grandriver

Callon Petroleum Company (NYSE:CPE) is an independent exploration and production company that operates in West and South Texas. This is hardly unusual, as there are many energy companies that operate in that area due to the general mineral wealth of the region. As has been the case with many other energy companies, Callon Petroleum has seen significant revenue growth over the past two years. In fact, the third quarter alone showed a 51.3% year-over-year increase in revenue.

The market has certainly not been impressed by this company, though, as it is one of the only energy stocks that is down over the past twelve months. This has resulted in the company having an incredibly low valuation, which may make it suitable for an investment today. Let us investigate further and determine if this is indeed the case.

About Callon Petroleum Company

As stated in the introduction, Callon Petroleum Company is an independent exploration and production company that operates in South and West Texas. As such, its acreage is largely in the Permian Basin and Eagle Ford Shale. These are names that anyone that has followed the energy industry for any amount of time is likely fairly familiar with. After all, the Permian Basin has been at the forefront of the American energy revolution that has taken place over the past decade or so. This is not surprising, considering the resource wealth of the region. The Permian Basin is the richest source of crude oil and natural gas in the United States and one of the most mineral-rich regions of the world, which is evident in the region’s reserves. According to the U.S. Energy Information Administration, the Permian Basin still contains at least five billion barrels of crude oil and nineteen trillion cubic feet of natural gas despite being exploited since the 1920s.

It is important to keep in mind that these estimates were derived in 2018 and only include those resources that could be profitably extracted at the prevailing prices of the time. As energy prices are higher now, we can expect that reserves also are almost certainly higher. This wealth is evident in the fact that Callon Petroleum has fifteen years of drilling inventory remaining on the acreage that it already controls, which should indicate that the company can continue to produce for quite some time.

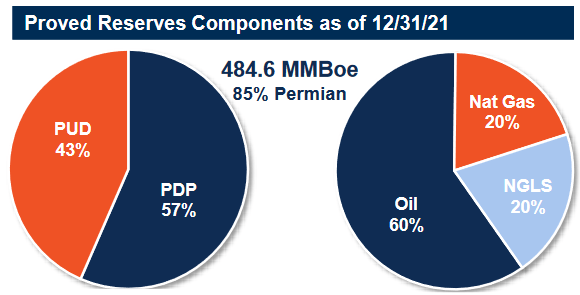

We can see the company’s ability to sustain its operations for a considerable amount of time even more by looking at Callon Petroleum’s reserves. An energy company’s reserves are something that is frequently overlooked by investors, but they are critically important. This is because the production of crude oil and natural gas is by its nature an extractive process. After all, these companies literally obtain their products by pulling them out of reservoirs in the ground. As these reservoirs contain a finite quantity of resources, an energy company must continually discover or otherwise acquire new sources of oil and gas or it will eventually run out of products to sell. As a company’s success at this is by no means guaranteed, its reserves dictate its ability to continue its operations without success. As of December 31, 2021, Callon Petroleum had proven reserves of 484.6 million barrels of oil equivalent, most of which are in the Permian Basin:

Callon Petroleum

During the third quarter, Callon Petroleum produced an average of 107,300 barrels of oil equivalent per day. The company’s reserves, therefore, are sufficient for it to produce for about twelve years at its current production level. This is a reasonable reserve life that is comparable to that of most of the major energy companies. Overall, this is a pretty good position for the company to be in.

Another advantage that the company’s large reserve base provides is the ability to grow production. This is nice because growing production is one of the only ways for an energy company to increase its revenue and it is the only method that is truly in the company’s control. After all, Callon Petroleum cannot control the price of crude oil or natural gas but increasing its production means that it has more products to sell and thus generate revenue from.

The company does not seem to be planning this, however. It has guided to produce an average of 105,000 to 108,000 barrels of oil equivalent per day during the fourth quarter, which is in line with its third-quarter production. This is not exactly a negative thing, though. Although some companies have been increasing their production, many other firms have been opting to simply maintain their production and focus on maximizing free cash flow. Even among those firms that have been growing their production, it has generally not been sufficient to keep up with demand. Currently, the global demand for crude oil is at 101% of its level on December 31, 2019, but the global production of crude oil is only at 99% of its level on that date. This balance will likely be skewed even more once numerous countries embargo Russian oil next month. The laws of economics tell us that this situation will result in rising crude oil prices, which will benefit Callon Petroleum for obvious reasons. The fact that the company is not aggressively growing its production supports this because if the industry as a whole increases production too much then it could drive down the price of crude oil and thus the per-barrel cash flow would decline.

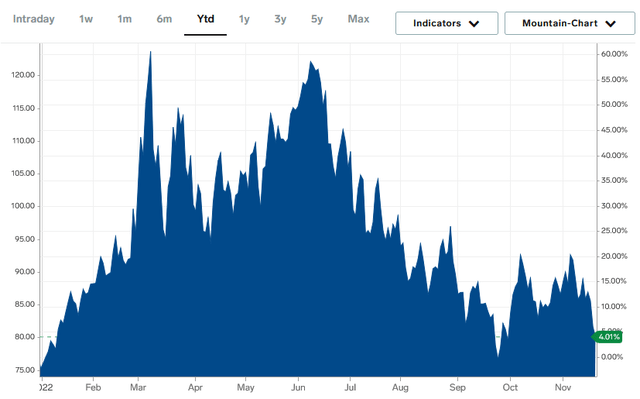

Over the past few months, the price of crude oil has generally been declining despite the rather positive fundamentals. As we can see here, prices have been falling since June:

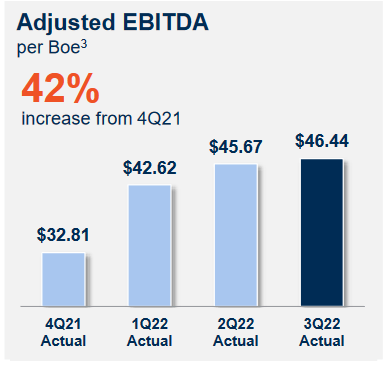

This would have been expected to have an impact on Callon Petroleum’s third-quarter results. In fact, though, the company’s adjusted EBITDA increased quarter-over-quarter. In the third quarter of 2022, Callon Petroleum reported an adjusted EBITDA of $458.523 million compared to $418.466 million in the second quarter of 2022. Although the company is apparently not planning to boost its production in the fourth quarter, it did increase it by about 7% in the third. This alone was not enough to account for the increased cash flow though since the company’s adjusted EBITDA per barrel of oil equivalent produced increased during the quarter as well:

Callon Petroleum

The only reason that the company gave for this is improving well productivity. Presumably, the company was producing more oil and gas on average from each well it drilled than in the previous quarters. This is something that we should appreciate since obviously the less money that the company is spending on drilling and the larger the profit on each barrel of oil produced, the more money that is available for the investors all else being equal.

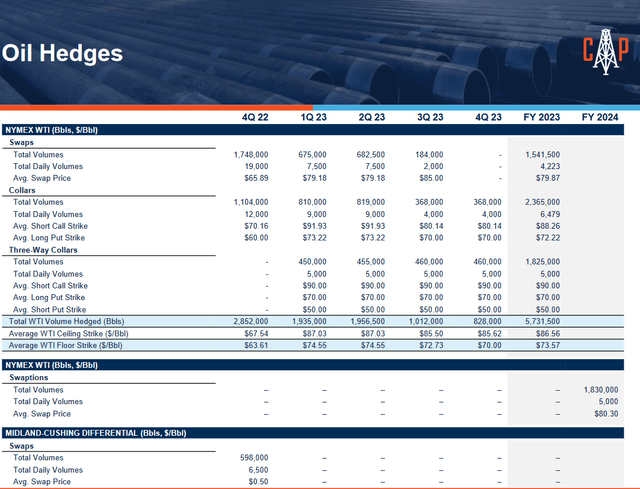

Unfortunately, Callon Petroleum will not benefit fully from today’s energy prices during the fourth quarter. This is because the company uses hedges to protect itself from commodity price risk. This is a common strategy used by all upstream exploration and production companies in order to prevent their cash flows from fluctuating too much due to commodity prices. Basically, Callon Petroleum uses derivative securities such as forward and futures contracts to effectively lock in a selling price for the resources that it produces. Here are the company’s current outstanding hedging contracts:

As we can see, the company has effectively committed to selling 2,852,000 barrels of crude oil during the fourth quarter at an average price of $67.54. During the third quarter, the company produced 6,112,000 barrels of crude oil. As we have already discussed, the company’s production will likely be about the same during the fourth quarter so Callon Petroleum has committed to sell about 46.66% of its expected fourth-quarter production at this price. As of the time of writing, the price of West Texas Intermediate crude oil is $79.72 per barrel so the company is basically going to be selling half of its production at a price that is well below the current market price. Admittedly, it could prove to be an advantage if the price of crude oil falls substantially but as we are already halfway through the fourth quarter, this seems highly unlikely. This is doubly unlikely considering the factors that we discussed earlier in this article. Overall, this is disappointing, but the amount of crude oil covered by hedges declines over the coming quarters, and the price at which the company has locked in is much higher so the situation should improve as we enter and progress through 2023.

Financial Considerations

In my last article on Callon Petroleum, one of the things that I was concerned about is the company’s relatively high level of debt. This could be a concern, because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. As this is usually accomplished by issuing new debt and using the proceeds to repay the existing debt, a company’s interest expenses may increase following a rollover depending on the conditions in the market. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a decline in cash flows may push a company into financial distress if it has too much debt.

Fortunately, Callon Petroleum has made some progress in reducing its overall leverage during the past quarter. One metric that we can use to see this is the net debt-to-equity ratio. This ratio essentially tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important. As of September 30, 2022, Callon Petroleum had a net debt of $2.369 billion compared to shareholders’ equity of $2.809 billion. This gives the company a net debt-to-equity ratio of 0.84. This is significantly better than the 1.11 ratio that the company had at the end of the second quarter, but it is still a bit higher than many of its peers:

|

Company |

Net Debt-to-Equity Ratio |

|

Callon Petroleum |

0.84 |

|

Continental Resources (CLR) |

0.44 |

|

Matador Resources (MTDR) |

0.26 |

|

Diamondback Energy (FANG) |

0.38 |

|

Pioneer Natural Resources (PXD) |

0.16 |

As we can see, Callon Petroleum still has a considerable way to go to match its peers’ numbers. However, the company’s quarter-over-quarter is still a considerable improvement that should reduce the risk of its debt somewhat.

Another metric that we can use to evaluate a company’s debt level is the leverage ratio, which is also known as the net debt-to-EBITDAX ratio. This ratio essentially tells us how many years it would take the company to completely repay its debt if it were to devote its entire pre-tax cash flow to that task. As of September 30, 2022, Callon Petroleum had a leverage ratio of 1.49x based on its trailing twelve-month EBITDAX. As with the net debt-to-equity ratio, this represents an improvement over the 1.67x that the company had at the end of the second quarter. However, the most financially strong companies in the industry are well under a 1.0x ratio right now so obviously, Callon Petroleum still has a considerable amount of work to do to get this figure down. Fortunately, management seems to realize this as well and has the stated goal of reducing the company’s leverage ratio down to 1.0x to 1.25x by the end of 2022. This would be a reasonable level if the company can actually achieve it.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of an independent exploration and production company like Callon Petroleum, one way to value it is by looking at the company’s forward price-to-earnings ratio. This ratio essentially tells us how much we are paying today for each dollar of earnings that the company is expected to generate over the next twelve months.

According to Zacks Investment Research, Callon Petroleum currently has a forward price-to-earnings ratio of 2.79. This is incredibly low for today’s market and continues the running theme that we have seen all year of energy companies being substantially undervalued. In the case of Callon Petroleum though, the firm is even undervalued relative to its peers:

|

Company |

Forward Price-to-Earnings |

|

Callon Petroleum |

2.79 |

|

Continental Resources |

6.62 |

|

Matador Resources |

6.27 |

|

Diamondback Energy |

6.29 |

|

Pioneer Natural Resources |

7.95 |

As we can clearly see, all of these companies are incredibly cheap. As of the time of writing, the forward price-to-earnings ratio of the S&P 500 (SPY) is 19.18. However, Callon Petroleum is very cheap even relative to its peers. This could position the company well as a portfolio addition assuming that it can manage to continue to get its debt down.

Conclusion

In conclusion, independent energy companies like Callon Petroleum have proven to be good investments over the past year. However, Callon has been one of the worst in the sector as the company’s stock is one of the few that has seen a loss over the period. There does not appear to be any good reason for it, however, as the underlying company is performing quite well. This has overall resulted in the company being substantially undervalued today. Callon Petroleum Company’s biggest problem appears to be its debt, and it has even made considerable headway at resolving that over the past few quarters. Callon Petroleum Company may thus be worth considering today.

Be the first to comment