sturti/E+ via Getty Images

What Is Cadrenal Therapeutics?

Ponte Vedra, Florida,-based Cadrenal Therapeutics (CVKD) was founded to acquire and develop tecarfarin, which has been previously developed by Espero BioPharma.

Management is headed by founder, Chairman and CEO, Quang Pham, who has been with the firm since inception in early 2022 and was previously founder of Espero BioPharma, the previous developer of tecarfarin.

Management seeks to submit its Phase 3 trial design to the US FDA using the same protocol as that of its previous developer, Espero.

If approved, the firm will attempt to commence the Phase 3 trials in the second half of 2023 at the earliest.

Cadrenal has booked fair market value investment of approximately $433,000 as of June 30, 2022 from investors including The PVBQ Living Trust, HESP LLC and The WEP Trust.

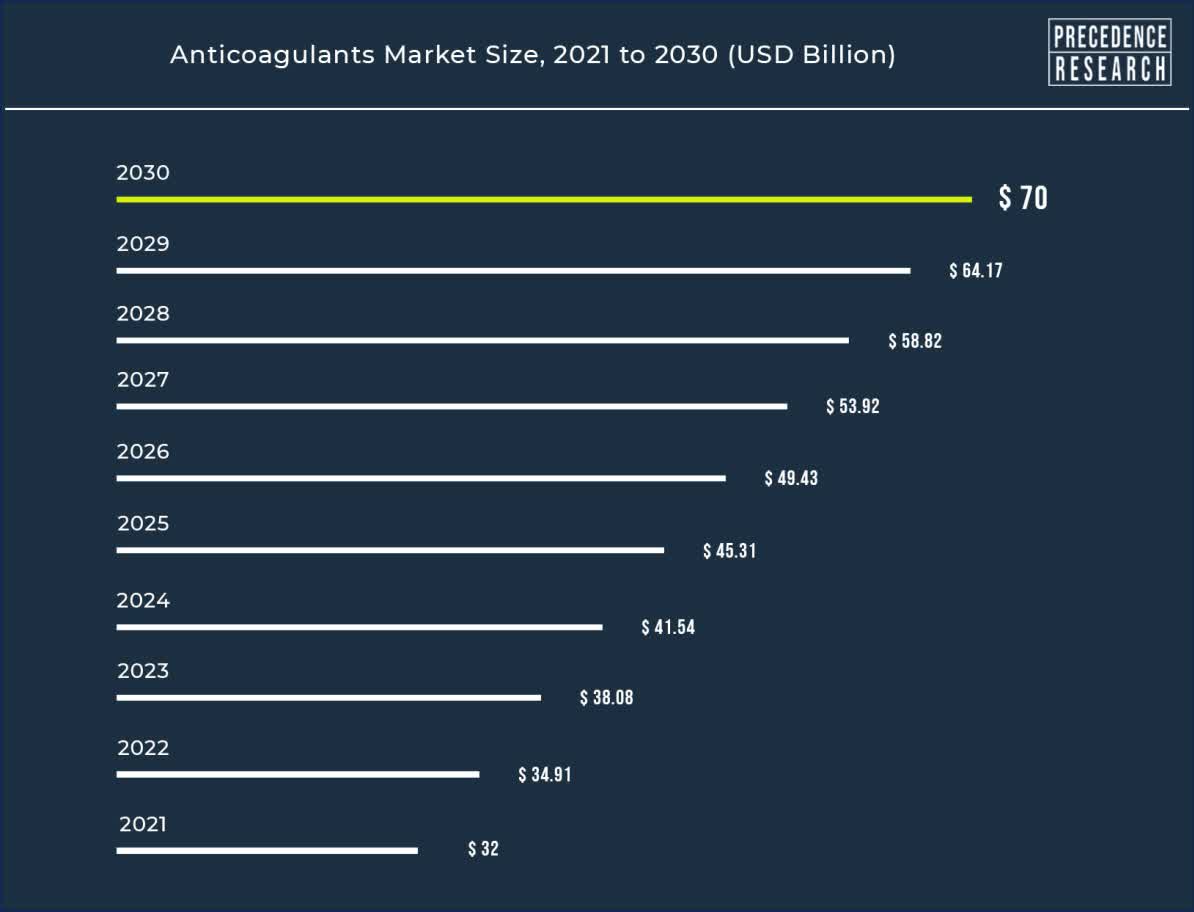

According to a 2022 market research report by Precedence Research, the global anticoagulant drug market was an estimated $32 billion in 2021 and is forecast to reach $70 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 9.1% from 2022 to 2030.

Key elements driving this expected growth are a rise in the incidence of cardiovascular conditions requiring blood thinning as the global population ages.

Also, below is a chart showing the historical and projected future growth of the anticoagulant drug market:

Global Anticoagulant Market (Precedence Research)

Major competitive vendors that provide or are developing related treatments include:

-

Bristol Myers Squibb

-

Sanofi

-

Baxter

-

Pfizer

-

Boehringer Ingelheim

-

Janssen Pharmaceuticals

-

Daiichi Sankyo

Cadrenal Therapeutics’ IPO Date and Details

The initial public offering, or IPO, for Cadrenal has not yet been set by the company.

(Warning: Compared to stocks with more history, IPOs typically have less information for investors to review and analyze. For this reason, investors should use caution when thinking about investing in an IPO, or immediately post-IPO. Also, investors should keep in mind that many IPOs are heavily marketed, past company performance is not a guarantee of future results and potential risks may be understated.)

Cadrenal intends to raise $10 million in gross proceeds from an IPO of its common stock, offering 2 million shares at a proposed midpoint price of $5.00 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Selling shareholders are also offering 1.1 million shares for sale.

Post-IPO, the founder and CEO Quang Pham will own almost 58% of the company stock, so the firm will be a “controlled company,” according to Nasdaq’s standards.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $47 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 18%.

Management says it will use the net proceeds from the IPO as follows:

$4.7 million will be used for CMC preparation, research and development, and other trial preparation expenses necessary for initiation of our planned Phase 3 pivotal trial; and

The remainder of $3.8 million for working capital and general corporate purposes.

We will require a total of $45 million to complete our pivotal Phase 3 trial. Therefore, we will require additional funding of approximately $40 million to enroll patients and complete our pivotal Phase 3 clinical trial.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not presently a party to any material legal proceedings.

The sole listed bookrunner of the IPO is Boustead Securities.

How To Invest In The Company’s Stock: 7 Steps

Investors can buy shares of the stock in the same way they may buy stocks of other publicly traded companies, or as part of the pre-IPO allocation.

Note: This report is not a recommendation to purchase stock or any other security. For investors who are interested in pursuing a potential investment after the IPO is complete, the following steps for buying stocks will be helpful.

Step 1: Understand The Company’s Financial History

Although there’s not much public financial information available about the company, investors can look at the company’s financial history on their form S-1 or F-1 SEC filing (Source).

Step 2: Assess The Company’s Financial Reports

The primary financial statements available for publicly-traded companies include the income statement, balance sheet, and statement of cash flows. These financial statements can help investors learn about a company’s cash capitalization structure, cash flow trends and financial position.

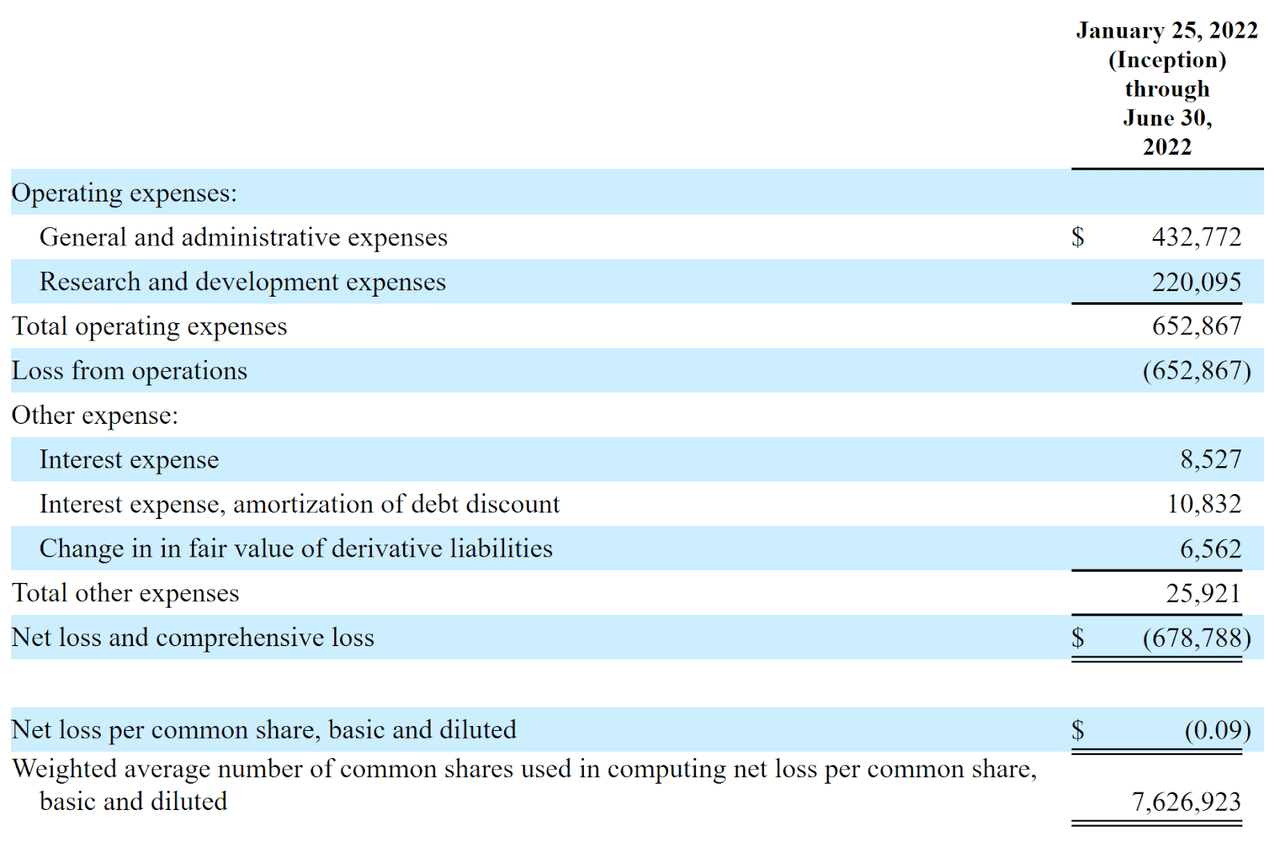

The firm’s recent financial results are typical of a biopharma firm in that they feature no revenue and significant G&A and R&D expenses associated with its development efforts.

Below are the company’s financial results since inception in January 2022:

Statement Of Operations (SEC EDGAR)

As of June 30, 2022, the company had $59,646 in cash and $914,184 in total liabilities.

Step 3: Evaluate The Company’s Potential Compared To Your Investment Horizon

When investors evaluate potential stocks to buy, it’s important to consider their time horizon and risk tolerance before buying shares. For example, a swing-trader may be interested in short-term growth potential, whereas a long-term investor may prioritize strong financials ahead of short-term price movements.

Step 4: Select A Brokerage

Investors who do not already have a trading account will begin with the selection of a brokerage firm. The account types commonly used for trading stocks include a standard brokerage account or a retirement account like an IRA.

Investors who prefer advice for a fee can open a trading account with a full-service broker or an independent investment advisor, and those who want to manage their portfolio for a reduced cost may choose a discount brokerage company.

Step 5: Choose An Investment Size And Strategy

Investors who have decided to buy shares of company stock should consider how many shares to purchase and what investment strategy to adopt for their new position. The investment strategy will guide an investor’s holding period and exit strategy.

Many investors choose to buy and hold stocks for lengthy periods. Examples of basic investing strategies include swing trading, short-term trading or investing over a long-term holding period.

For investors wishing to gain a pre-IPO allocation of shares at the IPO price, they would “indicate interest” with their broker in advance of the IPO. Indicating an interest is not a guarantee that the investor will receive an allocation of pre-IPO shares.

Step 6: Choose An Order Type

Investors have many choices for placing orders to purchase stocks, including market orders, limit orders and stop orders.

-

Market order: This is the most common type of order made by retail traders. A market order executes a trade immediately at the best available transaction price.

-

Limit order: When an investor places a buy limit order, they specify a maximum price to be paid for the shares.

-

Stop order: A buy-stop order is an order to buy at a specified price, known as the stop price, which will be higher than the current market price. In the case of buy-stop, the stop price will be lower than the current market price.

Step 7: Submit The Trade

After investors have funded their account with cash, they may decide on an investment size and order type, then submit the trade to place an order. If the trade is a market order, it will be filled immediately at the best available market price.

However, if investors submit a limit order or stop order, the investor may have to wait until the stock reaches their target price or stop-loss price for the trade to be completed.

The Bottom Line

CVKD is seeking U.S. public capital market funding to advance its sole drug candidate into Phase 3 trials.

The market opportunity for anticoagulant drugs is large as the average age of the population continues to rise increasing the need for cardiovascular system treatments.

Management has not disclosed any major pharma firm collaboration agreements, and the company’s investor syndicate does not include any known institutional venture capital investors.

Boustead Securities is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of 51.6% since their IPO. This is a bottom-tier performance for all major underwriters during the period.

As for valuation, management is proposing a very low enterprise value, far lower than a typical institutionally-supported biopharma company at IPO.

With a company that is seeking to gain approval for a drug that has gone through other companies previously, maybe Cadrenal will get lucky.

However, the IPO is ultra-high risk and the firm will need large amounts of additional capital before it achieves a meaningful milestone that could be a strong catalyst for the stock.

As such, I’m on Hold for the IPO due to its ultra-high risk profile.

Be the first to comment