Michael H/DigitalVision via Getty Images

ZIM Integrated Shipping’s (NYSE:ZIM) shares have suffered a great deal, since the highs recorded in 2021. While a series of factors resulted in an enormous freight rate rise back then, which boosted profitability to unprecedented levels, another series of factors, during the last few months, is pushing the company down. Despite yesterday’s 6% increase, shares are trading at $25, which is 65% down from the levels seen in March 2022. However, I believe that now is a good time for medium-term investors to jump into the company. Let’s see why.

Reason #1: The Fed may take it more easy with rate hikes

As we know, stock markets tend to discount future developments before they happen, and this is why they overreact, many times. According to FedWatch, markets have already priced in a 75 point rate increase in today’s Fed meeting, with a 90% probability. In other words, what we’re now seeing in the stock market reflects the probability that a specific decision will be made today. Although I won’t argue with a 90% probability, I will focus on this: A large number of analysts, during the past few weeks, have expressed their view that at some point, the Fed, should start reducing the rate of their rate increases. That point, they say, could be the November meeting. This view also is supported by some findings: The yield curve has reversed, meaning that investors expect higher interest rates in the short term and lower interest rates in the longer term. In addition, labor demand and rental growth have started to ease, or even reverse, in some cases.

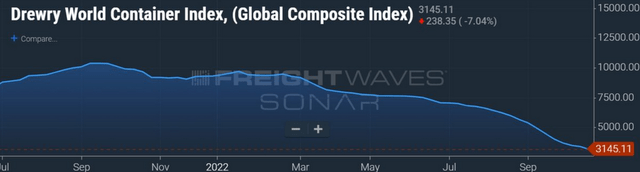

What the above developments have to do with ZIM is obvious: Plainly put, the rate of economic slowdown has a direct effect on the demand for goods, which also has a direct effect on ZIM. This is also confirmed by cross examining the Fed rate hikes timing and the Drewry World Container Index that is shown below.

Drewry World Container Index (Freightwaves Sonar)

The first rate hike post – COVID was decided on March 17th, 2022. As we can see that index was at an extremely high level at that point, while as I mentioned earlier, ZIM price was at $85 per share. Since, there has been a total of 4 additional interest rate increases. We can also correlate these with the World Container Index and ZIM moves. Subsequently, a potential rate hike easing could have the opposite effect.

Reason #2: Current freight rate levels are still nice for liners

When we compare two things, the comparison is usually made in relation of one thing to the other. This is not right in this case. If we compare today’s container freight rates with what was going on like 10 months ago, one could reach to a conclusion that a disaster has occurred. While we should “never say never”, fortunately a disaster hasn’t happened, at least yet. The Drewry World Container Index is currently at 3150 units, while in 2019, before COVID hits, it was at the ballpark of 1400 – 1500 units. So, the effect that we’re seeing on ZIM today, doesn’t have to do with the freight rates themselves, but rather with a liner that’s got caught in an era of rapidly falling freight rates. Well, this will stop at some point, and as I wrote in the previous paragraph, it could stop sooner rather than later.

This was also confirmed by yesterday’s earnings announcement of the Japanese liner Ocean Network Express (ONE). The company, which is the world’s 7th largest container liner in terms of fleet size, reported record revenues and record net income, for the Q3 2022. What was really important though, was the view that probably these are the peak results and that rates reversal will start showing itself from the next quarter. They said:

Due to the inventory build-up situation in North America and Europe’s entry into recession, it is expected to take some time for cargo movements and short-term freight rates to recover.”

However, it was acknowledged that these severe fluctuations are the second part of the spikes seen in the early post – COVID period, and that still, they expect a pretty solid year, from a company profits perspective.

Reason #3: ZIM’s dividends will ease the short-term pain

One of the main reasons behind ZIM’s increased popularity is their monstrous dividends. The company has paid / will pay 30% of their quarterly net income for the first three quarters of this year, while for Q4 2022, the dividend will be 30% of quarterly net income or up to 50% of annual net income. Further dividend payments are subject to board approval. This means two things:

Firstly, the company will pay out another hefty dividend for the Q3 2022, if we assume a nice third quarter, just the one that ONE reported. On August 2022, the company paid out its Q2 2022 dividend, which was equal to $4.75 per share. If we assume a more or less similar quarter, we can get a dividend of $4.5 per share. If we also assume that the Q4 2022 will be materially worse, and the 50% annual net income limit comes into play, we may get something much lower as dividend. However, in the latest earnings announcement, the company reaffirmed their FY 2022 guidance for $7.8 – $8.2 billion adjusted EBITDA. More specifically, if we assume a 40% discount to Q2 2022 net income, we get a Q4 2022 projected net income of $800 million, which should mean a quarterly dividend of $2 per share. To wrap things up, this means that an investment in ZIM today, has the potential to get you at least $6.5 per share in cash in hand in 5-6 months’ time, which translates to 26% of the current share price. From a different perspective, we can say, with a nice degree of certainty, that ZIM is on a 26% fire sale. While we have no information about dividend payments beyond 2022, it would be reasonable to argue that a long-term investor planning to hold ZIM throughout 2023 would get another 30%-40% of the current share price in the form of dividends, at the very (and I mean very) least.

Bottom Line

I would buy ZIM now, to benefit from the anticipated rally prior to the earnings announcement on November 16th. Chances are that the company will report much better results than anticipated. However, as I mentioned earlier, the stock market is a discounting mechanism. So, I believe a rally prior to earnings is imminent, for a number of reasons, including a potential reduction in the Fed‘s monetary tightening rate. Apart from that, the company’s dividend policy provides a significant downside risk mitigation, even in the very conservative scenario described above. For long-term investors, ZIM could do the trick.

Be the first to comment