da-kuk

Since I wrote my “puts are more compelling than stocks” piece on InterDigital Inc. (NASDAQ:IDCC) the shares are down about 25% against a gain of about 4% for the S&P 500. It’s time to return to this name because the company has reported results since, and the shares are obviously now much more compelling than they were previously. It’s time to decide whether or not it makes sense to buy. I’ll make this determination by looking at the most recent financial results, and by looking at the stock valuation as a thing distinct from the underlying business. I also want to write about the puts that I recommended people sell previously, because these have done relatively well in my estimation.

It’s time, once again, for the “thesis statement” paragraph of the article. It’s here where I regale you with the “gist” of my thinking in a few short sentences in order that you won’t be obliged to read the entire article. This is just one of the many ways I demonstrate that I’m absolutely obsessed with giving you as pleasant a reading experience as I can. There’s no need to throw around words like “hero”, because your undying gratitude is thanks enough for me. Anyway, I am switching polarities with this stock. Previously, I eschewed the shares while selling the puts. Today I’m of the view that the shares are much better relative value than short puts, so I’ll be simply buying the stock. I’m also going to be exercised on the puts I wrote earlier, which I’m comfortable with. Although I’ll be sitting on a small capital loss on these, that’s a much better outcome than has been experienced by the people who ignored my advice and bought the stock. I think the recent weakness relates to fears about Apple (AAPL) and Samsung (OTCPK:SSNLF) contracts, and I think those fears are overblown. Most compelling of all to my mind is the fact that the shares are trading near multi-year lows, while the sustainable dividend yield is very much on the “high” side.

A Quick Review of Recent Price Action

I’m always loathed to try to describe the single reason why a stock has recently dropped in price, because we don’t live in a world that often gives us single causes for events. That said, I think it’s worth thinking about why the stock has dropped, and I’ve decided that in this case it’s driven by fear about InterDigital’s future profitability. After all, this stock has lost about a quarter of its value in a few months, while the S&P 500 has managed a small gain, indicating that it’s not about a sudden loss of appetite for “stocks” in general. In my view, this fear is a bit overdone. Even an analyst who has an “underperform” rating on the stock acknowledged that the firm has a “robust recurring revenue model’, and seemed more concerned about valuation. It’s worth noting that I shared concerns about valuation at the time this analyst posted their underperform rating.

There may also be concerns about the fact that the current contract with Apple expires at the end of the current quarter and the Samsung contract expires at the end of the year. I feel a need to remind investors that “expire” is not the same thing as “terminate.” Apple has been a licensee since 2007, and has renewed several times over that period. The relationship with Samsung goes back a quarter of a century. I think it’s also fair to suggest that 5G adoption makes InterDigital an even more important partner for both Apple and Samsung, so I remain reasonably confident about the future of these relationships.

I’d remind readers that we’re told to “buy when others are fearfully selling.” That’s a great idea, but we rarely explore the implications of this idea. People only ever “fearfully sell” when they seem to have good reason to do so, and so if we want to do well buying and selling stocks, the only way to do so is to spot discrepancies between the crowd’s expectations, and subsequent results. Put another way, is the crowd overdoing it, and thus presenting us an opportunity to pick up a great company at a bargain?

Financial Snapshot

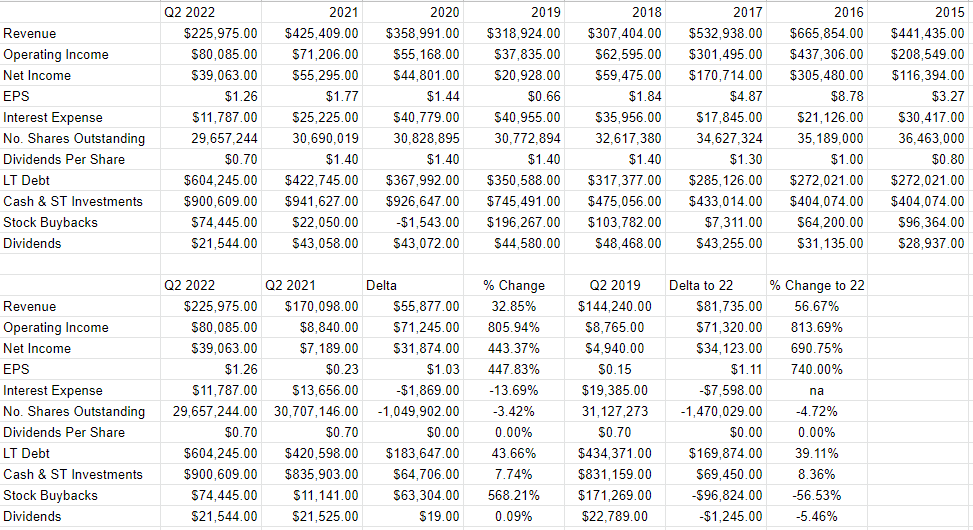

The most recent financial performance has been spectacularly good in my view. Relative to the same time last year, revenue, operating income, and net income are up by 33%, 806%, and 443% respectively. While indebtedness has grown fairly massively, the cost of that debt has fallen, with interest expenses down about 13.7% relative to the same period last year. More importantly, cash represents about 149% of total indebtedness, so I’m not concerned about the recent relative deterioration of the capital structure.

I imagine that some of you might be a bit skeptical about the comparison to 2021. As you may recall, the world suffered a pandemic in 2020-2021, and that had some negative consequences for the world economy. In case you’re worried that I’m comparing the most recent period to a “soft” year, fret no further. The most recent two quarters were much better than 2019 also. Specifically, revenue, operating income, and net income are higher today by 57%, 813% (!), and 690% respectively.

In a previous article, I determined that the dividend is very well covered by running through the size and timing of future obligations, and comparing those to current and likely future sources of cash. Nothing’s happened in the intervening period to move me from this view, so I’d be very happy to actually buy these shares at the right price.

InterDigital Financials (InterDigital investor relations)

The Stock

If you’re one of my regular victims, you know that I think the stock is distinct from the business in many ways. I’m about to elaborate on that idea yet again, so, strap yourselves in, I guess. Anyway, it’s not too controversial to point out that a business buys a number of inputs, adds value to them, and then sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company. The crowd may clutch its collective pearls, for instance, at the prospect of a new contract with Samsung and Apple. It seems that the crowd changes its views about the company relatively frequently, which is what drives the share price up and down. Additionally, the stock may move up and down dramatically because some fashionable analyst or money manager says something about future growth. Added to this are all the risks that have nothing at all to do with the specific company or stock. There’s the so-called “systemic” volatility induced by the crowd’s views about stocks in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. Although it’s tedious to see your favorite investment get buffeted in the short term, within this tedium lies opportunity. If we can spot discrepancies between the crowd’s price and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

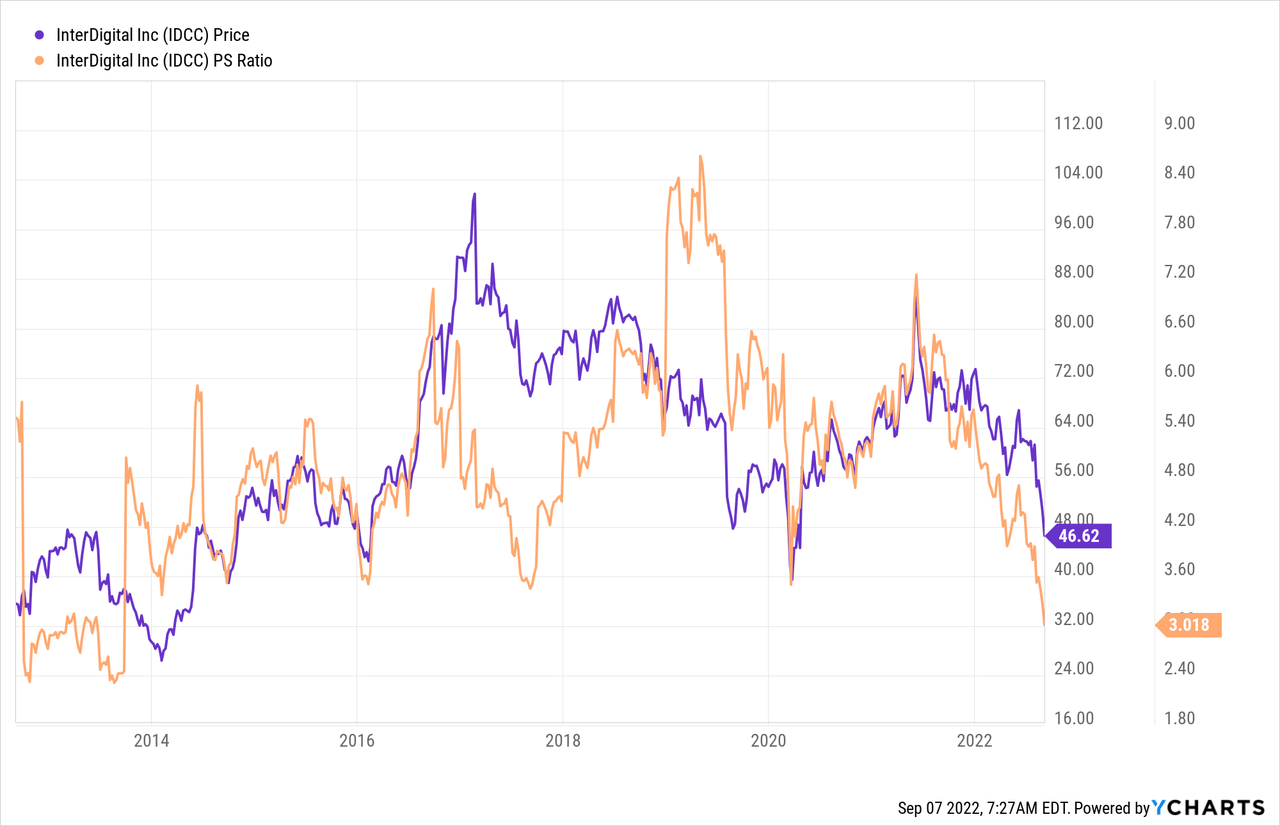

If you read my stuff regularly, you know that I measure the relative cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. I want to see a company trading at a discount to both the overall market, and the company’s own history. When we last reviewed InterDigital, I decided to avoid the stock because the shares were trading at a price to sales ratio of about 4.37. They’re now about 31% cheaper on that basis per the following. If you look closely you’ll note that the valuation is near a decade low.

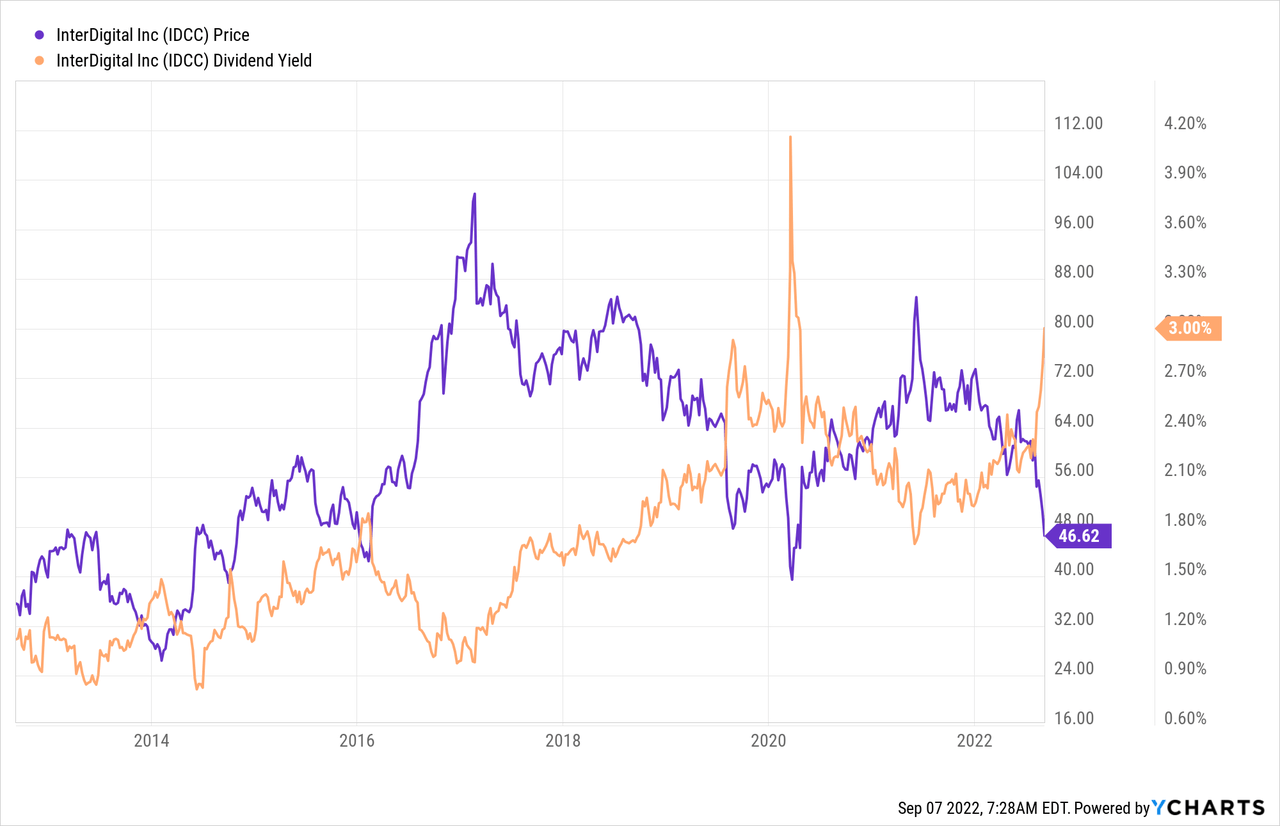

While the shares are trading near a multi-year low valuation, the yield is, understandably, about 33% higher now. If you pay particular attention to this graph, you’ll note that the dividend yield is near a multi-year high. So, investors are paying less and getting more. That’s generally a good circumstance in my view.

In addition to looking at simple ratios, I want to try to understand what the market is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in a fairly standard finance formula. Some people have complained that Penman is a bit dense for them. Another great introduction to this idea of using the stock price itself as a rich source of information to work out expectations is “Expectations Investing” by Mauboussin and Rappaport. The duo has recently written an update, and it is excellent in my estimation.

Anyway, applying this approach to InterDigital at the moment suggests the market is assuming that this company will grow at a rate of ~3.75%, which I consider to be reasonably pessimistic, actually. Given all of the above, I’ll be buying a few shares of InterDigital this morning.

Options Update

In my previous missive, I recommended avoiding the shares at $62, but suggested it was a good idea to sell the December puts with a strike of $50. I didn’t enter into the trade myself because I was (and still am) short the September puts with a strike of $50. I sold these for $2 each, so it seems that when I’m exercised on these I’ll be sitting on a $1.30 loss. While this isn’t ideal, obviously, it’s a superior outcome to the $15 loss experienced by the people who ignored my advice and went long the stock. This is yet another example of the risk reducing, yield enhancing potential of short put options in my view.

That written, there are times when the shares themselves are more compelling than the puts. For instance, the December puts with a strike of $50 are currently bid at only $3.90 when the stock itself is trading for ~$46.50. In my view this is inadequate because the put seller is close to being indifferent between selling the puts and being (potentially) obliged to buy at a net price of $46.10 against buying the stock at a price $0.40 higher. In my view, the current valuation is too compelling to pass up, and the risk of missing out on the opportunity to buy is just too great. Thus, I’ve switched polarities here. In the past I recommended eschewing shares and selling puts. Today I’m recommending eschewing puts and buying shares.

Be the first to comment