Funtap

Thesis

SAP (NYSE:NYSE:SAP) is one of the largest global software providers and the company is considered by many investors as a must-have blue chip company in Europe. However, the company’s shares have strongly underperformed the market, being down about 35% YTD versus a loss of approximately -14% for the Dax 40 (the relevant benchmark index).

Is SAP’s sell-off versus the broad market justified? Or does the company’s current valuation imply an attractive buying opportunity? Personally, I believe the latter is the case, as I argue in this article.

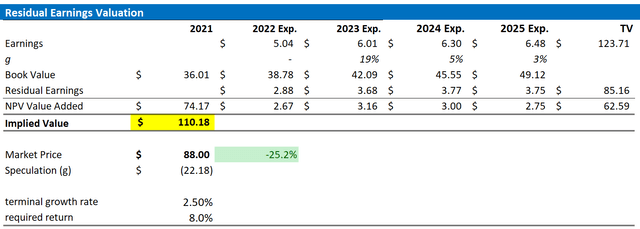

I value SAP based on a Residual Earnings Model – supported by analyst consensus forecast until 2025, a WACC of 8%, and a terminal growth rate equal to expected nominal GDP growth. My base-case target price is $110.18/share, implying about 25% upside.

About SAP

SAP is a leading global software company with headquarters in Germany. The company develops and markets enterprise software systems for the digitized management of business operations and is the world’s largest ERP (enterprise resource planning) vendor. the company’s flagship product SAP S/4 HANA has more than 20,000 customers worldwide, and customers include leading multi-national names such as Microsoft (MSFT), LVMH (OTCPK:LVMUY), Kyndryl (ex IBM) and Moderna (MRNA).

Notably, SAP is the largest non-US software company. In 2021, the company recorded $31.7 billion of total revenues and $5.98 billion of net income, or 5.07/share. SAP’s mission is:

to help the world run better and improve people’s lives. Our promise is to innovate to help our customers run at their best. We engineer solutions to fuel innovation, foster equality, and spread opportunity across borders and cultures.

Steady Growth & Value Accumulation

For the past few years, international investors regarded SAP as a stable German blue chip company, providing investors with steady business growth and value accumulation. From 2015 to 2021, SAP’s revenues grew at a 6-year CAGR of more than 6%, increasing from $22.6 billion to $32.7 billion. Respectively, net income available to shareholders increased by a CAGR of more than 7%, from $3.97 billion in 2015 to $5.98 billion in 2021.

Despite a very challenging macro-economic backdrop, SAP also performed quite well YTD, generating about $15.7 billion of revenues while defending a greater than 25% operating income margin.

SAP’s balance sheet does not raise any red flags and, accordingly, I view the >2% dividend yield as sustainable: As of Q2 2022, SAP recorded $8.9 billion of cash and short term investments and total debt of $14.5 billion. In 2021, cash provided from operations was $7.1 billion.

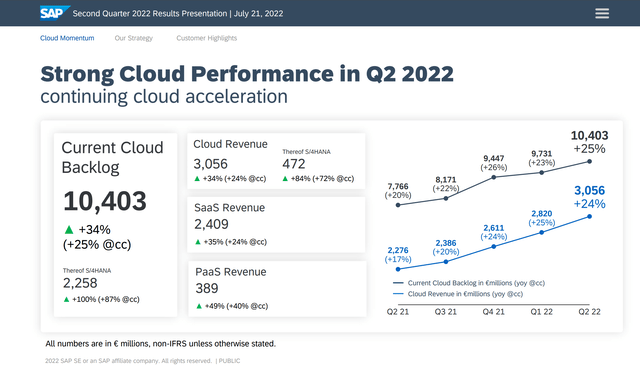

Cloud Business Could Provide Upside

A key argument for investing in SAP is the company’s accelerating cloud business, which I think the market has for a long-time underappreciated. Notably, SAP’s cloud business has grown at a CAGR of about 20% since 2020 and now aims for 50% of the company’s total revenue exposure.

On the backdrop of an accelerating cloud business, analysts expect that for 2022, 2023 and 2024 SAP could generate revenues of about $30.9 billion, $33.1 billion and $36 billion respectively. This would indicate a CAGR of about 7%, which is about double the expected global nominal GDP growth for the same period.

In my opinion, SAP’s continued cloud expansion will be the key catalyst that helps SAP stock to appreciate closer towards fundamental value — as calculated in the next section.

Residual Earnings Valuation

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the DAX 40 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of August 5, 2022. My calculation indicates a fair required return of about 8%.

- To derive SAP’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 2.5% percentage points. This is slightly lower than the global nominal GDP growth, which I think is a very conservative assumption.

Based on the above assumptions, my calculation returns a base-case target price for SAP of $110.18/share, implying material upside of about 25%.

analyst consensus EPS; author’s calculation

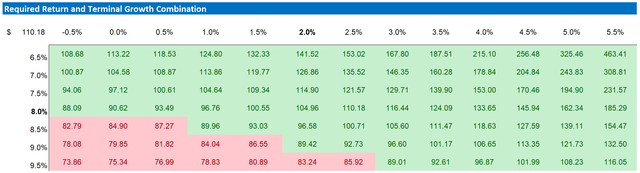

I understand that investors might have different assumptions with regards to SAP’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

analyst consensus EPS; author’s calculation

Risks

There are two key risk that I would like to highlight for investors interested in buying SAP stock. First and most notably, I would like to highlight the challenging macro-environment in Germany and Europe. That said, if the macro-economic outlook worsens significantly, investors expectations for SAP’s earnings outlook should be adjusted accordingly.

Secondly, I argue investors should be aware that SAP has significantly underperformed US peers, notably Microsoft. And honestly, it is hard to argue that going forward SAP will outperform. Accordingly, if an investor is seeking software and cloud business exposure, Microsoft might be the better long-term bet.

Thirdly, note that much of SAP’s current share price volatility is driven by investor sentiment towards risk assets and stocks in general. Thus, investors should expect price volatility even though SAP’s fundamental business outlook remains unchanged.

Conclusion

As a multinational software company, SAP might not be a close competitor to the omnipresent US FAAMG companies, but I think investors might appreciate buying some geographical exposure to a German software company — appreciating the opportunity to diversify away from the US focus. Moreover, SAP stock could be an interesting buying opportunity given a relative undervaluation as compared to its financials. Personally, I value SAP at $110.18/share and see about 25% upside.

Be the first to comment