JamesBrey

Introduction

Markets are in turmoil. Economic growth is slowing, inflation remains uncomfortably high, and the Federal Reserve isn’t expected to start supporting the economy and markets anytime soon. As a result, we’re in one of the worst market environments in a long time. Bonds are getting crushed, stocks are very weak, and even the markets’ most defensive stocks are not providing that much safety. In this article, I will show you three high-yield stocks that I believe make so much sense to buy in this market environment. They all come with a defensive business model, a high dividend yield, and a valuation that I believe offers buying opportunities.

However, we’re also going to look at the bigger picture and the theories that support long-term investments in high-yield stocks.

As a matter of fact, that’s where we start.

So, let’s get into it!

Buy Me Some (Quality) Yield

It’s a highly vicious market environment as everyone has found out by now. The S&P 500 has lost a quarter of its value since the start of the year as we’re seeing a mix of slowing economic growth, high inflation, and a Federal Reserve eager to do whatever it takes to get inflation down.

What this means is that markets will have to wait for monetary support (i.e., lower rates, or even QE) until one of the following two things happens:

- Inflation has come down to levels the Fed can live with.

- Financial stability has become so bad that the Fed will have to prioritize that instead of fighting inflation.

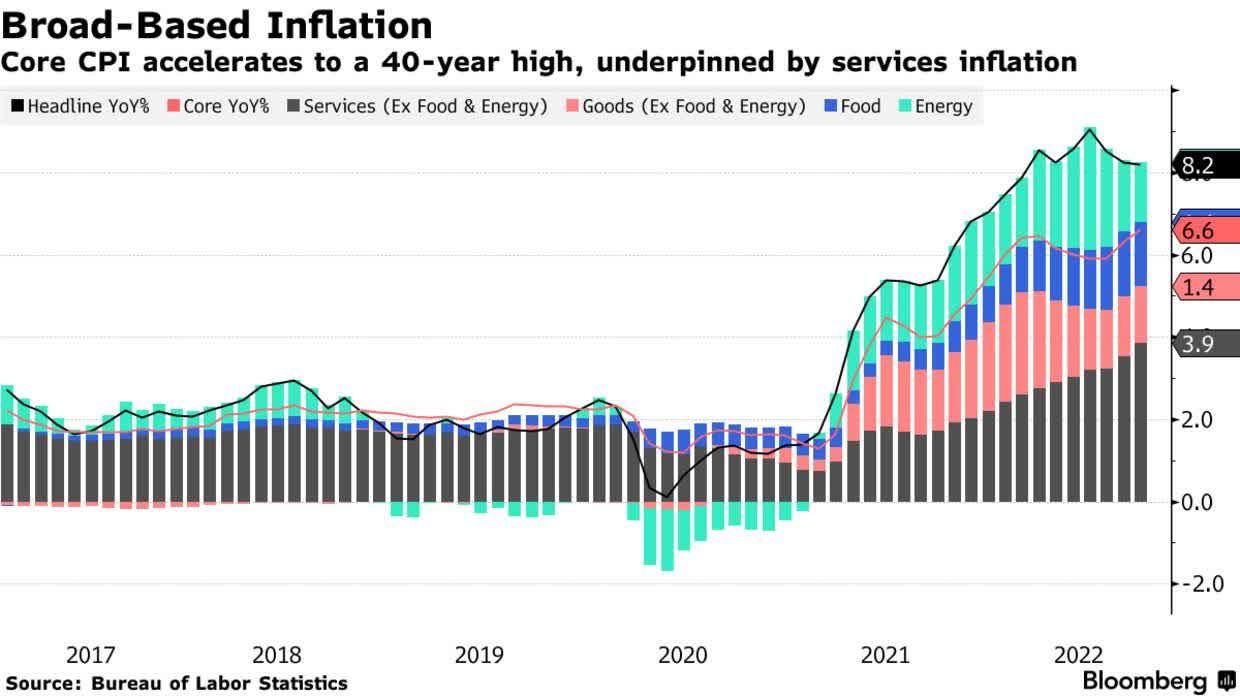

The first option is somewhat of a problem. Despite the economic weakness, inflation remains high. September consumer prices came in at 8.2%, 10 basis points higher than expected. Core inflation (excluding food and energy) reached a 40-year high. In other words, what used to be just energy inflation is now inflation in every key category. This is made worse by labor and supply shortages, and other related factors the Fed cannot directly impact. That’s the worst part, the Fed can weaken demand to pressure inflation, but it cannot address the supply side.

Bloomberg

As a result, we’re now in a situation where the period of “easy” money is over. Even worse, it comes with weakening economic growth, geopolitical issues, and unresolved supply issues.

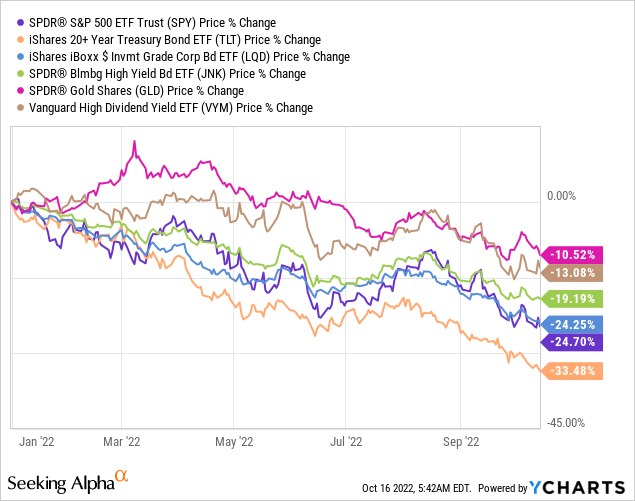

So, to get back to the S&P 500’s performance, there really isn’t a place to hide. As the chart below shows, the carnage is everywhere. It’s not just “stocks” and long-term bonds, but also investment grade bonds, gold, high-yield dividend stocks, and pretty much everything that doesn’t benefit from some secular tailwind – like certain energy stocks.

With that said, voices are getting louder to buy quality high-yield. The other day, I read an article, which made a strong case for high-yield debt.

In the article, Nuveen CIO Saira Malik made the case that high-yield spreads are likely to narrow over the long term.

“We’re looking for areas, given the environment out there, where you are getting the best bang for your buck,” Malik told host David Westin. “Even though we do predict a recession, you’re getting paid to wait in high yield with that kind of return.”

I really like the last sentence of the quote as we could indeed be in a situation where it takes time until markets rebound to previous highs. Moreover, in light of high inflation, it makes sense to add income-generating investments.

The article was written on September 10. Back then, the S&P 500 was down roughly 15%. However, even then, high-yield investments outperformed the market.

That’s currently the case as well. High-yield dividend stocks are down 13% year-to-date as the chart above shows. That’s not “great”, but it beats the S&P 500 by a considerable margin.

Hence, in this article, I decided to finally focus on a few high-yield stocks. Usually, I use the Vanguard High Dividend ETF (VYM) as a benchmark. That ETF is yielding 3.3%, which means that’s what I consider to be high-yield. However, after a lot of disagreement in my comment sections, I decided to go with a few great stocks that even I want to buy – and that says a lot as I’m generally speaking a dividend growth investor.

However, I still want to show you some more background info before we move further. We just discussed the macro environment.

Now, we look into reasons that make high-yield investments good alternatives, in general.

High Dividend Stocks (In Rising Interest Rate Environments)

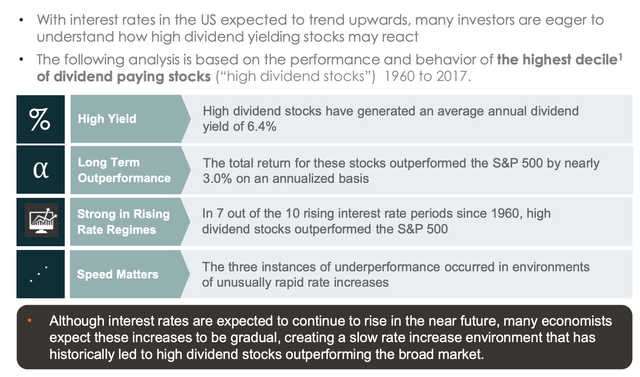

In 2018, Global X presented its view on high-dividend stocks in a rising interest rate environment. They obviously did that to promote their ETFs, but I still like their reasoning as it’s based on facts.

What’s interesting is that back in 2018, rates were rising as well. Now, they are rising again, but the macro environment is different.

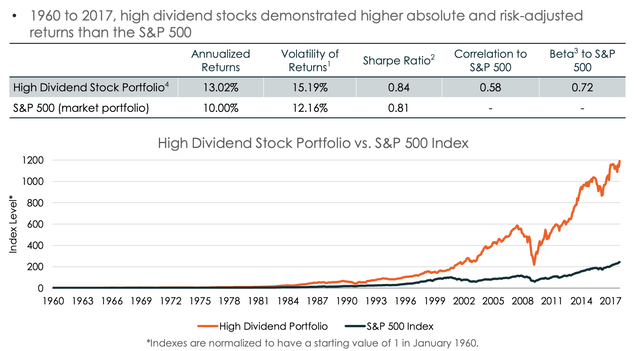

Global X found that high dividend stocks have generated an average annual yield of 6.4%. That’s well above “my” definition. It’s also a rate that I used in the stock selection for this article. Moreover, these stocks outperformed the S&P 500 by nearly 300 basis points on an annualized basis. That’s a huge deal as it really adds up over time. 300bps per year is 34% after 10 years of outperformance.

Moreover, in 70% of all rising rate environments, high-dividend stocks outperformed the market. Right now, we’re seeing that this is once again the case.

Global X also found that half of the returns came from dividends during rising interest rate periods.

These stocks also have a lower correlation and a lower beta, which helps people to sleep well at night.

With that said, I don’t know when or where markets are going to bottom. And I can assure you that the smartest investors on the markets don’t know either. I’ve heard anything from 3,200 points to 1,900 points from people who make way more money than me.

So, my strategy remains unchanged. I’m buying quality dividend stocks whenever I like the valuation. However, in light of market fundamentals, I will focus more on high-yield investments. The stocks that I’m about to show you next are all on my watchlist as I like their yields, business models, and valuations.

Additionally, I mainly focused on defensive high-yield investments.

So, now let’s dive into the next part of this article.

1. Verizon Communications (VZ)

I have never covered Verizon. That has to do with my focus on dividend growth instead of high-yield stocks and the fact that I always thought that Verizon was way too boring.

However, being boring is good for investing. And, even better, the valuation has come down a lot!

Here are some basic facts:

- Market cap: $153.8 billion

- Sector: Communication services

- Industry: Telecom services

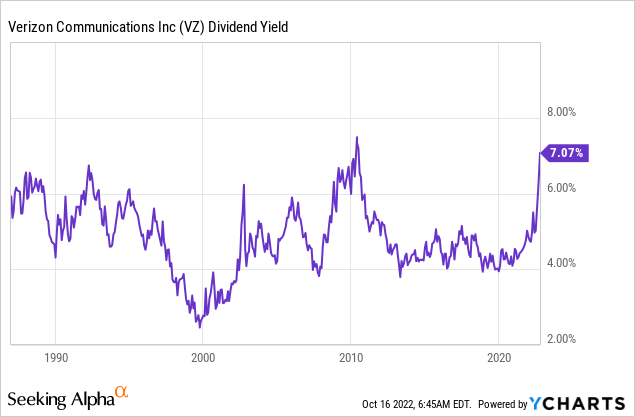

- Dividend yield: 7.2%

- 10Y average annual dividend growth: 2.50%

- YTD performance: -30%

The company’s most recent dividend hike was on September 6, when management announced a 2.0% hike. That’s not a lot, but it’s in line with past hikes. Also, we’re now dealing with a very juicy yield of 7.2%.

This is one of the highest yields in the company’s history.

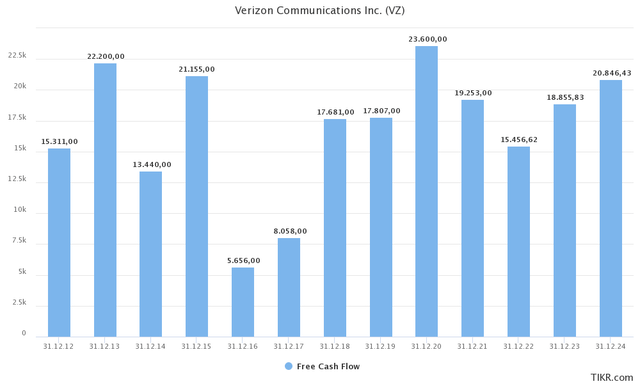

Almost needless to say, VZ is a cash cow, not a growth stock. Its free cash flow has gone nowhere, and that’s not expected to change.

However, if we assume that free cash flow rebounds to $21 billion in the years ahead, we’re dealing with an implied FCF yield of 13.6%, which implies there is a lot of room to grow the dividend in the future.

One of the reasons why the stock is selling off is because of its high debt load. The company has $143 billion in 2023E net debt, which is almost equal to its market cap. The same goes for utility companies and pretty much all companies with high investment needs and balance sheets to support a high debt load. The good news, however, is that net debt is not expected to go above 3.0x EBITDA anytime soon.

Hence, the company maintains a BBB+ credit rating with a stable outlook.

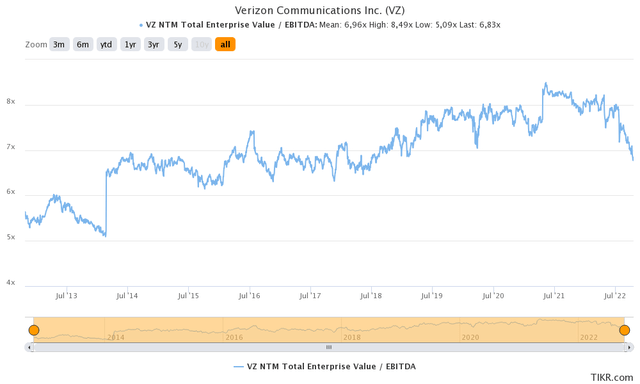

Its valuation has come down to 6.4x 2023E EBITDA.

That’s the lowest forward valuation in more than 10 years.

Moreover, as The Value Pendulum discussed on Seeking Alpha, the company is doing quite well, which is not what the stock price is suggesting:

At the company’s most recent investor event, the Goldman Sachs (GS) Communacopia + Technology Conference on September 14, 2022, VZ revealed that “two months into the quarter (Q3 2022), clearly we have more gross ads” and stressed that “we’re growing that month-over-month.” In my view, this seems to imply that Verizon has been largely performing in line with expectations for most of the third quarter and trends appear to be positive.

2. Altria Group (MO)

Imagine entering a recession and not believing that cigarettes will do well…

All kidding aside, I believe that Altria needs to be on this list. It combines a very high yield and a very defensive business model.

Some basic facts:

- Market cap: $81.5 billion

- Sector: Consumer Defensive

- Industry: Tobacco

- Dividend yield: 8.3%

- 10Y average annual dividend growth: 8.10%

- YTD performance: -4.6%

Altria is a stock I covered recently as I started to like the valuation, which includes its yield of more than 8.0%.

The stock is one of the best examples of how powerful a high-yield stock is during times of high inflation. This is what the Altria stock price did during the 70s and early 80s:

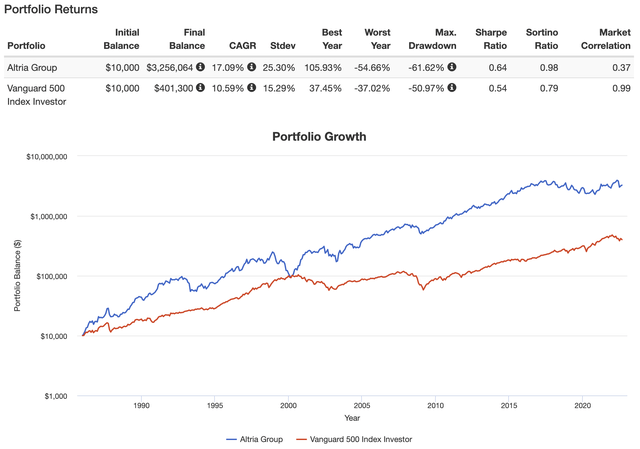

As a matter of fact, going back to 1986 (that’s as far as my data goes back), Altria has returned 17.1% per year, outperforming most tech stocks and high-flying growth stocks, in general. The standard deviation of 25.3% also wasn’t that bad as it allowed the company to beat the market on a volatility-adjusted basis as well (Sharpe/Sortino ratios).

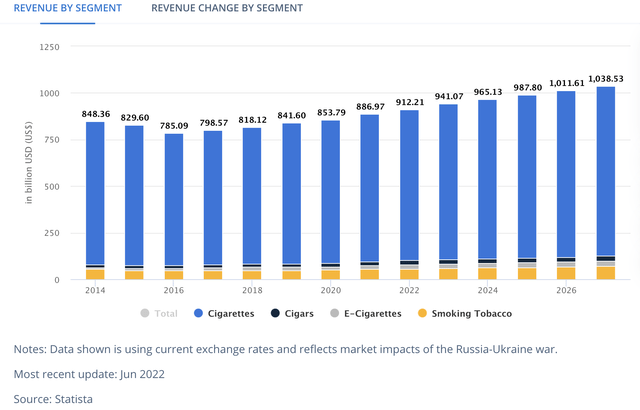

Moreover, global tobacco revenue is not expected to witness a serious decline – or any decline whatsoever.

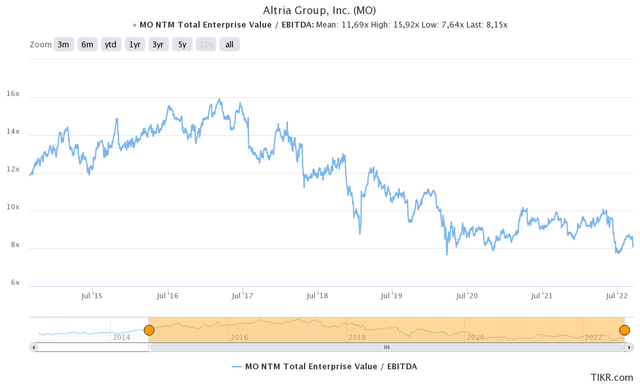

The valuation remains very attractive. Altria is trading at 8.5x 2023E EBITDA.

I believe that this valuation is attractive as it’s well below the longer-term average, and even below the short-term average of 9.0x NTM EBITDA.

While the two companies we discussed so far have defensive business models, number three is even more defensive.

3. Southern Company (SO)

Founded in 1945, Southern Company has become one of America’s largest regulated electric utilities.

- Market cap: $69.1 billion

- Sector: Utilities

- Industry: Utilities – Regulated Electric

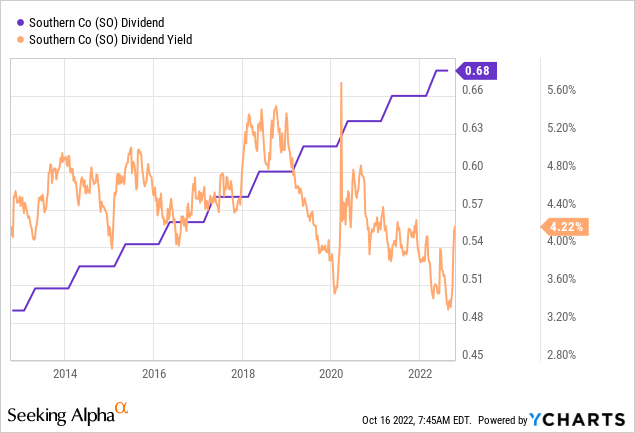

- Dividend yield: 4.3%

- 10Y average annual dividend growth: 3.40%

- YTD performance: -7.4%

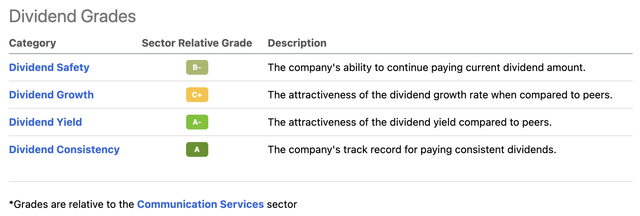

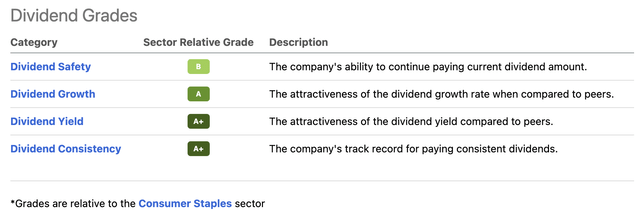

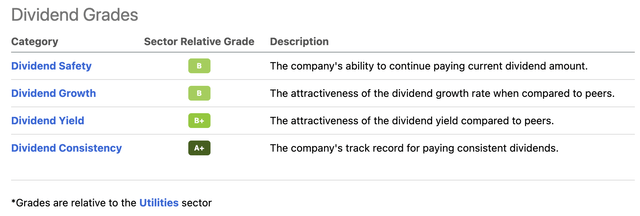

The dividend behind the SO ticker is one of the most consistent in the industry. Southern Company has hiked its dividend for 21 consecutive years since 2002, which explains why it’s rated A+ in the scorecard above.

The beauty of SO is that its energy transition is going smoothly. In 1Q23, the company is expected to operate Unit 3 of its Vogtle nuclear power plant. Vogtle Unit 4 is expected to be in service in 4Q23.

Like all major utilities, SO has pledged to reduce its emissions. However, becoming carbon neutral by 2050 is a huge project. Shutting down efficient coal plants and building new capacity is extremely expensive. Vogtle 3 and 4 alone are forecasted to cost $10,393 through 1Q23/4Q23. The good news is that the net investment as of June 30, 2022, is $8.9 billion, which means “only” $1.5 billion is required to finish the project.

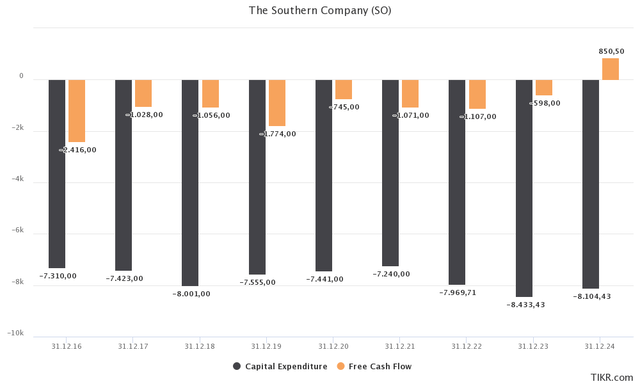

Hence, now we’re seeing something that is extremely rare among utility companies. Southern Company is expected to generate positive free cash flow after 2023. Note that free cash flow is operating cash flow minus capital expenditures.

Moreover, the company’s growth is everything but slow. Long-term EPS growth is expected to be in the 5% to 7% range. According to the company:

Southern Company’s adjusted earnings guidance range for 2022 is $3.50 to $3.60 per share vs. consensus of $3.55. In the first quarter of 2022, management estimates Southern Company adjusted earnings per share will be 90 cents. Management continues to project a long-term adjusted earnings per share growth rate for Southern Company in the 5% to 7% range, consistent with adjusted earnings in a range of $4.00 to $4.30 per share in 2024 vs. consensus of $4.11.

Like Verizon, Southern Company has a lot of debt. The company is expected to end up with $57.3 billion in net debt in 2023. However, that is 5.5x EBITDA, which is reasonable for a utility company the size of SO. Moreover, the average maturity of its bonds is 19 years. The average coupon rate is just 3.6%. Its credit rating is BBB+. While a steep surge in rates is pressuring its stock price, I’m not worried about the impact on the business itself.

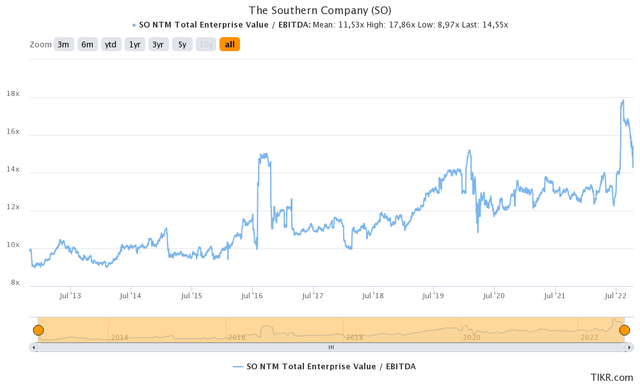

The valuation has become attractive. The company’s $128.2 billion enterprise value is roughly 9.1x its expected 2023 EBITDA. This is the best valuation in more than 10 years using the historical EV/(forward)EBITDA range.

Takeaway

In this article, we discussed the challenging economic environment, which is doing damage to almost every single asset class. I believe that tremendous opportunities present themselves in the high-yield space. Generally speaking, high-yield stocks have been able to outperform the market in the past. However, especially rising rate environments are favoring quality dividend stocks.

I presented three high-quality stocks that all offer high yields, consistent and sustainable dividend growth, rock-solid business models, healthy balance sheets, and tremendous valuations.

While I do not own any of them because of my focus on dividend growth, I am increasingly looking to add some quality yield to my portfolio.

I believe any of the stocks in this article will provide investors with very satisfying long-term returns.

In light of ongoing market uncertainty, I believe consistently buying these stocks on weakness is the way to go.

(Dis)agree? Let me know in the comments!

Be the first to comment