Alberto Masnovo/iStock via Getty Images

SSE plc (SSEZ) (OTCPK:SSEZF) is a mix of market-based (onshore and offshore wind, hydro power) and regulated businesses (transmission and distribution networks) focused on clean electricity infrastructure. Flexible (or fast-ramping) natural gas – touted as back-up power to variable renewable energy – remains the sole legacy unit.

I last rated SSE as a ‘Buy’. More than a year later, my thesis is essentially unchanged. Only that the stock is cheaper – because of painful economic conditions brought about by the energy crisis in Europe.

SSE remains massively invested in the transformation story towards lower carbon energy systems. Its capital budget for electricity infrastructure in the UK and Ireland over the next decade exceeds £25b. While there have been calls for an outright break-up with non-renewables, the company’s narrative of its different assets along the “clean electricity value chain” being complementary in nature does sound valid.

The UK

The world economy may be going through a rough patch, but there’s plenty happening closer to home for SSE. Markets are losing confidence in the new government, upset by its handling of the cost of living crisis that has gripped the nation. Energy prices in particular are being capped at higher levels for the next couple of years, a guarantee which could cost the government up to £150b. This money, along with £43b worth of tax cuts, will have to be expensively borrowed.

SSE has responded to the Prime Minister’s energy plan positively. It sees itself more as an enabler of long-term energy independence and thus hopes to benefit from policies supportive of green technologies. But the government is yet to offer any detail to substantiate their commitment; they seem distracted and might find finances constricted. In the meantime, SSE will be contributing to funding the energy bills support scheme by fixing the prices of such intermittent sources of electricity as wind power at pre-war levels.

Financials

SSE’s last published update for Q1 was thin and did not cover anything other than electricity output numbers and some guidance for the financial year. A bit more was revealed in the announcement of the closed period before the scheduled release of 1H results on 16 November.

Gas business has fared well so far this year, due to a combination of known factors. Renewables produced slightly less than expected which has led to a moderation in the (adjusted) EPS forecast for the six months to 30 September (40p), although the full-year figure is being maintained (120p).

SSE continues to spend big, potentially hitting “record” £2.5b in capex (with acquisitions) in the current financial year. This unbridled expansion, of course, comes at a cost. The company’s leverage ceiling is already a high 4.5 times net debt to EBITDA. Adjusted net debt at 30 September has been approximated at £10b (year-end to 31 March: £8.6b). But almost all of it is fixed rate, and interest payments are adequately covered by EBIT (11.9x). Which is why SSE’s credit still makes an investment grade, albeit of the lowest kind.

Even more important is how effectively the capital is being invested. And in that sense SSE has something to show for its spending. The return on capital employed, based on pre-tax earnings, rose from low single digits in the past to a decent 15.8%, almost twice as much as the industry average.

Growth

SSE’s Net Zero Acceleration Programme, announced in 2021, allocates 40% of the five-year £12.5b capex to renewables and another 40% to networks. Renewables capacity is supposed to double to 8GW by 2026; adjusted EPS as a result is expected to grow by 7-10%. By 2031, renewables output is projected to increase fivefold to 50TWh and a renewables pipeline to more than 15GW.

SSE is starting, tentatively, to look beyond domestic markets in the UK and Ireland. In September, it acquired a 5.2GW portfolio of early stage development projects of Siemens Gamesa Renewable Energy. The deal costing €580m makes for a good entry into continental Europe which has the most ambitious targets for low-carbon energy.

Renewables are clearly central to SSE’s growth strategy, but it is not scrapping its thermal business entirely. The sale of a 33% stake in Scotia Gas Networks was its last disposal, and new additions – specifically those with decarbonization potential – are still being made. For example, Triton Power, acquired together with Equinor, is to become the main offtaker of the Hydrogen to Humber (H2H) Saltend project.

Recruiting partners to fund growth has worked well for SSE, and this is what transmission and distribution networks will be going through too. The sale of a 25% stake in SSE Transmission is scheduled to be completed by the end of 2022.

Performance

Underlying shares on the LSE have returned 21% over the past three years and an entire 42% with dividends included, about double the industry average and many times the UK average.

More recent performance has been on the lighter side, -2.6% in price and 2.4% in total returns for the last year, broadly in line with the market. In the same period, sponsored ADR SSEZY has fallen by much more, -21.2% and -17.1%, clearly affected by stock market gyrations in the host country.

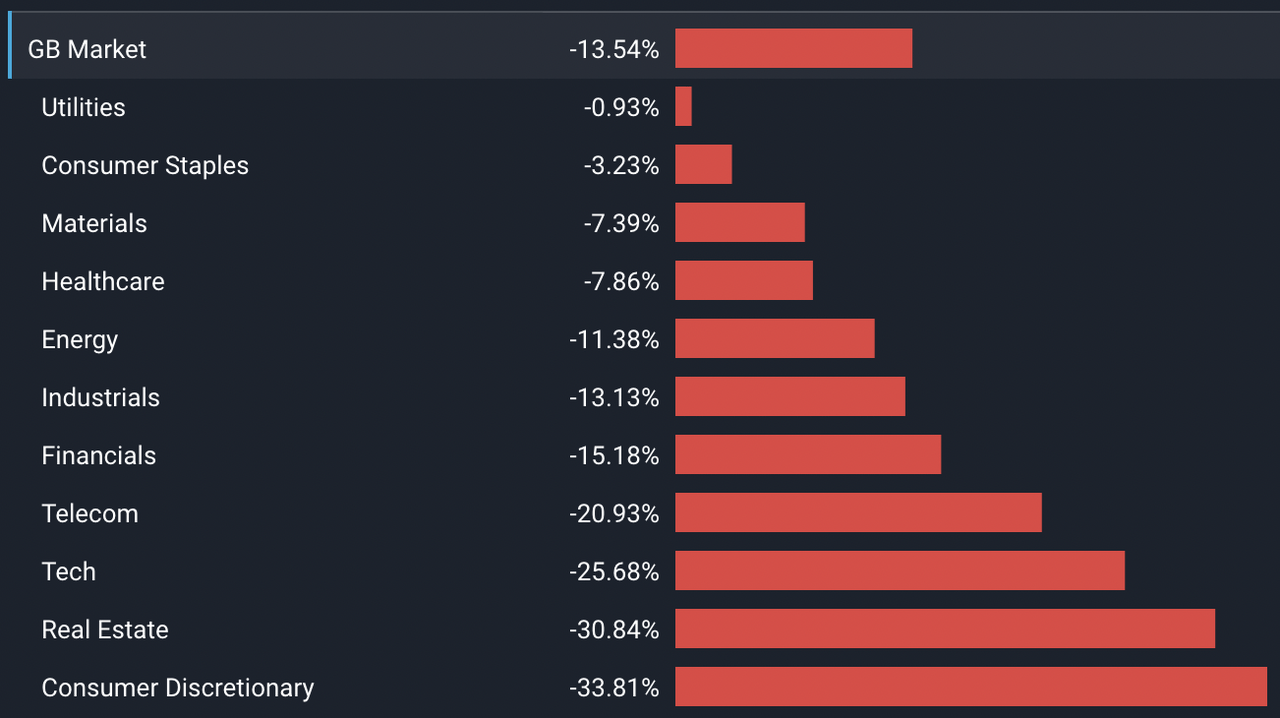

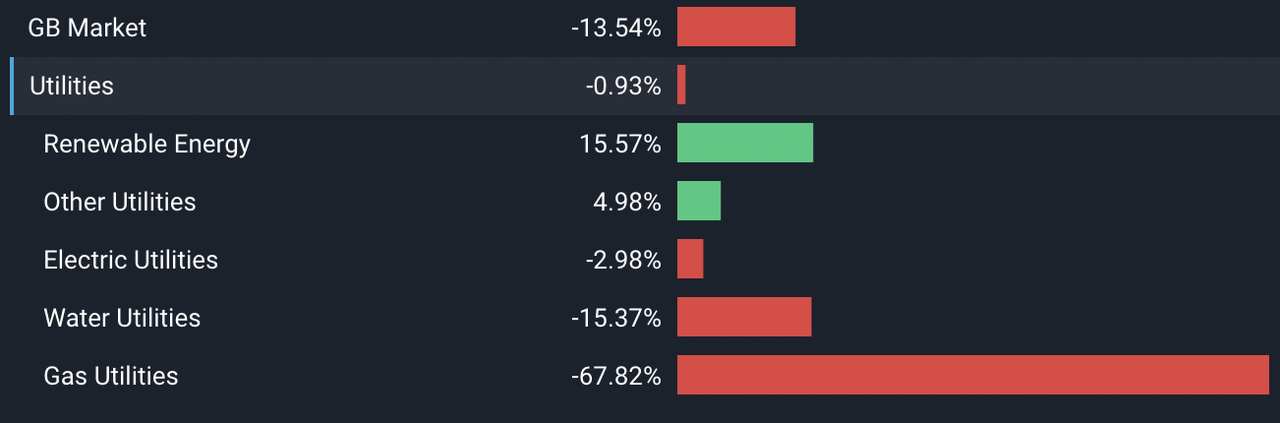

FTSE Sector 1 Year Performance

Simply Wall St as of October 6 Simply Wall St as of October 6

SSE has been a reliable dividend payer, with a consistent track record of increasing payments except in pandemic hit 2020. Another cut of 30% from 85.7p today to 60p in the next financial year is meant to aid the funding efforts for the Net Zero Acceleration Programme. It is a reasoned decision given the company’s growth ambitions. It also promises to make future payments more sustainable: increases of at least 5% are already being targeted for two years following the rebasing. For the time being, a boon for the shareholders is a stock buyback program worth 10% of the issued capital that has started on October 3.

Conclusion

The upcoming earnings announcement should not surprise. And if the UK government delivers on pro-growth reforms in the green energy space, despite economic difficulties of the moment, SSE will be a clear beneficiary. Right now may be a good time to buy. At £15.04 a share as of October 6, LSE:SSE had a P/E of 6.4. At $16.69 a share, SSEZY’s P/E GAAP stood at 5.50. This is far below the company’s historical averages as well as the Utilities sector’s valuation in the high teens. The 1-year average price target is £19.24.

Be the first to comment