FOTOGRAFIA INC./E+ via Getty Images

My history with Harley Davidson Inc. (NYSE:HOG) is interesting (to me at least) because the investment has been “good” or “bad” for you depending on when you took my advice and bought. If you bought when I first suggested you do so, you’re down about 3% relative to the S&P 500 which has grown by about 67% since then. Let’s not focus too much on that, though, dear reader. Let’s look instead at the fact that the shares have returned about 18.5% against a gain of ~4.4% for the S&P 500 since I wrote about them a little over two months ago. While I’d be much more comfortable just bragging about how great my call was two months ago, I have to put my fragile ego aside for the moment in order to make the broader point that I’ve been going on about for some time now. While it seems obvious, it bears repeating. You do better when you buy cheaper. I bought four years ago at a price of just over $44. I bought again a couple of months ago at $33. The latter was a better entry price because it represented a greater return at lower risk. All of that is preamble to get to the question before me today: should I buy more, sell, or hold? I’ll make that determination by looking at the recent (spectacular) financial results, and by looking at the stock as a thing distinct from the business. Because I’m so inclined, I’m also going to write about put options.

It’s that time again, dear readers. I’m about to write out the summary of my argument below so you won’t have to wade through my ponderous writing. Although it takes me time to write this summary paragraph, and it feels somewhat repetitive to me, I do it for you. I do it so I can save you a few minutes of your day. You’re welcome. Thank you gifts are always welcome. Anyway, since I last looked at the company, Harley Davidson has released financials and they are quite good in my estimation. I previously described the dividend as “reasonably sustainable”, and now I think it’s “very, very sustainable.” In spite of this, the shares are still relatively inexpensive, and so I’ll be buying even more of this iconic brand. In addition, I’m going to be selling some more put options. The ones I wrote a few months ago are down about 35%, and I want to try to repeat that success. In particular, I want to sell the August puts with a strike of $30. These are currently bid at $1.15, which is a 3.8% yield on capital, which is very attractive for such a short time in my estimation.

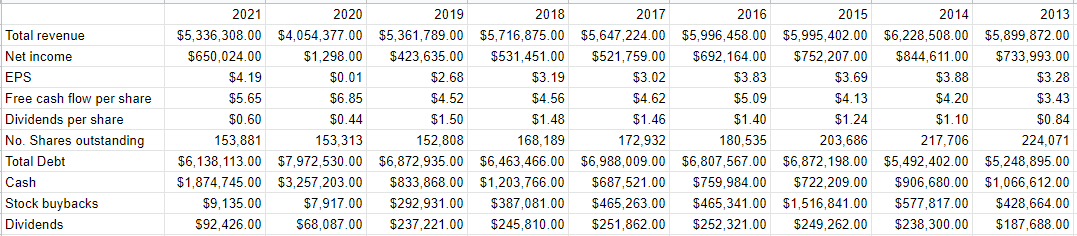

Harley Davidson Financial Snapshot

It seems that the company has managed to put 2020 behind it. For example, revenue was up about 32% in 2021 relative to 2020, and net income swung from a mere $1.3 million in 2020 to $650 million in 2021. Additionally, the company managed to clean up the capital structure pretty handily also. Total debt declined by about 23% to ~$6.2 billion. Finally, I like the fact that the company seems to be on track to restoring the dividend. We’re not back to 2019 levels, but we’re getting closer, with dividend payments 36% higher in 2021 relative to 2020.

You probably recall that the year 2020 was singular, though, and so any comparisons to only that period should be taken with a boulder of salt. When we expand our horizons to include 2019, we see that sales in 2021 were about 0.5% lighter than they were in 2019, but that net income was about 53% greater, and total debt in 2021 was about 11% lower than it was in the pre-pandemic period.

Admittedly, much of the great returns in 2021 were a function of the absence of large restructuring expenses, which dropped from $130 million in 2020 to only about $3.4 million in 2021, but there’s no denying the company had a very good year in 2021. Operating income, for instance, was about 48% higher in 2021 than it was in 2019.

Dividend Sustainability

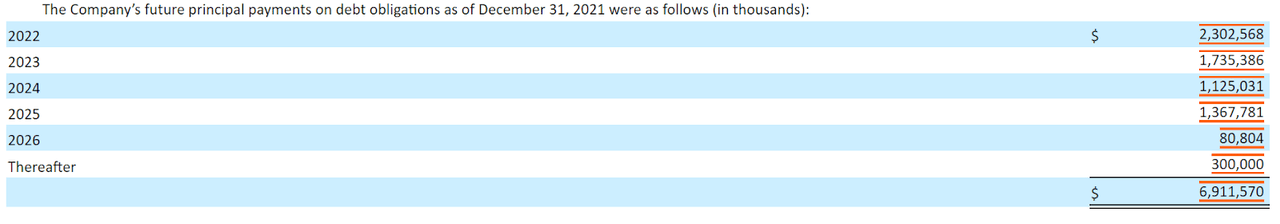

I’m as interested in financial history as the next finance nerd, but investors are particularly interested in a company’s financial future for obvious reasons. In particular in this case, people may be interested to learn about the level of dividend sustainability for two reasons. First, the cash flows received from dividends help smooth the ride from a bumpy stock like this one. Second, the dividend is obviously supportive of stock price. So, you guys may be curious about what goes on with the dividend. If you guys have an itch, I’m absolutely committed to scratching it, so I want to spend some time writing about the dividend. Although I’m as much of a fan of accrual accounting as any semi-sane person can be, when it comes to tracking the sustainability of a given dividend, I look at cash. I specifically want to compare the size and timing of future cash obligations to the current and likely future sources of cash. Let’s start with the obligations. I’ve taken the liberty of clipping the size and timing of future debt payments from page 74 of the latest 10-K for your reading pleasure. We see from the table below that the company is “on the hook” for ~$2.3 billion this year, and about $1.74 billion next. Note that debt constitutes the lion’s share of these obligations. In addition to these debt obligations, for instance, the company is on the hook for ~$18 million in operating leases this year, and $10 million next.

Harley Davidson Debt Schedule (Harley Davidson Latest 10-K)

Against these obligations the company has about $1.9 billion in cash and equivalents. Additionally, they’ve generated an average of $1 billion in cash from operations over the past three years, while spending an average of about $345 million on CFI activities. In my previous missive on this name I suggested that the dividend is reasonably well covered. After the year they’ve just had, as expressed in the financial results since published, I’d suggest that the annual dividend of approximately $93 million is very, very well covered. Thus, I’m comfortable holding assuming the market hasn’t gotten ahead of itself.

Harley Davidson Financials (Harley Davidson investor relations.)

The Stock

Some of you who follow me regularly, for some reason known only to yourselves, know that it’s at this point in the article where I turn into a real “downer” because it’s here that I remind everyone not to get too excited about Harley’s latest financial results. The company can make a great deal of money, but the investment can still be a terrible one if the shares are too richly priced. This is because Harley is an organisation that sells motorbikes for a profit. The stock is a proxy whose changing prices reflect more the mood of the crowd than anything to do with the business. In my view, the stock price changes are much more about future expectations, and the whims of the crowd than anything to do with the business. This is why I look at stocks as things apart from the underlying business.

Now if you thought I was done and couldn’t belabour this point further, you’d be wrong, dear reader. I’ll argue this point further because I think it’s important to understand that companies and stocks are different things. I’ll use Harley Davidson stock itself to demonstrate. The company released annual results on February 25th. If you bought this stock that day, you’re down about 5% since then. If you waited until March 7th, to pick a date completely at random, you’re up about 5% since then. Obviously, not much changed at the firm over this short span of time to warrant a 10% variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

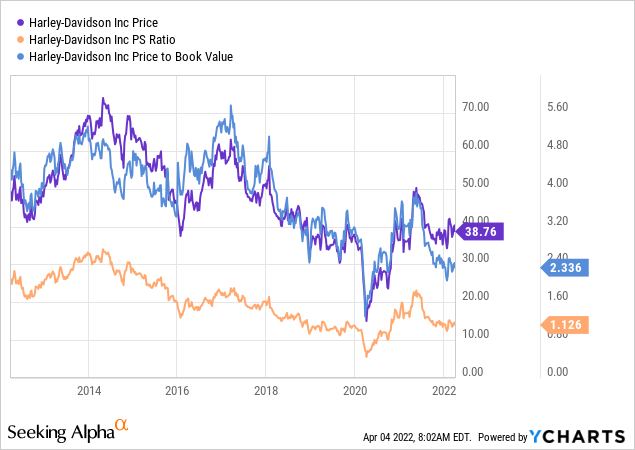

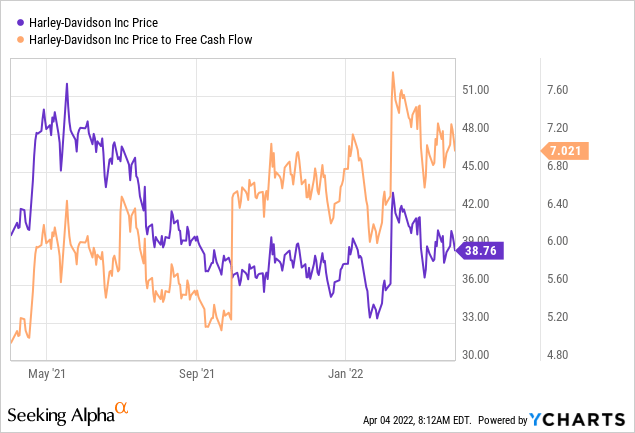

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive on this name, I became downright giddy when the stock hit a price to book value of 2.26 and a price to sales of just over time, both of which were very near a multi year low. The price to book is now about 5% more expensive, and the price to sales is up about 12% per the following:

Source: YCharts

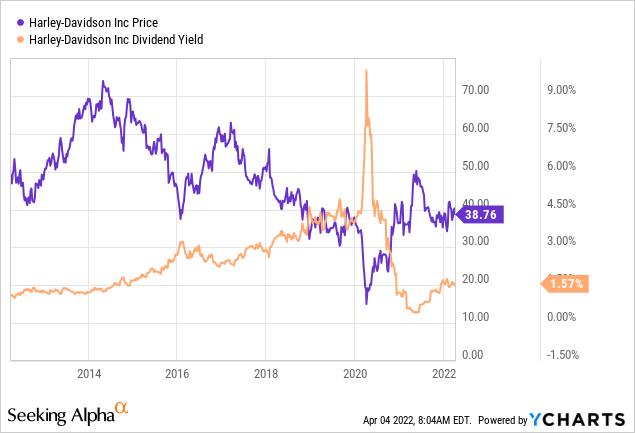

The dividend yield was 1.75% when I last headed out on the highway with this stock. People who buy today will receive about 10% less income for their risk capital, per the following:

Source: YCharts

I’d also note that Harley is now about 29% cheaper on a price to free cash flow basis than when I first reviewed the stock just over four years ago.

Source: YCharts

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Harley Davidson at the moment suggests the market is assuming that this company will grow at about 0.25% over the long term. This is very nicely pessimistic in my view. Given the valuation, and the fact that I think the company is on track to continue to raise dividends, I’m going to add to my position here.

Options Update

My regulars know that I like to sell put options on great companies, because I consider these to be “win-win” trades. If the shares remain above the strike price, I’ll simply pocket the premium, which is never a hardship. If the shares fall in price, I’ll be obliged to buy, but will do so at a price that represents an even better entry price. Thus, “win-win.” In the latest article on Harley Davidson, you may recall that I recommended selling the January 2023 puts with a strike of $25 for $1.65 each. Since the shares have gone up in price, and more grains of sand have flown through the hourglass of time, the price of these has dropped. Specifically, they’re now bid at $1.05. I like the fact that these have lost about 36% of their value, and I want to try to repeat that success again.

In particular, I’m going to be selling some of the August puts with a strike of $30. These are currently bid at $1.15. If the shares remain above $30 over the next five months, I’ll add the premium to my returns on this name. If the shares fall about 21% over that time, I’ll be obliged to buy more of this stock, but will do so at the equivalent of a 1.97% dividend yield, and a price to free cash flow of ~5.4 times. I’m comfortable with either outcome, and thus, “win-win.”

It’s that time again. Remember when I took the mood down a little bit by suggesting that a great company can be a terrible investment at the wrong price? I’m about to do so again, after getting you all excited about “win-win” trades. It’s all well and good for me to characterise these as “win-win” trades, but there’s risk with every investment, including short puts. I consider risks with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, don’t take what I write about short puts being “win-win” as an excuse to go out there selling puts both “willy” and “nilly.” Only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the market really likes what’s happening at Harley Davidson and the shares climb to $60 over the next five months. Obviously my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price, though. So, short put returns are capped by the premium received. This is emotionally painful for some, but not for me.

Secondly, it can be emotionally painful when the shares crash below your strike price. This has happened to me many times over the years. While it most often works out well, it is emotionally painful in the short term. The fact is that it’s not fun when the stock crashes well below the strike price. So, I can make a reasonable argument that Harley Davidson shares would be a bargain at a net price of $22.35, but if they drop to $18, for instance, that will take an emotional toll, at least in the short run. I think people who sell puts should be aware of these emotional risks before selling.

Conclusion

I think Harley Davidson is turning a corner, as evidenced by the very powerful financial results in 2021. I think the dividend is sustainable, and there’s a very good chance that the company will grow it from here. In spite of this, the shares remain relatively cheap. We did well recently taking advantage of that market pessimism, and I want to do so again. For those just joining the party here, I think you could do much worse than buying these shares at these prices. For those comfortable with selling put options, I would recommend this or a similar trade. In all circumstances, I think a bullish position here will be a profitable one.

Be the first to comment