Kevork Djansezian/Getty Images News

In the 13 months or so since I put out my bullish piece on Sturm Ruger & Co. (RGR), the shares have returned just over 14% against a gain of ~22% for the S&P 500. Interestingly, fully 5% of my returns here came from the dividend, so that’ll be one of the things I focus on in this article. I thought I’d look at the name again, because holding a stock priced at $67.25 is by definition more risky than buying that same stock at $61.75. I’ll try to determine whether to buy more, sell, or hold by looking at the most recent financial history here. In addition, I’ll be looking at the stock as a thing distinct from the underlying business, mindful of the fact that a great business can be a terrible investment at the wrong price. Also, as you might have guessed if you’re one of my regulars, I’m going to write about potential opportunities with short put options here.

Here’s the “thesis statement” portion of the article, dear readers. I offer this up to those people who are of the view that the “juice” of my analysis is not worth the “squeeze” of needing to wade through my thinly veiled brags and rambling circumlocution. I get it. Not everyone likes my style of writing. I’m not offended by that. I’m fine with it. Really, I’m fine. Anyway, I’m of the view that Sturm Ruger remains an excellent investment. The volatility of the underlying business is more than made up for by the quality of the balance sheet. In addition, the dividend is very well covered in my view. The shares are priced near multi year lows, which insulates investors against the inevitable volatility in my view. For those still nervous about buying this name, I recommend selling put options as a viable alternative.

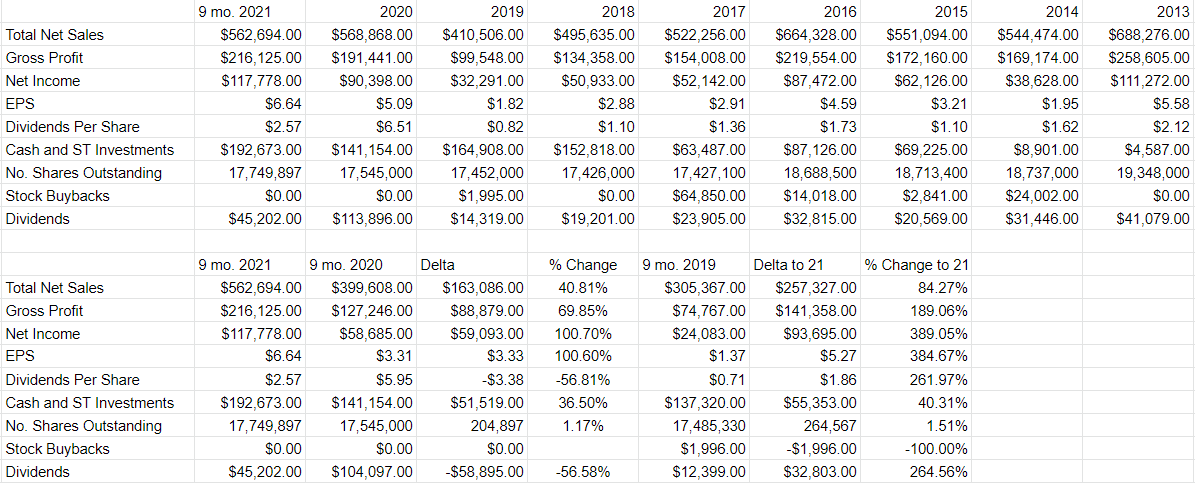

Financial Snapshot – Choppy, But Sound

When reviewing the financial history here, the only negative that pops off the page is the volatility of the business. Since 2013, annual revenue has ranged from $410.5 million on the low side (in 2019), to $688.3 million on the high side (in 2013). Given that dividends are determined by how well the business does, this has obviously caused similar volatility with payouts. For my part, I embrace the volatility, though, and I like the fact that dividends are paid based on how well the business does. This obviates the need to load up on debt to satisfy the market’s desire for ever growing dividends at all costs. Although they’ve been volatile, the company has managed to return over $342 million in the form of dividends since 2013.

Turning to the balance sheet, I’ve droned on about the solid capital structure here in the past, so I won’t make the point again other than to write that the only significant long term liability here are the operating leases, valued on the balance sheet at ~$1.5 million, and cost the company somewhere between $200 and $250 thousand annually.

Dividend Very Well Covered

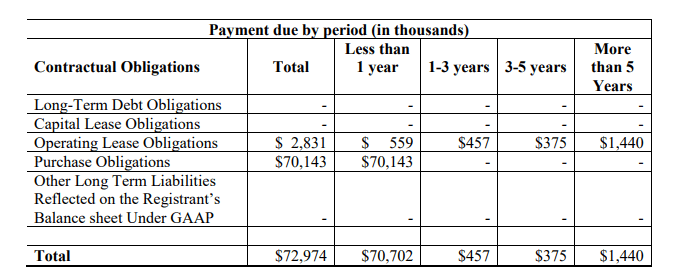

Although I like accrual accounting as much as anyone who claims to be sane can actually like something like this, when it comes to trying to work out whether a dividend is sustainable or not, or in the case of Sturm Ruger, the chances that there will be a dividend of a given size, I need to put aside my beloved accrual accounting and think only in terms of cash and cash flow generation. Specifically, when I’m trying to work out whether a dividend is likely to be sustained, grow, or be cut, I want to compare the size and timing of future contractual obligations, and compare those to the current and likely future sources of cash. The greater the delta between the amount of cash on the balance sheet and the average cash from operations on the one hand and contractual obligations on the other, the better. I’ve taken the liberty of clipping the size and timing of future contractual obligations from the latest 10-K and have reproduced it here for your enjoyment.

Please note that since this is from the point of view of the latest 10-K, now several months old, the “less than 1 year” column is largely behind us. Thus, over the next four years, the company will be spending ~$832 thousand….yes, “thousand’ on contractual obligations, which works out to ~$208 thousand annually. At this point, I’m starting to think that Sturm Ruger spends less annually than my ex-wife.

Contractual Obligations at Sturm Ruger (Sturm Ruger latest 10-K)

According to the latest 10-Q, the company has about ~$193 million in cash and short-term investments. Additionally, over the past three years, they’ve generated an average of ~$104.4 million in cash from operations, and invested an average of ~$68 million in the business, per CFI. The company spent about $45 million on dividends during the first nine months of this year, and I’m of the view they have the capacity to repeat that pace over the next five quarters at least.

Taking the above into account, I’d be very happy to buy this business at the right price.

Sturm Ruger Financial History (Sturm Ruger Investor Relations)

The Stock

Some of you who follow me regularly know that it’s at this point in the article where I turn in to a real buzzkill by whining about the fact that a great company like Sturm Ruger can be a terrible investment at the wrong price. I’ll defend my discipline by pointing out, again, that the more you pay for a stock, the lower will be your subsequent returns. Rather than try to demonstrate this point abstractly, I’ll use Sturm itself to demonstrate the principle. The people who bought this stock on Canada’s birthday (July 1 in case you don’t know) are down about 24.7% since then. Those who bought on my birthday in early December are up about 4.2% since then. The company didn’t change dramatically enough to warrant a near 29% swing in performance in my view. The delta in returns is nearly entirely a function of the price paid. The investor who bought this stock relatively cheaply did better. This is why I try to avoid overpaying for a stock, and insist on buying cheap.

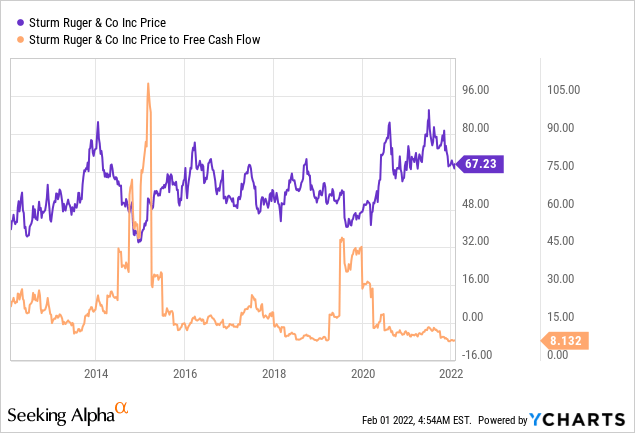

I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. To refresh your memories, in my previous article, I was very impressed by the fact that Sturm was trading at a price to free cash flow of ~10.5. It’s currently about 23% cheaper, per the following.

Source: YCharts

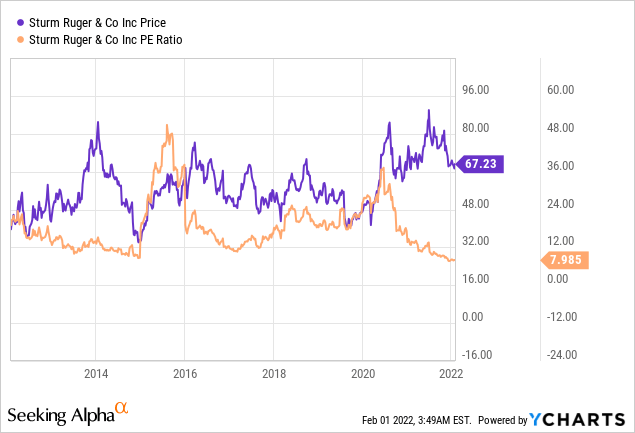

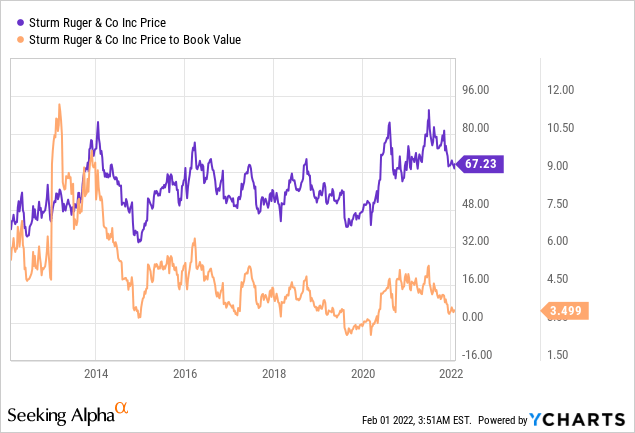

It’s also near decade lows on the basis of PE and Price to Book, per the following:

Source: YCharts

Source: YCharts

It’s fair to say that ratios such as these may give us a false sense of security because they’re backward looking, and the future is much more unknowable. In fact, the one thing that could be said about the future here is that it’ll be volatile. I still think ratios of this sort can be useful, though, because they allow us to see whether the shares are cheap or not against a worst case scenario. So, for example, if the world returns to the dark days of 2019, and EPS drops to $1.82, the PE will spike to ~36. That won’t be ideal, but it’s worth noting that the shares have done reasonably well from when they were priced at that level in the past. So, I think the shares are cheap now, and that cheapness in some way insulates us against the vagaries of this business.

Given all of the above, I’ll add to my position in this name.

Put Options An Even Safer Bet

In addition to buying shares at the current price, I want to sell some puts on the name because I think these are also a great way to “play” the name. In my view, short put options represent a “win-win”, and so they’re too compelling to pass up in my view. To refresh your memories, dear readers, I consider these “win-win” trades because the results are great no matter the outcome. If the puts expire worthless, I’ll simply pocket the premium, which is a positive. If the shares drop below the strike price, I’ll be obliged to buy at a price that I predetermined is acceptable to me, so that’s also a positive.

At the moment, I’m willing to sell the January 2023 Sturm Ruger puts with a strike of $45. These are currently bid at $1.75 , which works out to a 3.9% yield on cash. If the share price remains above $45 over the next year, I’ll simply collect this 3.9% return, which is acceptable to me. If the shares drop 33% from the current (reasonable) price, I’ll be obliged to buy at a net price of ~$43.25. Holding the current dividend constant (a big assumption, I know), that represents a 7.3% dividend yield. Being “forced” to buy at that price is, unsurprisingly, also very acceptable to me.

It’s now time for me to engage in my time honored tradition of spoiling the mood by writing about risk. The reality is that every investment comes with risk, and short puts are no exception. We do our best to navigate the world by exchanging one pair of risk-reward trade-offs for another. For example, holding cash presents the risk of erosion of purchasing power via inflation and the reward of preserving capital at times of extreme volatility. The risks of share ownership should be obvious to readers on this forum.

I think the risks of put options are very similar to those associated with a long stock position. If the shares drop in price, the stockholder loses money, and the short put writer may be obliged to buy the stock. Thus, both long stock and short put investors typically want to see higher stock prices.

Puts are distinct from stocks in that some put writers don’t want to actually buy the stock – they simply want to collect premia. Such investors care more about maximizing their income and will be less discriminating about which stock they sell puts on. These people don’t want to own the underlying security. I like my sleep far too much to play short puts in this way. I’m only willing to sell puts on companies I’m willing to buy at prices I’m willing to pay. For that reason, being exercised isn’t the hardship for me that it might be for many other put writers. My advice is that if you are considering this strategy yourself, you would be wise to only ever write puts on companies you’d be happy to own.

In my view, put writers take on risk, but they take on less risk (sometimes significantly less risk) than stock buyers in a critical way. Short put writers generate income simply for taking on the obligation to buy a business that they like at a price that they find attractive. This circumstance is objectively better than simply taking the prevailing market price. This is why I consider the risks of selling puts on a given day to be far lower than the risks associated with simply buying the stock on that day.

I’ll conclude this rather long and ponderous discussion of risks by looking again at the specifics of the trade I’m recommending. If Sturm Ruger shares remain above $45 over the next twelve months, investors will simply pocket the premium and move on. If the shares fall in price, investors will be obliged to buy, but will do so at a price that works out to a 7.3% dividend yield in a company with one of the most rock solid balance sheets I’ve ever seen. Both outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” You may conclude that it’s odd to end a discussion of risk by writing about how puts reduce risk. If it hasn’t been made apparent to you yet, I’m odd. Get past it.

Conclusion

I think Sturm Ruger is a great investment at current prices. The yield is well covered, and the balance sheet is one of the strongest I’ve ever seen. In addition, the shares are relatively cheaply priced. There is admittedly some volatility in the business, and if that disturbs you, you should probably not invest in stocks. Many other companies try to paper over the volatility inherent in their businesses by taking on debt to finance the dividend, for instance. This does no one any favours in my view. Sturm Ruger is volatile, and as a consequence, dividends have been volatile. I like the honesty of that. For those nervous about buying at current prices, I think the put option described above offers a very safe, viable alternative to owning shares.

Be the first to comment