hapabapa/iStock Editorial via Getty Images

Investment Thesis

We follow up on our previous article on C3.ai (NYSE:AI), which turned out to be a poorly-timed call.

Our first mistake was valuing the company based on its revenue multiples, when we should have focused on the negative profitability that we highlighted. Our second mistake was not paying attention to its price structures, as we bet against its dominant bearish bias. Notwithstanding, our saving grace was recognizing AI as a speculative opportunity, thus not suitable for all investors.

So, we have learned our lessons as we update the current opportunity in AI for investors.

We noted a bear trap in May that has held up well and absorbed the selling pressure after its FQ4’22 earnings call in early June. Therefore, it demonstrated that the market could be looking to turn AI’s bearish bias around. However, we noted that AI has failed to break out of its near-term resistance ($20.5) over the past few weeks. As such, we believe it’s appropriate to wait for a possible re-test of its support/resistance for more constructive price action signals.

As such, we revise our rating on AI from Speculative Buy to Hold for now. We will watch the price action closely and reassess our rating moving forward.

Given the resilience of the bear trap in May, we urge investors not to go short now, as the risk/reward profile is no longer as attractive. Instead, they should look for a possible opportunity to go long, riding on a potential reversal in its bearish bias.

C3.ai Still Has To Prove Its Path To Profitability

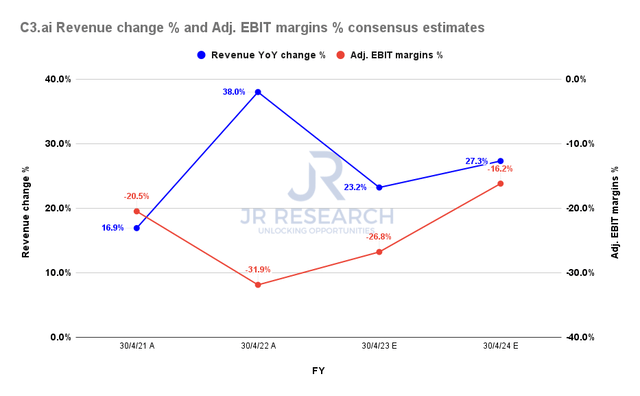

C3.ai revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Wall Street was disappointed with its FQ4 card, with Wedbush calling it a “debacle.” CEO Thomas Siebel then stoked more worries as he feared for the arrival of the “Four Horsemen of the Apocalypse.”

Notably, the Street’s consensus (generally neutral) estimates that C3’s revenue growth could decelerate to 23.2% in FY22, down markedly from FY21’s 38% growth. Coupled with its deeply unprofitable operating model, the market wouldn’t be lenient. As a result, the consensus estimates suggest that C3 could continue posting negative adjusted EBIT margins through FY24, with no line of sight toward sustainable profitability yet.

However, Siebel raised a “defiant” tone against the Street’s pessimism. He emphasized that he has a wealth of experience running a “cash-positive business” from his earlier days with Salesforce (CRM) Co-CEO Marc Benioff running Siebel Systems. He also accentuated that C3 could turn cash flow profitably in “eight to 12 quarters” and achieve a long-term adjusted operating margin of 20%. He articulated (edited):

We have $1 billion cash in the bank. We have a business where we have 80% gross margins. Come on, guys. It’s not that hard to run a profitable business with 80% gross margins. We’ve cost of revenue at 21%, okay? Marketing programs, I’m invested massively in branding, okay? Research and development, 44%. Nobody spends 44% on R&D, right? G&A at 15%. So now we bring these down to a reasonable level, okay. We have economies of scale from research and development, which gets us down to 28%, which is still high. We’re still investing in innovation. This is a cash-positive business. We said that we could do it in 8 to 12 quarters. We’ll do this over 8 to 12 quarters. We’ll be operating a business with a non-GAAP operating income of 20%. (Baird 2022 Global Consumer, Technology & Services Conference)

AI – Still Stuck In A Bearish Bias, But There Was A Bear Trap

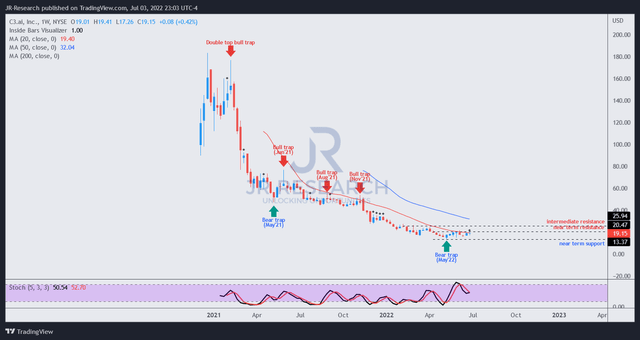

AI price chart – A (TradingView)

AI remains deeply entrenched in a bearish momentum since its double top bull trap (significant rejection of buying momentum) in February 2021. In addition, a series of lower-high bull traps continued to drag AI lower. Therefore, the right way to play AI was to set up directionally bearish set-ups, capitalizing on its downside bias and leveraging those bull traps as potential entry points. Until proven otherwise, AI remains in a downtrend.

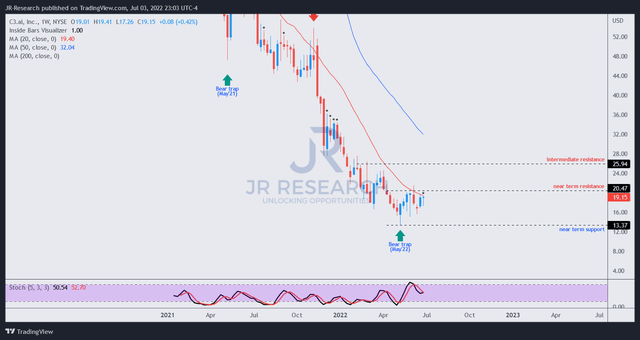

AI price chart – B (TradingView)

However, we noted a bear trap (significant rejection of selling momentum) formed in early May, creating its near-term support ($13.4). Its support also held through the initial selling pressure after its FQ4 earnings card and proved its resilience.

Therefore, we believe the market could be setting up an accumulation phase in AI, given May’s bear trap and its post-FQ4 strength. Notwithstanding, we noticed considerable selling pressure at its near-term resistance ($20.5) in early June, which had rejected AI from recovering further upward momentum.

Accordingly, we think it’s still too early to suggest that AI has retaken its bullish bias, but the price action seems constructive. However, we will err on the side of caution, as we await a re-test of its resistance or support first before reassessing our rating on AI.

Is AI Stock A Buy, Sell, Or Hold?

We revise our rating on AI from Speculative Buy to Hold.

The price action in AI is constructive. The stock could likely be in an accumulation phase. However, we will first await the re-test of its near-term resistance or support.

Notwithstanding, C3.ai remains deeply mired in unprofitability, even though management sees a line of sight toward a long-term adjusted operating margin of 20%. But, we believe the onus is on C3 to prove its path toward profitability. Until then, investors should consider AI suitable only as a speculative opportunity.

Be the first to comment