Chung Sung-Jun/Getty Images News

Introduction

It’s time to talk about General Dynamics (NYSE:GD). It’s the only major diversified defense contractor we haven’t talked about this quarter. The company recently reported its earnings, which came in higher than expected. These numbers are backed by strong new orders from both defense and commercial customers and the outlook that higher defense spending will benefit the company’s advanced products. While the valuation has become lofty, I will make the case that General Dynamics remains a buy on any weakness. After all, the company has one thing the market needs right now: quality earnings.

Now, let’s dive into the details!

Buying Quality

The market is down roughly 18% since the start of the year, yet my four largest investments are all trading at an all-time high (Lockheed Martin (LMT), Exxon Mobil (XOM), Chevron (CVX), and Northrop Grumman (NOC)).

That’s energy and defense. Two industries that benefit from secular tailwinds like limited fossil fuel supply growth, the war in Ukraine (boosting global defense spending), and the fact that investors find refuge in these stocks because they offer quality earnings when it matters most.

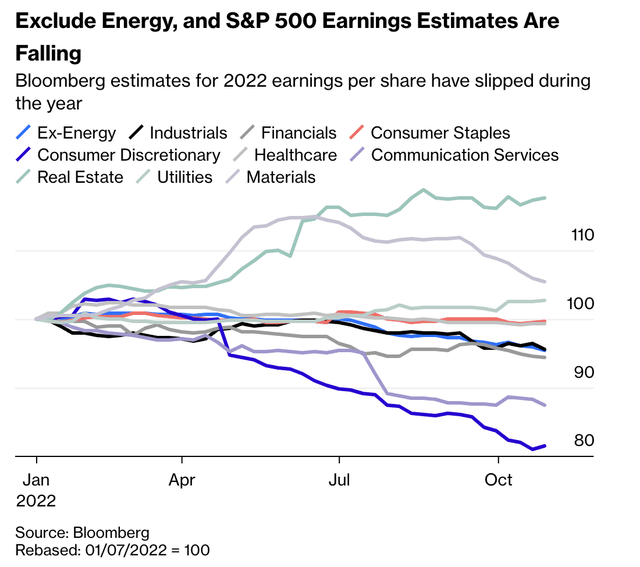

Excluding energy, S&P 500 earnings are roughly 4.5% lower since the start of the year. Note that energy earnings have doubled during this period.

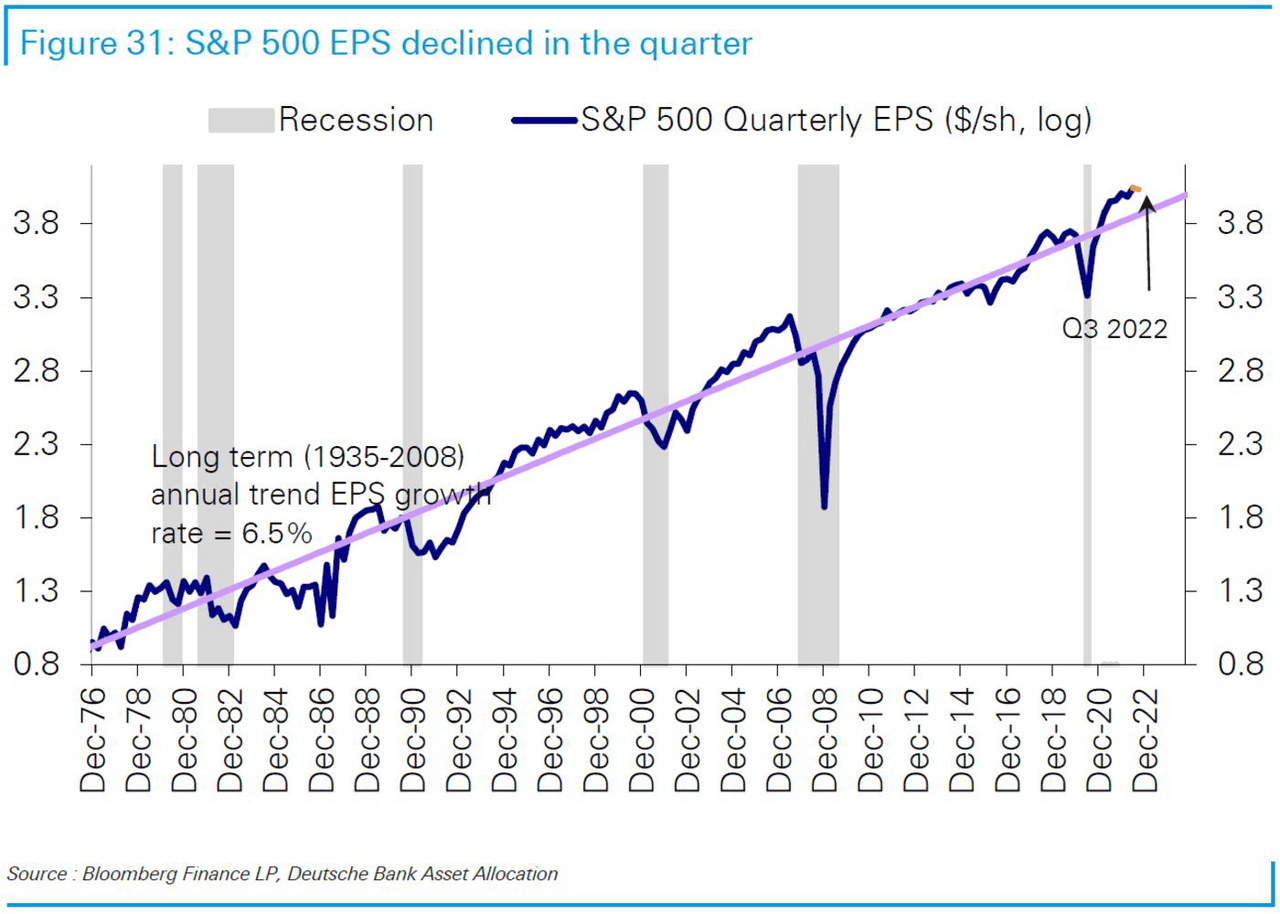

Even though consumer earnings have come down more than 20%, that’s not a bad performance. Especially when looking at the bigger picture, S&P 500 quarterly earnings are still close to all-time highs.

Deutsche Bank

The problem is that economic growth started to gain downward momentum in the third quarter. What this means is that earnings will suffer more in the quarters ahead. The current decline is just the start.

Depressed consumer sentiment, falling manufacturing sentiment, high (and persistent) inflation, and the fact that the Fed will have to remain aggressively hawkish in this environment are reasons to expect earnings to fall further.

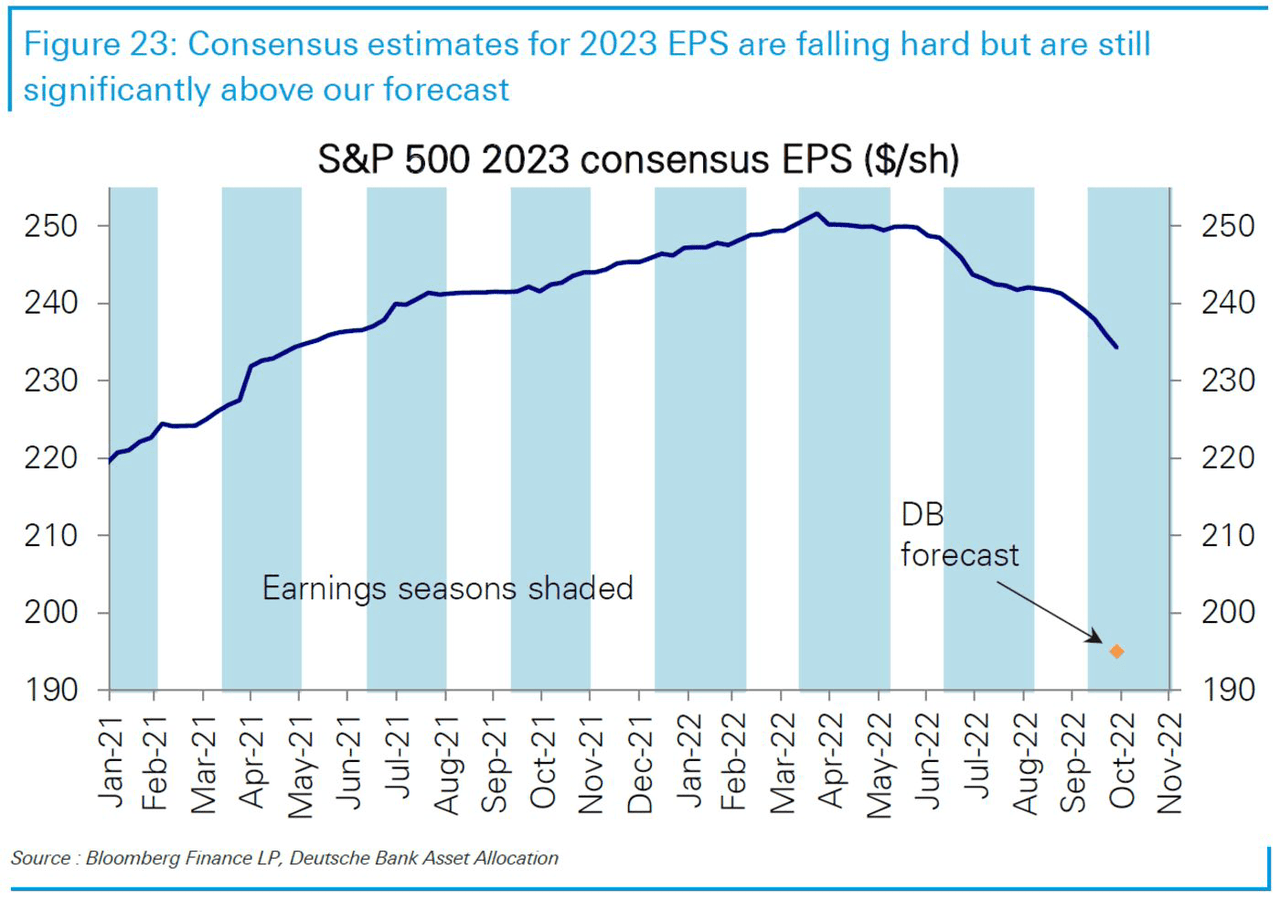

Hence, Deutsche Bank expects earnings to fall to a multi-year low.

Deutsche Bank

What this means is that investors will continue to go for quality stocks. This includes companies with stable earnings, positive (or outperforming) growth, and subdued risks.

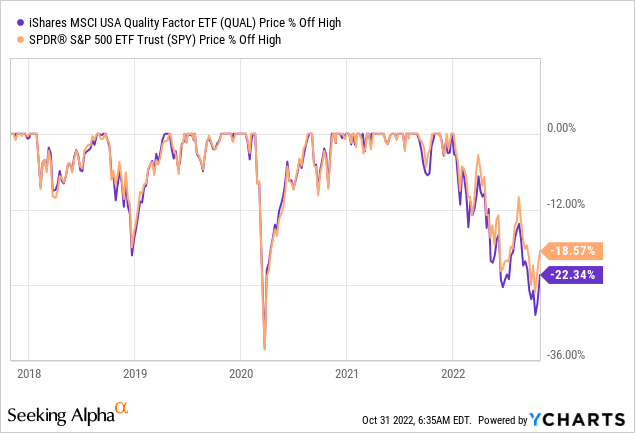

There are many ways to track “quality” stocks, but I like to go with low-volatility ETFs like the one below. While the difference versus the S&P 500 isn’t high, low-volatility stocks are indeed outperforming.

I believe that General Dynamics is one of the stocks that protect investors in times of turmoil.

General Dynamics Is Back On Track

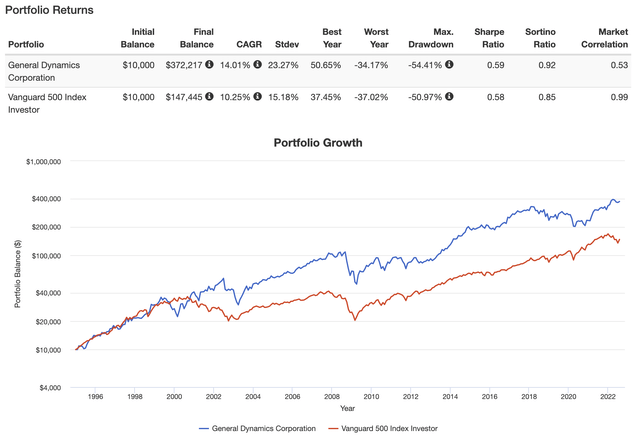

In August, I wrote an article titled “When In Doubt, Buy General Dynamics For Its Dividends”. I included the following chart, showing that GD shares have returned more than 14% going back to 1995, outperforming the market with subdued volatility.

The major reason is the company’s defensive (literally) business model, which we need to discuss, anyway, before we dive into the quarterly earnings.

General Dynamics is the 5th-largest defense contractor in the US with a market cap of $68.8 billion. Located in Reston, Virginia, the company has a very interesting business portfolio consisting of both commercial and defense/government products and services.

As the table below shows, the company’s sales are well-diversified as no segment generates more than a third of total sales. The company has also no segment with exposure of less than 19%.

In its aerospace segment, the company builds and sells the famous Gulfstream private jet, which now consists of 8 models.

General Dynamics

General Dynamics supports an installed base of more than 3,000 Gulfstream models, which benefit from the largest factors-owned service network in the industry, which allows the company to benefit from the sale of new planes and long-term maintenance and aftermarket sales.

Its marine systems segment competes with one of my core holdings: Huntington Ingalls Industries (HII). While other players have marine operations, Huntington and General Dynamics are the two largest suppliers of Navy ships and the sole producers of nuclear submarines for the Navy.

According to the company:

Our Marine Systems segment is the leading designer and builder of nuclear-powered submarines and a leader in surface combatant and auxiliary ship design and construction for the U.S. Navy. We also provide maintenance, modernization and lifecycle support services for Navy ships and maintain the most sophisticated marine engineering expertise in the world to support future capabilities.

In its combat systems segment, the company produces the famous M1A2 Abrams main battle tank and Stryker wheeled combat vehicle. While investors like to buy companies that focus on next-gen war capabilities, all of these vehicles are part of multi-domain warfare and a cornerstone of NATO defense capabilities. In other words, demand for these products isn’t going anywhere.

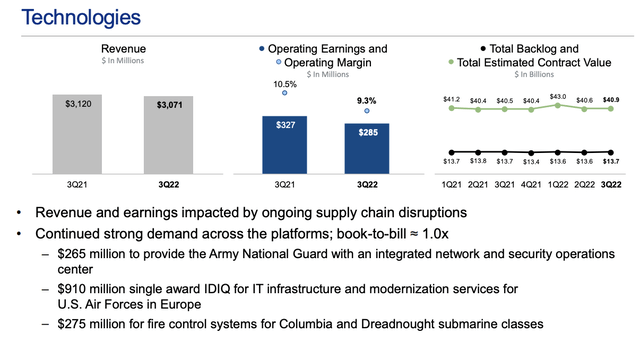

The technology segment is different as it is much more asset-light. This segment:

[…] provides a full spectrum of services, technologies and products to an expanding market that increasingly seeks solutions combining leading-edge electronic hardware with specialized software. The segment is organized into two business units – Information Technology (“GDIT”) and Mission Systems. Together they serve a wide range of military, intelligence and federal civilian customers with a diverse portfolio that includes:

•information technology (“IT”) solutions and mission-support services;

•mobile communication, computers, command-and-control and cyber (“C5”) mission systems; and

•intelligence, surveillance and reconnaissance (“ISR”) solutions.

Putting everything together, General Dynamics generates roughly 70% of its sales from the US government. 10% of sales come from non-US governments, which puts commercial exposure close to 20%.

With that said, defense companies are finally in a better spot.

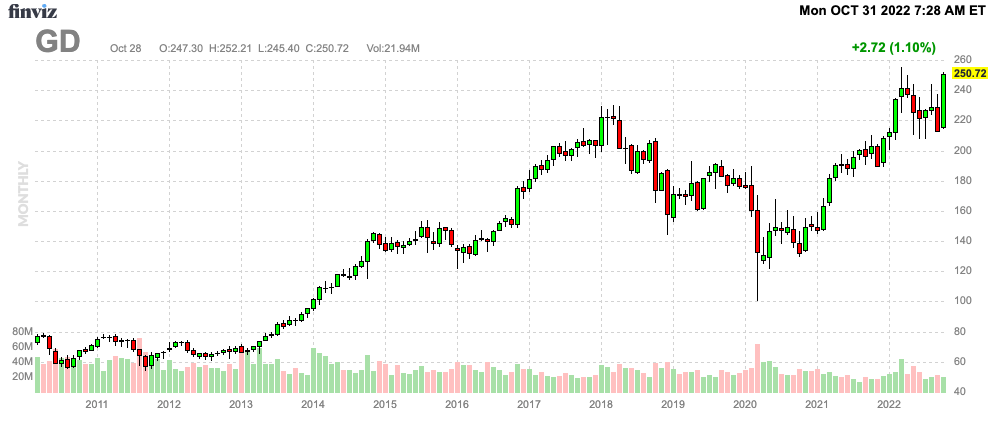

General Dynamics Is Back

Despite its many qualities, GD shares have been (more or less) unchanged since 2018. In 2018, the global economy peaked. Before the economy was able to bottom, the pandemic hit. This did a number on commercial aviation (including business demand). It also hurt supply chains, including the availability of high-tech supplies like chips, qualified labor, and a lot of other supplies needed in the defense industry.

FINVIZ

These supply issues are frankly the only reason I was able to invest a quarter of my net worth in defense stocks as most earning calls since 2020 were impacted by negative supply chain comments. It prevented companies from turning orders into finished products, hurting i.e., long-term guidance. The result was weak stock prices, allowing me to buy quite aggressively.

Now, these headwinds are turning into tailwinds.

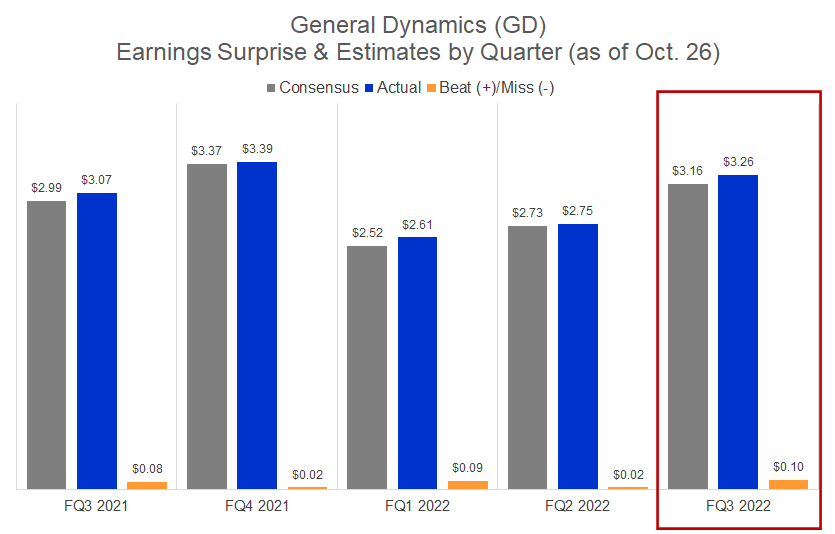

In its third quarter, the company generated GAAP EPS of $3.26, which beat estimates by $0.10. This 6.2% improvement was provided by 4.5% revenue growth, which pushed quarterly revenues to $10 billion, $70 million higher than expected.

Seeking Alpha

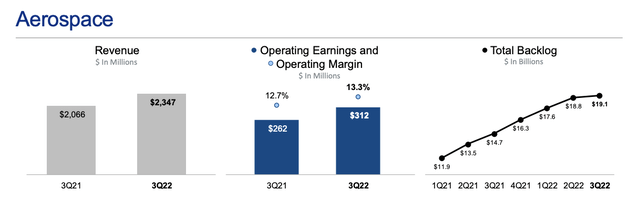

While supply chain problems remain persistent, the company’s stronger sales benefited from easing issues in the industry. For example, in aerospace, revenues were up 13.6% with operating margins rising to 13.3%. This boosted operating income by 19%.

According to the company:

To be fair, the prior quarters revenue and earnings were somewhat lower as a result of the inability to deliver for Aircraft, due the airworthiness directive, which was fully resolved in the third quarter. From an audit perspective, this was yet another good quarter reflecting continuing strong demand.

Even more impressive is demand, impacting the company’s backlog. Despite macroeconomic headwinds, the company sees high interest in its products. The book-to-bill ratio in aerospace was 1.2x in 3Q22 and 1.6x on a year-to-date basis. This means that the company is seeing much higher orders than its ability to turn backlog into finished products. As a result, the company is now sitting on $19.1 billion in aerospace orders (backlog). That’s up almost 100% since 1Q21.

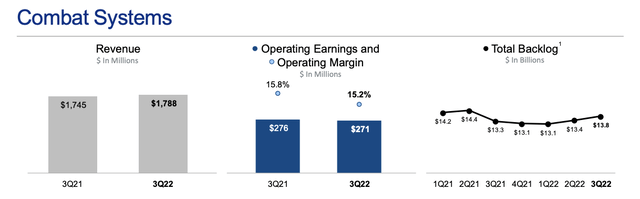

In combat systems, the company grew revenues by 2.5%. Operating income was down 1.8%. However, operating margins remain at 15.2%, which is a number the company is more than comfortable with.

Demand was high in this segment. The book-to-bill ratio remains at 1.30, with new orders for Abrams tanks for Poland, and orders for $370 million worth of ammunition.

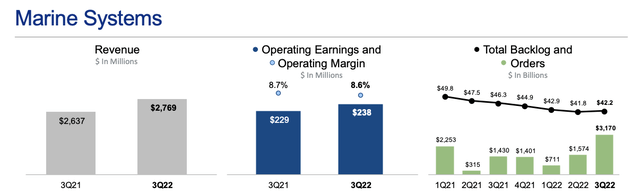

In its marine segment, the company grew revenue by 5%, supported by Electric Boat and NASCO.

At Electric Boat, the Columbia first ship remains on cost and on contract schedule. The ship is more than 25% complete.

NASCO had a particularly good quarter with improved TAO revenue and higher margins across the board. From an orders perspective, Electric Boat received a large maintenance and modernization order for the USS Hartford. NASCO received orders for an additional ESB and 2 TAO oilers. This puts the book-to-bill was 1.1:1, leading to a $400 million increase in backlog.

The marine segment is now seeing strong order flows for both new construction and repair works. Moreover, the company believes that the FY23 defense budget is well-aligned with its own capabilities.

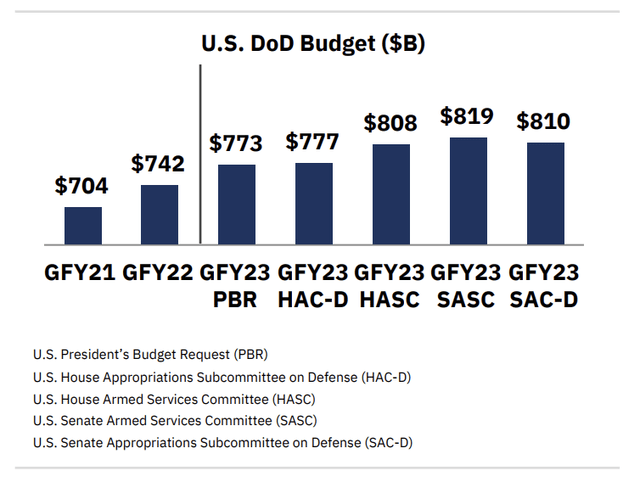

Speaking of defense spending, the US defense budget could end up at $810 billion, up from $742 billion in 2022.

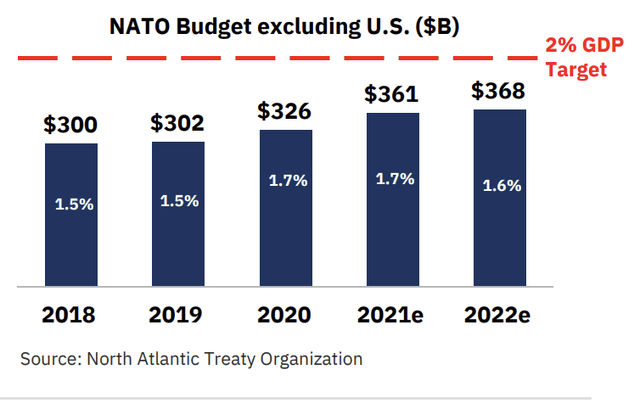

Moreover, NATO has made clear that it wants to make the 2% GDP target the floor of its funding, not the ceiling. This would mean at least another $92 billion in NATO (ex-USA) funding based on 2022 GDP numbers.

Technologies saw lower revenues and lower operating income as a result of weakness in both mission systems and IT. Mission systems suffered from nagging supply chain disruptions and the failure of some government customers to obligate funds for authorized and appropriated products. In the case of IT services, it was largely timing and program mix. In other words, nothing serious.

As a result, the company stuck to its prior guidance as improvements in aerospace are offsetting temporary headwinds in technologies.

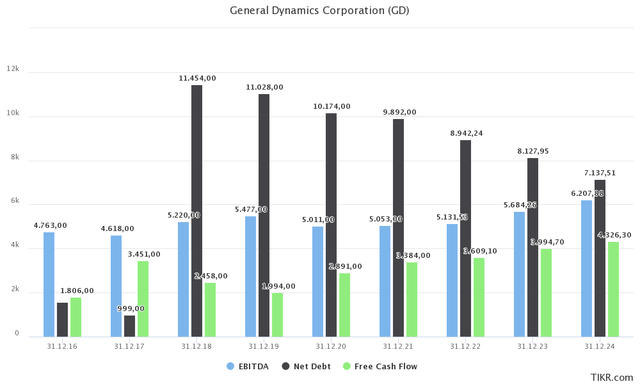

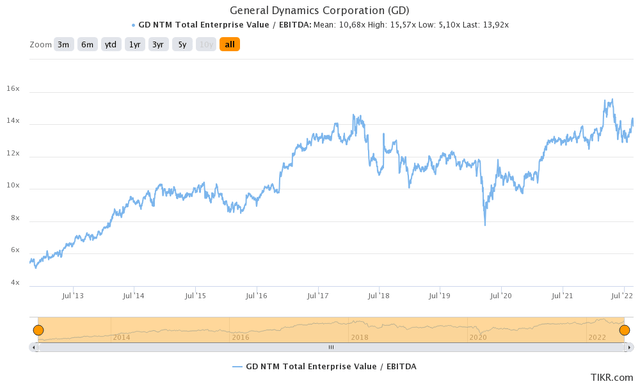

Valuation

General Dynamics isn’t cheap. After rallying 20% since the start of the year, the company is now trading at 13.9x 2023E EBITDA of $5.7 billion. That’s based on its $79.4 billion enterprise value, consisting of the aforementioned $68.8 billion market cap, $8.1 billion in net debt, and $2.5 billion in pension-related liabilities.

As I wrote in my prior article:

This valuation is below the 2022 peak bust still somewhat elevated compared to pre-pandemic levels. What we’re seeing now is that investors are pricing in higher growth as a result of filled order books and rebounding demand in both commercial and defense markets.

The 2023E implied free cash flow yield is 5.8%, which is fair.

In other words, I believe that General Dynamics remains a great investment whenever dips occur. I wouldn’t chase the price at current levels but I would be a buyer at everything 10% below current prices.

The only reason why I do not own GD shares is that I have a quarter of my net worth in defense companies. I have commercial exposure via Raytheon Technologies (RTX), I have marine exposure via Huntington Ingalls, larger defense equipment via Lockheed Martin, and advanced technologies via Northrop Grumman. I also own L3Harris Technologies (LHX) I’m obviously painting with a very broad brush, but I think people get the point.

Takeaway

In this article, I started by highlighting the need for companies with strong earnings power. Especially in this macroeconomic environment, investors are looking to put their money into quality stocks.

General Dynamics is such a company. It has a well-diversified business model consisting of commercial aerospace, heavy defense equipment, and next-generation technology.

The company is on pace to accelerate its earnings going forward as new orders are accelerating. On top of that, the company is benefiting from easing supply chain issues, allowing it to turn orders into finished products in an increasing space.

However, because the stock has done so well this year, I recommend investors wait for a larger drawdown before buying.

(Dis)agree? Let me know in the comments!

Be the first to comment