hapabapa/iStock Editorial via Getty Images

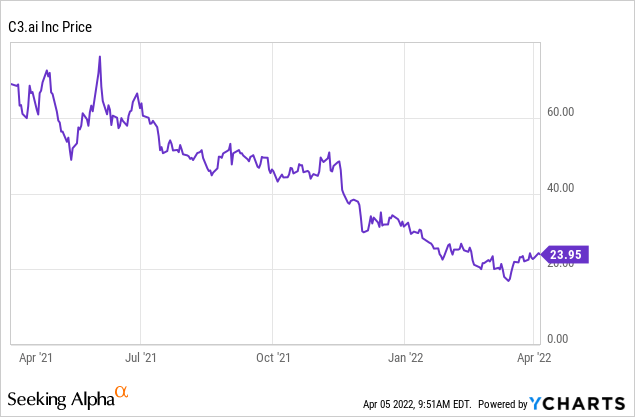

The tech correction that has picked up steam over the past few months was certainly driven by a need for valuation correction, but in some cases, the severe reaction we’ve seen has gone too far. Such is the case for C3.ai (NYSE:AI), a one-time market favorite that specializes in enterprise AI software. This niche software stock was once one of the most richly valued stocks in the software sector (at a time when tech companies sporting any buzzword themes, including AI, saw nothing but gains), but now, C3.ai has been relegated to the penalty box.

It’s difficult to document the “why” behind C3.ai’s fall from grace. This stock may actually be a key example of why it may behoove smaller tech companies to stay private for longer, as I’m sure the ~85% drop in highs has many C3.ai employees unnerved (and potentially less beholden to the company’s stock grants and options). But fundamentally speaking, the company has continued to excel – showing aggressive growth rates, major wins including with the federal government, and customer expansion.

The bullish thesis for C3.ai revisited

I remain bullish on C3.ai, and I believe it’s one of the best buy-the-dip opportunities currently available in tech. The name of the game here is “business transformation.” In the aftermath of the pandemic, two major things were realized: 1) technology infrastructure has become the lifeblood of most companies, and IT is now a very strategic part of a company’s roadmap and not just a side function; and 2) with skilled workers in high demand and short supply across industries, companies are being forced to innovate and drive business transformation to stay lean and compete. C3.ai’s motto is to “solve the previously unsolvable,” and build/deploy AI applications to tackle tough business challenges.

It’s not just companies recognizing the need to transform their operations, however. C3.ai has recently made major inroads with the U.S. government, and in Q4, the company signed a massive $500 million 5-year agreement with the Department of Defense:

C3.ai DoD win (C3.ai Q3 investor deck)

Here’s a refresher of what I believe to be the key bullish drivers for C3.ai:

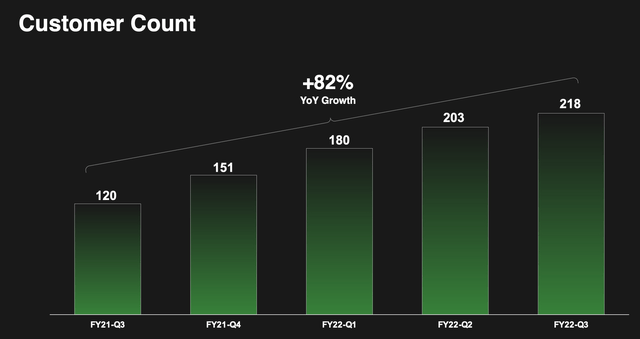

- C3.ai is still exhibiting hyper growth. In its most recent quarter, the company grew revenue north of 40% y/y. This actually represents acceleration over its growth CAGR since 2019. The company is also scaling from a customer base perspective, and is now at over 200 customers (versus just ~50 at its IPO).

- Industry diversification. AI is a “horizontal” technology, meaning it can be equally applied and benefited from by companies in any industry. Historically, C3.ai has concentrated in heavy manufacturing and oil, due to its relationship with Baker Hughes. More recently, however, the company has expanded applications in production to cover customers in financial services, healthcare, and other expansion industries for C3.ai.

- Star leadership. C3.ai’s CEO, Tom Siebel, is a well-known software industry veteran best known for selling his startup Siebel Systems to Oracle for $5.8 billion.

- Powerful technology. C3.ai is one of the best-recognized names in enterprise AI transformation, which is an area that will only continue to receive more corporate investment as businesses look to modernize and automate their operations.

In spite of these strengths, meanwhile, C3.ai’s valuation has sunk to what can rightly be considered as value levels. At current share prices near $24, the company has a market cap of $2.57 billion. After we net off the $968.7 million of cash on the company’s most recent balance sheet, C3.ai’s resulting enterprise value is only $1.60 billion.

For the upcoming fiscal year FY23, meanwhile (the fiscal year for C3.ai ending in April 2023), Wall Street analysts are calling for $333.8 million in revenue, representing 33% y/y growth (data from Yahoo Finance). This puts C3.ai’s valuation multiple at a mere 4.8x EV/FY23 revenue (in its heyday, C3.ai had once been valued at over 20x revenue).

The company is recognizing the undervaluation in its stock, too – it has authorized a $100 million share buyback program (covering 4% of its current market cap), which it can well afford with the $1 billion of net cash on its balance sheet.

The bottom line here: in my view, C3.ai shares have fallen too far in spite of the company’s fundamental outperformance and future growth trajectory. Stay long here and buy the dip.

Q3 download

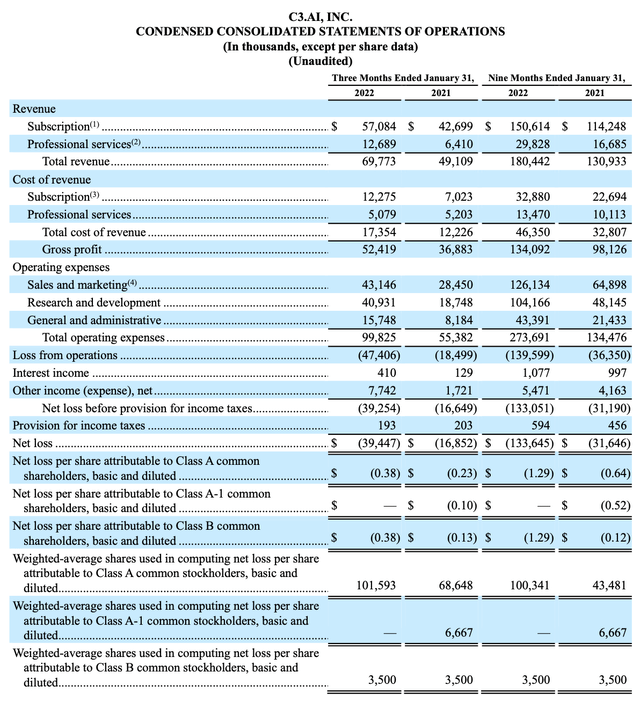

Let’s now review C3.ai’s latest fiscal Q3 results (the January quarter for C3.ai) in greater detail, which the company released in early March. The Q3 earnings summary is shown below:

C3.ai Q3 results (C3.ai Q3 investor deck)

C3.ai’s revenue in Q3 grew at a 42% y/y pace to $69.8 million, beating Wall Street’s expectations of $66.1 million (+35% y/y) by an impressive seven-point margin. The company’s revenue growth also accelerated slightly versus 41% y/y growth in Q2.

Here’s some additional commentary from CEO Thomas Siebel on the quarter’s successes, taken from his prepared remarks on the Q3 earnings call:

Let me touch on customer wins and expansions. Business from contracts executed in the quarter showed substantially increased industry diversification. 32% was from utilities, 30% of our business was from chemical industry, 20% from agribusiness, 12% from financial services. I’ve spoken in the past about our emphasis to increase our business with small and medium customers, and I’m pleased to report that we made excellent progress in that regard. During the quarter, we executed 12 agreements of less than $1 million; 3 contracts between $1 million and $5 million; 2 transactions between $5 million and $10 million and 3 agreements in the range of $10 million to $50 million.”

Customer development is another big highlight for C3.ai. In the third quarter, the company added 15 net-new customers to end at 218 customers, representing 82% y/y growth.

C3.ai customer counts (C3.ai Q3 investor deck)

We will note one caveat here: the company has changed its calculation of customer counts to include separate “entities” within the same overall company as distinct customers. While this is admittedly a bit of sleight-of-hand from a reporting front in order to mask what investors have routinely called out as one of C3.ai’s biggest risks, we note that the company is still disclosing customer counts under the original pure-customer approach (110), which is still significantly higher than ~50 at the time of IPO.

Moreover, the customers that C3.ai is winning aren’t small ones, either. We’ve already discussed the massive DoD win – one quick note here is that Wall Street’s consensus for FY23 ($334 million in revenue) is only ~$80 million higher than the company’s $251-$252 million consensus for FY22. While we don’t know if the contribution of this $500 million deal across five years will necessarily be linear, I think it’s fairly safe to assume FY23 revenue consensus may have upside if there is at least $50-60 million in contribution from this deal in FY23 (assuming contribution in FY22 is minimal).

Outside of the DoD, the company has also signed on other major wins in the quarter, including Shell (SHEL), Bank of America (BAC), and Ernst & Young:

C3.ai key wins (C3.ai Q3 investor deck)

One note on profitability: admittedly, C3.ai’s losses are still harrowing, which aside from customer counts is investors’ second big hesitation for the company. Q3 pro forma operating margins came in at -22% (two point better than -24% in the year-ago quarter).

There are two points of comfort in profitability, however:

- C3.ai touts sky-high pro forma gross margins at the 80% mark, which means it has a strong capacity to expand its bottom line at scale.

- Its $1 billion in net balance sheet cash is enough to absorb years of losses without raising additional capital. YTD free cash flow burn through the first three quarters of FY23 were “only” -$75 million, which is well supported by C3.ai’s current balance sheet.

Key takeaways

If you told investors just one year ago that C3.ai would one day be trading below 5x forward revenues, it would have been nearly impossible to believe – yet the stock’s ~85% decline from peaks has represented one of the fastest conversions of a tech stock from “high flier” to “value stock.” Take advantage of that current irrationality to build up a position.

Be the first to comment