David Ramos

Thesis

Verizon stock (NYSE:VZ) is one of the most popular names on Seeking Alpha. So, I know this article will be a tough pill to swallow. After reading many analyses about Verizon, I am surprised to conclude that readers are not getting the full picture about the most important investment variable “too much debt,” in my opinion.

Many authors have for a long time recommended buying VZ stock due to the approximately 5% dividend yield. Accordingly, after a 30% sell-off YTD, the 7% dividend yield is even more attractive — so the thinking goes. But, such an argument is too superficial. And the environment that rendered VZ stock a ‘Buy’ in the past, has changed.

Smart money is selling Verizon stock. And smart money is selling because of too much debt. In this article I discuss what you need to know about the Verizon’s crushing debt position; and why I believe the stock could go as low as $23.74/share. ‘Sell’.

Seeking Alpha

Verizon Has Too Much Debt

With $177.2 billion of net debt Verizon is the world’s most indebted company, followed by Volkswagen with $172.8 billion of debt, and AT&T (T) with $158.2 billion of net debt. (Here is the list; but note that I use updated numbers, as well as net debt, vs total debt)

Verizon’s crushing debt load has not been a headwind for the company’s fundamentals in the past, given an environment of low single digits to zero percentage interest rates. Debt was almost ‘free’ and easy for companies with stable cash flows. At the same time, debt could be used to buy real productive assets and/or be used to finance shareholder distributions. Simply speaking, debt has been too attractive to ignore.

As a consequence, Verizon grabbed the ‘opportunity’ and loaded up on the poisonous pill: From 2012 to 2022 (June 30 reference) Verizon’s net debt position exploded from 48.4 billion to unsustainable $177.2 billion. At the same time, Verizon’s annual cost of debt only increased from $2.57 billion in 2012 to $3.11 billion in 2022 (TTM reference). Dividing $3.11 billion of interest expenses by $177.2 billion of net debt, the company’s most recent cost of debt is calculated at about 1.75%. The company’s cost of debt was about 5.3% in 2012.

But what has been cheap in the past has suddenly become expensive, given the rapidly rising interest rates in 2022. For reference, the yield on US treasuries (10-year reference) surged from about 1.66% in January to 3.88% as of October 2022. Moreover, it remains yet to be seen if the current yield has touched a ceiling. In my opinion, it could very likely be that yields push higher for another one to 2 percent.

As a consequence of rising interest rates, debt investors can now obtain a ‘safe’ 4% yield on ‘riskless’ US treasuries. Under such circumstances, who will want to finance Verizon at 1.75%? Nobody, I argue.

The past risk premium for Verizon debt versus treasuries has been somewhere around 200 basis points. In my opinion, there is no reason why this risk-premium should be lower now or in the future. (In fact, technically the risk premium should be higher, given that the combination of high debt plus high interest rates makes Verizon debt riskier as compared to high debt and low interest rates previously).

The Impact Of Higher Interest Costs …

Investors should consider what happens to Verizon’s profitability when the cost of debt rises to about 6% (U.S. 10y treasury yield plus 200 basis points of risk premium).

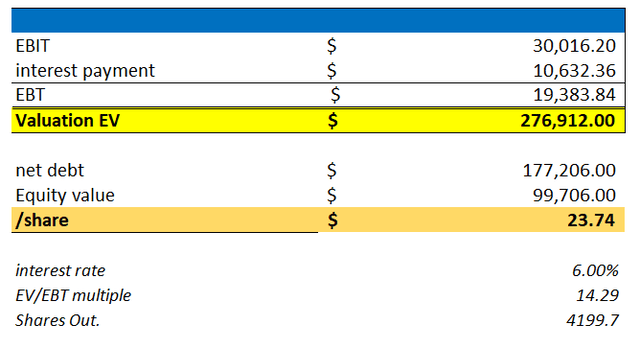

The answer can be found through the application of a simple but effective thought exercise: (1), find Verizon’s cyclical adjusted operating profitability (pre-interest expenses); (2), estimate a fair implied cost of debt; (3), multiple the cost of debt by the company’s net debt position to estimate the annual interest payment, and; (4), deduct the annual interest payment from the company’s cyclical adjusted operating profitability in order to calculate the earnings capacity available for the amortization of outstanding debt and shareholder’s equity.

(1) To find Verizon’s cyclical adjusted operating profitability, I argue it is fair to take the average of the past 5-year’s operating income, which I calculate is $30.016 billion.

(2) Personally, I believe that Verizon’s cost of debt will rise to at least 6%, given the arguments presented in the previous sections. But please note that later when I structure a valuation, I will also present a sensitivity table that varies the cost of debt.

(3) Based on a 6% cost of debt and a $177.2 million net debt position as of June 30, 2022, I calculate the annual cost of debt for Verizon at $10.632 million.

(4) Now, if we deduct the annual cost of debt from Verizon’s cyclical adjusted operating income, Verizon’s estimated earnings capacity (earnings before tax) is $19.383 million. For reference, in 2021 Verizon generated earnings from continuous operations of $22.618 million, and for the trailing twelve months the respective metric is $21.317 million.

… On Valuation

Based on the previous exercise an investor could calculate a fair implied share price for VZ stock.

In theory, an investor’s expected annual return from investing in a company is the ratio of 1 divided by the EV/EBT multiple (assuming no growth). For example, if an investor requires a return of 10%, then the EV/EBT multiple must be x10.

Following this train of thought, what is a fair return for investing in Verizon? Well, I have argued that debt holders will soon require 6%. I argue that equity holders would like more — in order to be compensated for the higher risk. So, 7% would be acceptable? We also know that the headline dividend yield on VZ stock is 7%. So, in my opinion 7% would indeed be a reasonable anchor.

In order to get an 7.0% annual return, Verizon’s EV/EBT multiple should be x14.3 (calculation: 1/0.007)

Previously we have calculated Verizon’s sustainable EBT at $19.383 million. Given a x14.3 EV/EBT multiple, the firm’s enterprise value is $276.912 million, which after net debt of $177.206 million implies an equity value of $99.706 million, or $23.74/share.

Thus, if Verizon’s cost of debt would indeed rise to 6%, and investors require an 7% annual return, then VZ stock would need to fall an additional 35% from current levels of $36.85 share to make the risk/reward acceptable.

Verizon’s financial statements; author’s calculation

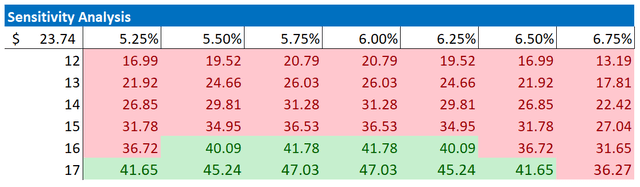

I understand that an investor might want to assume a different cost of debt for Verizon’s net debt, and/or require another EV/EBT multiple. So, I would also like to provide readers a sensitivity table. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Verizon’s financial statements; author’s calculation

Risks To My Thesis

In this article I point out that Verizon’s debt is unsustainable — in the context of a rising interest rate environment. Accordingly, my argument for why Verizon shares could depreciate by 35% is closely tied to the actions of the federal reserve, and everything else that influences interest rates directly and indirectly, including for example inflation, supply chains, OPEC+ supply decisions, etc.

That said, if the Fed would pivot early, before Verizon needs to refinance its debt position, then the impact of the company’s debt burden would need to be repriced again accordingly. For reference, if the interest rate environment would return to 2020/2021 levels, then Verizon’s fair implied valuation would jump to about $55/share — based on the same mathematics presented previously.

Investors should consider that it will be very difficult for Verizon stock to sell assets in order to repay outstanding debt. In fact, most of Verizon’s asset base is composed of goodwill ($28.64 billion) and other intangibles ($160.01 billion). As asset prices are falling across markets, and capital markets start to freeze, any sale would likely need to be made at distressed valuations. Moreover, prospective buyers of Verizon’s telco asset base, including intangibles, are in distressed conditions themselves (for example, private equity and AT&T)

Conclusion

Investing in Verizon stock is much more dangerous than investors might think: the companies past financial data does not accurately reflect Verizon’s earnings power anymore. I argue Verizon is burdened withan unsustainably high debt position, and given rising interest rates, the investment recommendation is clear: “Sell.”

If Verizon’s cost of debt would rise to 6%, which I think it will, VZ stock could fall as low as $23.74/share. If, however, an investor believes that the FED will soon pivot, and interest rates will fall again, then buying VZ stock might be a good speculation — as the stock could bounce back to $55/share. Personally, I do not think a Fed pivot is likely though.

Be the first to comment