CHENG FENG CHIANG/iStock Editorial via Getty Images

The financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

It’s been a while since I wrote a dividend-focused article. It’s also been a while since I wrote my most recent article covering the Canadian National Railway (NYSE:CNI).

In this article, I’m going to do both, as I believe that Canadian National should be on everyone’s watchlist as we want to benefit from potential market weakness in the weeks and months ahead.

The company is proving it’s one of the best railroads in North America as it is improving its operating efficiencies at a time when most struggle to lower their operating ratios. Free cash flow generation is high, allowing the company to boost shareholder returns.

The only thing that bothers me is that the valuation is somewhat high. This has everything to do with Canadian National not selling off like the broader market as investors continue to reward its qualities.

In this article, we’re going to discuss all of that and what I would do as a potential investor.

So, bear with me!

Canadian National Stands For Quality (When It Matters Most)

Next to my keyboard, I have a list of all the stocks that I discuss on Seeking Alpha. I always write down the stocks I want to buy when I expect market volatility to last. My buying strategy is to have several stocks that I like ready and to buy one or multiple different companies as soon as the market presents me with an opportunity.

Sometimes, I get to buy a stock I like. Sometimes I don’t get that opportunity.

Canadian National is a stock I put on my list, despite having 14% railroad exposure, which is a lot.

It’s all based on the ability of Canadian National to bring true value to the table. It’s what I consider a tremendous quality opportunity.

This starts with its huge footprint in North American logistics. Canadian National is one of five major independent North American Class I railroads.

Class I railroads connect every economic hotspot and port in North America. While all have certain competitive strengths, they are all dependent on economic growth, including consumer health, homebuilding, automotive production, and everything related to that.

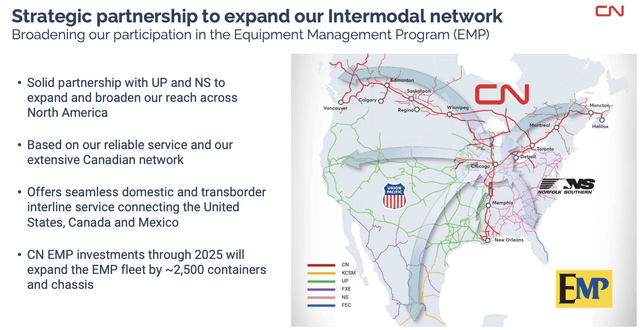

Canadian National services every economic hotspot in Canada, the United States Midwest, and the route south to New Orleans. On top of that, the company is expanding partnerships with its American peers.

Right now, economic conditions are far from perfect, as the global economy has entered a steep slowing cycle.

For example, new manufacturing orders in the United States are once again in contraction territory as we’ve now erased the entire surge in demand after the first wave of lockdowns in 2020.

Wells Fargo

On top of that, we’re dealing with an energy crisis (especially overseas in Europe), high inflation, a weakening housing market, consumer weakness, and hawkish central banks.

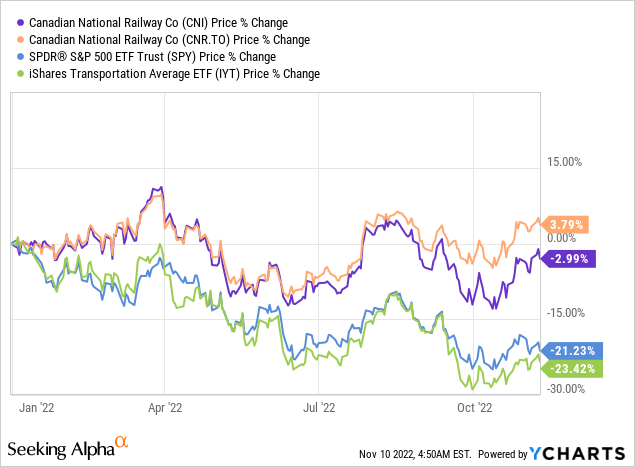

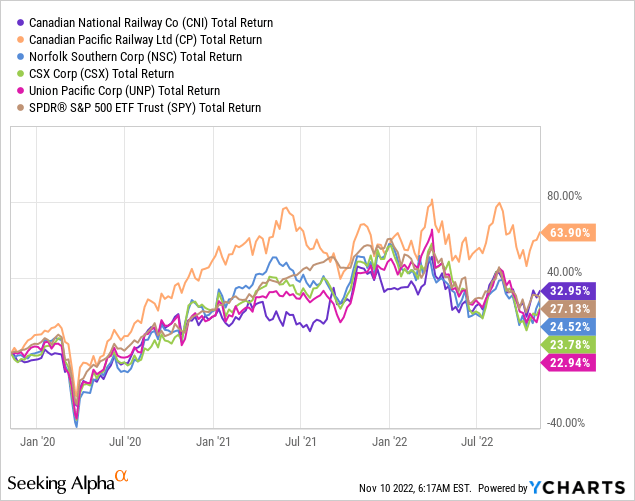

Yet, Canadian National is doing quite well. Shares are down only 3% since the start of the year. Toronto-listed shares are even up 3.8%. Meanwhile, the S&P 500 is down 21%. The iShares Transportation Average ETF (IYT) is down 23%.

That’s a remarkable performance. And it didn’t happen by mistake. The company’s performance this year is truly a sign of high quality as the company is efficiently dealing with economic weakness, high inflation, and operating issues.

After all, railroads in North America had (and still have) a very hard time. This started in 2020 when lockdowns crushed transportation demand. Railroads responded by reducing the workforce and equipment load to protect the operating ratio (how much it costs to operate the railroad in % of total revenue).

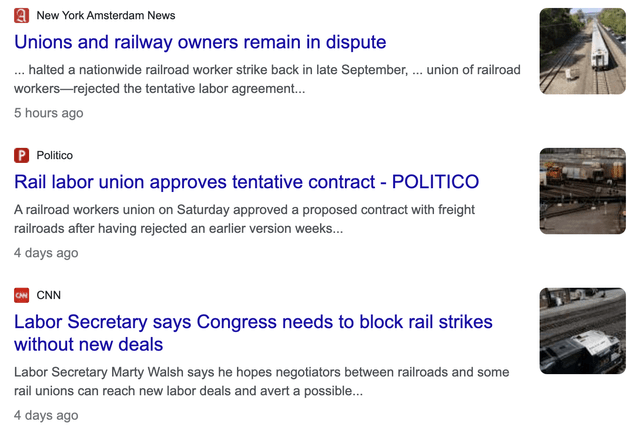

Then, demand came back. Railroads had to accelerate hiring efforts and bring back equipment. Again, without hurting the operating ratio. On top of that, railroads in the United States are now dealing with labor unions as a lot of workers are extremely unhappy with the way things are going. Pressure on operating efficiencies has made their jobs a lot worse. Add high inflation and everything related to the pandemic, and we get a mix that comes with high labor inflation and new efforts to hire quality labor.

In light of these developments, Canadian National continues to be a haven of safety for its investors.

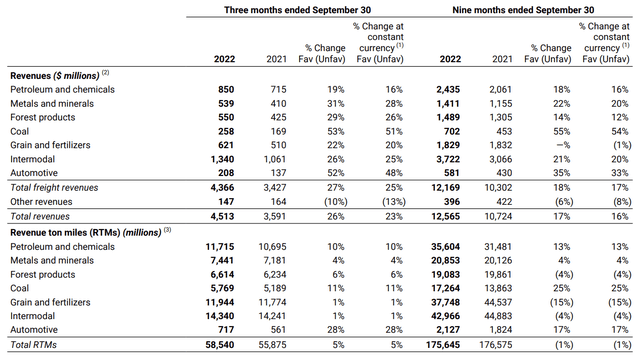

In its just-released third quarter, the company generated $4.51 billion in revenue, $190 million higher than expected. It’s also 23% higher compared to the prior-year quarter based on a constant currency basis.

This was caused by volume growth in every single segment and strong pricing (including fuel surcharges).

Operating income soared by 42% to $1.9 billion as the company did a stellar job managing operating expenses. Total operating expenses rose by just 12%. That’s high, but not in this environment. Almost all American railroads saw higher growth in operating expenses than revenues.

In this case, fuel costs were up 80%. Labor costs were up just 4% as the company never had major issues dealing with labor. The company is now moderating its hiring to respond to weakening economic fundamentals.

The operating ratio came in at 57.2%, an improvement of 5.5 points (1.8 points on an adjusted basis).

Moreover, despite headwinds, the company boosted its full-year guidance. This year, adjusted diluted EPS growth is expected to be 25%. The prior target range was 15% to 20%. Free cash flow is expected to be $4.2 billion, up from a previous target range of $3.7 to $4.0 billion.

The company continues to target an operating ratio below 60%.

What It Means For Dividend Investors

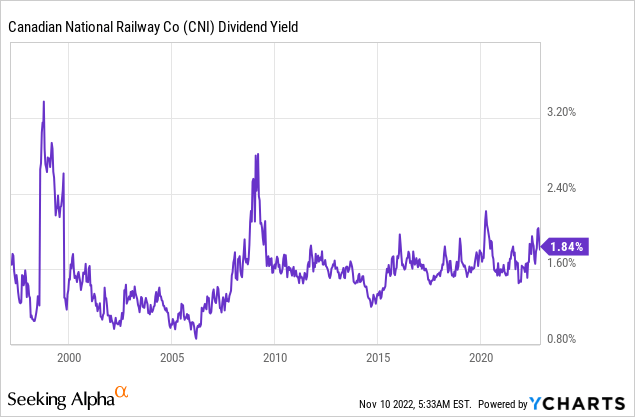

While I am writing this, Canadian National is paying a $0.7325 quarterly dividend. That’s $2.93 per share per year. That’s 1.8% of the company’s Toronto-listed share price.

At this point, a lot of high-yield-focused readers will probably stop reading. However, while 1.8% isn’t a high yield, it’s pretty much the long-term median, looking at the graph below.

Not only that, but dividend growth is good.

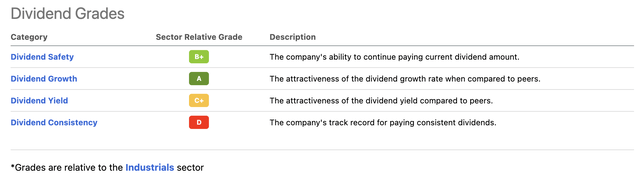

The dividend scorecard below is truly fantastic. The company scores very high on dividend growth, and dividend safety is high. The yield doesn’t score that high, which is understandable. The company scores very low on dividend consistency. However, that is caused by currency translations. Canadian National pays its dividend in Canadian dollars. In other words, if it hikes by 5% and the dollar loses 6% of its value versus the loonie, you end up with negative real dividend growth.

With that said, over the past 10 years, people receiving American dollar dividends have enjoyed 11.8% annual average dividend growth

These are the most recent dividend hikes:

- January 2022: +19%

- January 2021: +7%

- January 2020: +7%

- January 2019: +18%

In general, the company accelerates dividend growth whenever economic growth is rebounding. It lowers dividend growth whenever it is faced with headwinds. The same goes for its buybacks.

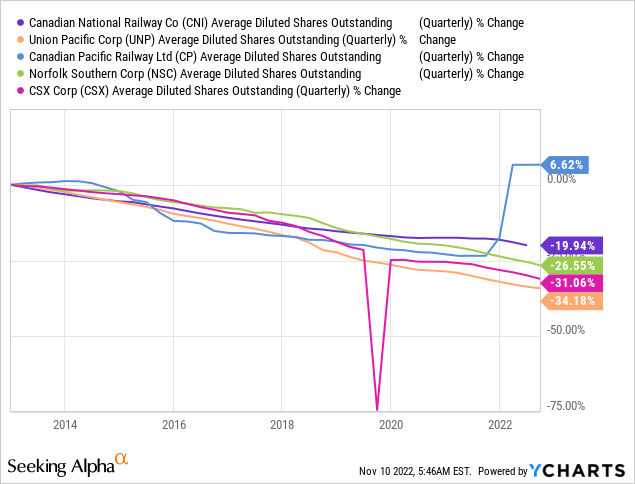

Over the past 10 years, Canadian National has repurchased 20% of its shares outstanding. That’s a lot, but it’s the lowest reduction of current Class I railroads. Note that Canadian Pacific’s (CP) share count is higher. That’s the result of the Kansas City Southern merger.

Now, the company is accelerating buybacks.

Under our current share repurchase program, which runs from February 1, 2022 through January 31st of next year, we have repurchased nearly 23 million shares for $3.5 billion as at the end of September.

Why is the company accelerating buybacks? Because it can, given its financials.

We have a strong balance sheet that provides us financial flexibility, and we will allocate our capital in a manner that drives long-term value for our shareholders.

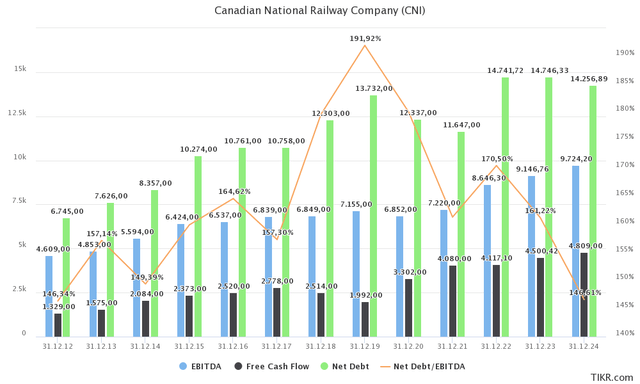

Canadian National is by far the most conservative railroad, which comes with great financials. The company’s net debt has not made it above 2.0x EBITDA. Not even during the pandemic or during the 2015/2016 manufacturing recession.

Moreover, next year, the company is expected to do $4.5 billion in free cash flow. That’s 4.1% of its $109.3 billion market cap. In other words, there’s plenty of room to grow the 1.8% dividend yield and engage in buybacks.

Now, everything we discussed so far is bearing fruit.

Valuation, Underperformance, And Outperformance

Canadian National’s conservatism came at a price. The company wasn’t aggressive enough. For example, TCI Fund Management, an activist fund, pressured the company to make changes in 2021. As I wrote last year:

Basically, between 2016 and 2020, CN was the only Class I railroad with flat operating profit growth. In 2017, the company had the lowest operating ratio (most efficient operations). In 2Q21, the company had the worst operating ratio. During this period, the OR went from 59.8% to 61.6%. Between 2016 and 2020, the OR rose by more than 600 basis points.

Moreover,

According to TCI, the company has a pricing problem as its revenue per revenue ton-mile has risen just 1.4% since 2016. CP, which is the second-worst performer saw 7.6% growth.

The company also has an expense problem as the OR may have suggested. CNI’s expenses per revenue ton-mile are up 18.4% compared to 2016. CSX Corp. (CSX) is the only railroad that actually lowered its total expenses.

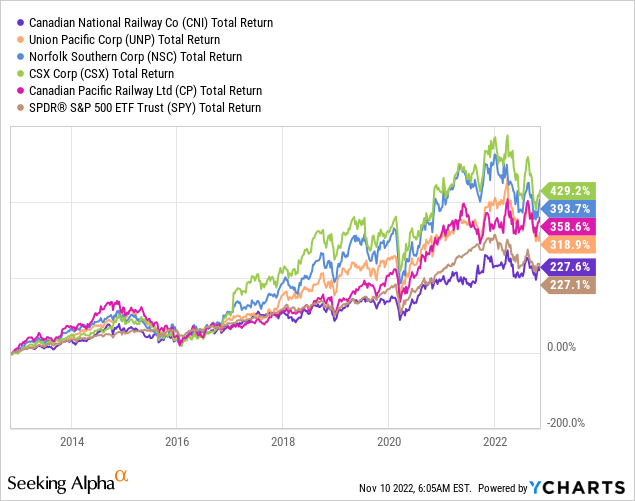

When looking at all major Class I railroads, all have outperformed the S&P 500 over the past 10 years – on a total return basis. However, CNI has beaten the index by just 50 basis points. That makes sense as the operating ratio didn’t fall as fast. The company was also way more conservative when it comes to buybacks.

Now, the company is back on track. It has a very healthy balance sheet, and efficient operations, while most American peers are struggling to get operations back on track. They will succeed, but you get my point. Its conservative behavior has paid off. Moreover, the company is now accelerating buybacks and focusing on improving operating efficiencies.

Over the past three years, only two railroads are outperforming the S&P 500. Both are Canadian. One of them is Canadian National.

With that said, the company currently trades at 13.7x 2023E EBITDA of $9.1 billion. That’s based on its $109.3 billion market cap, $14.7 billion in 2023E net debt, and $600 million in pension-related liabilities.

That valuation isn’t bad. However, it’s also far from great.

Especially in this environment, investors can buy better stocks at better valuations. A lot of American railroads are trading at a 6-7% implied free cash flow yield (CNI’s is in the low-4% range).

In other words, the company’s qualities have kept it from underperforming the market as we discussed at the start of this article. The company is holding up very well.

That’s great for investors, but bad news for people looking to buy CNI exposure.

Hence, I would put CNI on a watchlist. If we get more market turmoil this year, I doubt that CNI will continue to be spared if it comes with a further weakening economy. At that point, we’ll get great buying opportunities again, which is why it’s so important to maintain a watchlist of great stocks.

I believe that CNI should be on that list.

Takeaway

In this article, we discussed a stock that, I believe, makes a great long-term dividend investment for a wide variety of investors. Canadian National has a terrific business model, allowing it to generate high and growing free cash flow.

The company has been extremely conservative in the past. It has led to underperformance, yet it’s currently protecting the company against operating inefficiencies and related issues.

CNI is now in a good spot to boost buybacks, and its dividend, allowing it to outperform the market going forward.

Unfortunately, the valuation isn’t great, given the bigger macro picture.

Hence, my recommendation is to wait for weakness before buying.

(Dis)agree? Let me know in the comments!

Be the first to comment