AsiaVision/E+ via Getty Images

Overview

I recommend buying Bumble (NASDAQ:BMBL). Online dating has seen increased penetration due to the global expansion of online dating apps and liberalization of social norms around online dating. I believe BMBL is well positioned in this industry with more than a decade of experience to take advantage of this trend.

Business description

The BMBL platform allows people to connect and form relationships. Bumble now operates two apps, Bumble and Badoo.

- The Bumble app, which debuted in 2014, was one of the first dating apps designed with women in mind.

- The Badoo app, which debuted in 2006, was one of the first to offer free web and mobile dating services.

Online dating is here to stay and the market is huge

Online dating has spread quickly, in my opinion, because of the proliferation of dating applications and the normalization of its use. As younger generations get more comfortable with technology, we may anticipate a further increase in the number of people using online dating services. Additionally, people use or have two different applications installed on their phones simultaneously to help diversify their network and boost the likelihood of discovering effective connections, proving that the online dating industry is not a “winner-take-all” market.

According to BMBL’s S-1, the percentage of single North Americans who used an online dating app in 2016 was around 22%; by 2020, that number had risen to over 43%, and it is expected to rise to around 59% by 2025. I also see fresh potential in emerging markets outside of the industrialized world, including some countries with much more challenging gender dynamics that can reap the benefits of online dating apps.

Despite satisfying some of the most fundamental human needs, like the yearning for love and companionship, just 16% of North American online daters and 15% of freemium mobile app users pay for their apps (according to BMBL prospectus). I believe that the substantial disparity between what customers is prepared to spend for online dating and current monetization levels will promote long-term growth in online dating’s average revenue per user.

And I predict that the freemium part of the online dating business, which includes applications like Bumble and Badoo that are free to use but provide optional premium paid services, will expand at a quicker rate than traditional web-based goods, which require upfront paid subscriptions.

Underlying technology provides further insights to optimize user experience

It’s a cliché, but I think the best way to close a sale is to focus on the customer’s experience. BMBL has been consistently successful in this regard.

I believe that BMBL’s technology is the primary differentiating factor for its platform. In order to run hundreds of tests on the entire audience at once, they routinely push out live changes, typically once per week to our mobile app and twice per day to their server backend. Due to the speed of this testing framework, BMBLs can improve the quality of the user experience.

One of the main things that I think was a good move that legacy companies will find difficult to reproduce is the usage of common infrastructure. By sharing a common backend, the Bumble and Badoo applications can pool their users’ data and better serve them both. As a result, BMBL is able to switch between apps and try out new features much more quickly. For instance, it took six months to establish a video chat function for the Badoo app, but only two months to migrate that feature to the Bumble app. This allows them the freedom to share features where it makes sense, which boosts scalability through quicker app improvements and operational efficiencies through reduced costs associated with introducing new features. Due to the consolidated resources, I am confident that BMBL can efficiently innovate and grow as they branch out from the niche of online dating into other regions and product types. This is a huge competitive advantage that doesn’t show up in the numbers, but which I anticipate will pay off big for BMBL as it grows.

Significant room available to monetize the app

The rise of the world’s singles population, the rising popularity of online dating, and the rising willingness of users to pay all point to a bright future for BMBL’s primary business.

Gaining a larger portion of the current market is the most direct route to growth for BMBL. There’s a lot of potential value for BMBL if their products are widely adopted in the markets where they’re already active. I believe Bumble can continue to capitalize on brand marketing and effect, as well as product leadership, to increase its user base in North America, a region where it now serves only a small portion of the total addressable market. Where there has been less emphasis on brand investment in the past, such as with the Badoo app, I think there is a potential to raise spending on marketing to generate improved awareness and word of mouth acquisition in core areas.

Otherwise, entering adjacent markets is a natural next step. I think BMBL is only starting to expand the Bumble app internationally. Initial results from BMBL’s entry into the European, Asian, and Latin American markets give me faith in the wisdom of the company’s global expansion. The good news is that BMBL has been around for a while and has created local operations in many different parts of the world, as well as profited from insights about dating behavior gleaned over the course of more than a decade. Bumble’s marketing prowess and the power of their cause should help them grow swiftly.

At long last, there’s room to enhance BMBL’s monetization. Think about how many streaming services there are; a price increase of 50 cents to a dollar per month is unlikely to be noticed. One dollar out of ten may not seem like much, but 10% more money goes straight to the bottom line. I think BMBL is only getting started monetizing, and I expect them to steadily increase paying users and average revenue per paying user. That said, if companies want to see a rise in the use of in-app purchases, it’s likely that they’ll have to create brand-new monetization tools or significantly enhance their existing ones.

Growing into adjacent markets is a viable strategy too

The mission of the BMBL brand and its products is to encourage women to go for their goals in all areas of life, not just romantic relationships. Bumble’s management is confident that, with the help of user feedback and feedback from the development team, the company may expand into any and all spheres of society.

It is BMBL’s intention to begin investing in marketing and product development, as well as building a monetization strategy for these and other prospective new product categories, beginning with the platonic friendship and business networking products Bumble BFF and Bumble Bizz, respectively.

While I do have my doubts, I do think there is possibility for Bumble BFF MAU to grow in this area. Finally, growing the platform will boost BMBL’s TAM and lifetime value for existing users.

Strong and reputable brand is important in the online dating world

The company’s founders set out to change the world by challenging harmful gender stereotypes and encouraging online accountability and kindness. With the Bumble brand, it’s always the woman who makes the first move. BMBL is changing the atmosphere for the better by rewriting the script on gender norms through the creation of a platform that is safe and empowering for women.

Their dedication to advancing the status of women serves as a cornerstone of their business and has proven to be quite successful. I think BMBL’s brand has an edge in the market since customers are increasingly drawn to companies with strong social missions. Sixty-three percent of consumers worldwide, according to Accenture, are more likely to buy from companies with a goal than from those without one.

Latest earnings review

It’s fair to say that Bumble’s end results were a bit unexpected and inconsistent. Positives include Adj. EBITDA exceeding estimates in Q3, net additions to the Bumble app being in line with forecasts in Q3, and BMBL reiterating its guidance for at least 100bps margin expansion in 2023. In spite of this, Bumble’s quarterly revenue missed expectations, leading BMBL to reduce its fourth-quarter guidance by $20 million.

The revenue guidance for 2023, which ranged from mid- to high-teens year-over-year growth and high-teens to low-20% constant currency growth, was better than I had anticipated. This suggests only a moderate decline from the 21% constant currency growth in 4Q. The margin expansion forecast for 2023, of at least 100bps, also came in above estimates. While a decrease in the numbers is necessary, this was anticipated and eliminates a major overhang to the remainder of the year.

A disappointing 8- to 10-week delay in the deployment of some monetization capabilities is the latest in a spate of product issues across the online dating sector, which is where I place the bulk of the blame. I am aware that BMBL has had mixed outcomes as a whole, and that the company may find itself in the “show me” camp with certain investors due to the problems with its products.

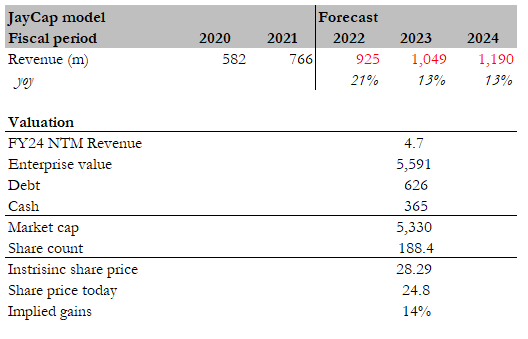

Forecast

Based on my investment thesis, I expect BMBL to continue growing at a healthy rate of low-teens percentage post FY22 (I used management guidance in FY22). As I mentioned earlier, the TAM is huge, so there should be no issues for BMBL to continue capturing dollar share by capturing new users or increasing monetization. I expect BMBL to generate $1190 million in revenue in FY24. Assuming BMBL does that and trades at the same forward revenue multiple as today, it should be worth $28.29.

Author’s estimates

Key risks

Competition from MTCH

Bumble’s main rivals, owned by Match Group (MTCH), are the dating apps Hinge and Tinder. While it’s likely that the vast majority of users will have both applications loaded, the relatively cheap switching cost will continue to act as a long-term shadow over BMBL’s ability to raise pricing.

Bad reputation

A negative reputation can be a serious threat to an app’s success. With so many potential entry points for criminals, this danger is inevitable in the online dating market. That’s why BMBL needs to keep improving their security measures.

Conclusion

BMBL is undervalued. Bumble is an online dating platform with two apps: Bumble and Badoo. Bumble, which debuted in 2014, was one of the first dating apps to put women first. Badoo was one of the first companies to offer free web and mobile dating services, having launched in 2006. I expect the online dating market to expand further as new generations of young adults become more digitally literate and mobile-savvy. The freemium online dating market, which includes apps like Bumble and Badoo, is expected to drive increased online dating penetration.

Be the first to comment