Leonid Ikan

Denbury Inc. (NYSE:DEN) is an independent energy company with operations and assets focused on Carbon Capture, Use and Storage (CCUS) and Enhanced Oil Recovery (EOR) in the Gulf Coast and Rocky Mountain regions. Due to hiked oil prices, the company was able to report strong quarterly results in 1Q-3Q 2022. Oil prices in the fourth quarter of 2022 are lower than in the first three quarters of the year. Thus, DEN cannot benefit from the oil prices in 4Q 2022 as much as it did in the first nine months of the year. However, it is important to know that compared with 4Q 2021, oil prices are still significantly high and are expected to increase in 2023. Also, the Inflation Reduction Act, which was signed into law in August 2022, incentivized DEN’s EOR and CCUS projects. The stock is a buy.

Quarterly results

In its 3Q 2022 financial results, DEN reported total revenues of $439 million, compared with $344 million in the same period last year. The company’s oil sales increased from $305 million in 3Q 2021 to $390 million in 3Q 2022. DEN’s total expenses decreased from $261 million in 3Q 2021 to $148 million in 3Q 2022, driven by commodity derivatives income of $109 million, partially offset by higher lease operating expenses, higher oil marketing purchases, higher general and administrative expenses, and higher taxes other than income. The company’s net income increased from $83 million in 3Q 2021 to $250 million in 3Q 2022. In the third quarter of 2022, DEN reported non-cash fair value gains on commodity derivatives of $165 million.

DEN’s adjusted net income in the third quarter of 2022 was $102 million. DEN reported an adjusted EBITDAX of $161 million in the third quarter of 2022. The company’s net cash from operating activities increased from $104 million in 3Q 2021 to $156 million in 3Q 2022. Also, its net cash investing activities increased from $63 million in 3Q 2021 to $105 million in 3Q 2022. DEN’s oil sales decreased from 48145 Bbls/s in 3Q 2021 to 45639 Bbls/d in 3Q 2022. The company’s natural gas sales decreased from 9222 Mcf/d in 3Q 2021 to 8815 Mcf/d in 3Q 2022.

Excluding derivative settlements, DEN’s oil average realized price increased from $68.88 per barrel in 3Q 2021 to $92.77 per barrel in 3Q 2022. Also, the company’s natural gas average realized price increased from $3.96 per million cubic feet in 3Q 2021 to $7.00 per million cubic feet in 3Q 2022. DEN’s cash flow deficit of $23 million on 30 September 2021, turned into a free cash flow of $47 million on 30 September 2022. The company reported total capital expenditures of $119 million in 3Q 2022, compared with $101 million in 3Q 2021.

“Our great progress in both the EOR production and CCUS businesses advanced significant value creation at Denbury during the third quarter,” the CEO commented in the release, and continued:

“Despite persistent supply chain challenges and inflationary pressures, our teams have continued to execute safely and efficiently across the Company. This operational momentum, combined with continued progress at the CCA EOR development, sets a great foundation for our business for years into the future,” he continued.

The market outlook

Driven by oil development activities, particularly the development of the company’s Cedar Creek Anticline (CCA) EOR project in Montana and North Dakota, DEN’s capital expenditures for the fourth quarter of 2022 are expected to be higher than in the third quarter. The company’s CCA EOR project production response is anticipated in 2H 2023. DEN expects its 4Q 2022 capital expenditures to be $135 million. The company reported total sales of 47109 BOE/d and 46866 BOE/d for the quarter ending 30 September 2022 and nine months ending 30 September, respectively. Due to incremental production from multiple projects in the company’s 2022 capital program, DEN expects its 4Q 2022 sales volumes to be between 47,500 to 49,000 BOE/d, with the midpoint up 2.5% from 3Q 2022.

“These predicted fourth quarter 2022 sales volumes are slightly lower than original expectations due to timing associated with equipment and materials delays, which should benefit production in early 2023,” the company explained.

According to Grand View Research, the global EOR market size, which is valued at $38.83 billion in 2021, is expected to grow with a CAGR of 7.8% from 2022 to 2023 to reach $76.78 billion in 2022. Also, according to Stratview Research, the carbon capture and storage market is expected to grow with a CAGR of 5.71% during 2022-2028, reaching $5.04 billion in 2028. It is important to know that North America has the largest market share in the carbon capture and storage market (more than 31% in 2021).

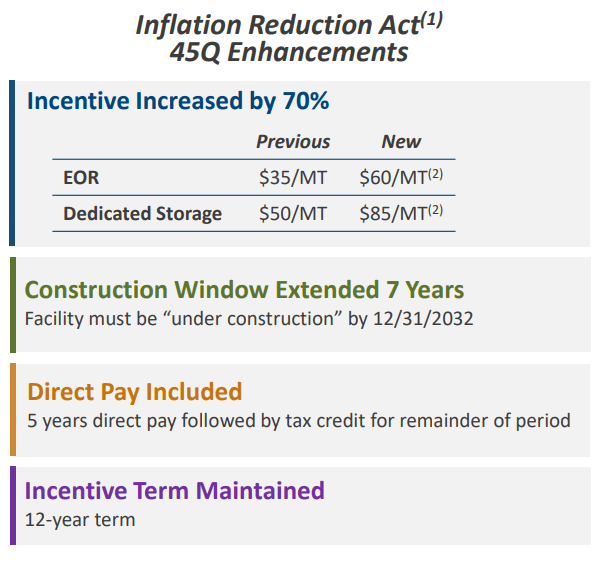

DEN’s current portfolio of CO2 EOR and CCUS projects, increase its oil production significantly and improve its reserves. Moreover, the Inflation Reduction Act that that signed into law in August 2022 incentivized EOR and CCUS projects by 70%. The recently approved enhancements to the 45Q tax incentives available for carbon capture have significantly expanded the market opportunity for DEN (see Figure 1).

Figure 1 – Inflation Reduction Act 45Q enhancements

DEN’s 3Q 2022 presentation

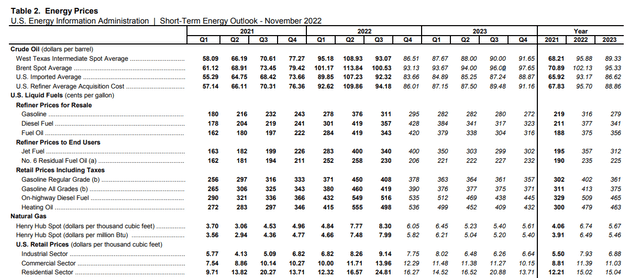

Oil prices have direct connectivity with DEN’s projects developments. Higher oil prices can support DEN’s EUR and CCUS projects significantly. According to EIA, the Brent crude oil spot price averaged $93 per barrel in October 2022. On one hand, due to weakening global economic conditions, oil prices may decrease. On the other hand, the war in Ukraine, supply disruptions resulting from the EU’s ban on Russian crude and OPEC+ production cut, support oil prices. Brent crude oil price is expected to be $94 per barrel in 1H 2023. EIA forecasts that Brent crude oil price will increase to $98 per barrel in 4Q 2023 (see Figure 2).

Figure 2 – Energy prices

Performance outlook

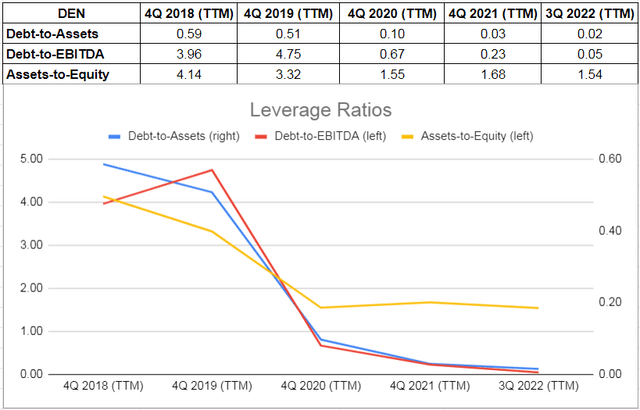

In this detailed analysis, I used some common leverage ratios that have significant comparability to DEN’s debt. The proportions are calculated in comparison with previous years to be more helpful.

The debt-to-assets ratio measures the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risks. The company’s debt-to-asset ratio plunged from 0.51 in 2019 to 0.10 in 2020. In 2021, the company’s debt-to-asset ratio decreased by 70% to 0.03. On 30 September 2022, DEN’s debt-to-asset ratio was 0.02. DEN’s debt-to-EBITDA ratio (which determines the probability of defaulting on debt) dropped from 4.75 at the end of 2019 to 0.67 at the end of 2020. It decreased further to 0.23 at the end of 2021 and to 0.05 on 30 September 2022.

Finally, DEN’s asset-to-equity ratio increased from 3.32 at the end of 2019 to 1.55 at the end of 2020. The company’s asset-to-equity ratio increased to 1.68 at the end of 2021. However, due to better market conditions, DEN’s asset-to-equity ratio decreased to 1.54 on 30 September 2022. The decreasing assets-to-equity ratio indicates that the company has been using lower debt to finance its assets. As oil prices are expected to remain high, the development of DEN’s EOR and CCUS projects is supported. Thus, due to the current oil market condition and EOR and CCUS market outlook, DEN’s leverage ratios will continue improving (see Figure 3)

Figure 3 – DEN’s leverage ratios

Summary

In the third quarter of 2022, oil represented 97% of DEN’s sales volumes. 28% of the company’s oil was attributable to the injection of CO2 in its EOR operations. Oil prices will remain high in the following quarters. Also, the EOR market is growing fast. Thus, DEN will stay profitable and can finish its projects without considerable financial challenges. Denbury Inc. stock is a buy.

Be the first to comment