Alex Potemkin

I have been working through updates on stocks that I covered earlier in the first half of 2022. Yesterday I covered BlueLinx Holdings (BXC), a small-cap building products distributor. While a recession could have a negative impact on the business, shares are extremely cheap, and the company has been buying back tons of stock recently. Today’s article will cover a different company in the same sector. Builders FirstSource (NYSE:BLDR) is a larger building products distributor, but it is also very cheap and buying back gobs of stock at cheap valuations.

Investment Thesis

Builders FirstSource is a large building products supplier in the US. Shares of the company have seen massive returns over the last couple of years as EPS has exploded. They also strengthened the balance sheet and have spent a good chunk of the last couple of years on an acquisition spree. While that may slow down in the near term with the economic uncertainty, I think they will continue to gobble up smaller companies and consolidate on their size and scale advantages.

Shares aren’t quite as cheap as BlueLinx, the company I wrote up yesterday, but at 5.6x earnings, they are still cheap in my book. As long as earnings don’t decline significantly, all it would take is a little bit of multiple expansion to drive attractive returns for investors. They are also buying back a ton of stock at these cheap valuations. They boosted their buyback program to $2B after Q1, and with shares trading below the Q1 range, I would assume they have been fairly aggressive in buying back stock in the last quarter. For investors with a long-term time horizon, Builders FirstSource is a buy if you are looking for exposure to the building industry.

The Business

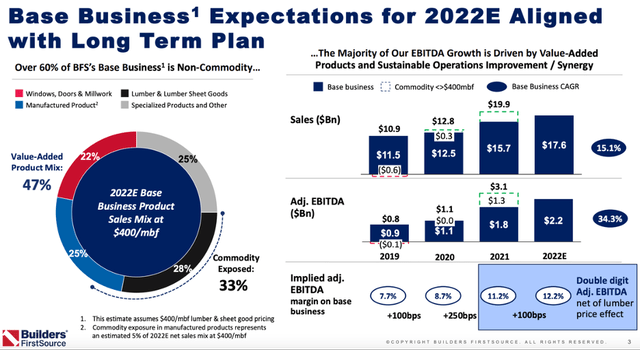

While some investors might be worried about the potential for a recession and the possibility of crashing lumber prices, Builders FirstSource should be able to handle a slowdown in economic activity. About a third of their product mix is exposed to commodity prices, and sales have been impressive over the last couple of years. Below is the company’s product mix, which includes a large portion of specialized products outside of lumber and lumber sheet goods.

Business Overview (bldr.com)

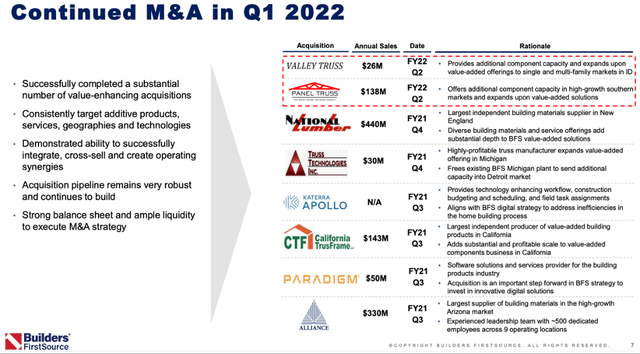

Like BlueLinx, Builders FirstSource has used the operating environment over the last couple of years to delever the balance sheet and set themselves up for whatever may come next. One of the things that is different about Builders FirstSource is the scale of the company. The market cap is $11B, which is much larger than BlueLinx. They have also used the last couple of years to acquire several smaller competitors.

M&A (M&A (bldr.com))

I wouldn’t be surprised if the acquisitions continue. It is possible that they slow down in the near term as the economic picture has gotten worse, but over the long run, I think Builders FirstSource is likely to continue to gobble up smaller players in the industry. While the M&A run has been impressive, one of the biggest drivers of the bullish thesis on Builders FirstSource is the cheap valuation.

Valuation

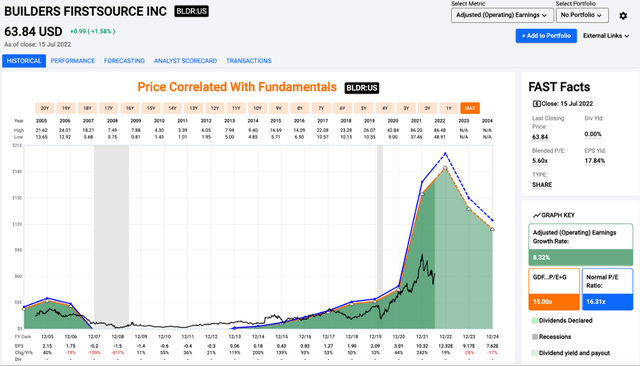

While most stocks have spent the last couple of years at elevated valuations, Builders FirstSource is still cheap at 5.6x earnings. This is even after impressive returns from COVID selloff lows near $10 as EPS has exploded in the last couple of years. This is not quite as cheap as BlueLinx, but that is to be expected in my opinion given the size of the company.

Price/Earnings (fastgraphs.com)

While the short term may be bumpy with the economic picture looming as a major uncertainty, I think multiple expansion is likely in the long term, especially if EPS doesn’t decline significantly. While I wouldn’t make any bets on 15x earnings in the next couple of years, even a bump in valuation to 10x earnings would lead to very attractive returns. Another reason to get excited about the cheap valuation is the large buyback program.

Buybacks

Like BlueLinx, Builders FirstSource is buying back huge amounts of stock at cheap valuations. With their first quarter report, Builders FirstSource upped the buyback program from $1B to $2B (replacing the original $1B buyback). This is after repurchasing 3.6M shares in Q1 for $286M. This is a huge buyback program for a company with an $11B market cap. We will see what the repurchase activity was like for Q2, but the share price was lower than Q1, so my guess is that they will have been more aggressive as the price dropped.

Conclusion

While Builders FirstSource isn’t immune to a recession, they are not as exposed to lumber prices as some investors might think. The other thing that offsets recession risk is the cheap valuation at 5.6x earnings. The business, and especially the balance sheet, are in good shape after the last couple of years, and they have been growing via acquisition in a meaningful way. If your time horizon is 3 to 5 years instead of 3 to 5 months, I think you might find Builders FirstSource to be an interesting choice.

Be the first to comment