Vladimir Vladimirov/E+ via Getty Images

Bumble (NASDAQ:BMBL) is a company we have been following since its IPO, but have so far not invested in. At first glance it has one of the characteristics we very much like to see in a business, mainly a competitive moat from network effects. Unfortunately it is not the biggest dating platform, so its competitive advantage from network effects is greatly diminished. The biggest dating platform is Match (MTCH) with its very popular Tinder app. Bumble does have some differentiating characteristics that attract certain types of users that prefer the way it operates versus the competition, meaning that there is likely space for a number of dating apps to prosper, even if most of the users will flock to the top two or three.

A little concerning is that Bumble users don’t appear particularly happy with the app, hinting at a poor product market fit. Its rating on the Google Play Store is only 2.9 stars out of 5, which in our experience is significantly below average for popular apps. Although in the Apple App store the app is better rated with a 4.2 star rating.

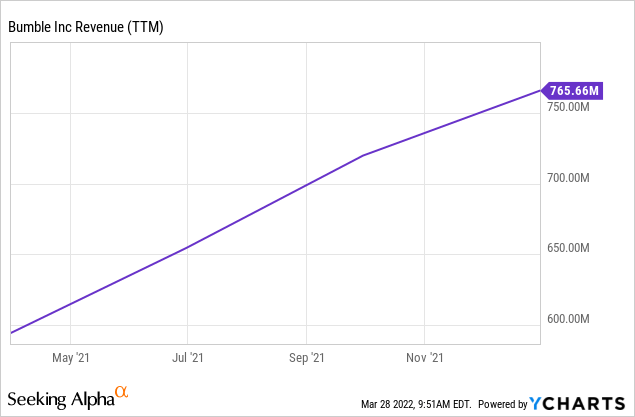

Despite these limitations Bumble has managed to increase paying users and revenue, as can be seen in the graph below. While this is encouraging, the growth is far from spectacular, and what worries us the most is that we don’t see much operating leverage.

Financials

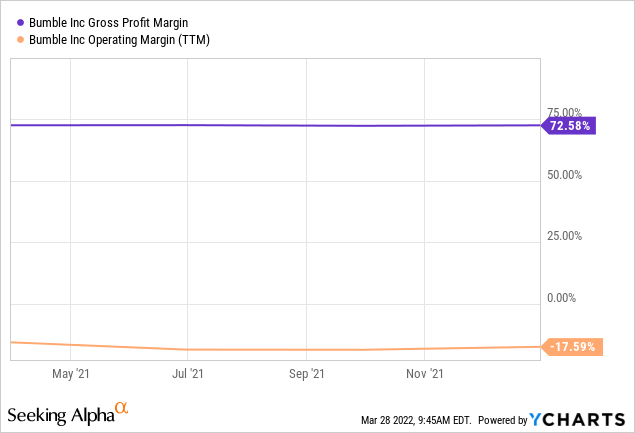

While the company has relatively attractive gross margins ~72%, notice below how the operating margin has remained flat despite the growing revenue. We do not see any sign of operating leverage from the company, or that it is on a path to profitability. We find this very concerning, and it is the main reason that has kept us from investing in the company.

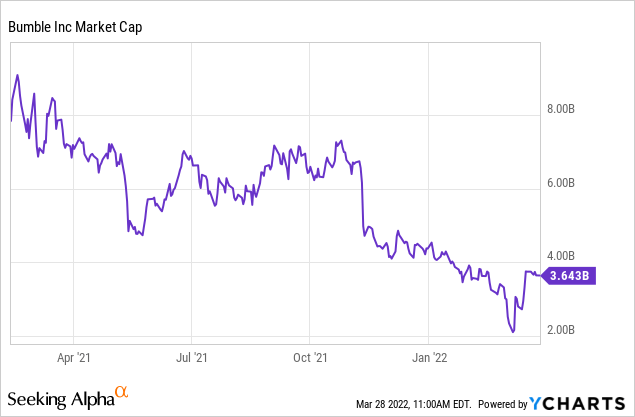

If this was priced into the share price, we might consider a small speculative position with the hope that eventually the company would figure out how to improve profitability. The problem is that the company is valued at more than $3 billion, which is more than 4x its trailing twelve months revenue. This is far from cheap and does not, in our opinion, reflect the fact that the company is having trouble generating operating leverage. We are not ready to invest at this valuation without a clear path to profitability.

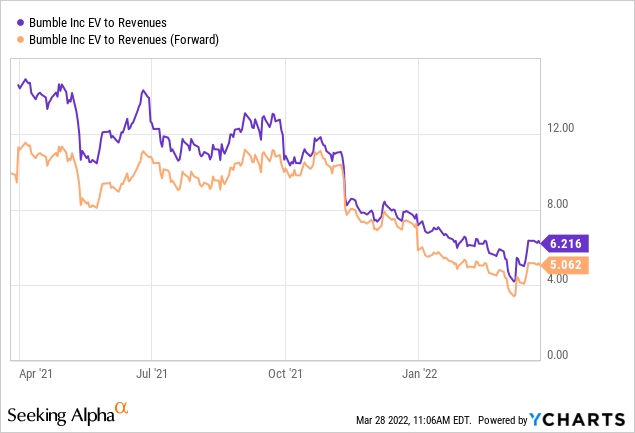

Valuation

Some will say that the valuation is attractive because it is trading at ~5x forward EV/Revenues. While this might be cheap for certain software SaaS businesses, we think in this case it is far from a bargain given the relatively low revenue growth and the lack of operating leverage. It is certainly cheaper that where it was previously trading, but it just might be because many investors are coming to the realization the profitability is nowhere in sight.

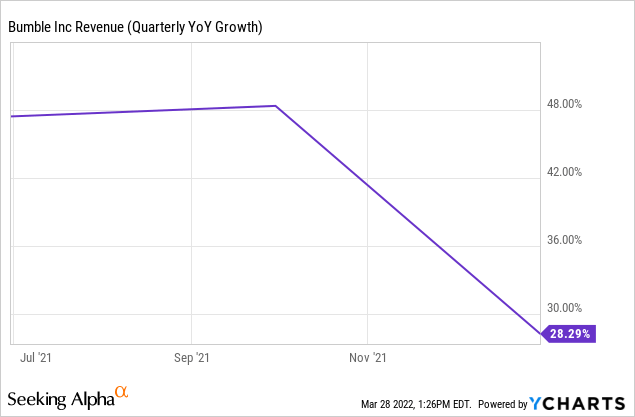

Not only is revenue growth far from spectacular, it is actually decelerating. At one point it was close to 50% y/y, and now it has reduced to ~28%.

All of these factors combined paint a less than pretty picture, and that is why we would recommend investors to either wait for fundamentals to improve before investing, or to simply pass on this company. We think the one factor that might be able to turn things around for the company is if it managed to re-accelerate user growth and/or premium subscriptions, but that is something that remains to be seen.

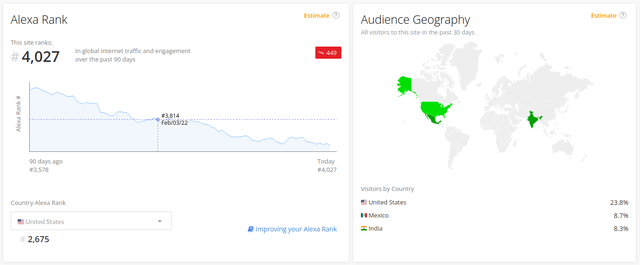

Looking at visits to their website (which admittedly is not the same as app downloads, a data point unfortunately not available), we see that there has been a noticeable reduction the last few months. This might be a precursor to further disappointing growth numbers in the next quarter. Notice how the Bumble.com website went from being the #3,578 most popular website in the world 90 days ago, to #4,027 today, that is a descend of almost 500 positions in only three months.

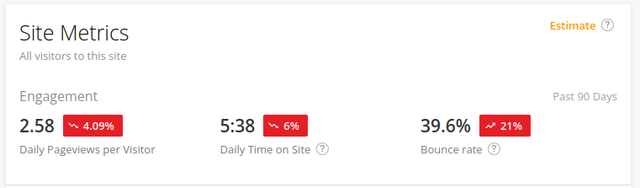

Similarly looking at other engagement metrics such as page views per visitor, time on site, and bounce rate, they all have experienced deterioration in the past 90 days.

Conclusion

The biggest problem we see with Bumble is lack of operating leverage and the fact that there is no clear path to profitability at the moment. In addition there is the issue of decelerating revenue growth which further complicates things. For all these reasons we think that Bumble is not cheap enough to warrant an investment, and we would like to see clear signals that there is a path to profitability before investing.

Be the first to comment