Scharfsinn86/iStock via Getty Images

Introduction

The Andersons (NASDAQ:ANDE) reported its 2Q22 earnings. The stakes were high. In this case, I’m not referring to analyst estimates but the fact that I’ve been bullish on The Andersons since the agricultural bottom of 2020. Especially after the 1Q22 earnings results caused the share price to crash, I reiterated (here, and here) my bullish stance as the company benefits from a lot of tailwinds including high ethanol demand and margins, an improving grain basis, and an overall emphasis on North American agriculture exports.

The good news is that the best-case scenario has happened. In this article, we get to discuss the company’s just-released earnings and the bigger agriculture bull market. The company reported blowout financial numbers as it saw improvements across the board. Not only does this mean that the company is back on track, but it also confirms that the Maumee, Ohio, based agribusiness giant is still well undervalued.

So, let’s look at the details!

ANDE Is All About Demand & Margins

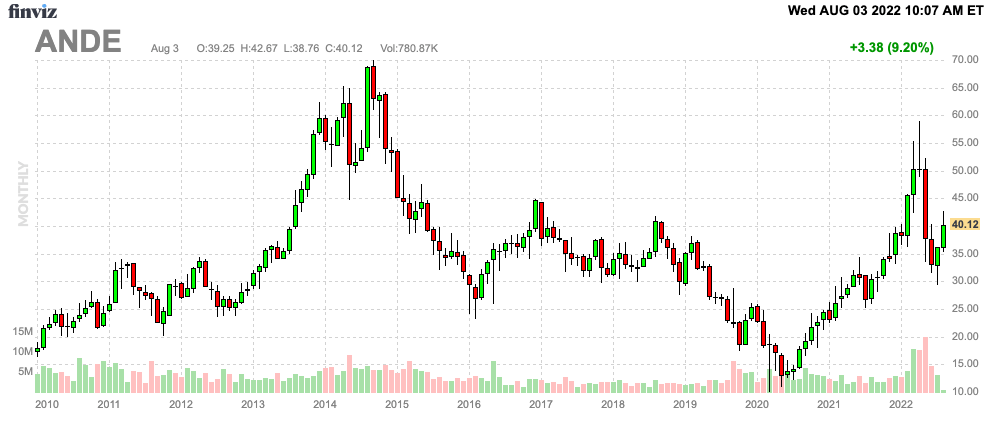

If there’s one thing I mention in (almost) every single article on The Andersons or its peers, it’s that agriculture stocks tend to be volatile. The ANDE ticker traded at less than $15 in 2020 after peaking at $40 in 2018. Even that was still almost 50% below the 2014 peak of $70 per share.

Between the 2020 bottom and the 2020 peak, the stock rallied to almost $60, or 300%. Now, the stock is back at $37.

FINVIZ

Like most commodity stocks, ANDE is what I like to call a “margin” play. While every single company that ever existed is dependent on good margins, commodity companies are highly dependent on margins as margins are volatile and impacted by a lot of factors like futures.

The Andersons operates three major business segments, and all of them are dependent on margins.

Trade

In its trade segment, the company specializes in the movement of physical commodities such as grains, grain products, feed ingredients, domestic fuel products, and pretty much everything related to agriculture.

Moreover, and I’m going to quote the company here:

The business also operates grain elevators across the U.S. and Canada where income is earned on commodities bought and sold through the elevator, commodities that are purchased and conditioned for resale, and commodities that are held in inventory until a future period, earning space income. Space income consists of appreciation or depreciation in the basis value of commodities held and represents the difference between the cash price of a commodity in one of the Company’s facilities and an exchange-traded futures price (“basis”); appreciation or depreciation between the future exchange contract months (“spread”); and commodities stored for others upon which storage fees are earned.

I used this quote as it highlights how important the “basis” is, which is a major driver of margins in this segment, and the difference between regional cash prices and exchange-traded futures.

Basis values were the reason why investors panic-sold ANDE shares after 1Q22 earnings, as trade segment adjusted pre-tax income fell from $14.3 million to $3.7 million.

This is what the company commented back in 1Q22:

The significant run-up in commodity prices resulting from the conflict in Ukraine and the smaller South American crop caused a dramatic drop in basis values, primarily in corn and soybeans. While the lower basis values allowed us to buy new bushels at favorable basis levels, existing domestic positions experienced large basis reductions, which impacted first quarter results.

Renewables

This segment was formerly called the Ethanol Group, as it produces ethanol and various by-products.

In 2021, ethanol generated 47% of total adjusted EBITDA.

Including joint ventures with Marathon Petroleum (MPC) and its 51% stake in ELEMENT, LLC, the company shipped 727 million gallons of ethanol in 2021.

This comes with 286 million pounds of corn oil, and 2 million tons of DDG, which stands for “dried distiller grains”, a by-product of ethanol production.

Plant Nutrient

In this segment, the company is basically supplying much-needed input products for farmers.

According to The Andersons:

The Plant Nutrient Group is a leading manufacturer, distributor and retailer of agricultural and related plant nutrients, corncob-based products, and pelleted lime and gypsum products in the U.S. Corn Belt and Puerto Rico. The group provides warehousing, packaging and manufacturing services to basic nutrient producers and other distributors.

Now, with all of this in mind, let’s look at very bullish earnings and my view on agriculture.

The ANDE Bull Case

ANDE shares are up 9% while I am writing this as the market is finding out that the bull case is for real.

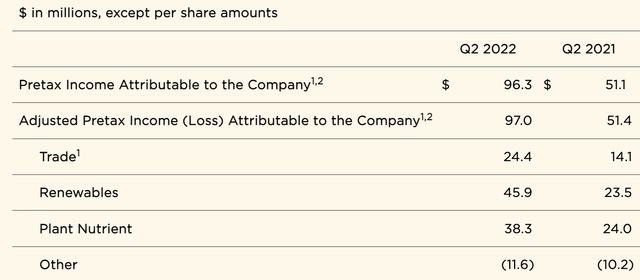

The company reported a non-GAAP EPS result of $2.39, which was $1.36 higher than expected. This was made possible because the company did $4.45 billion in revenue, that’s 37.3% higher compared to the prior-year quarter and $790 million higher than expected.

That’s one of the biggest beats I’ve seen all year.

Growth came from all segments. For example, adjusted pre-tax income rose from $51.4 billion to $97.0 billion.

This was provided by a surge in trade, doubling results in ethanol/renewables, and high growth in nutrients.

In trade, the company saw an improving basis and good selling margins in many of its products, despite falling spot prices.

Moreover, the company sees favorable crop conditions despite a late start to planting this year. Given high expected volumes and tight global supplies, ANDE is in a good spot to capitalize on this with its infrastructure and capabilities in this segment.

In its renewables segment, the company benefited from high margins. Seasonal demand was impacted by high gasoline prices, but higher exports have put somewhat of a floor under ethanol prices. Additionally, the company mentioned that the corn supply in the West of the United States is tighter, favoring companies with better supply in the East.

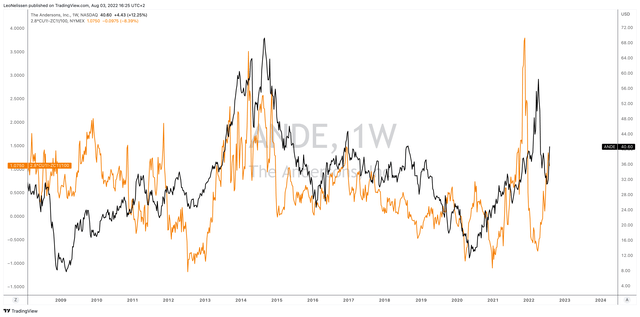

The following chart shows the ANDE stock price compared to ethanol margins (orange). Please note that it’s an estimate that I made myself. In this case, I used a simple formula based on the assumption that 1 bushel of corn produces 2.8 gallons of ethanol.

This estimate completely ignores by-products like DDG, but DDG futures have been discontinued. Moreover, companies hedge ethanol production.

Yet, my rough estimate is highly correlated with ANDE as the company benefits from high gasoline prices, which supports ethanol. Moreover, the worsening energy crisis in Europe is supportive of energy exports and domestic margins. As corn prices have come down a bit (December corn below $6 per bushel), margins for ethanol producers are quite good.

TradingView (Orange = Ethanol Margins Proxy, Black = ANDE Stock Price)

While I believe that tight supply keeps corn prices high, I don’t expect deteriorating margins as energy is also seeing severe supply issues. Ethanol is key in satisfying exports and keeping fuel affordable.

The company’s nutrient segment not only felt tailwinds from a favorable planting season but also the company’s inventory management, which was able to provide enough supplies to farmers at the right time.

In this segment, pricing more than offset weaker demand, as volumes were lower in some areas due to high pricing. I’ve read countless stories from farmers who cut back on fertilizers in some areas to deal with inflation.

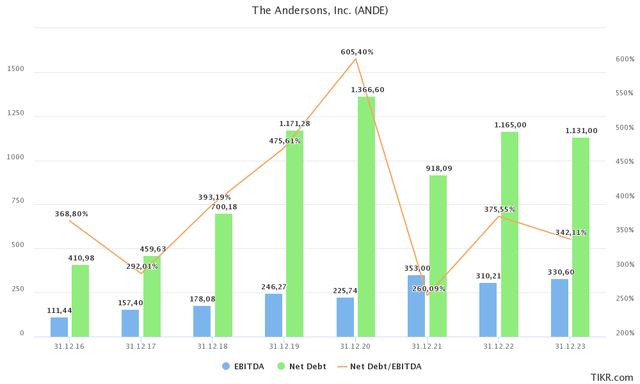

And, on top of that, the company repaid $560 million in debt, which resulted in a much better-than-expected leverage ratio:

Our businesses continue to generate strong operating cash flows and we remain disciplined in our approach to capital spending decisions. We are well below our goal of long-term debt to EBITDA of less than 2.5 times, ending the quarter at 1.5 times, and are well-positioned to fund strategic growth projects with appropriate returns.” said Executive VP and CFO Brian Valentine.

This also validates my assumption that ANDE is too cheap.

Valuation

ANDE has a $1.4 billion market cap. 2023 net debt is expected to be $1.2 billion. Moreover, the company has $240 million in minority interest and $23 million in pension-related liabilities. This gives the company an enterprise value of $2.9 billion. That’s 8.7x expected EBITDA of $330 million, which I believe to be the base case.

With that said, I stick to what I wrote last month:

This valuation is too cheap as investors are pricing in a decline in sentiment and agriculture prices on a longer-term basis. I don’t see that happening.

Hence, I stick to my fair value of $65-70. However, as I said in my prior article, we’re more than likely not getting there this year. I hope to see a rebound towards $45 this year followed by a move to my target by the end of 2023.

In this case, the rebound to $45 looks extremely likely, as 2Q22 earnings were too good to ignore.

Takeaway

This earnings call was very important. The Andersons has been doing well all year (financially speaking), which wasn’t recognized by investors due to issues with pricing in 1Q22 and because investors sold agriculture-related investments.

Now, this is changing. The Andersons reported blowout earnings thanks to strength in every single segment:

- Strong pricing in ethanol and high demand.

- High margins in nutrients and solid volumes.

- Trade saw a comeback of favorable basis prices, high volumes, and a tailwind from good crop conditions and agricultural demand.

I believe that all of these tailwinds are lasting.

Moreover, ANDE is attractively valued as I believe that the company can exceed $330 million in annual EBITDA due to the aforementioned tailwinds.

Needless to say, I remain long as I like the risk/reward.

(Dis)agree? Let me know in the comments!

Be the first to comment