Yield (FWD) | 0.33% |

| Coverage Ratio | 3x |

| Operating Cash Flow | $415.88 million |

Source: Seeking Alpha

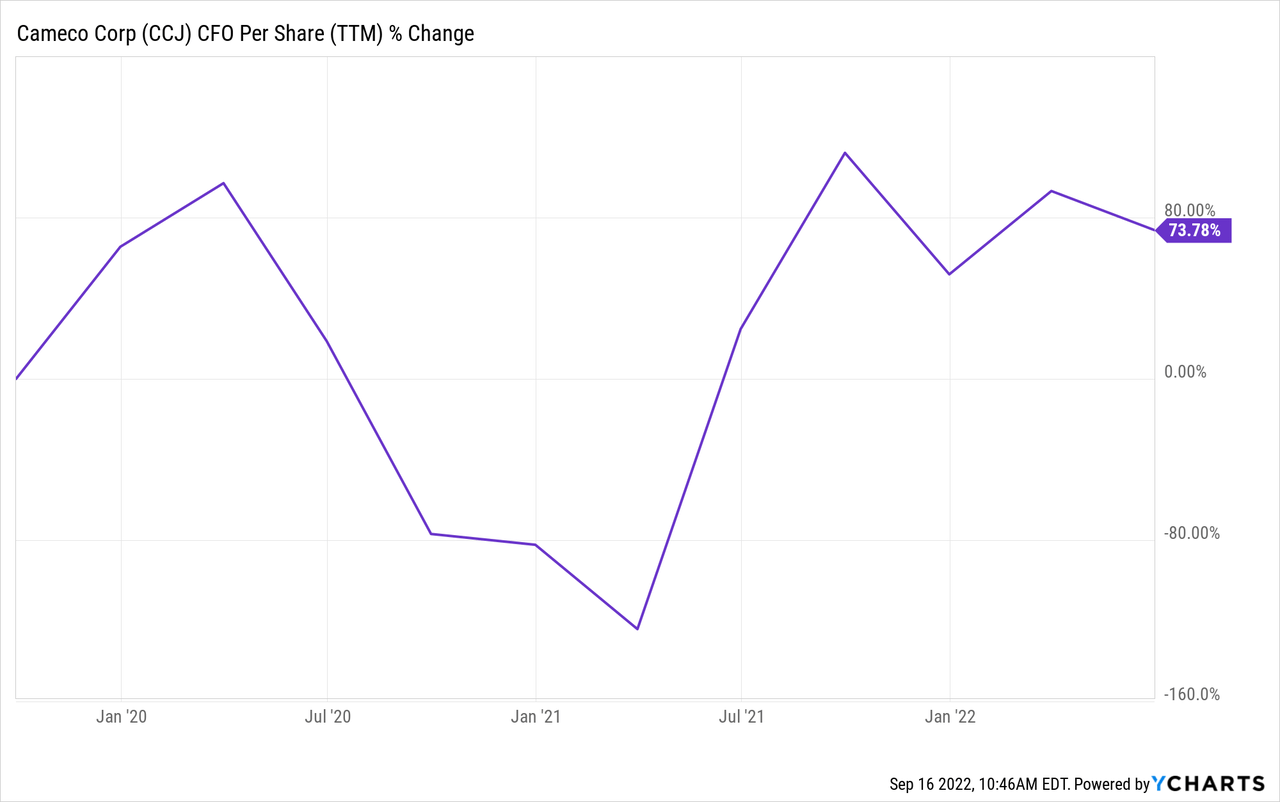

Conversely, Cameco’s 73.78% 3-year CFO (Cash From Operations) per share growth could ignite improved shareholder compensation in the coming years.

Our Conclusion

Although a pending energy crisis could stimulate Uranium demand, Cameco is facing too many operational disruptions to fill the void. The company has various sites on post-covid maintenance lockdown, and we remain negative with regard to the firm’s operations until tangible evidence signals otherwise.

Lastly, Cameco’s significantly overvalued and provides an undesirable dividend yield. Additionally, a pending recession could exacerbate the stock’s poor valuation metrics as Uranium deposits will likely be devalued.

If you’re interested in more advanced analysis, be sure to keep an eye out for our marketplace program, “The Factor Investing Hub,” which launches soon. FIH is an AI-driven “smart beta/factor investing” portfolio management concept with the goal of balancing long-term portfolios relative to “factors.”

Be the first to comment