Chris Hondros

Thesis

I am very bullish on US diversified banks, as I believe that ever since the financial crisis, the market is grossly overestimating the risk associated with investing in financial service companies. This opens the opportunity for investors to claim an above market return by identifying the winning banks and buying them at a cheap price to earnings multiple. One name that I personally like, is Goldman Sachs (NYSE:GS). Trading at a TTM P/E of x7.8 and a P/B close to x1, the market is arguably mispricing GS stock in relation to the bank’s fundamentals. Personally, I calculate almost 30% upside. My argument is anchored on a residual earnings model based on analyst consensus EPS.

For reference, GS stock is down about 13% YTD and about 17% from ATH.

About Goldman Sachs

The Goldman Sachs Group, Inc., is one of the US most influential diversified bank and securities firm with focus on investment banking, trading, asset management and wealth management. As of 2021, Goldman Sachs has about $2.5 trillion in assets and covers services in all major asset classes. Goldman Sachs operates four key segments: Global Markets, Asset Management, Investment Banking, and Consumer & Wealth Management. Global Markets, which includes trading, risk management and a variety of brokerage services, is GS’ largest business segment and accounts for about 35% of revenue. Investment Banking activities account for about 25% of revenue and include financial advisory services, equity and debt underwriting, and a diversified solution portfolio of corporate lending activities. Asset Management also accounts for about 25% of revenues and offers services that help client preserve and growth their financial asset base. Consumer & Wealth Management is responsible for about 15% of revenues and offers wealth advisory and banking services. Geographically, GS has offices across the world-with the Americas being the bank’s most important region with about 65% of revenues, followed by EMEA with 25% and APAC with about 15%.

Attractive Investment

There are a few things that investors might appreciate when investing in Goldman Sachs.

First, GS has leading exposure in a diversified portfolio of financials services. This makes the bank less vulnerable to cyclical fluctuation in the economy. For example, as the recent history has highlighted, when interest rates are low and economic uncertainty is subdued GS’ investment banking and asset management segment perform well. While when interest rates are rising and markets are volatile, Global markets (trading) and wealth management are poised to deliver a strong performance.

Second, Goldman Sachs is strongly focused on capital markets services with little exposure to credit/lending. Consequently, GS balance sheet carries little risk from credit and interest rate duration, and remains arguably resilient during an economic downturn.

Third, banking is a value proposition deeply anchored on brand equity and human capital. There is no doubt that the GS, perhaps only matched by Morgan Stanley and JPMorgan, attracts some of the best industry talent. And corporations and individuals trust the GS brand with the most high-profile and high-value deals.

Finally, Goldman Sachs stock is trading cheap as compared to fundamentals. Having generated $59.34 billion of revenues in 2021 (up more than 60% versus 2019) and net-income of $16.6 billion (31.5% margin), GS stock is now effectively trading at a TTM P/E of x7.8.

Residual Earnings Valuation

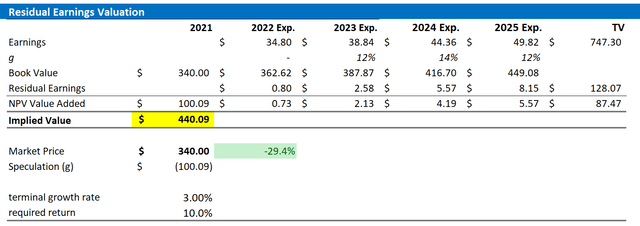

In my opinion, banks are prime candidates to be valued with a residual earnings (“RE”) valuation, given that the RE framework anchors on both the income statement and the balance sheet as well as accrual accounting. That said, I apply the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal till 2023. In my opinion, any estimate beyond 2023 is too speculative to include in a valuation framework – especially for banks.

- I anchor the required equity return at 10%, in line with most banks.

- To derive GS’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 3% percentage points, approximately the nominal GDP growth, which I think is a fair assumption for an industry leader like GS.

Based on the above assumptions, my calculation returns a base-case target price for GS of $440.09/share, implying material upside of almost 30%.

Analyst EPS Estimates; Author’s Calculations

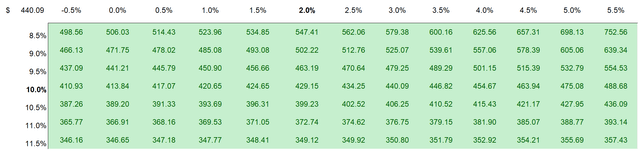

I understand that investors might have different assumptions with regards to GS’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst EPS Estimates; Author’s Calculations

Risks

While I believe that investments in banks are less risky than the market implies, investors should consider that the performance of the financial industry is closely correlated to the health of the global economy. Accordingly, investors should monitor macro-economic developments and global geo-political tension. And in case of a severe recession, earnings estimates for GS should be revised downwards, which will of course lower the bank’s equity valuation. In any case, GS’s 13.3% CET1 ratio should buffer the company for most market stress scenarios, even severe ones.

Conclusion

Goldman Sachs is one of the best banks in the world with diversified strength on multiple verticals, including investment banking, global markets, asset management, and wealth management. Looking at a EV/EBIT of x10, I believe the bank is undervalued as compared to its fundamentals, including growth, profitability, and competitive strength. I value GS based on a residual earnings model, and I see about 30% upside. Buy.

My other articles about US banks:

Be the first to comment