SouthWorks/iStock via Getty Images

A long/short hedge fund will traditionally “Buy” or “Go Long” on a basket of stocks, they are most bullish on. While they will typically Short sell a basket of stocks, they believe is overvalued and will fall. The benefit of this is it allows you to make money in both a rising or falling market. In this post, I’m going to deep dive into two electrifying EV Charging stocks. The first is ChargePoint (NYSE:CHPT) which I believe is a Buy due to its vast scale, robust business model and low valuation. The 2nd is Blink Charging (NASDAQ:BLNK) which I believe is a Short Sell opportunity due to its small scale, higher risk business model and high valuation. I will outline a comparison between the Business Model, Technology, Financials and Valuation of these two EV stocks, let’s dive into to the juicy details.

Business Model (Blink Vs. ChargePoint)

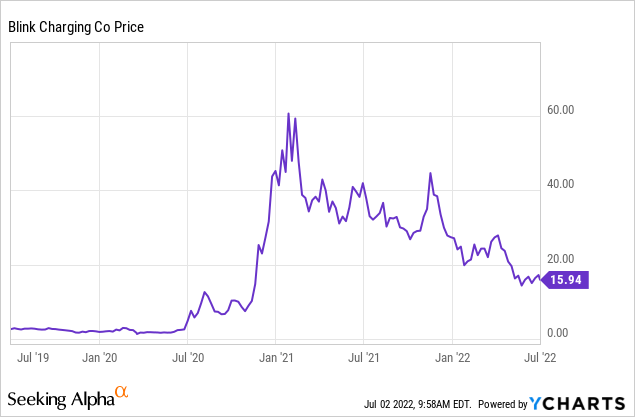

Blink Charging is a small cap Electric vehicle (EV) charging company which has sold, deployed or installed over 30,000 charging stations in 19 countries. The company currently has charging stations at established locations such as McDonald’s, Marriott, Four Seasons and many more. On the face of things you may think the stock sounds great and a perfect way to play Biden’s latest $700 Million EV charging proposal. However, the company is facing many challenges and has a few fundamental issues with its business model. The stock price is currently down 71% from its highs in February 2021 and is also extra sensitive to the high inflation and rising interest rate environment as a small cap Growth stock.

As a former Electrical Design Engineer, I have never really understood what is so special about the majority of EV charging suppliers as they are basically supplying a commodity product, which has very little distinction or competitive advantage. According to fundamental Economics this is basically a product with “Elastic” demand, which means there are many substitutes and it ends up being a pricing game. The only caveats to this are companies which had a first mover advantage in building out their network such as Tesla (TSLA) and ChargePoint or those with faster charging and better technology.

Charging Infrastructure

Let’s dive into the main differences in scale and technology between Blink and competitor ChargePoint.

Blink Loses on Scale and Speed

- Blink has 32,000 charging stations

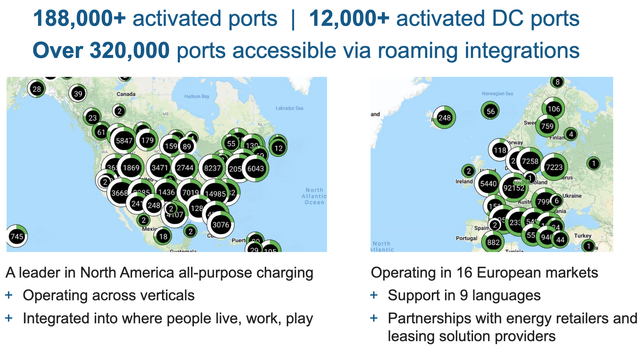

- ChargePoint has 188,000 charging stations and 320,000 ports accessible via integrations.

These means ChargePoint’s network is nearly 6 times the size of Blink’s (not including integrations). But it’s not all about Scale, Speed of charging is extremely important also. A legacy Internal combustion engine (ICE) vehicle takes ~10 minutes to fuel up, depending upon the tank size. Whereas, an EV can take anywhere from 20 minutes to 20 hours. The key factor is the Charging Station type which are available in three main flavours:

- Level 1 Stations (+2 to 5 miles per hour of charge)

- Level 2 Stations (+10 to 20 miles per hour of charge)

- Level 3 Stations (+60 to 80 miles per hour of charge)

The majority of consumers who are driving an EV on the road will likely want the fastest charging possible, while it may be slightly less of an issue for home charging stations, where you wouldn’t mind putting on a slow Level 1 charge overnight. Building out any infrastructure is expensive and of course the faster chargers usually cost more to purchase. ChargePoint in this case has the largest Level 2 network and over 12,000 activated DC port’s, thus ChargePoint also steals the speed game from Blink.

ChargePoint Network (Investor presentation)

In terms of Business Model, Blink has a preferred “operator” model in which it owns some of the stations. This has the benefit of being able to sell adverts and make money from the electricity costs, but it’s also a more risky model in the short term and depends on usage for profitability. Whereas, ChargePoint has a less capital heavy model, which offers lower risk scalability. Analyst Christopher Souther from B.Riley Financial Inc also had similar concerns to myself he stated in reference to Blink;

“Attempting to scale meaningful revenue from charging fees will be a challenge.”

“We are cautious on the company owned model, which relies on utilization for speedy payback, given our belief that most slow charging will likely continue to occur at one’s home, office, or other location where electricity prices are low or complementary, and drivers will be less willing to pay premium prices for Level 2 charging speeds, which has been the company’s focus”

They also expect low usage rates in the short term and agree with my thoughts on the lack of pricing power long term. Building out a network of charging stations is one part of the puzzle but it’s all about “utilization”, especially for a company which plans to make money from the usage (more on this in the Financials section). As there are many players in the EV charging station market, I predict consolidation in the industry. Larger players such as ChargePoint have better access to the capital markets and a lower cost of capital, which can help ensure more profitable expansion and more robust ability to weather any storm.

1. ChargePoint Financials – Buy

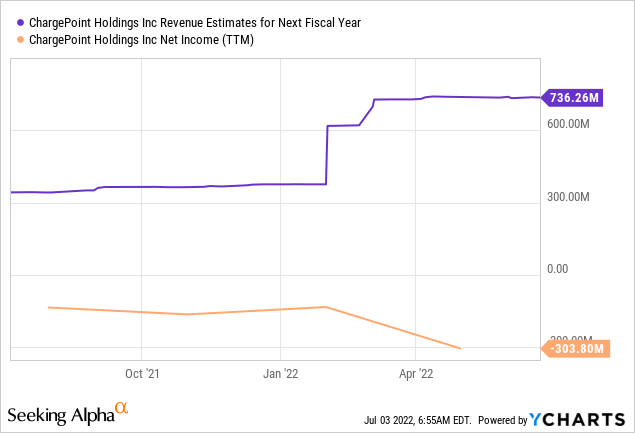

ChargePoint produced strong first quarter earnings for 2022. Revenue was $81.6 Million, up a blistering 102% year over year. This was primarily driven by networked charging systems revenue for the first quarter, which was $59.6 million, up 122% year over year. Subscription revenue also grew strong to $10.8 million or 63% compared to the prior year.

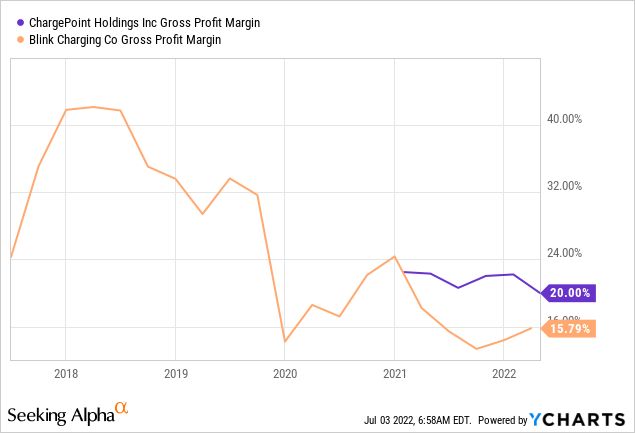

ChargePoint’s Gross Margin was 15%, which was down from 23% in the prior year’s period. The main reason of this was lower margin products sold better than higher margin offerings. In addition, supply chain disruptions squeezed availability and increased costs.

ChargePoint’s produced an operating loss of $89.3 million in the first quarter of 2022. This loss is primarily due to large investments into R&D $48.3 Million, followed by $32.6 million invested into Sales and Marketing for growth. As ChargePoint reaches greater scale, ideally, we will want to start seeing operating expenses lower as a percentage of revenue and economies of scale start to take over.

ChargePoint has a strong balance sheet with $541 million in cash and short term investments, in addition to just $294 million in long term debt.

ChargePoint Valuation

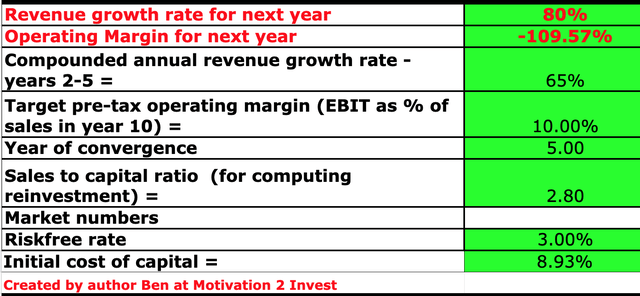

In order to value ChargePoint I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 80% revenue growth for next year, in line with the company’s own guidance. In addition, I have forecasted revenue growth of 65% for the next 2 to 5 years.

ChargePoint (created by author Ben at Motivation 2 Invest)

As the business scales, I forecast operating expenses to start to decrease as a percentage of revenues and thus operated margins increase to 10% within the next 5 years.

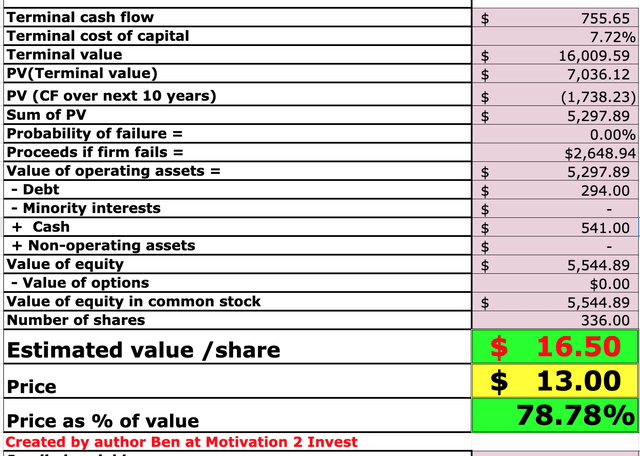

ChargePoint stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $16.5/share the stock is currently trading at $13/share and thus is ~21% undervalued.

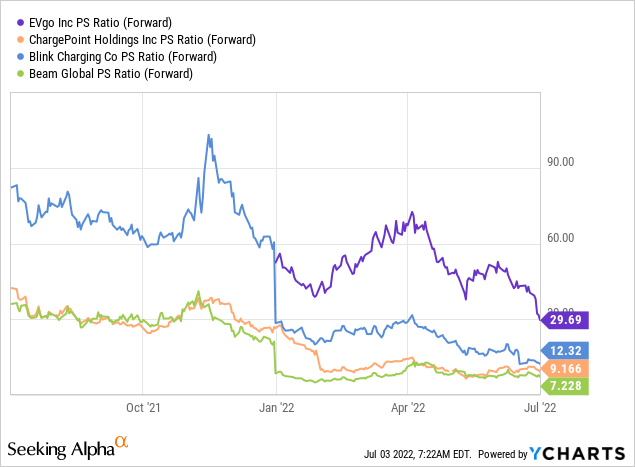

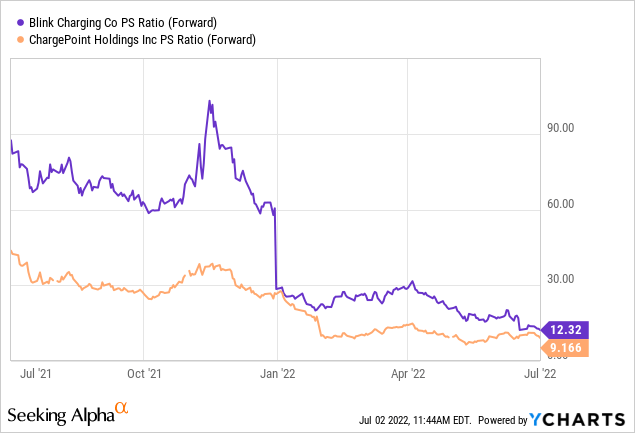

For a relative valuation, ChargePoint trades at a Price to Sales (forward) ratio = 9.2. This is cheaper than both Blink, which trades at a PS = 12 and EVgo (EVGO) which trades at an PS = 30. However, it is slightly more expensive than Beam Global (BEEM) which trades at a PS ratio = 7.3.

Risks

Competition

As mentioned prior the EV charging station product is effectively a commodity with very little differentiation apart from speed and sometimes extra software management features. Thus, it’s no surprise there are many competitors in the industry, Publicly traded EV charging stocks include; Blink, EVgo, Beam Global etc. There is also the elephant in the room Tesla. In addition, mammoth Oil company BP (BP) has recently acquired Charge station provider’s Chargemaster and Polar for its BP Pulse network, the company now over 8,000 public charge points. Shell (SHEL) has also built out a network of charging stations. In addition, there are many private companies such as Osprey, PodPoint, InstaVolt and many more. As mentioned at the start of the post a “Land Grab” is happening and to win you either have to be a first mover or acquire a first mover.

Technology Changes

Warren Buffett has never been a great fan of investing into technology due to the rapid changes. Stellantis the parent company of (Fiat, Chrysler, Dodge, Maserati and more) is testing “in road wireless/inductive charging” which basically means your car will charge while you drive. This technology has the potential to disrupt the entire Charge station industry, however it is extremely early stage right now and the current infrastructure costs to fit wireless technology into roads is very costly. However, technologies such as Battery Swapping is already extremely popular in China with EV provider NIO (NIO) spearheading the way, these of course mitigate the need for charging stations. Then we also have Hydrogen Fuel Cell technology which is been pioneered by companies such as Plug Power (PLUG).

Final Thoughts (ChargePoint)

ChargePoint has the largest level 2 EV charging network in North America and a strong first mover advantage against many competitors. The company has strong financials, bold expansion plans and is also undervalued relative to the majority of players in the industry. The company will need to prove its business model works and continue to hit revenue growth targets in order to keep investors happy.

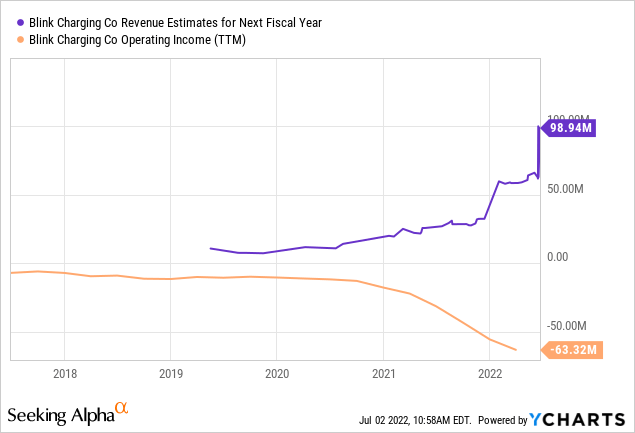

2. Blink Financials – Short Sell

Blink Generated just $9.8 million in revenue for the first quarter of 2022, this was up a substantial 345% from $2.2 million achieved in the first quarter of 2021. The lower starting base of $2.2 million, makes revenue growth as a percentage seem much healthier than it is, which should be noted. Product Sales jumped to $8.1 million, up 382% which is great and represented an increase of $6.4 million. This was driven by sales of Commercial chargers, Residential charges and DC Fast chargers. But it should be noted this also includes revenues from Blue Corner which was acquired in 2021. Service Revenues, which consist of charging service revenues, network fees, and ride-sharing service revenues, increased to $1.5 million in the first quarter of 2022, up $1.2 million year over year. The increase in utilisation is great but $1.5 million is still small for a company with a $681 million market cap, they have a long way to go.

Operating expenses also jumped by 120% over the same period from $7.7 million to $17 million, which is not a great sign. This means operating income losses increased from -$7.4 million in Q121 to -$15 million in Q122.

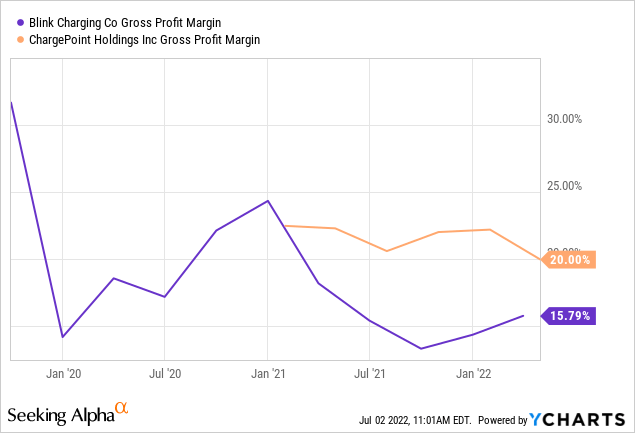

Blink has a Gross Margin of 15% which is down from historic levels and lower than competitor ChargePoint’s baseline Gross Margin of 20% (although in Q122 they also had a 15% Gross Margin).

The good news is the company has a strong balance sheet with $162 million in cash and short term investments, this gives them dry powder for expansion and more acquisitions.

Blink Valuation

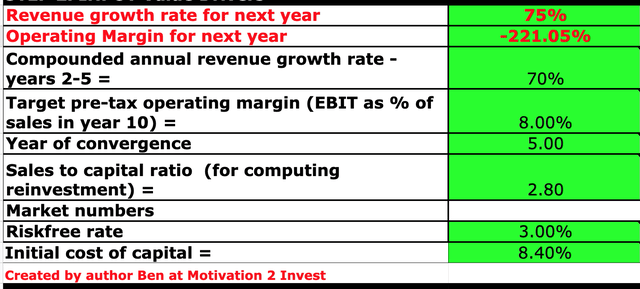

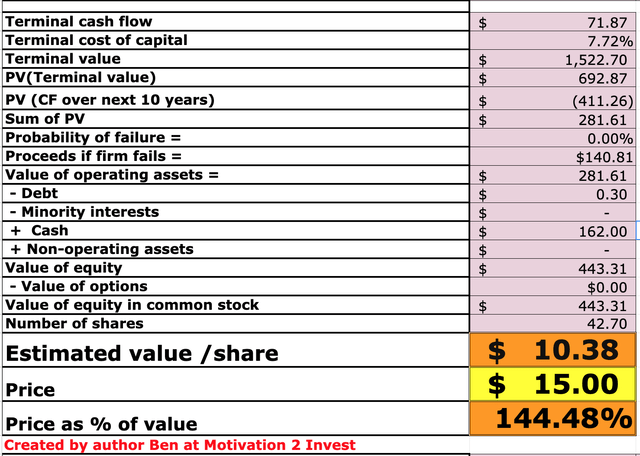

In order to value Blink I have plugged the latest financials into my valuation model, which uses the discounted cash flow method of valuation. I have forecasted a rapid 75% growth next year and 70% for the next 2 to 5 years. As the company has a small revenue base to start, I have based this growth rate on dollar revenue growth achieved last year and then worked backwards to a percentage.

Valuation Blink Stock (created by author Ben at Motivation 2 invest)

I have also optimistically forecasted the company’s operating margin to increase to 8% within the next 5 years, as the company scales through acquisitions.

Blink Valuation model (created by author Ben)

Given these factors I get a fair value of $10/share, the stock is currently $15/share and thus is 44% undervalued. As mentioned prior, Blink trades at a price to sales (forward) ratio = 12, which is higher than competitor ChargePoint which trades at a PS (forward) = 9.

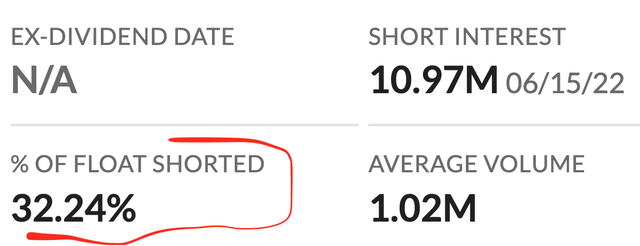

High Short Interest

Blink also has a high short interest with 32.2% of the float shorted. This means many short sellers believe this stock has further to fall.

Blink short interest (marketwatch)

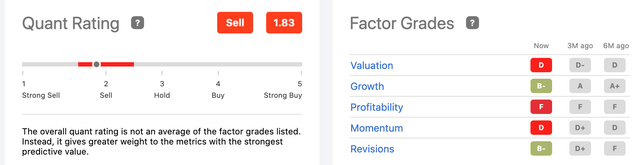

Seeking Alpha’s Quant Rating also has the stock down as a “Sell” due to poor technicals and fundamentals.

Risks (Blink Short Sell)

Usually with a Long investment or buy, the risk section would cover the negatives but in this case the risk with short selling, is actually positive events occurring.

It’s not all bad.

Blink has a scored a few key partnerships with major players such as GM and BridgeStone to deploy EV Stations across their dealerships and service centers. In addition, they recently agreed an acquisition of SemaConnect, which will add an extra 13,000 EV charge points and an extra 3,800 site host locations, this acquisition has also been praised by analysts.

Short Selling Risk

Short Selling is inherently more risky than buying a stock long. When you buy a stock normally the maximum you can lose is what you invested, as the lowest a stock can go is zero. However, a stocks price can keep going up to infinity theoretically and thus effectively your losses can be unlimited. Although usually what occurs is if you short a stock and it starts to rise you will get a “margin call” from your broker and have to cover it. “Short Squeezes” are also another major risk which can occur when a large number of short sellers are forced to buy the stock to cover their position. Famous cases of Short Squeezes include the GameStop (GME) saga and of course Tesla and Michael Burry of the “Big Short”. In this case, Blink is a smaller cap company and thus more volatile and prone to large swings.

Final Thoughts

As mentioned in the intro, the EV charging industry is really about three factors Scale, Speed and Utilisation. Blink loses to large competitors such as ChargePoint on both Scale and Speed. Its “managed” business model means “utilization” is a key success metric and thus they have a long way to go. The company is overvalued intrinsically and has one of the highest short interests in the industry. The opportunity to invest into ChargePoint and Short Sell Blink is a dual bet on the electrifying EV industry.

Be the first to comment