Jonathan Kitchen

If you’ve got a vague inkling that the only reason I write on this platform is to brag publicly, get ready for that inkling to be massively reinforced, because today will see some industrial-grade bragging on my part. I’ll try (unsuccessfully) to ignore this annoying little voice in my head yammering something about “pride goeth the fall” or whatever, so I can focus on writing about the latest win. As I pointed out in my latest piece about United-Guardian, Inc. (NASDAQ:UG). I had outperformed the S&P 500 slightly over the previous four years, but it was time to take chips off the table. I did that this past April, and since then the shares are down about 36%. So, to drive the point home, in 2018 I was bullish on this stock and rode it to a great return. This past April I sold shares, and they’ve lost over ⅓ of their value since. I want to revisit this name primarily to brag, obviously, but I think there are some other reasons to revisit the name. Specifically, the company has posted financial results since I last looked at the company, and those deserve commentary. Additionally, a stock trading at $15.50 is much less risky an investment than the same stock trading at $24.50, so it may be worth buying back in at this point.

I’m self-aware enough to realise that my writing can be tiresome to many. I spell words properly, and that may bother some of my American audience, with their, uh, “singular” approach to the English language. Worse, I can be a tiresome braggart, as I’ve already demonstrated above. This may offer some clues about the current state of my social life. Anyway, whatever the reason, I fully understand that you may not want to douse yourself in undiluted “Doyle mojo.” For that reason, I offer up a “thesis statement” paragraph in each of my articles. This gives you the highlights of my argument without needing to wade through the swamp that is a full-blown article. You’re welcome. Here goes. I’ll be buying back into this company this morning because the shares are now sufficiently cheap again. I’m doing this in spite of the recent drop in profitability. I think the dividend is reasonably well covered, and I think the high dividend yield will be supportive of price, suggesting very limited downside from here. That said, even if the shares drop in price from the current level, the dividend will compensate for any losses over time in my view. I like investments where time is your friend, and that is certainly the case here. There you have it. If you continue to read from this point, any resulting nausea that my writing produces is on you.

Company Background & Risks

In case you’re unfamiliar with United-Guardian, I’ll do my best to enlighten you. The company operates in four distinct product categories: cosmetic ingredients, pharmaceuticals, medical products, and specialty industrial products, and each of these is marketed slightly differently. In all four categories, the company is focused on R&D activities, as evidenced by the fact that it’s been granted 30 patents since its founding in 1942. The R&D efforts in the cosmetic ingredients space have been directed toward formulating “natural” products that are used as components of various cosmetic products that are then included in the formulations produced by marketing partners.

The company sells its cosmetic ingredients through 5 marketing partners, the largest of which is Ashland Specialty Ingredients. These partnerships are ideal because partners have much deeper market penetration and reach than the company could achieve. The “cosmetic ingredients” category is the company’s largest (~49% of sales) and fastest growing, and it is the group of products that I’m most excited about. In particular, I have high hopes for the Lubrajel suite of products. I think the macro background is quite favourable, because the demand for “natural” products is expected to grow somewhere between a healthy 5.3% and an eye-watering 6.6% pace over the next 8 years.

There are two risks that I’ve been able to identify here. The first of these is the currency. Although fully 80% of sales take place in the United States, the stronger U.S. dollar will inevitably impact sales going forward. The next risk involves the company’s ability to obtain raw materials. They have consistently been able to acquire what they needed, even during the height of the pandemic, some materials are now more expensive, and there are now longer lead times for some of them. The rising dollar and increased costs may obviously impact the company’s gross profit margin on certain products.

Financial Snapshot

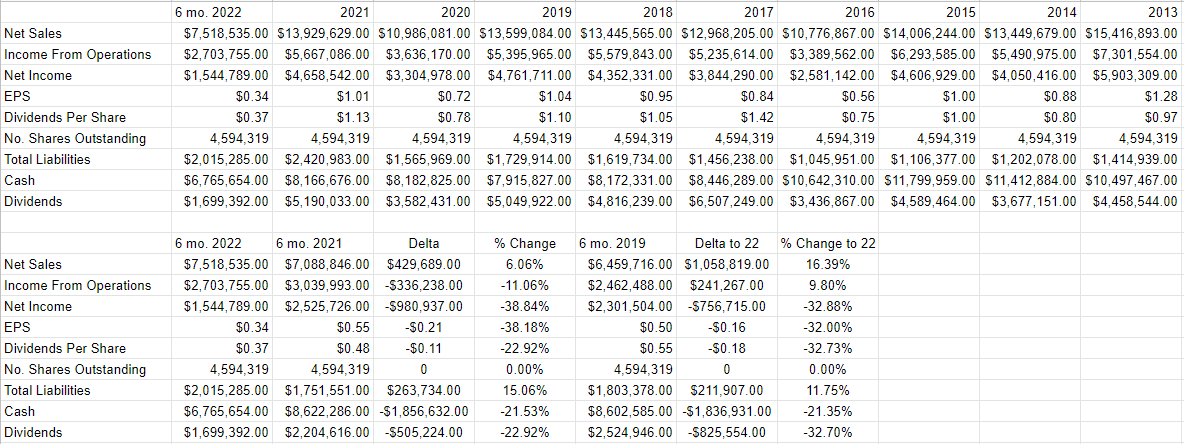

Relative to the first six months of 2021, the financial performance during the most recent period has obviously been mixed. Revenue during the first six months of the year saw sales up by about 6% compared to 2021, but net income has collapsed, down by ~$981 thousand, or 39%. The reason for this relates to increased costs of sales, operating expenses, and R&D expenses, each up by 19%, 20.3%, and 11.74% respectively. Additionally, the company took an $854 thousand dollar loss on marketable securities. The capital structure also deteriorated fairly significantly relative to the same period in 2021, with total liabilities up by ~15%, and cash down by about 21.5%.

While I like making comparisons from one period to the next, it’s sometimes troubling because one or both periods may not be representative. For instance, you may remember that there was a global pandemic in 2020-2021 that turned off global economic activity, and thus any comparisons to that period may be fraught with bias. For that reason, I also want to draw a comparison between the most recent period and the first six months of 2019, as the latter period is free of the pernicious effects of the pandemic. When compared to 2019, similar themes emerge. Revenue was higher and net income was lower in 2022, and the capital structure in 2022 was also much weaker. Given the above, I think it’s reasonable to suggest that a part of the stock price weakness relates to the drop-off in income.

One thing that buoys the stock price, though, is the dividend, and so I want to write briefly about it. If the dividend is reasonably secure, and the valuation is low enough, I’d be very happy to buy back in.

The company generated $1.164 million in cash from operations during the first six months of 2022, compared to $2.6 million during the same period in 2021. The reason for the drop obviously relates to a drop in net income, but there are two other factors worth noting. First, the company spent $317.4 thousand on new inventories and spent $231.4 thousand in prepaid taxes. I think these will either add to future cash inflows, or at least reduce future outflows. During the same period, the company spent $1,699.392 on dividends, or about $535,000 more than it generated in cash from operations. It’s also relevant that the company has $355 thousand in cash and approximately $6.4 million in marketable securities. Finally, although I moaned about “deterioration” above, I think it’s worth noting that “cash and marketable securities” is still over 3x greater than “total liabilities.” Thus, I’m reasonably confident that the dividend can be maintained here, and for that reason, I’d be happy to buy back in at the right price.

United-Guardian Financials (United-Guardian Investor Relations)

The Stock

If you read my stuff regularly you know what time it is. It’s the time where I turn into a bit of a financial “hall monitor”, where I remind everyone that a company is distinct from its stock. The company buys inputs and sells them (ideally) at a profit. In the final analysis, that’s all any company is. The stock, on the other hand, is a piece of paper that gets traded around in a public market and is influenced by a great many factors, many of which are only peripherally related to the underlying business. For instance, the stock price is certainly impacted by the company’s recent financial performance. It’s also impacted by the crowd’s ever-changing views about the company’s future financial performance. It’s also potentially impacted by the changing moods of an influential analyst. Finally, the stock is influenced by the crowd’s ever-changing perspectives on the relative merits of “stocks” as an asset class. For these reasons, the stock is a much more volatile thing than the underlying business. While this is tiresome, it is potentially profitable. If we can spot the discrepancies between the crowd’s take on a given business, and the assumptions embedded in the price, we can earn a profit. Although I’m very, very sorry to circle back on this point, I bought when the market for these shares became excessively pessimistic years ago, and sold when the market became excessively optimistic. That was a lie. I wasn’t at all sorry about reminding you of my success with this one. I really, really hope you forgive me.

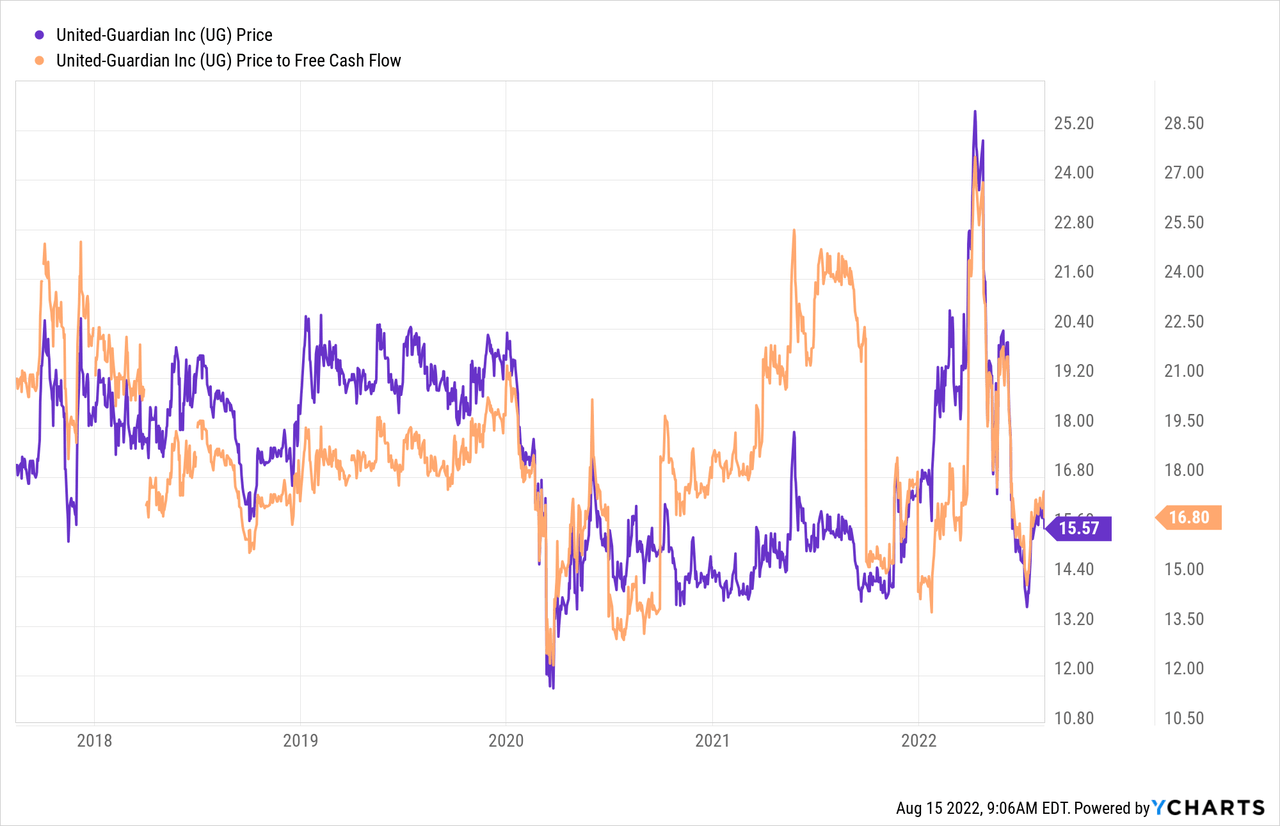

Anyway, I’ve found that cheaper stocks offer a higher risk-adjusted return, so I like to buy shares when I consider them to be cheap and eschew them when they get expensive. If you’re one of my regular reader-victims you know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive, I took profits here because the price to free cash reached 22.5 times. The shares are now about 25% cheaper on that basis per the following:

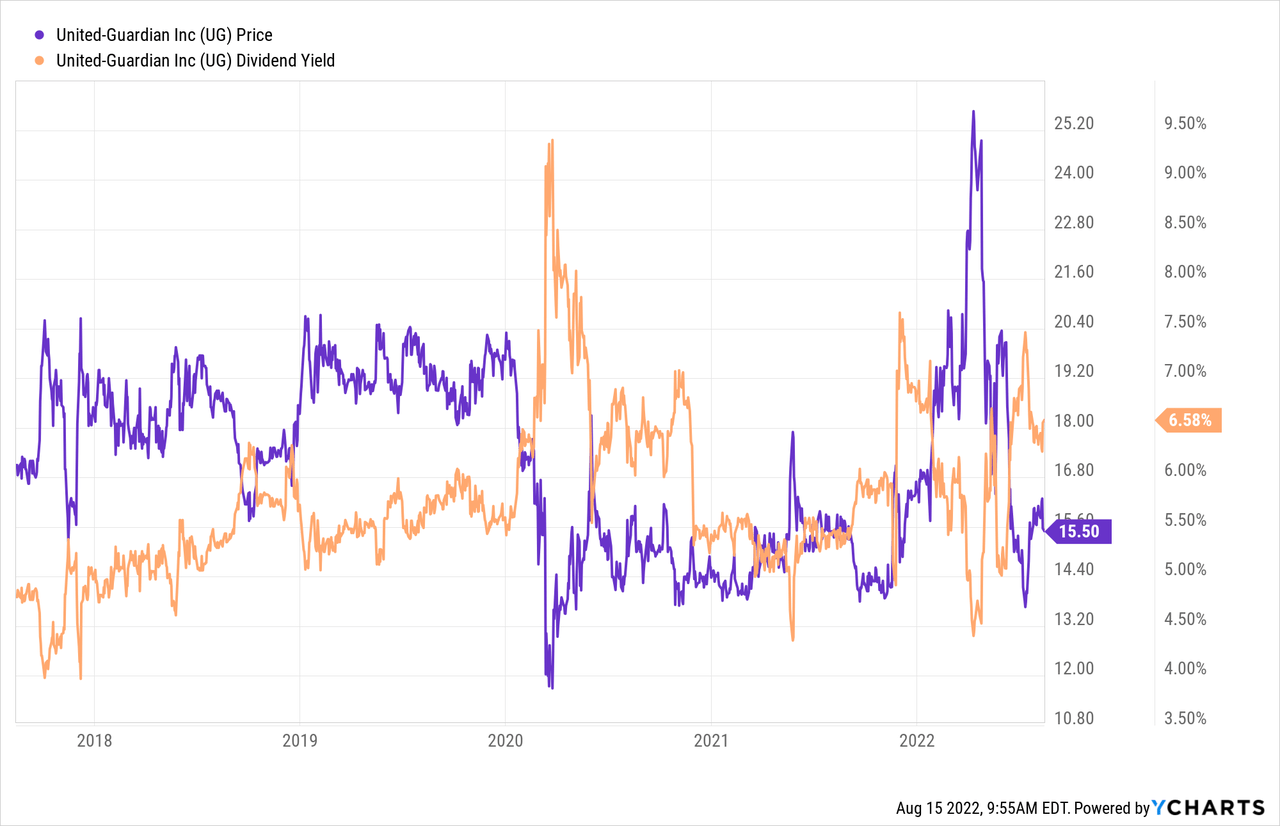

While the shares are relatively cheaper, investors are (unsurprisingly) being compensated with a much higher dividend yield, per the following:

In my view, it’s always a good idea to pay less and get more.

In addition to looking at simple ratios, I want to try to understand what the market is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this tome, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in a fairly standard finance formula. Some people have complained that Penman is a bit dense for them. Another great introduction to this idea of using the stock price itself as a rich source of information to work out expectations is “Expectations Investing” by Mauboussin and Rappaport. The duo has recently written an update, and it is excellent in my estimation.

Anyway, applying this approach to United-Guardian at the moment suggests the market is assuming that this company will grow at a negative rate of ~1.5%, which I consider to be very nicely pessimistic. Given all of the above, I’ll be buying back into United-Guardian.

Conclusion

I think it’s possible that a struggling business can be a great investment if you buy it at the right price. It’s even better if that struggling business throws off a decent stream of sustainable dividends. In my view, that’s the current state of affairs at United-Guardian. The company is less profitable, to be sure, but the dividend is currently well covered in my view. Additionally, the shares are relatively inexpensive, and that’s a powerful combination in my opinion. The shares may fall further in price from here, but I’d remind investors yet again that we want to buy when others are fearfully selling, and I think that’s what investors have done here since early April of this year. Finally, “price” and “value” can remain unmoored for some time, but will eventually meet. I think it would be wise to buy now before the former rises to match the latter.

Be the first to comment