Canadian Dollar Fundamental Forecast: Neutral

Recommended by Daniel Dubrovsky

What are the top trading opportunities this year?

The Canadian Dollar traded mixed against the US Dollar this past week, but its broader path of appreciation since late March 2020 remains intact. CAD received a boost after Bank of Canada’s Governor Tiff Macklem noted that the nation ‘will not need as much QE’ over time under their base case. His comments crossed the wires following the BoC’s expected rate hold at 0.25%.

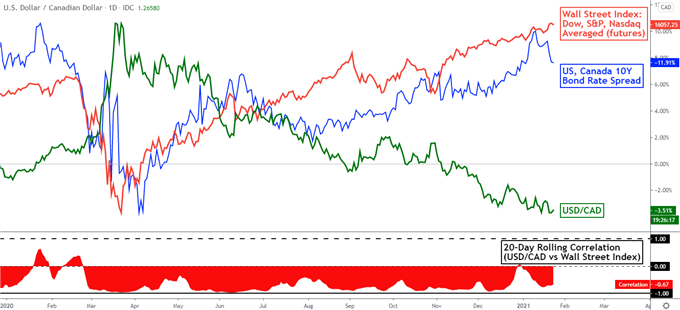

Monetary policy expectations are often a key fundamental driver for currencies. One way of visualizing this is through government bond yield spreads. USD/CAD appears to not have a particularly strong correlation with US and Canadian bond yield spreads. Rather, it remains heavily inversed with market risk appetite – see chart below. As such, the pair will likely continue to follow the general trajectory of equities in the near-term.

Canadian GDP is on tap for November. It will offer both an update on how domestic growth is behaving while also giving an idea of how the global economic recovery from the coronavirus is faring. Strong Canadian retail sales this past week for the same time period seem to offer a rosy preview for GDP. After all, consumption is the largest segment of growth.

Recommended by Daniel Dubrovsky

What does it take to trade around data?

While the data may stir short-term CAD volatility, the broader trend will likely remain glued to risk appetite. For that, it is a very busy week for market-moving events. The Federal Reserve interest rate announcement, World Economic Forum, IMF World Economic Outlook update, US GDP and earnings season are among key updates investors will be watching.

With such a crowded schedule, the risk for market volatility may be elevated if there is an unexpected surprise. The events mentioned in the previous paragraph all in some ways serve a purpose to offer broader outlooks for the global economy. This is as some jitters unnerved markets last week, such as preliminary reports that the new more-contagious Covid strain may be linked to higher mortality.

This is as US President Joe Biden appears to be hitting some roadblocks in the Senate to pass a USD 1.9 trillion Covid relief package. A few moderate Republicans, such as Susan Collins, have downplayed the urgency for another bill. Investors have been betting on a larger-than-expected package, but these expectations risk fading, opening the door to a pullback in sentiment which may bode ill for the Canadian Dollar.

USD/CAD Versus Wall Street and Government Bond Yield Spreads

Chart Created Using TradingView

— Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment