Mrinal Pal

Thesis

Despite facing challenges such as the impact of the COVID-19 pandemic, the electronic design automation (EDA) tools market is expected to experience strong growth in the coming years, driven by increasing adoption in various industries and strong performance in the semiconductor industry. Cadence Design Systems (NASDAQ:CDNS) is well-positioned to capitalize on this growth with its advanced solutions, diverse customer base, and partnerships with leading semiconductor and system companies. As their financial results this year exceeded investors’ predictions, I would put CDNS at a buy rating.

About Cadence

Cadence Design Systems, Inc. is a leading provider of EDA software, hardware, and services. The company helps engineers design and verify advanced semiconductor chips, printed circuit boards, and systems used in a variety of electronic devices. It has a strong focus on data science, machine learning, hyperscale computing, autonomous vehicles, 5G, the Internet of Things (IOT), and healthcare. CDNS offers a range of EDA solutions for different stages of the design process, including digital, sign-off, custom/analog, and verification.

Crunchbase

Their EDA tools and services enable engineers to design and verify complex chips and systems faster and more efficiently. The company’s software and hardware solutions help customers to reduce time-to-market, lower costs, and improve the quality of their designs. CDNS also offers consulting services to help customers optimize their design flow and use its EDA tools effectively.

Cadence Design serves a diverse customer base, including semiconductor companies, system companies, and foundries. The company has a strong presence in the semiconductor industry and has partnerships with leading semiconductor and system companies. CDNS has a global presence with offices and research and development centers around the world.

Positioning

Cadence Design Systems has reported financial results for the third quarter of 2022. The company exceeded all financial metrics for the quarter, including revenue of $903 million and non-GAAP earnings per share of $1.06. CDNS has raised its outlook for the full year 2022, expecting revenue growth of 18.5% and a non-GAAP operating margin of 40.2%. This will result in non-GAAP earnings per share growth of 28.3%. The company’s outlook for the full year includes the impact of the latest China export controls. CDNS also closed its acquisition of OpenEye on August 31st. For the fourth quarter of 2022, CDNS expects revenue of $870-$890 million and non-GAAP earnings per share of $0.89-$0.93. The company plans to use approximately $300 million to repurchase Cadence shares in Q4.

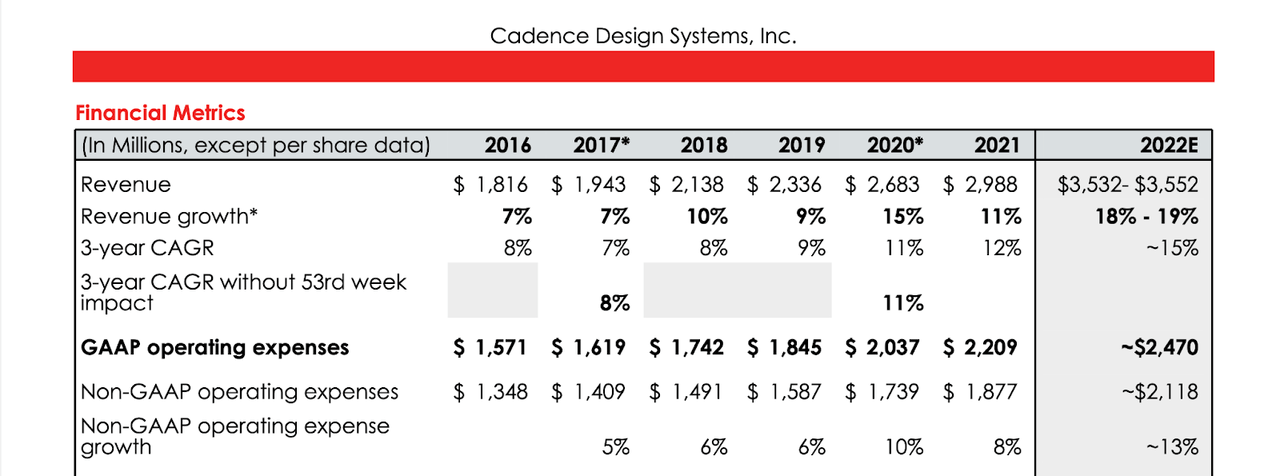

Cadence Revenue Growth (CDNS)

The company has seen significant growth in recent years, with sales increasing from $2 billion in 2017 to $3 billion in 2021, and non-GAAP operating margins steadily rising to 37% of sales. In 2021, Cadence’s shares hit a high of $190 but have since pulled back to $160 in June 2022. The company has a strong backlog of more than $5 billion and generates a large portion of its sales from recurring revenue streams.

However, its high valuation, with earnings multiples above 50 times, has been a concern for some investors, especially in the context of rising interest rates. In August 2022, the company’s shares retested the highs in the $190s and are currently trading at around $165. Cadence recently announced a $100 million share buyback program and completed the acquisition of OpenEye Scientific Software for $500 million.

For the year 2022, Cadence expects to continue to see impressive growth in revenue, at an estimated 18%. It should be mentioned 85% of Cadence’s revenue come from recurring clients, indicating high satisfaction and a stable income source.

Overall, CDNS’s strong financial results for Q3 2022 and raised outlook for the full year indicate a healthy demand for its EDA solutions. The company’s focus on helping customers design and verify complex chips and systems faster and more efficiently, as well as its consulting services, likely contributed to its strong performance. CDNS’s diverse customer base and partnerships also likely played a role in its success.

About EDA

Cadence is the leading service provider in the EDA industry, so the market would be an important indicator on Cadence’s growth in the coming years.

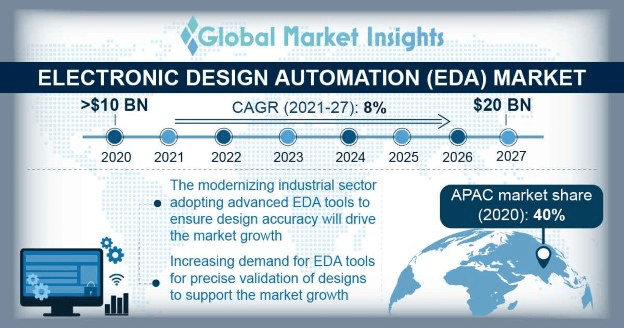

According to Yahoo, the electronic design automation (EDA) tools market is expected to reach $14.9 billion by 2026, driven by strong performance in the semiconductor industry and increasing adoption across various industries. EDA tools are in high demand in sectors including automotive, medical, communications, electronics, manufacturing, aerospace & defense. The COVID-19 epidemic had an impact on the market, but a recovery is anticipated as a result of the steady demand for chips and PCBs as well as the emphasis on system-level design simulation.

The market is currently dominated by North America. However, the Asia-Pacific region is also expected to see increasing demand for EDA tools due to technological advances in sophisticated electronic devices and equipment. The IC physical design & verification segment is expected to reach $3.3 billion by 2026, driven by the increasing sophistication of IC designs and the focus on precision and accuracy of semiconductor devices.

Expected EDA growth (Global Market Outlook)

The global electronic design automation (EDA) tools market is expected to grow at a compound annual growth rate (CAGR) of 8.7% from 2020 to 2026.

By 2026:

- The EDA tools market in the US is expected to grow at a CAGR of 7.6%

- The market in China is expected to grow at a CAGR of 9.8%

- The Asia-Pacific region is expected to grow at a CAGR of 9.3%.

As the leader of EDA, CDNS can take full advantage of this potential growth.

Furthering Dominance – Team Allegro

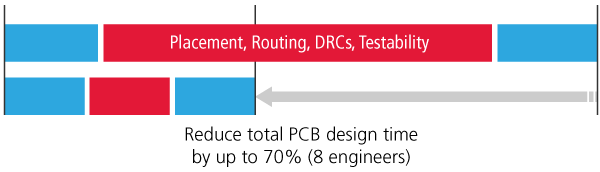

In a competitive field like the one Cadence finds themselves in, it is important to offer features their buyers can take advantage of in order to keep high recurring client rates and attract new customers. Their relatively new team Allegro team may be the key to extending their dominance.

Cadence Allegro is a PCB design software that is known for its advanced features and capabilities, which may make it a better option for some users compared to other EDA (electronic design automation) software. Some of its benefits such as reducing routing time by up to 80% for advanced high-speed interfaces are a much-needed improvement for their customers.

Attempts to revolutionize PCB design (CDNS)

It is important to keep in mind Cadence’s clients are large technology-related companies, and with 85% of revenue from recurring customers, it is clear Cadence has provided high satisfaction. Allegro should be treated as a catalyst, an ambition to outcompete others in its market.

Overall, Allegro may be a good choice for users who need a powerful, feature-rich PCB design software that can handle complex designs and advanced high-speed routing. However, it is up to the investor whether or not to buy into their vision.

This team has the potential to give Cadence the edge it needs in the EDA market, allowing for potential dominance over its many competitors.

Valuation

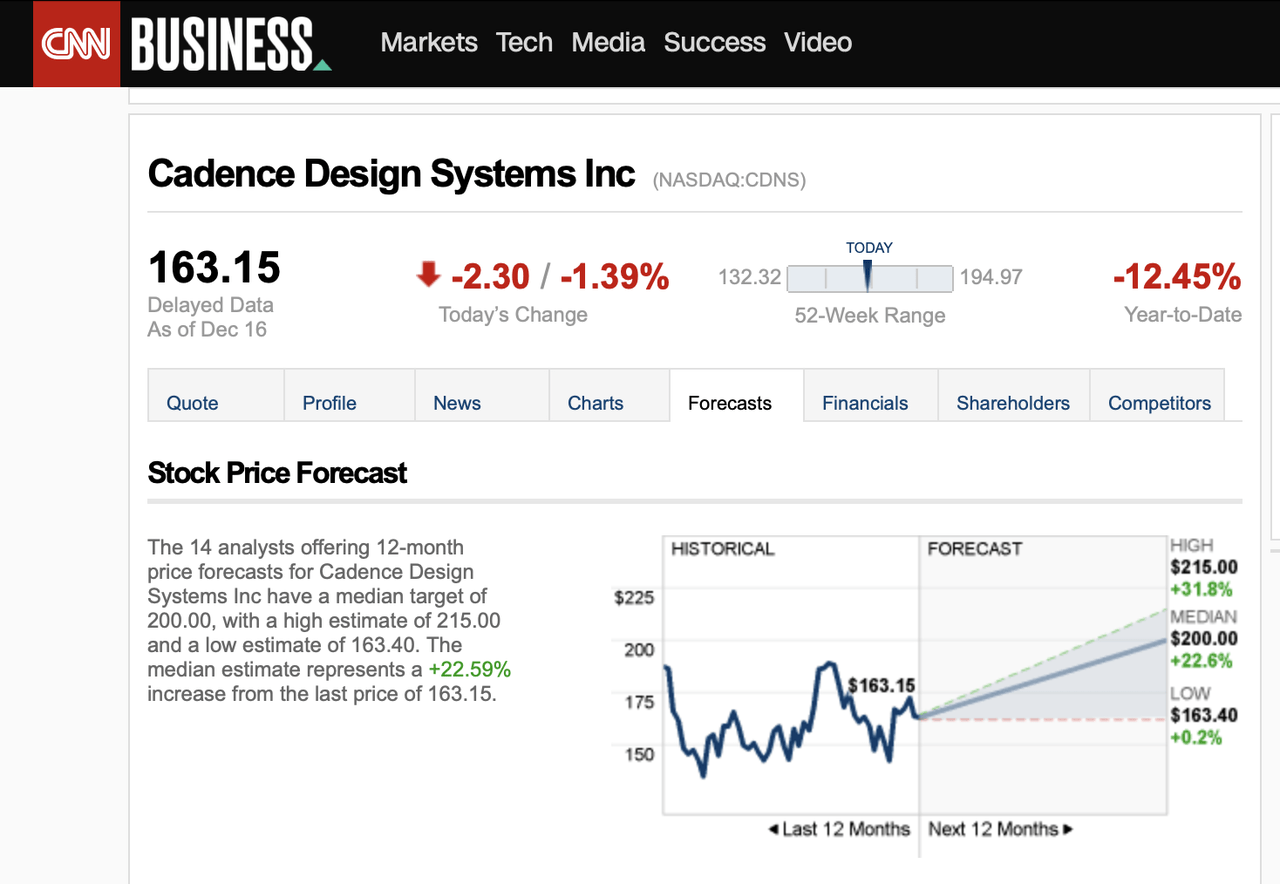

CNN Business gives Cadence a very optimistic outlook, with a PT at $200. However, Cadence Design Systems EPS for the quarter ending September 30, 2022 was $0.68. This number can expect to grow with the shares buyback program, though it seems alarming low.

Analyst’s PT value (CNN business)

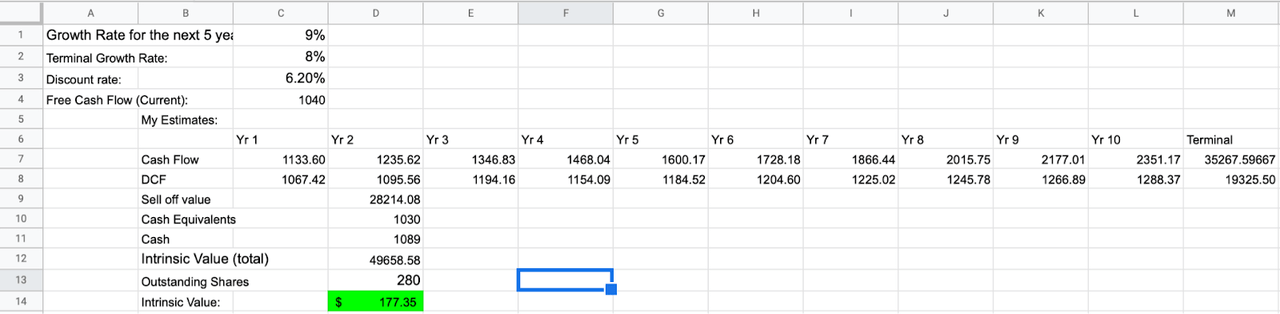

For my calculations, given Cadence’s increasing dominance over its sector and the 18% growth it expects to see this year, I will conservatively expect an average of 9% growth the next 5 years, followed by 8% which is consistent of the industry. I estimate that the levered beta for the company is 0.996, and the expected return on the market is 8%. Using the CAPM formula, we can calculate the cost of equity as follows:

Cost of equity = Risk-free rate + Beta * (Expected return on market – Risk-free rate)

Cost of equity = 3% + 0.996 * (8% – 3%)

Cost of equity = 6.2%

I will use 12x for the sell-off value, typical of a large company like CDNS.

Author’s Own Calculations (Excel)

I calculated a PT of $177. However, with a company like Cadence actively trying to buy back its shares, the DCF calculation needs to be taken with a large amount of salt. However, it can be concluded that the stock appears to be fairly valued.

Risks

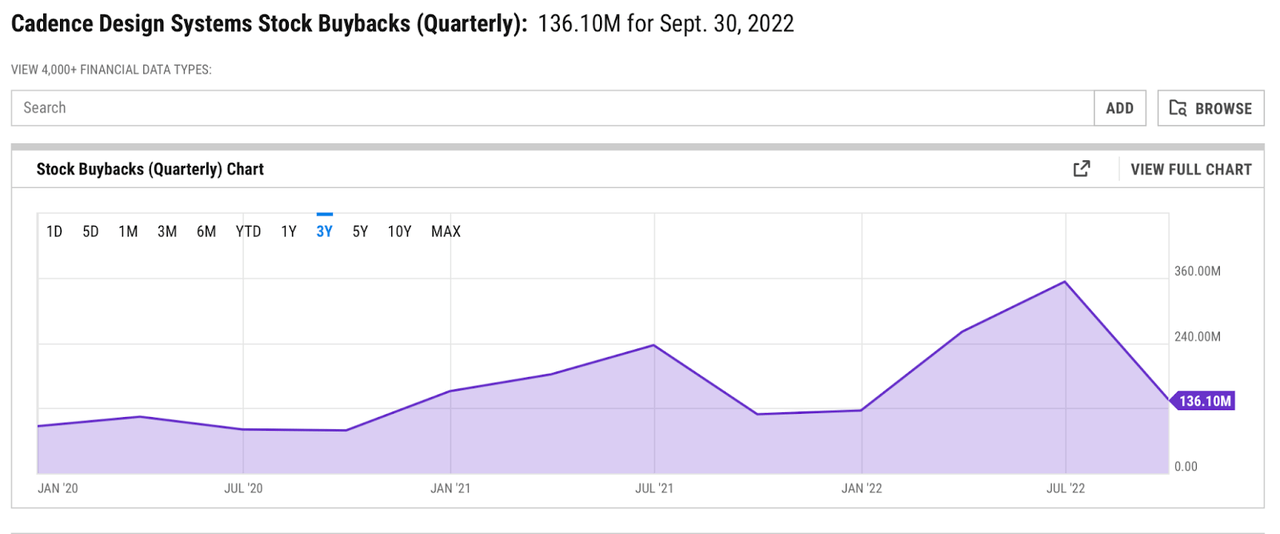

Cadence Design Systems faces a number of risks, including intense competition in its industries, the success of its efforts to improve efficiency and grow, changes in customer demand and supply constraints, economic and geopolitical conditions, capital expenditure requirements, and regulatory changes. The company is also subject to the risk of acquiring other companies, businesses, or technologies and failing to successfully integrate and operate them. Cadence’s financial performance may also be affected by events that impact cash flow, liquidity, or reserves, as well as by litigation or regulatory proceedings. Additionally, the COVID-19 pandemic and containment measures may have a significant impact on Cadence, its employees, and its suppliers and customers. The timing and amount of Cadence’s share buybacks may also be affected by business and market conditions, regulatory requirements, stock price, and acquisition opportunities.

Y-charts

Cadence Design Systems recently announced a $100 million share buyback program, which may be seen as a way to return value to shareholders and potentially improve the company’s financial performance by increasing earnings per share. However, share buybacks are not without risk, as they can be seen as a sign that the company does not have other opportunities for growth or investment, and they may also decrease the company’s financial flexibility by using up cash that could be used for other purposes. Additionally, share buybacks can be affected by business and market conditions, regulatory requirements, stock price, and acquisition opportunities.

With that in mind, given the increasing market and their recovery in the past year, I expect to see a continued monopoly in the EDA sector.

Conclusion

The EDA tools market is expected to experience strong growth in the coming years, driven by increasing adoption in various industries and strong performance in the semiconductor industry. Cadence Design Systems, a leading provider of EDA software, hardware, and services, is well-positioned to capitalize on this growth with its advanced solutions, diverse customer base, and partnerships with leading semiconductor and system companies. The company has reported strong financial results for the third quarter of 2022 and raised its outlook for the full year, indicating a healthy demand for its EDA solutions. Therefore, investors should feel comfortable investing in Cadence’s future.

Be the first to comment