Steve Allen/DigitalVision via Getty Images

You don’t expect to see many big deals in a market with exponentially rising interest rates. But that is precisely what we got and it included three players we follow rather closely. Brookfield Business Partners L.P. (NYSE:BBU) is the seller here of Westinghouse Electric Company. The purchasers include Cameco Corporation (NYSE:CCJ) and in an unusual twist, another Brookfield company, Brookfield Renewable Partners L.P. (BEP, BEPC).

What Is Westinghouse Electric Company?

Westinghouse is about as close to a monopoly as you can find today. The company services about 50% of the nuclear power generation sector. It is also the original equipment manufacturer for more than half of the currently functioning global nuclear fleet. It generates the bulk of its revenues from long-term contracts and has an extremely stable customer base. There are really not many competitors who can do what the company does.

How Did BBU Come To Own This?

On March 24, 2017, parent company Toshiba announced that Westinghouse Electric Company would file for Chapter 11 bankruptcy because of US$9 billion of losses from nuclear reactor construction projects. The projects responsible for this loss are mostly the construction of four AP1000 reactors at Vogtle in Georgia and the Virgil C. Summer plant in South Carolina. BBU bought Westinghouse while it was in bankruptcy in 2018.

BROOKFIELD, NEWS, Jan. 04, 2018 (GLOBE NEWSWIRE) — Brookfield Business Partners L.P. (TSX:BBU.UN) (“Brookfield Business Partners”), together with institutional partners (collectively “Brookfield”), announced today that it has entered into an agreement to acquire 100% of Westinghouse Electric Company (“Westinghouse” or “the Company”), a leading global provider of infrastructure services to the power generation industry, which is currently owned by Toshiba Corp.

The transaction provides for a purchase price of approximately $4.6 billion, expected to be funded with approximately $1 billion of equity, approximately $3 billion of long-term debt financing and the balance by the assumption of certain pension, environmental and other operating obligations.

Source: BBU Press Release

How Has Westinghouse Been Performing?

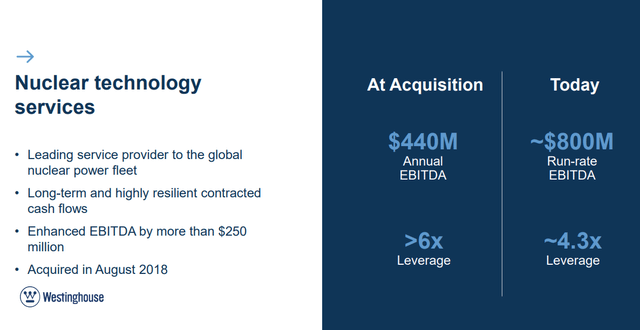

BBU has got things working well at Westinghouse and we have seen steady EBITDA from the company, despite some cost pressures.

The most recent results were under par versus expectations. BBU indicated that EBITDA at Westinghouse was suppressed by 9% due to disruptions caused by the conflict in Ukraine

How Does This Impact BBU?

Reports that BBU was trying to monetize this surfaced in late April of this year. Note the expected price in that press release.

Brookfield Business Partners (BBU_u.TO) is exploring options including the sale of a minority stake in Westinghouse Electric Co that could value the U.S. nuclear power developer and servicer at as much as $10 billion including debt, people familiar with the matter said on Friday.

The sale plans come as the nuclear power sector may benefit from President Joe Biden’s push to tackle climate change. Biden unveiled a target to slash America’s carbon emissions by the end of the decade to 50% of what they were in 2005, and included nuclear power in the potential energy mix to achieve this goal.

Source: Reuters

The actual sale price, including debt was $7.875 billion.

The total enterprise value for Westinghouse is $7.875 billion. Westinghouse’s existing debt structure will remain in place, leaving an estimated $4.5 billion equity cost to the consortium, subject to closing adjustments. This equity cost will be shared proportionately between Brookfield and its institutional partners (approximately $2.3 billion) and Cameco (approximately $2.2 billion).

Source: Seeking Alpha

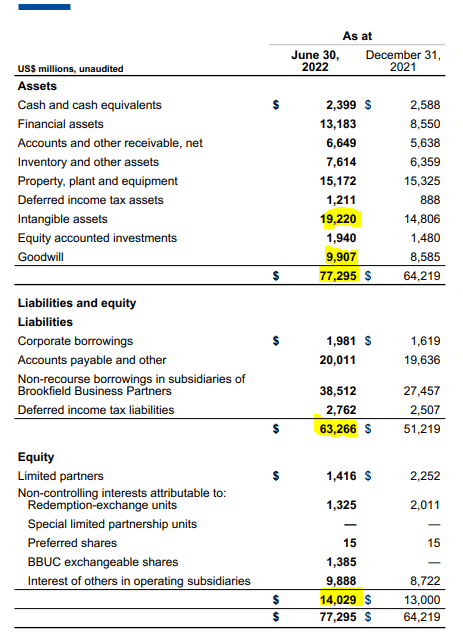

While the drop in enterprise value was about 21%, the drop in equity value was 32%. All Brookfield entities tend to run with a ginormous amount of leverage and this tends to happen when the tide goes out. EV to EBITDA multiples are around at 10-11X. There is a lot of uncertainty around the exact numbers as Westinghouse’s last quarter was quite weak versus the expected run-rate. Nonetheless, even at 11X, the sale is a big letdown from the Reuters implied 14X multiple. At the Reuters implied price, NAV per BBU share would move up by $7.00. The uplift from the current deal is closer to $1.25 per share. While the deal exit is good, BBU still runs one of the most leveraged balance sheets that you can find. $77 billion of assets with almost $30 billion of intangibles and goodwill, runs up against $63 billion of debt.

BBU Presentation

Sure, almost all of that is at the asset level, but those refinancings are going to be riveting in this market. The cash influx from this sale is helpful in case BBU needs to reinject some into an unstable investment. We upgrade BBU to a hold as valuation has compressed enough since our Sell Rating.

How Does This Impact Cameco?

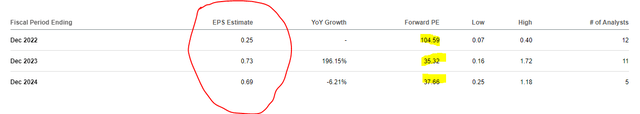

On our last take, we suggested that CCJ might need uranium prices to more than double, just to justify the current valuation.

Cameco is an interesting play for sure and we think the crowding into this mid-cap stock could push it into an even more extreme valuation. But as far as we are concerned, we are not interested here. Close, but no cigar.

Source: Cameco Bull Case, Close, But No Cigar

This deal is good in one regard, that CCJ gets a stable new EBITDA base that it can integrate into its existing operations. But it has been painfully obvious that the stock is so expensive, even after the big uranium price increase, that it would require a big leap of faith to invest here.

This deal makes CCJ even less sensitive to the price of uranium. Some might argue that that is a good thing. We don’t think the uranium groupies will see it the same way. If they wanted a utility company, they would have bought a utility company. CCJ’s pre-market action (minus 14%) probably comes from that and the large secondary offering.

Cameco today announced that it has entered into an agreement with a syndicate of underwriters led by CIBC Capital Markets and Goldman Sachs & Co. LLC, pursuant to which the underwriters have agreed to purchase, on a bought deal basis, 29,615,000 common shares of Cameco at a price of $21.95 per share (the “Offering Price”), for gross proceeds to us of approximately $650 million (the “Offering”). The common shares will be offered to the public in Canada and the United States. The Offering is expected to close on or about October 17, 2022, subject to customary closing conditions, including receipt of all necessary approvals of the Toronto Stock Exchange and the New York Stock Exchange. Additionally, we have granted the underwriters an option to purchase up to an additional 4,442,250 common shares at the Offering Price, exercisable in whole or in part at any time up to 30 days following the closing of the Offering, for potential additional gross proceeds to Cameco of approximately $97.5 million.

Source: Cameco

We downgrade CCJ to a Sell as we see investor capital fleeing after this deal.

Verdict

One critical aspect of this deal is that BBU was only able to unload half of this asset to CCJ. The other half was picked up by BEP and its partners, undoubtedly masterminded by Brookfield Asset Management Inc. (BAM). The net benefit to BAM here appears rather minuscule, especially when one takes into account potentially dilutive equity issuance by BEP. We would have thought this deal would be better suited to Brookfield Infrastructure Partners L.P. (BIP) but BAM works in mysterious ways. Overall, this deal shows how quickly deal appetite has come down and how equity valuations are being starkly reduced by small drops in enterprise valuations.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment