Images By Tang Ming Tung/DigitalVision via Getty Images

Investment Thesis

Masonite International Corporation (NYSE:DOOR) will see growth as a result of its high-quality products and continued acquisitions, plus organic growth. DOOR can provide an excellent return from covered call premiums even if the stock does not move much.

Masonite International

Masonite International Corp is engaged in designing, manufacturing, marketing, and distributing interior and exterior doors for the new construction and repair, renovation and remodeling sectors of the residential and non-residential building construction markets. Its product categories include interior molded residential doors, interior stile and rail residential doors, exterior fiberglass residential doors, exterior steel residential doors, interior architectural wood doors, wood veneers, and molded door facings and door cores.

Its portfolio of brands includes Masonite, Premdor, Masonite Architectural, Marshfield-Algoma, USA Wood Door, Solido, Residor, Nicedor, Door-Stop International, Harring Doors, National Hickman, Graham-Maiman, Louisiana Millwork, Baillargeon and BWI. The company operates its manufacturing and distribution facilities in seven countries in North America, Europe, South America, and Asia.

North American Residential sales were $1,756M or 80% of the total year-to-date. Europe accounted for 10% or $220M, and Architectural totaled 10% or $224M.

Please go here to view a one-minute video about the first-ever* powered and fully integrated smart door, including emergency battery backup, motion-sensing LED welcome lighting, a Ring Video Doorbell, and a Yale® smart lock.

DOOR has annual sales of $2.8B with 10.3K employees. They are 101.4% owned by institutions, with 3.5% short interest. Their return on equity is 23%, and they have an 11.6% return on invested capital. The free cash flow yield per share is 2%, and their buyback yield per share is 10.5%. The price-to-book ratio is 2.4. Their Piotroski F-score is five, indicating some strength.

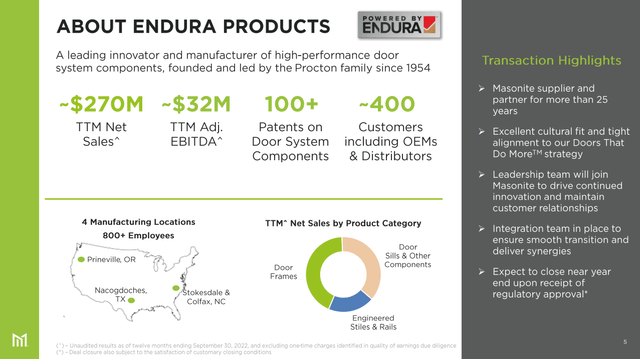

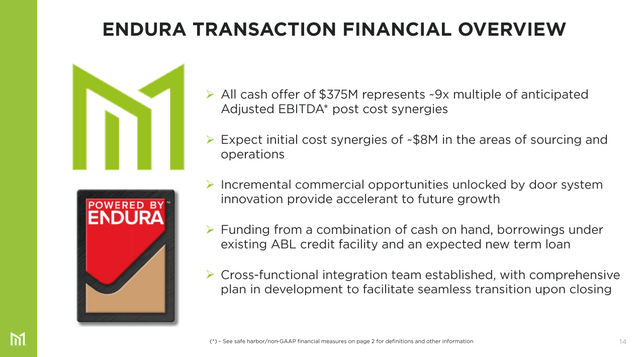

Masonite Acquisition of Endura

Masonite expects to close its $375M acquisition of Endura near year-end. This will allow DOOR to expand the premium end of its product line, its patents, and its North American footprint. DOOR’s revenue potential from the acquisition is about $270M or $32M in adjusted EBITDA. There are cost synergies and cross-selling opportunities between the two companies.

www.masonite.com/homepage

www.masonite.com/homepage

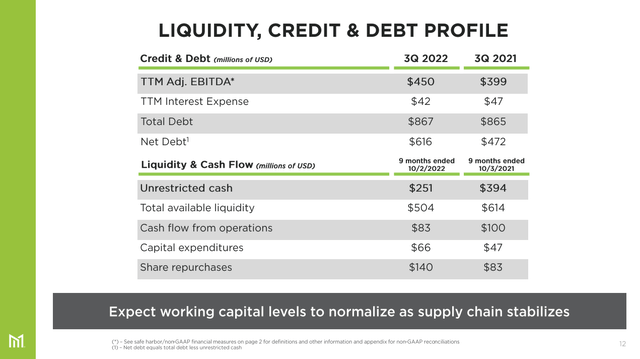

DOOR has a 2.2 net debt to EBITDA ratio. They expect working capital levels to normalize as the supply chain stabilizes.

www.masonite.com/homepage

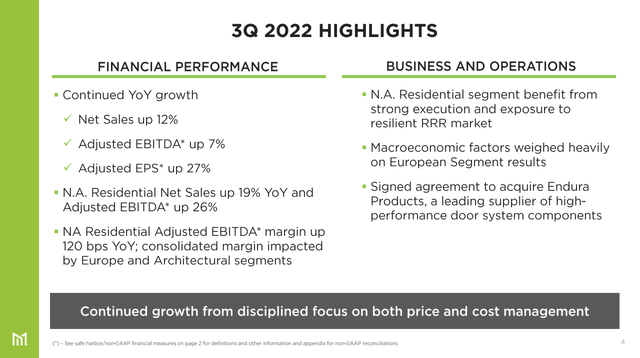

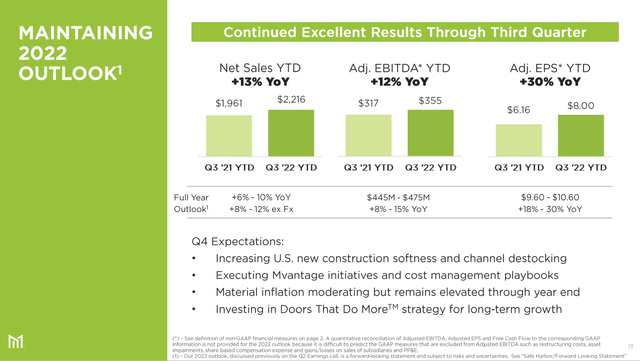

Q3 Earnings and Full-Year Outlook

DOOR’s Q3 press release showed strong results. Both earnings and net sales surpassed the analyst’s estimates and increased year-over-year. Q3 net sales were up 12%, EBITDA was up 7%, and EPS was up 27% versus last year.

They are making proactive investments in product and in marketing to make sure that they are driving a more profitable mix from hollow core to solid core, from steel to fiberglass, et cetera. They are also continuing to consume the higher-cost materials that they purchased earlier and, in some cases, built higher levels of safety stock as a means to ensure that they could deliver a consistently reliable supply. Inflationary costs are starting to recede but will happen slowly throughout 2023.

www.masonite.com/homepage

They forecast full-year sales to be up 6% to 10% versus last year, with EBITDA up 8% to 15% and EPS up 18% to 30%.

www.masonite.com/homepage

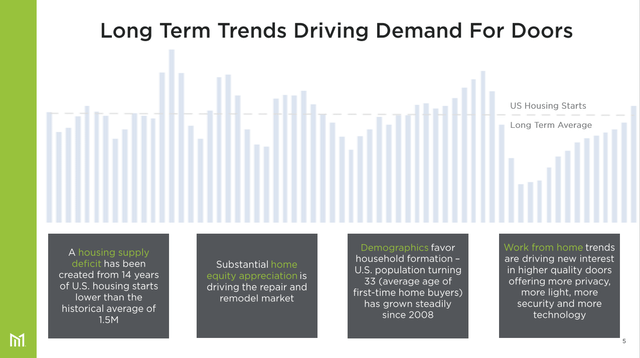

The long-term demand for doors has several drivers.

www.masonite.com/homepage

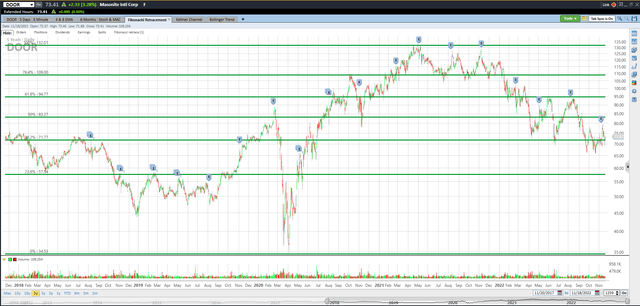

Good Technical Entry Point

The share price of DOOR closed at $73.41 on November 18th. I’ve added the green Fibonacci lines, using DOOR’s high and low for the past five years. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. DOOR is just above the 38.2% Fibonacci retracement level but could go lower. However, I believe that DOOR will trade above $75.00 by April for the reasons in this article.

Schwab StreetSmart Edge

The four most accurate analysts have an average one-year price target of $98.25, indicating a 33.8% potential upside from the November 14th closing price of $73.41 if they are correct. Analysts are just one of my indicators, and they are far from perfect, but they are usually in the ballpark or at least headed in the right direction with estimates. They often seem optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

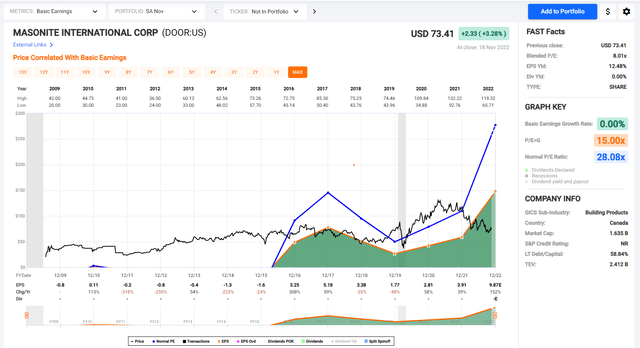

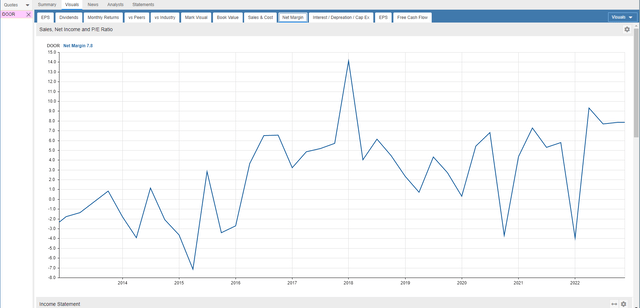

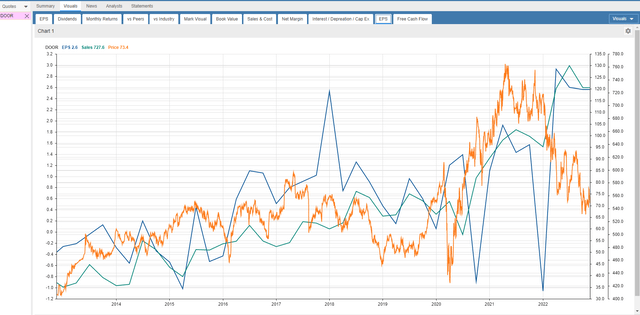

Trend in Earnings Per Share, P/E Ratio, and Net Margin

The black line shows DOOR’s stock price for the past twenty years. Look at the chart of numbers below the graph to see DOOR’s EPS. Earnings were $1.77 in 2019, $2.81 in 2020, and $3.91 in 2021, and they are projected to earn $9.87 in 2022 and $9.31 in 2023.

The P/E ratio for DOOR is currently at 8, but the average ratio over the past ten years is 24. I don’t think the P/E will rally back to 24 anytime soon. If DOOR earns $9.31 in 2023, the stock could trade at $75.41 even if the market only assigns an 8.1 P/E ratio.

FastGraphs.com

DOOR net margins for the past ten years show growth since 2013 and are now near 8%.

StockRover.com

Sales and earnings per share have also been appreciating since 2013. The stock price in 2022 has not yet caught up with this growth. There may be concerns about how this company will do post covid during an expected pullback in 2023 housing starts. I’m not concerned since many new houses are still to be built in 2023 to catch up with housing demand, and replacement doors are also needed for existing structures.

StockRover.com

Sell Covered Calls

My answer to uncertainty is to sell covered calls on DOOR five months out. DOOR closed at $73.41 on November 18th, and April’s $75.00 covered calls are at or near $7.30. One covered call requires 100 shares of stock to be purchased. The stock will be called away if it trades above $75.00 on April 21st. It may even be called away sooner if the price exceeds $75.00, but that’s fine since capital is returned sooner.

The investor can earn $730 from call premium and $159 from stock price appreciation. This totals $889 in estimated profit on a $7,341 investment, which is a 29% annualized return since the period is 152 days.

If the stock is below $75.00 on April 21st, investors will still make a profit on this trade down to the net stock price of $66.11. Selling covered calls reduce your risk.

Takeaway

I expect Masonite International Corporation’s stock to appreciate as demand for their new and existing products remains strong. New housing starts are expected to decline by 20% in 2023, but the demand for DOOR’s new and replacement doors will continue to be strong. Even if Masonite International Corporation’s stock price only moves from $73.41 to $75.00 by April 21st, a 29% potential annualized return is possible, including a covered call premium.

Be the first to comment