vitranc

Over the past few months, the consensus on the housing market has turned increasingly negative as higher interest rates discourage construction and make affordability far harder for many prospective homebuyers. As evidenced by a decline in home prices last month, there is no disputing the housing market has slowed. However, given my view, that the housing market’s medium-term fundamentals are quite positive, the bearishness is creating opportunities. In particular, I would highlight Builders FirstSource (NYSE:BLDR) as a stock which at a 4x multiple is just too cheap to ignore.

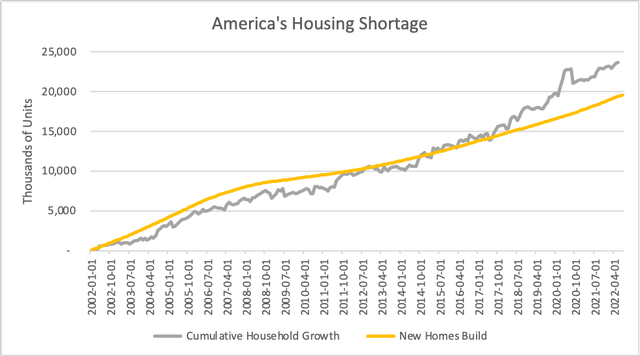

With mortgage rates approaching 7%, there are many prospective buyers in a state of shock over how expensive a mortgage is, and that has pushed many to the sidelines. Given that, you may be tempted to feel that the housing market is too tough, and better investments are to be found elsewhere. I though keep going back to this fundamental support point: we have a significant shortage of housing. As you can see below over the past twenty years, about 23 million new American households have formed. But, we have only built 20 million new homes, leaving us 3 million short.

St. Louis Federal Reserve and my own calculation

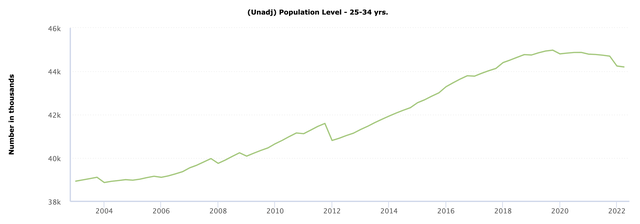

The housing market is fundamentally undersupplied, and it will take several years of elevated construction activity to close the gap. As a consequence, I expect the housing market to hold up better than many expect, as tight supply should keep prices from falling much, keeping builders profitable and looking to start new projects. This is particularly true because the 25-34 year-old population has risen substantially over the past fifteen years. 25-34 is the primary time individuals leave roommates or move out from their parents and form their own household. This should keep the household formation pace elevated and support ongoing home-building.

Whenever a stock is trading 4x earnings, it is probably safe to assume that the company either has a really poor balance sheet or the market is extremely skeptical that the current pace of earnings can be sustained. Well, as I will discuss below, Builders FirstSource has a solid balance sheet, and the issue is one of earnings sustainability. Given my view that the US housing market is fundamentally quite tight, I think construction will hold in better than expected, which in turn will preserve much of BLDR’s earnings power. Combine that with its extraordinary free cash flow today, and the potential upside is significant.

First, even bears on the company’s future should concede that Builders is performing at a high level today. In the company’s Q2, revenue jumped by 24% to $6.9 billion, spurring an 80% increase in adjusted EBITDA to $1.5 billion. Core organic revenue growth was 12%, with the balance coming from acquisitions and non-core commodity price movements. EPS more than doubled to $6.26, and the company generated $900 million in free cash just in the quarter. About 80% of the business is tied to single-family construction, 6% multi-family, and 14% to repairs and remodels, giving the company more exposure to new construction than retailers like Home Depot (HD) or Lowe’s (LOW). While HD and LOW sell directly to consumers, Builders FirstSource primarily sells its products to homebuilders. As homebuilding accelerated since COVID, the business has blossomed.

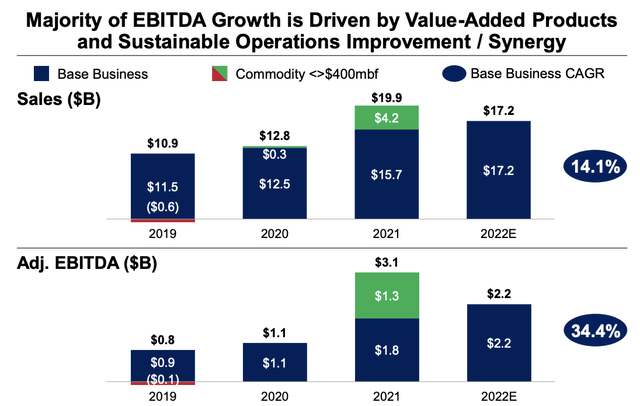

Now, some of this growth has been due to the surge in commodity prices. The below chart separates out the Builders FirstSource’s revenue and EBITDA by its ongoing base business from the impact of commodities. In 2021, as lumber and other building materials soared, that added $4.2 billion to revenue and $1.3 billion to EBITDA, benefits which are now washing out this year. In a sense, in 2021, the company “over-earned” its true potential with one-time benefits. Management though has used this windfall to buy back stock, deleverage its balance sheet, and do tuck-in acquisitions, thereby increasing the per share earnings power permanently going forward.

The growth we are seeing in the base business is not an accident, but consistent with the company’s long-term plan to move away from just supplying raw materials to also supplying custom products. By moving away from commodity products to value-added products like windows, doors, and manufactured products, the company has grown revenue by 12x since 2007 and free cash flow by 24x. This shift to higher margin and more differentiated products has been deliberate and successfully grew the business even before the post-COVID boom.

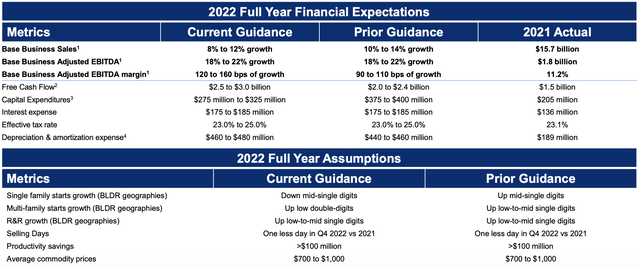

The increased durability of the business is apparent when we look at the company’s updated financial guidance. Recognizing the slowing we are seeing in the housing market, it revised down its single-family housing starts from up mid-single digits to down mid-single digits, a drop of about 10%. Yet, base sales growth was just revised down just 2% to 8-12% with EBITDA unrevised at up 18-22% thanks to higher margins. Growing EBITDA even as housing starts decline is a particularly resilient performance. As a consequence, its free cash flow midpoint increased by $550 million to $2.75 billion, up from last year’s commodity-supported $1.5 billion figure.

Builders FirstSource has taken advantage of the post-COVID boom in its free cash flow generation to do several things. First, it has strengthened its balance sheet with net debt-to-EBITDA of 4x in 2017 dropping to 0.8x today. That financial flexibility prepares it well for a sharper-than-expected slowdown and gives it capacity to do opportunistic M&A. In 2021, BLDR spent $1.2 billion in cash on acquisitions to deepen its windows, doors, and value-add business. It also repurchased $1.7 billion of stock.

So far in the first half of 2022, the company has repurchased another $1.3 billion of stock. That has reduced the share count from 208.3 million to 171.5 million over the past twelve months, a decline of 17.7%. At $64 a share, BLDR is trading just 3.4x free cash and about 4x earnings. By reducing debt, expanding its presence in value-add products, and taking out share count, management has taken advantage of the post-COVID surge in cash flow to fundamentally transform the business, putting it permanently on a stronger footing today than it was in 2019. Being a supplier to homebuilders, BLDR will always be a highly cyclical business, but BLDR is far better positioned to manage through the cyclicality than before.

With second-half cash flow, BLDR has the capacity to repurchase another $1 billion in stock while still building cash, enough to retire another 11% of its share count. With the rapid reduction in shares taking place this year, even if absolute earnings fall, earnings per share (which ultimately underpins the value of a stock) could hold steady.

As the lower rate of housing starts feeds through fully to financial results, I do expect to see revenue to continue to decelerate but continue to outpace housing activity as its manufactured products provide greater stickiness than pure commodities. Given the housing shortage, I don’t expect construction to fall more than mid-single digits meaning BLDR’s base business should be flat to down 5% in 2023, enough to generate at least $1.5 billion in free cash flow and at least $10 of EPS. With buybacks helping to support the price and the market growing more comfortable with the resilience of earnings due to the smart capital allocation policies of management, I think the stock should receive at least an 8x multiple or trade to $80, representing 30% of upside.

Ultimately, the biggest risk to my thesis is that despite the shortage the housing market falls much more deeply for longer, leading to double-digit declines in construction. Even if BLDR’s revenue can outpace the housing market, it would register more meaningful declines. Still, at the current share price, earnings could fall 70%, and the trough earnings multiple would be 15x. For a company generating such substantial free cash flow, that is providing quite a cushion. And as the stock falls, its buyback power becomes even more powerful.

I believe the risk/reward in BLDR is extremely compelling given its shift away from commodity product, the medium-term fundamentals of the housing market, and its valuation. In fact, as I have researched the company more closely, I have grown so bullish I plan to buy shares in the coming days. I would recommend you do as well, with a price target of $80.

Be the first to comment