razihusin

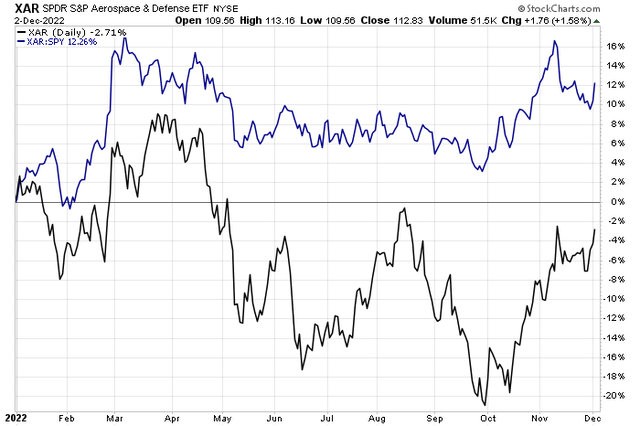

Aerospace and defense stocks are just slightly down on the year, outpacing the broader market. There are many high relative strength names in the group, but it’s important to identify ones with good valuations and favorable technical charts.

Does BWX Technologies (NYSE:BWXT) fit the bill or are shares set to sink? Let’s assess the situation in this defense name.

Alpha In Aerospace And Defense Equities

According to Bank of America Global Research, BWX Technologies primarily supplies US submarines and carriers with naval nuclear reactors and associated nuclear fuel and refueling services, as well as other nuclear components. It operates in three segments: Nuclear Operations Group, Nuclear Power Group, and Nuclear Services Group.

The Virginia-based $5.7 billion market cap Aerospace and Defense industry company within the Industrials sector trades at a near-market 18.5 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.4% dividend yield, according to The Wall Street Journal.

Last month, BWXT missed on its Q3 earnings forecast and produced topline results below analysts’ expectations. The firm declared a $0.22 quarterly dividend. Earlier this year, the firm raised its guidance, but there are risks from some labor setbacks as hiring headwinds could stymie growth. Still, there’s upside potential from improved government investments in uranium processing.

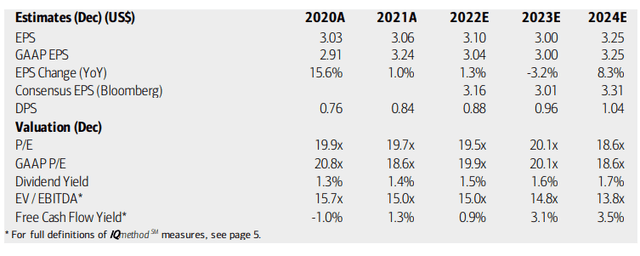

On valuation, analysts at BofA see earnings continuing to be about flat this year after just a 1% 2021 advance. Per share profits are seen as falling by 3% in 2023 but then rising in 2024. The Bloomberg consensus forecast is about in line with what BofA expects. Dividends are forecast to continue their upward trajectory in the coming quarters and years.

With both operating and GAAP P/Es near 20 and tepid profit growth, the valuation appears a bit stretched to me. Moreover, its EV/EBITDA ratio is higher than that of the S&P 500 and its free cash flow is not particularly high. Overall, the valuation does not look great in my eye.

BWXT: Earnings, Valuation, Free Cash Flow Forecasts

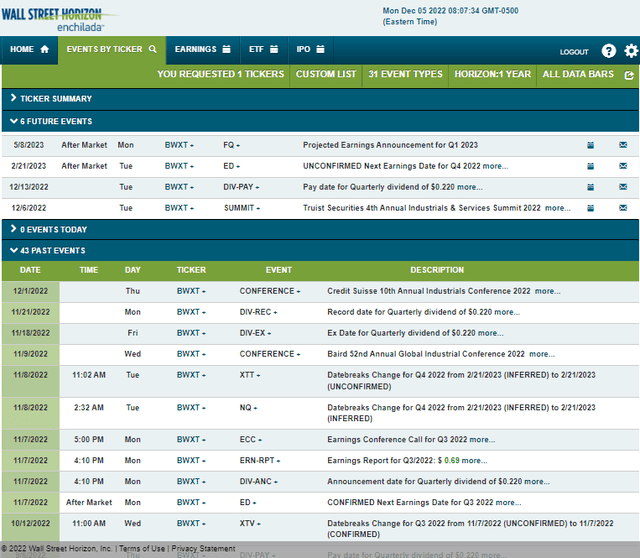

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Tuesday, February 21 AMC. Before that, the management team will speak at the Truist Securities 4th Annual Industrials & Services Summit 2022 on December 6. There’s also a dividend pay date upcoming on December 13.

Corporate Event Calendar

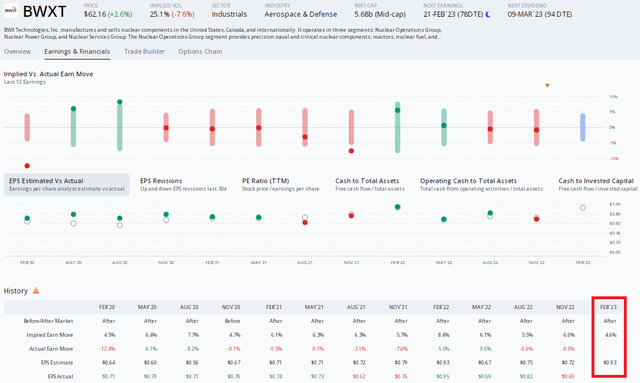

Data from Option Research & Technology Services (ORATS) show a small year-on-year decline in BWXT EPS in its February Q4 report. The options market, meanwhile, has priced in a historically modest 4.6% implied post-earnings stock price swing using the nearest-expiring at-the-money straddle – the previous three reports have moved shares less than 1%, so it could be an opportunity to buy premium given that recency bias potentially in the market.

BWXT: Low Volatility Expected

The Technical Take

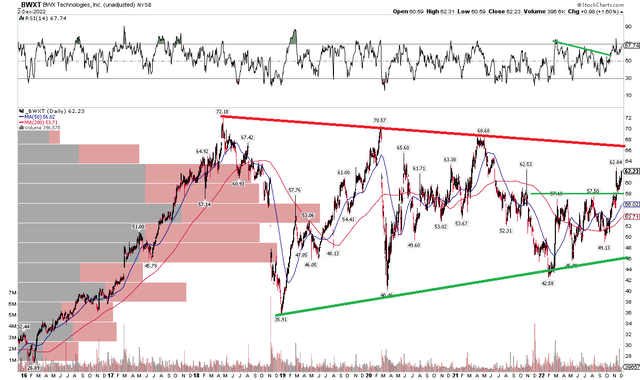

BWXT has been consolidating in a broad symmetrical triangle pattern for the last few years. The stock is now approaching the upper end of that coil, so I am inclined to fade the strength, but there could still be a bit more upside. Notice how the RSI has broken above a downtrend line while there is near-term price support in the $57 to $58 range, so I think another $3 to $4 of upside is possible with the name, but risk should be taken off the table there.

On the downside, there’s ultimate support in the mid-$40s – that would be a good spot to buy a dip. A breakout above $70 would trigger a bullish measured move price objective to near $100 based on the size of the consolidation pattern.

BWXT: Shares Continue To Consolidate – Sell The Rip

The Bottom Line

I don’t like the risk/reward right now in BWXT. Short-term traders can get a few more bucks of upside, but resistance soon comes into play. I would avoid the stock now given the chart and high valuation.

Be the first to comment