MF3d/E+ via Getty Images

C3.ai (NYSE:AI) is one of the most beaten down tech stocks in my coverage universe. It hasn’t helped that the company’s planned pricing model shift will compress growth rates in the near term. While management has guided for a significant acceleration in growth after this year, this is not the kind of market that holds much trust in future promises. The company maintains $938 million of net cash making up 70% of the market cap. While the risk profile is as high as ever, the stock is undeniably cheap and can provide home-run returns for brave investors.

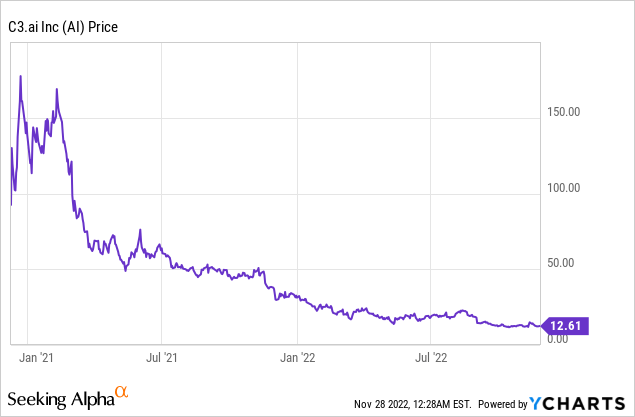

AI Stock Price

Shifts in sentiment can be brutal. That is illustrated very clearly by AI’s stock price history. The stock came public to hyped-fanfare but has since seen that hype completely implode on itself.

I last covered AI in August and the stock has since dropped 35%. Due to the lack of operating profits, this is a name which has great inherent volatility and that remains the case even at these depressed levels.

AI Stock Key Metrics

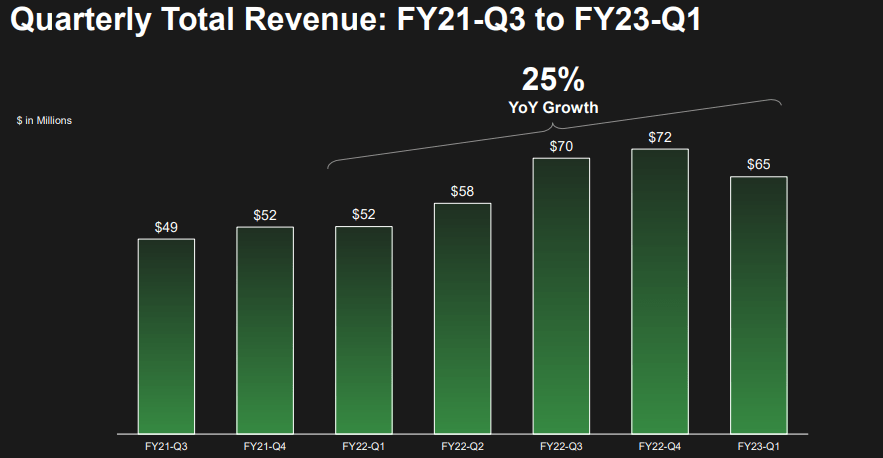

The latest quarter saw revenues decline sequentially, but still grow by 25% year over year.

FY23 Q2 Presentation

Lumpy revenue results are not uncommon for this company due to the uniqueness of implementing artificial intelligence products. That deceleration in growth was also not necessarily a deal breaker considering that tech valuations had already been reset to match pessimistic expectations.

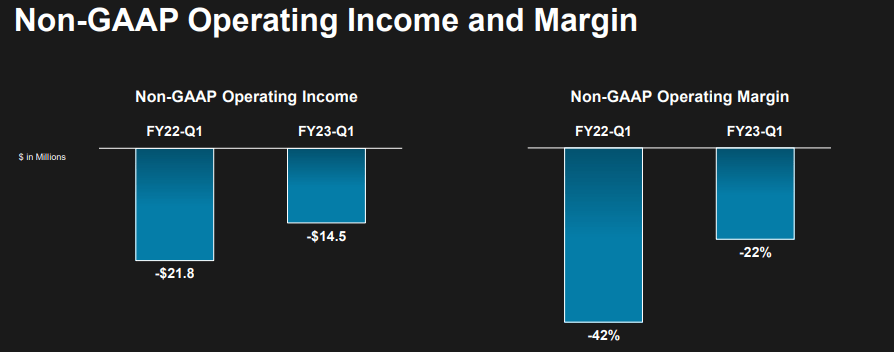

AI was still not profitable even on a non-GAAP basis, though it did manage to realize some operating leverage.

FY23 Q2 Presentation

The company ended up burning $54.8 million of cash in the quarter – almost equivalent to the $65.3 million in revenue but arguably manageable in light of the $938 million in net cash on the balance sheet.

On the conference call, management noted that the macro-environment had a pronounced impact on their business, with 66 forecasted deals moving out of the quarter. Management believes that this is now an environment in which “decision processes are being subjected to more rigorous budgetary scrutiny and additional levels of approval authority.”

AI also announced a transition away from its software-as-a-service pricing model towards a consumption based pricing model, similar to Snowflake (SNOW) or Amazon Web Services (AWS).

FY23 Q2 Presentation

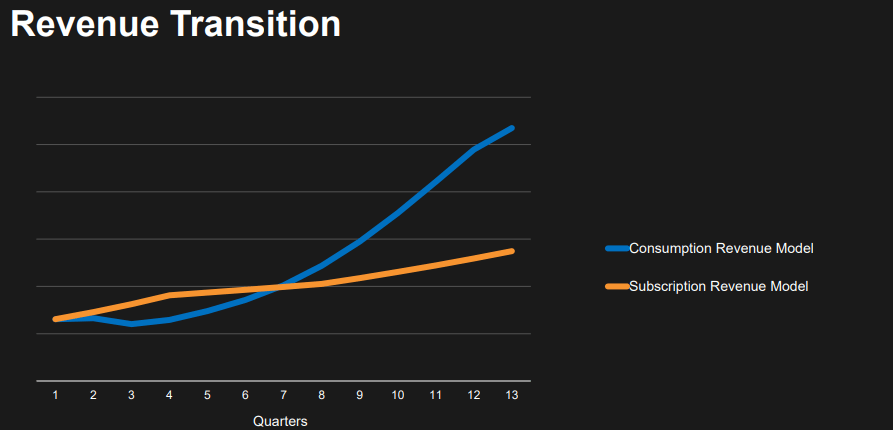

While management stated that this was a planned transition from many years ago, this is the kind of market environment in which one might assume that this is just another indication of tough market conditions. AI expects this transition to lead to a temporary stall in revenue growth before picking up later.

FY23 Q2 Presentation

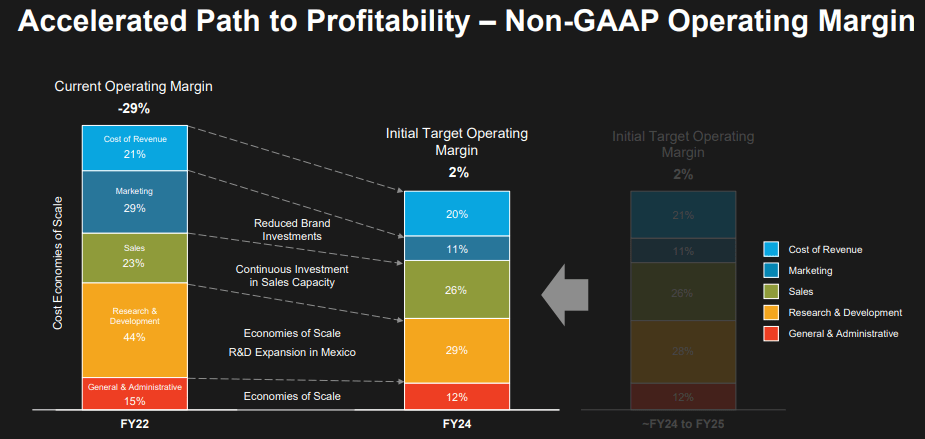

AI did accelerate its path to non-GAAP profitability as it now expects 2% non-GAAP operating margins by next year (this past quarter was the FY23 Q1).

FY23 Q2 Presentation

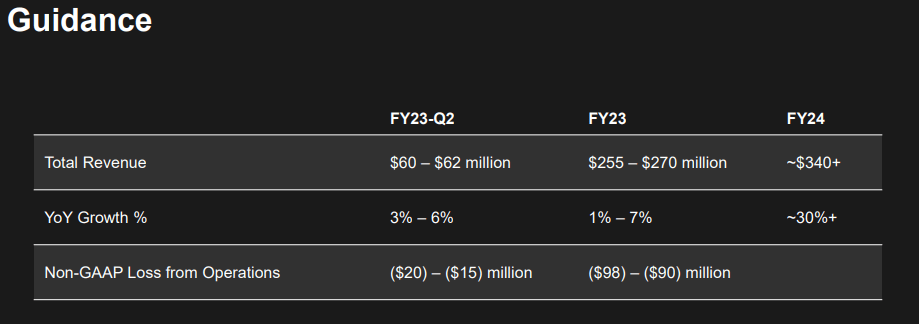

For this year, AI dramatically cut revenue guidance from $316 million to up to $270 million, representing only 7% growth. AI did guide for the next year to see a huge acceleration in growth to 30%.

FY23 Q2 Presentation

On the conference call, management initially noted that the reduction in guidance was mostly due to the shift to a consumption-based model, but later acknowledged the impact from the macro-environment.

Honestly, I think trying to sell $10 million, $20 million, $30 million, $50 million, $60 million transactions in the next year could be pretty tough, Pat. I mean, large chemical companies, manufacturing companies, food companies, I mean these guys are all going to the bunkers, okay? They’re preparing for a recession.

Management also noted that it expects to maintain a cash balance of at least $700 million up until the projected non-GAAP profitability is reached.

Is AI Stock A Buy, Sell, Or Hold?

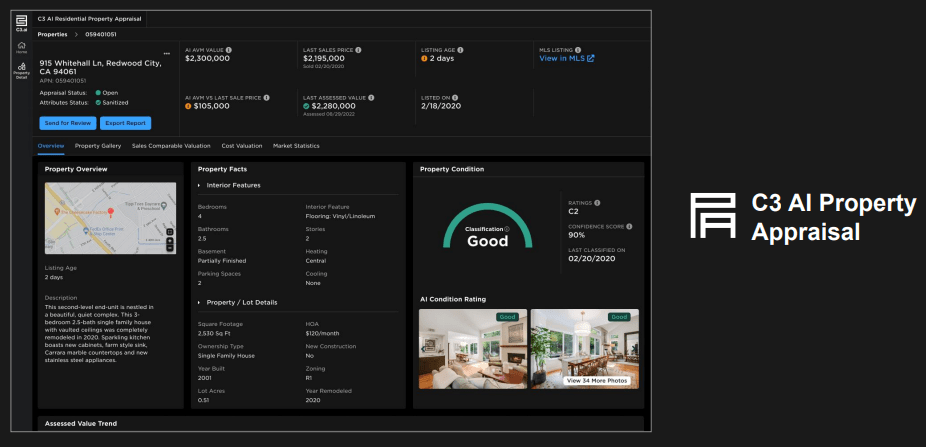

AI remains a compelling play on the future of artificial intelligence. Its products can serve a wide range of applications, including property appraisal, as seen below.

FY23 Q2 Presentation

An argument can be made, however, that the world might not be fully ready yet for artificial intelligence. Just like how it took some time for e-commerce or video streaming to take hold, it appears to be taking time to embrace the potential value from AI.

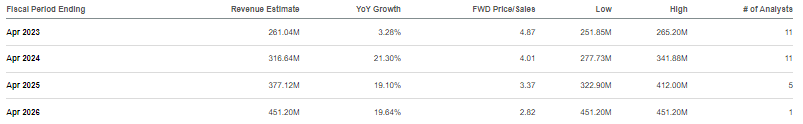

At this point, the stock is very cheap. AI is trading at just 5x this year’s sales. After deducting $700 million of cash (there actually is $938 million of net cash but I am using the lower number for conservatism), AI is trading at 2.3x sales. Consensus estimates show great skepticism regarding management’s long term projection of 30+% growth.

Seeking Alpha

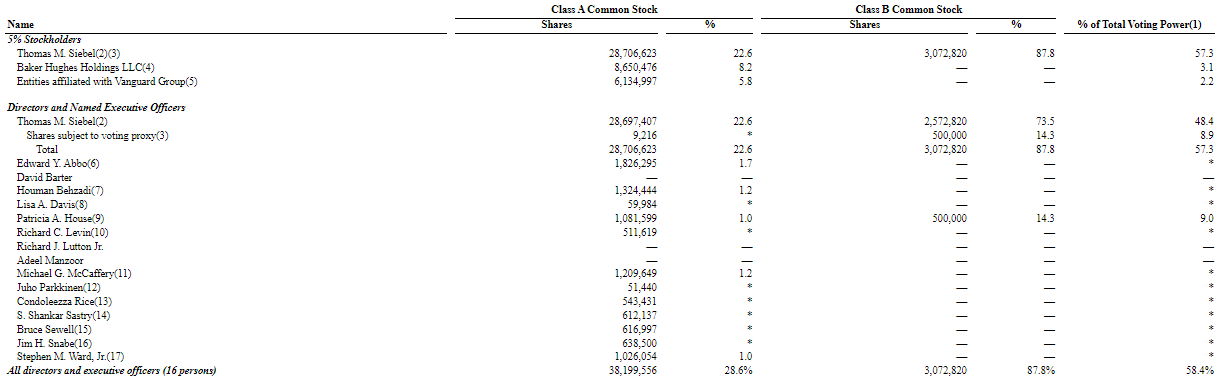

It is worth noting that insider ownership is high here, with CEO Thomas Siebel owning 31.8 million shares.

2022 DEF14A

Insider selling has also been arguably modest as of late. If this is a “pump-and-dump” scheme, then insiders aren’t doing it right. The valuation is compelling if management can deliver on guidance, but it should be noted that they have been calling for 30+% long term growth ever since they came public. Assuming a 30% growth rate next year, a long term 25% net margin, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see AI trading at around 11.3x sales, representing a stock price of $27 per share. That represents 125% potential upside over the next 12 months, and gives no credit to the $938 million in net cash on the balance sheet. To the downside, there are many tech stocks trading at 2x-3x sales though the net cash should provide some downside protection. The main bearish scenario might end up being the stock treading water for many years while the market (or simply the rest of the tech sector) takes off.

What are the risks here? Maybe growth never returns to former levels. Growth is needed for operating leverage and profitability. While the company maintains a strong balance sheet, that cash may gradually disappear after many years of operating losses. Even if AI does reach non-GAAP profitability, the lack of GAAP profits may imply ongoing shareholder dilution. AI is facing great competitors like Palantir (PLTR) and Alphabet (GOOGL, GOOG). This is the kind of stock that should be owned in small quantities as part of a diversified tech portfolio, like the one I have provided for subscribers Best of Breed Growth Stocks. I like to think about it as follows: own little enough to not get hurt if it does not work out, but just enough to profit handsomely if it does. I rate AI a buy as one of the most beaten-down names in the tech sector.

Be the first to comment