chrisp0/iStock via Getty Images

Overall entertainment, casino and hotel operations have been volatile over the past few years, to say the least. They enjoyed a surge in activity before the pandemic locked and shut down most of their operations worldwide and have since been quite successful in coming back to near full swing.

Caesars Entertainment (NASDAQ:CZR) is not different. As one of the largest casino, hotel and golf course operators in the Nevada region, the company saw some big spikes in revenues in the past few quarters as people got back out into the world and wanted to make up for the past year and a half of lockdowns.

As the company moves forward in these rather uncertain times, as a potential economic recession looms due to factors like inflation and home price declines, the company has the potential to return to profitability and generate some serious cash. There’s just one problem – Caesars has too much debt.

Let’s explore why this matters so much.

Improving Business Model

After the company merged with Eldorado Resorts back in 2020, they’ve become one of the largest casino and entertainment operators in the world and have also completed acquisitions like William Hill to expand their gaming and booking business segment. As a result, the company’s combined revenues have shot up over the past few years and now stand at almost $10.4 billion.

One of the most optimistic parts of these acquisitions is that the companies are not yet done with the full merger cost savings that usually take a while to complete. This means that the company still have ways to go in lowering their cost of revenues and operating expenses, both of which have been moving upwards over the past few quarters.

Improving Liquidity

After raising an additional $1.3 billion in liquidity during the merger in 2020 by selling some 23 acres of land on the Las Vegas strip, the company is in a decent financial position when it comes to their liquidity.

They currently hold just shy of $1 billion in cash and equivalents have relatively low depreciation on over $17 billion in gross property, plant and equipment. Right now, the company is reporting operating income of $1.5 to $1.7 billion annually, which is amazing considering the volatile times they’ve faced over the past few years.

But accounting for the company’s long term debt – that operating income turns to a net loss of over $1 billion a year due to interest expense. That’s where the company is losing their investment thesis.

Debt Load Crippling Profitability

There’s a positive and a negative here. The positive is that the company is trying to pay down their debt load, especially the high interest rate ones in the current rising rates environment. They’ve managed to reduce their overall debt load by about $400 million since the completion of the merger, decreasing from roughly $14.1 billion to $13.7 billion.

This high debt load means that the company has paid almost $2.3 billion in interest expense in the last full reporting year, a figure which isn’t supposed to decline all that much. This is due to the fact that even with their lower debt load, interest rates are still rising and the company still has a fair bit of high interest rate and floating interest rate debt, which rises with the federal funds rate.

I expect the company to report about $75 million less in interest expense paid this year compared to last year, which really doesn’t put much of dent in it. The fact that the company goes from an operating income of over $1.3 billion to a loss of over $1 billion means they have to prioritize reducing this debt to a level where they can become profitable again.

Can they do it?

It’s Possible, But It’s Hard

I surely believe that as the company’s fundamentals improve and the industry sees some rebounding in terms of sales, as well as the company working to lower operating expenses and completing the merger cost of revenue savings – that they can make it to a place where they’ll be profitable soon.

This will result in them generating more cash flow to lower that debt. The somewhat negative aspect about their cost of revenues is that, since the pandemic closures have stopped – casino, hotel and gaming companies have been able to keep some underperforming assets and parts of their casinos closed and thus bring in revenue with a higher profit margin.

As time goes on, I believe that additional revenue dollars will come in with a lower profit margin, thus hindering some growth that analysts and the market expect them to bring in while revenues continue to increase as the market improves in the coming months and quarters.

Bright Spots Do Exist

Even though those negatives are quite alarming and it’s hard to see them getting to a position of a low enough interest expense burden to become as profitable as analysts currently expect them to be, there are bright spots.

One of those is the company’s focus on expanding beyond traditional hotels and casinos and into the online legal sports betting market, which has exploded in recent years. While the casino, in-person gambling market is expected to remain rather volatile over the next few years, the online gambling market, which includes sports betting and other activities, is set to grow at an impressive CAGR of 17.3% through 2027.

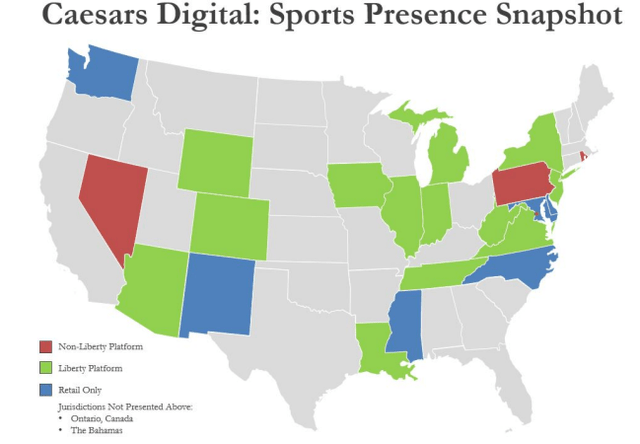

Online sports betting have taken off in recent year with more and more states in the United States authorizing some sort of activity and the company has been partnering with various local companies to penetrate those market more efficiently.

Investor Presentation – Quarterly Report

This, I believe, will help them offset some of their growth problems, should they occur, in cash of another slowdown. Furthermore, the margins in online gambling services are significantly higher due to the lack of personnel needed and relatively low maintenance and infrastructure already in place.

Conclusion – Messy, But Getting Better

It may sound obvious, but if it weren’t for the company’s debt load and subsequent high interest expense payments in a rising interest rate environment, a long term investment in the company would have been a no brainer due to their increasing organic revenues and expansion into online gambling market, which is expected to see higher margins with lower costs.

With analysts currently projecting that the company will report a profit next year, with EPS of $0.57, it’s hard for me not to think that they’ll miss those expectations and subsequently see a sharper reduction in share price. As a result, I am avoiding the company for now and will wait for further financial reports from the company before thinking of initiating a position.

I initiate Caesars Entertainment with a cautious outlook until more information is presented and may initiate a position if the company reports a larger than expected reduction in the debt or interest expense, even if they underperform their current EPS and revenue expectations.

Be the first to comment