Angel Di Bilio/iStock Editorial via Getty Images

It’s been about four months since I took my Atlas Air Worldwide Holdings Inc. (NASDAQ:AAWW) chips off the table in an article with the terribly original title “Taking My Atlas Air Worldwide Chips Off the Table”, and since then, the shares are down about 8.6% against a loss of 8.7% for the S&P 500. The company has posted results since then, and so I thought I’d look at the company again. Additionally, a stock trading at $70 is, by definition, less risky than one trading at $76, so I thought I’d review the name yet again. The most important reason to revisit the name is to point out that I outperformed the S&P 500 by about 30% with this name. So, to be clear, I bought, the shares outperformed the S&P 500, I sold, they dropped. I’m just going to wallow in that for a few minutes before moving on. Alright, so in this article I want to try to work out whether or not it makes sense to buy more shares or not. I’ll make that determination by looking at the updated financials and the current valuation.

As you may be able to tell if you read my stuff frequently, I’m positively obsessed with making your reading experience as pleasurable as possible. One of the innovations I’ve come up with is something called the “thesis statement.” This so-called “thesis statement” is a paragraph in which I outline my thinking in very broad strokes so that you won’t have to wade through the whole article. I hope you appreciate the sacrifices I make for you people. Anyway, I think the recent financial results have been generally good. Although net income during the first quarter was lower than the same period last year, this comparison was made challenging by the ~$36.5 million of non operating income the company enjoyed last year. The share count continues to fall at a reasonable enough level, and the company has sufficient financial resources to maintain obligations, and remain profitable in my opinion. On top of that, the shares are trading below book, and are ~40% cheaper on a price to free cash flow basis. For that reason, I’m taking a small position in this name. I’ll add to it, or not, depending on how the future unfolds.

Financial Snapshot

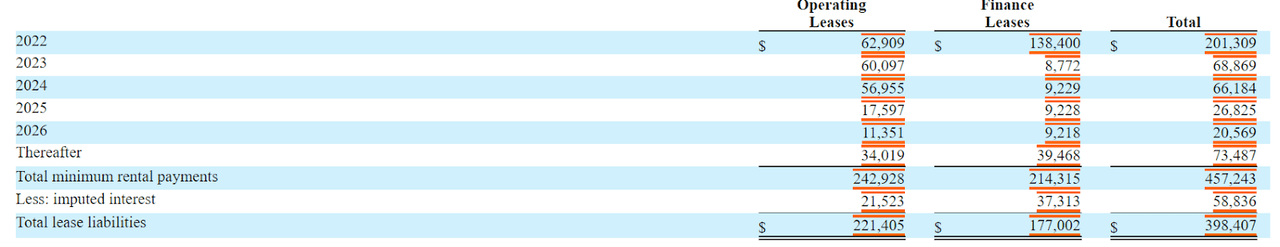

The most recent quarter was generally good, but requires some explanation in my view. On the one hand, the capital structure improved fairly massively, with debt and lease expenses down dramatically relative to the same period in 2021. Additionally, share count dropped, which is good to see.

The apparent problem starts when looking at the income statement. While revenue in Q1 of 2022 was over 20% greater than it was the same period in 2021, net income was down about 9%. This is because the company earned $39.5 million in non operating income last year, which makes comparisons challenging. That said, we can’t avoid the fact that operating expenses increased $158 million or 21%. In particular, salaries and benefits increased by 47%, and fuel increased by just over 49%. It’s not damning, but we should note that this isn’t the most “scalable” company in the world.

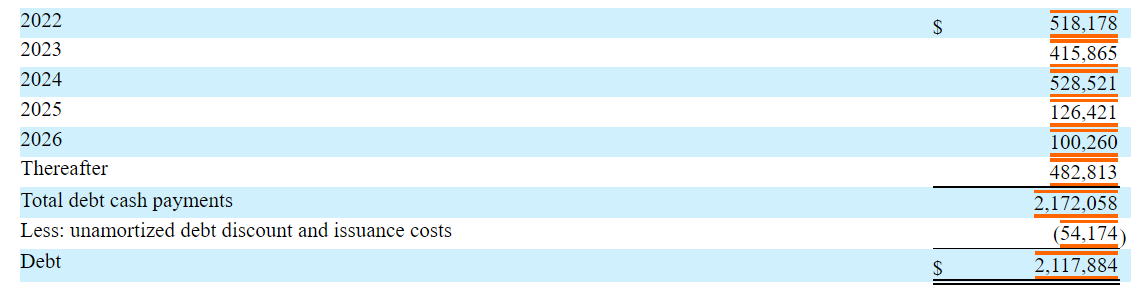

In my previous missive on this name, I concluded that the company is reasonably well financed and won’t run out of cash anytime soon. They’ve posted a 10-K since, so I took it upon myself to update that view. When it comes to working out whether or not a company is likely going to run out of cash, I focus on, well, “cash.” First, I’ve plucked the following obligations from pages 82 and 84 of the latest 10-K for your reading pleasure:

Atlas Air Worldwide Debt Obligations (Atlas Air Worldwide 2021 10-K) Atlas Air Worldwide Lease Obligations (Atlas Air Worldwide 2021 10-K)

So, according to the above, the company is on the hook for ~$719.5 million this year, and $484.7 million next, and $595 million in 2025.

On the other side of the ledger, the company has ~$730.4 million cash on the balance sheet, and has generated about $664 million cash from operations over the past four years. They’ve spent an average of $406 million in investing activities over the same time period. Mashing all of this together leads me to conclude that there’s only a moderate level of risk of the company will need to return to the credit market or equity market wells for fresh capital anytime soon.

Given this, I’d be happy to buy back in at the right price.

Atlas Air Worldwide Financials (Atlas Air investor relations)

The Stock

I’ve made the point that a stock is quite distinct from the underlying business so often that by now my regular readers may be getting bored of this observation. Just because it’s boring to you, though, doesn’t mean I’m not gonna do it again, so here goes! Businesses and the stocks that supposedly represent them are very different things. Businesses buy inputs like crew services, maintenance and the like, they then perform value adding activities to these, and then sell the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long term prospects for a given company. The crowd changes its views very frequently which is what drives the share price up and down. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. This is easier said than done. I’ll tie off this “businesses versus stocks” discussion by stating that the only way to earn a return on stocks is to identify a discrepancy between the assumptions about the future embedded in the current price, and the subsequent performance of the company. In my experience, you want to buy stocks cheaply, when the expectations are most pessimistic, because those are the ones that are most likely to outperform over time.

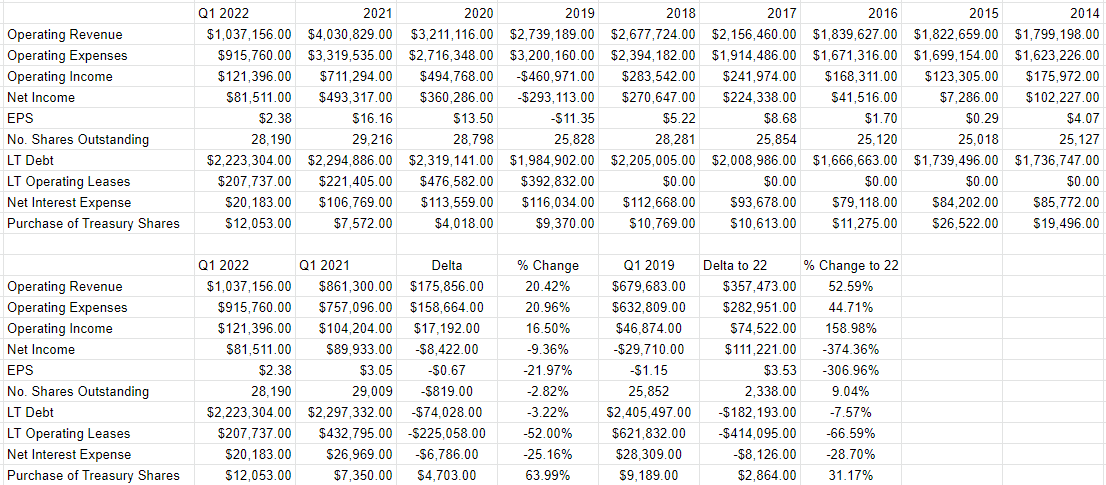

As my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. I want to see a company trading at a discount to both its own history, and the overall market.

In the previous article on this name, I took chips off the table, in spite of the fact that the PE was basically unchanged from previous. I had a problem with the fact that the shares were trading at a price to free cash of ~7.4 times. I’d note that the shares are now fully 41% cheaper on that basis, which is a significant “plus” for me, per the following:

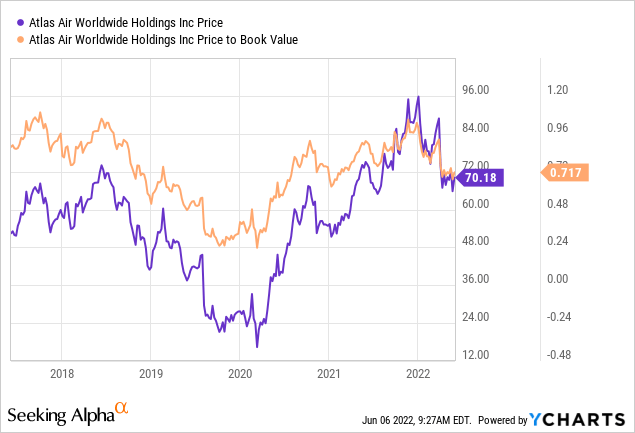

At the same time, I like the fact that this company continues to trade at a nice discount to its book value, per the following:

I think the company’s financial “sins” have been somewhat minor, and for that reason I’m willing to look past them. At the same time, the shares are much cheaper on a price to free cash flow basis, and it continues to trade below book value, so I’m willing to buy a few more shares. I’m not buying as many shares as I sold previously, as I’m worried about the market in general, but I’ll buy 150 shares at current levels.

Conclusion

Relative to what it was when last I looked at it, Atlas Air is either “cheaper” or “much cheaper”, and for that reason I’ll be taking a small position. I’ll add to this position (or not) in future depending on how things play out in future. The company continues to grow nicely, and it remains consistently profitable. Further, the company has the means to cover current and future obligations, so I think there’s little risk that they’ll need to “return to the well.” Although net income is lower now than it was in Q1 2021, that is largely driven by the non-operating earnings the company enjoyed last year. Operating earnings were up nicely, and that’s what I choose to focus on. I’m happy to have made money on this stock previously, I’m happy to have taken chips off the table when I did, and I’m happy to re-enter the trade now.

Be the first to comment