Katrina Wittkamp/DigitalVision via Getty Images

Burlington (NYSE:BURL) shares have been hit hard thus far in 2022, with the stock off 52% year-to-date. Shares have significantly underperformed off-price retail peers Ross Stores (ROST) and TJX Companies (TJX) which have seen share price declines of 18 and 7%, respectively. While Burlington’s operational results have been far worse than TJX and Ross, I believe that results will normalize as inflationary pressure recedes (eventually). Looking out to 2025, I see more than 70% upside in the stock.

Burlington Overview

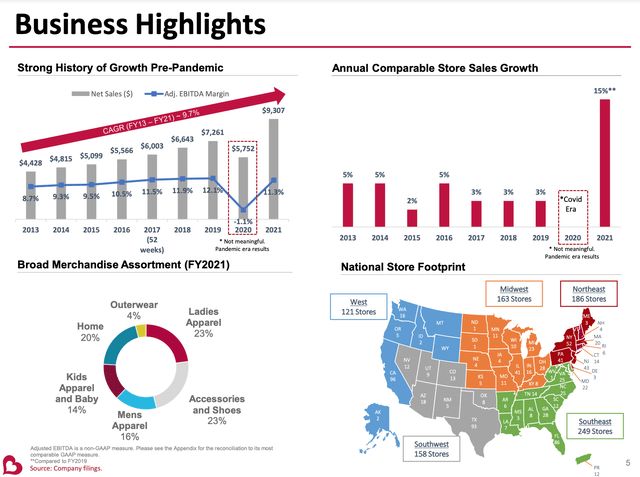

Burlington is the third largest off-price retailer in the US, with annual sales of about $9 billion. Sales have more than doubled since 2013 as same store sales have increased, while the store count has grown to just under 900 locations today.

Overview (Burlington Investor Presentation)

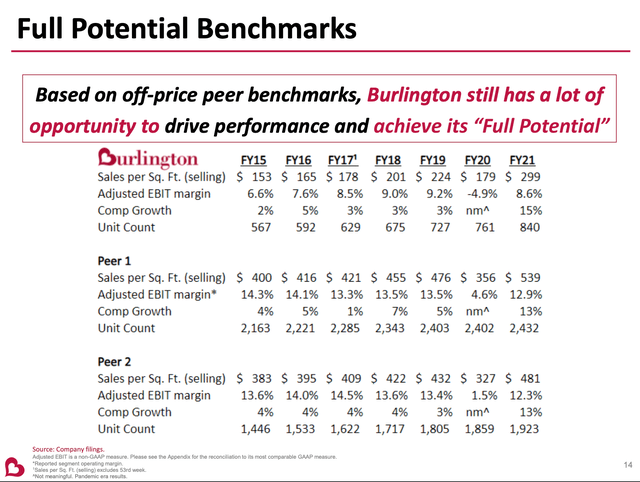

While Burlington has an impressive track record of growth, with just 900 stores, it has a much smaller footprint than TJX and Ross which have 2,500 (TJ Maxx & Marshall’s) and 1700 stores, respectively. In addition, as shown below, Burlington has an opportunity to increase store-level productivity as sale/store and operating margins meaningfully lag peers

Key metrics for Off-Price retailers (Burlington Investor Presentation)

Off-Price Retail Is A Long-term Winner

Traditional apparel retail is a very difficult business. Department stores like Macy’s (M) and Kohl’s (KSS) have seen a decades-long decline in market share, profitability and stock prices. Mall-based retailers like Gap (GPS), Abercrombie (ANF), and American Eagle (AEO) have suffered a similar fate. However, traditional retail’s losses have been off-price retail’s gain. Over the past decade the big 3 off-price retailers (TJX, Ross, Burlington) have seen their collective sales more than double from $30 billion to over $60 billion. Why has off-price retail succeeded where others have struggled?

1. Lower pricing – off-price retail sells products 20-60% below department store prices. As I discuss below, off-price retailers have a competitive advantage in their cost structure, which allows them to pass savings on to customers.

2. Treasure hunt mentality keeps increases customer visit frequency – off-price retailers have a constantly changing assortment of products (stores receive deliveries of new products 1-2x per week) which keeps customers coming back regularly and reduces the need for expensive advertising and aggressive discounting.

3. Significant buying power ($55 bn in annual merchandise purchases)/ buying overstocked/out-of-season items allows off-price retailers to procure products at a lower cost than traditional retailers.

4. Most off-price retailers are located in shopping centers (as opposed to malls). On average, off price retailers spend 4-5% of revenue on rental expense versus mall-based retailers which spend 11-12%.

5. Limited service model reduces in-store labor costs – off-price retail is a self-serve model – there aren’t many sales associates and checkout lines are longer (customers make the trade-off of longer lines/less service for lower prices).

Current conditions

Burlington’s massive underperformance versus peers in 2022 is largely attributable to its lower income customer base. While this was a tailwind in 2021 as stimulus checks flooded this economy and customers spent aggressively, the absence of stimulus in 2022 has led to a reversal of this impact.

Further, while most TJX stores are located in areas with annual household income above $75,000, Burlington stores target less affluent households ($55,000 and below). Lower-income households are more impacted by inflationary pressures as customers re-allocated spending from discretionary items like apparel to necessities (the cost of rent, gas, and food have all increased significantly in 2022).

As a result of these factors, Burlington has seen significant same-store sales declines as lower income consumers are being more heavily impacted by inflationary pressure. In 2Q22, Ross (customer household income somewhere in between TJX and Burlington) saw a comparable sales decline of 7% year-over-year, while Burlington experienced a whopping 17% decline. By contrast, TJX saw its comparable sales slip just 2% in its Marmaxx (TJ Maxx & Marshall’s) division.

Valuation & Conclusion

I believe that over time, economic conditions and spending behavior of lower-income houses will normalize. I assume Burlington will continue to execute on its playbook of increasing its store count while gradually improving its operational metrics (sale per store/sq ft and operating margins).

Assuming Burlington is able to achieve a 10% operating margin on a revenue base just north of $12 billion in 2025, I get to $14 per share in EPS. My revenue estimate assumes a 3% annual increase in same store sales and that Burlington continues to grow its store count by 90 stores per year.

While my 10% operating margin assumption seems like a big improvement from the sub-5% Burlington will likely do in 2022, it is only a modest improvement from 2021’s 8.6% which suffered from stratospheric freight costs (these are now coming down -discussed in my recent SA piece on TJX) as well as pandemic related costs (such as additional cleaning costs). For reference, Burlington achieved a 9.2% operating margin in 2019 (the last truly ‘normal’ year) while Ross has historically earned 13-14% operating margins and TJX has historically earned 13% margins in its MarMaxx (TJ Maxx/Marshall’s) segment.

Applying a 17x P/E multiple (historically off-price retailers have traded between 16-20x earnings), this gets me to a value of $238 per share which is 72% above the current share price, which I see as an attractive entry point for a long-term winner.

Risk

Should inflation remain high, this will likely pressure low-income household spending and continue to depress Burlington’s results.

Be the first to comment