Petmal

Main Thesis & Background

The purpose of this article is to evaluate the BlackRock Utility & Infrastructure Trust (NYSE:BUI) as an investment option at its current market price. The fund is managed by BlackRock, and its objective is to “provide total return through a combination of current income, current gains and long-term capital appreciation”. BUI seeks to achieve this objective by investing in equity securities issued by companies in the Utilities, Infrastructure, and Power business segments and by utilizing an option writing strategy.

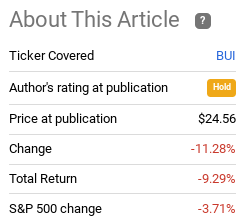

I have owned BUI for the long term but was reluctant to add to this position since the summer. This patience has been rewarded so far, with BUI almost in correction territory since my last review:

Fund Performance (Seeking Alpha)

As we approach the start of 2023, I wanted to take another look at BUI to see if I should switch to a buy rating again. After some thought, I do see renewed value in the fund where I haven’t in a while. I think buying in now is a reasonable option and will explain why in detail below.

Valuation Is Back To A Nice Discount

The first topic to touch on is a simple one – but also very important. This is valuation, which my followers know is always critical in my evaluation of any CEF. While I have liked BUI’s strategy and make-up for years, that doesn’t mean I will buy it at just any price. Back in August, the fund was sitting with a premium to NAV in excess of 3%. The patient investor in me told me to wait for a better price to come along as that seemed too rich.

Fortunately, with BUI dropping over 9%, a more reasonable valuation has indeed presented itself. Aside from a cheaper market price, BUI now sits with a discount to NAV near 6%, as shown below:

My takeaway is BUI is now a very reasonable value. I will get to why I like the fund’s make-up in the following paragraphs, but a top-line review of the price on offer suggests to me now is a good time to buy. A 6% discount is attractive for most of the CEFs I cover, and BUI is not an exception to this.

Inflation Has Been Easing, Good News For Utilities

The next topic is a macro one. This relates to interest rates, with the outlook for rates driven heavily by inflation. As anyone following the market in 2022 knows, inflation has been red hot most of the year. This has pushed the Fed to embark on an aggressive rate hiking path, punishing stocks and bonds alike.

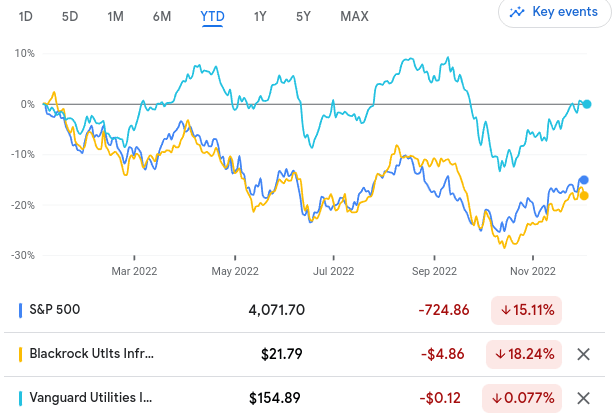

While Utilities as a whole has held up reasonably well compared to other sectors, the impact has still been negative on BUI. As a global and income-oriented fund, the geo-political risks in Europe and consistent higher rate environment across the developed world have made BUI less attractive. Nowhere is this more evident than comparing BUI’s performance against a straight-line Utilities SPDR, such as the Vanguard Utilities ETF (VPU):

YTD Performance (Google Finance)

When we factor in BUI’s yield, it does give the fund a better total return than the S&P 500. But the lag against the broader Utilities sector is notable. This is likely due to the European exposure, as well as the general sell-off the market has taken towards income-oriented products. While Utilities as a whole could be considered an income-oriented play, BUI is an amplified version of that because of its call writing strategy. If investors are moving out of equity income plays due to rising rates, then BUI is almost always going to drop by more than VPU.

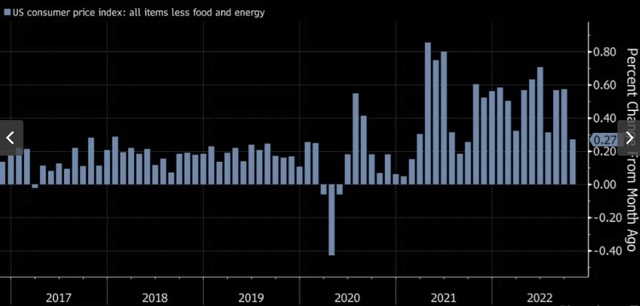

Of course, the opposite could also be true, and that is the good news here. While 2022 has been the year of inflation, there are signs this is starting to ease. The logic would follow that if inflation has peaked, the Fed will pump the brakes at a bit, and funds like BUI have some breathing room. To understand where this is coming from, consider that October’s increase in core inflation was the smallest in over a year:

US CPI (Month over Month) (Department of Labor)

This is an encouraging sign and one that the Fed is already starting to evaluate. While the Fed has been raising its benchmark by .75 basis points generally, there is an indication it could downshift to a .50 basis point move later this month:

Powell’s Prepared Statement (Federal Reserve)

Source: Fed Chief Jerome Powell’s Statement

The premise here is that if an aggressive Fed and higher interest rates have disproportionately hurt BUI, then a shift in this policy should disproportionately help it. I do see a less hawkish Fed going forward into 2023, and I think BUI’s market price here is worth the risk to bank on it.

More Than Just Utilities, I Like The “Waste” Positions

Aside from being a global fund, BUI also differs from passive Utilities ETFs due to its domestic holdings too. This is another reason why I find BUI compliments my VPU exposure, rather than using it as a replacement. BUI’s call writing strategy, foreign holdings, and more liberal definition of “utilities” makes it a more rounded investment. While defining “utilities, power, and infrastructure” can be done loosely, I think this gives the fund managers a lot of discretion in deciding what to include – so I view it positively.

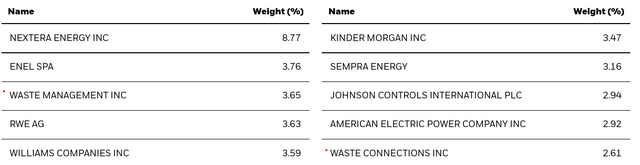

For example, two of BUI’s top holdings are not even remotely in the Utilities space. They are both actually in waste collection, representing over 6% of total fund assets:

BUI’s Top Holdings (BlackRock)

This is good for diversification but more importantly I actually like this space. This is a necessity if there ever was one, as Americans are producing more and more trash every year. The business is stable/growing modestly and makes for a great defensive name. With recession fears top of mind, finding businesses that are “recession proof” makes a lot of sense going into 2023. And waste collection, by both Waste Management (WM) and Waste Connections (WCN) are top names in the sector.

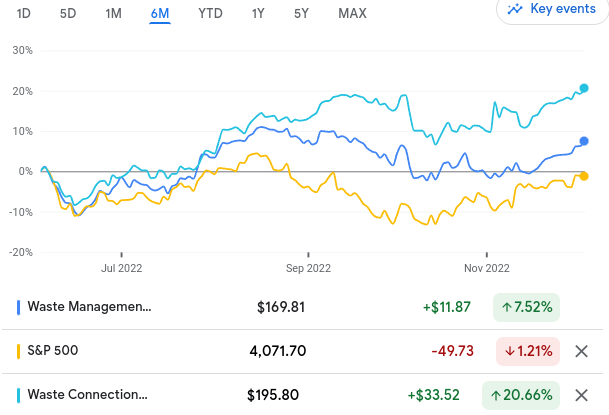

This is an idea I actually touched on over the summer, when recession fears really flared up. Readers should note that these names have already performed extremely well – so it makes sense to manage expectations and not expect outsized gains to continue uninterrupted:

6-Month Performance (Google Finance)

The conclusion I draw here is the inclusion of these names is a good thing for the fund. It has clearly helped performance in 2022, and I like the fact that these companies offer a service that is recession resilient, domestic in nature, and have the ability to pass through higher cost to end users (after all, what neighborhood will be willing to go without trash service!). This makes me confident BUI can continue to add value to my portfolio and helps to justify my “buy” rating at the moment.

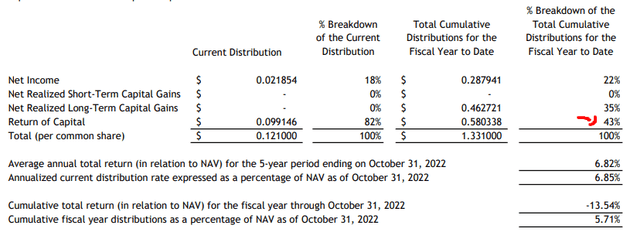

Income Level Is High, Monitor ROC

The next topic I will discuss is the fund’s income. With a current yield over 6%, BUI seems like a reasonable income play. With the share price down markedly this year, that income has been more valuable than ever (helping to boost total return and/or allowing investors to reinvest the distribution at a lower cost basis). While that is the good news, that bad news is this income stream has been under pressure with the fund shifting towards using more return of capital to pay it. Through this fiscal year, 43% of the distribution has been a result of ROC:

BUI’s Distribution Info (BlackRock)

Now, I don’t want to read into this too much. BUI has paid out a consistent income stream since August 2014. This gives me a lot of confidence. But ROC is something we will want to monitor going forward. Many CEFs have seen their income streams cut in 2022. BUI is different, because it relies less on leveraged borrowing to pay out a higher distribution than the average CEF. The use of writing options puts the fund less at risk of higher borrowing costs due to Fed rate hiking. So this is a positive. Yet, the fund still is relying on ROC to a large degree. So I would suggest keeping a close eye on this in the months to come.

Europe Remains A Key Risk

While my tone has been mostly positive so far, we do have to consider the risks facing BUI. I like the value and the outlook but let us remember the fund is still in correction territory for the calendar year. There are market forces at work pressuring the fund, and some of those remain on the table as we approach 2023. Just because the calendar reads “January” does not mean those headwinds will magically disappear!

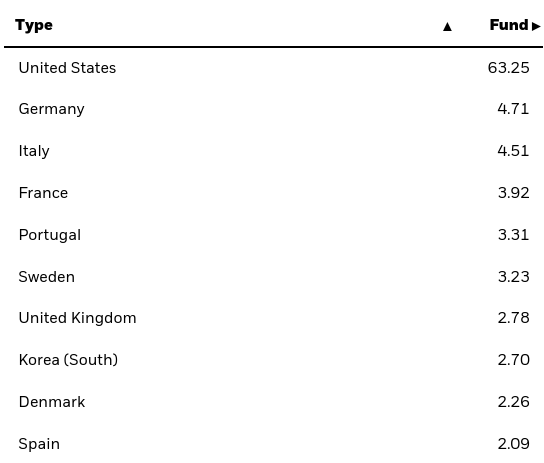

Chief among my concerns is the European exposure. This has almost certainly been a drag on the fund and a reason why it has underperformed a benchmark like VPU (which is almost purely domestic). BUI is still mostly American, to be fair, but it does hold a meaningful amount of European-based equities:

BUI’s Geographical Make-up (BlackRock)

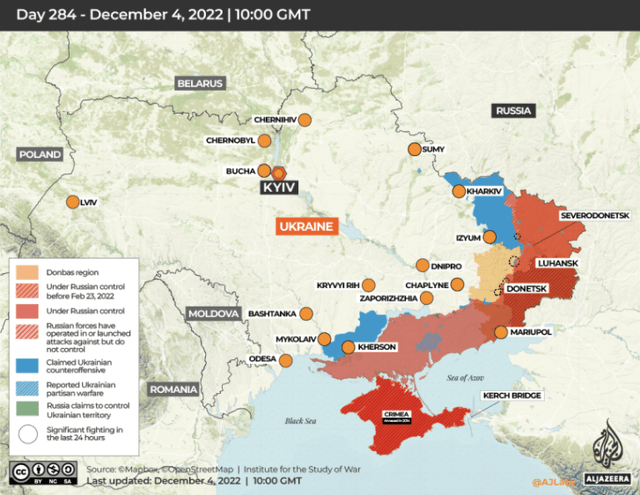

I don’t need to go into much detail on why this is a headwind for BUI. All market followers are surely aware of Russia’s invasion of Ukraine, the risks of escalation from that conflict, and the resulting energy crisis that Europeans face this winter. While utility providers can benefit from rising gas and oil costs and from government funding/support of the sector, the ongoing volatility and uncertainty counter-balances that benefit.

The bright side is these countries (and underlying companies) are not directly impacted by the conflict as they are headquartered outside of Ukraine/Eastern Europe. But they are close enough that it could make an impact and it is also already impacting investor sentiment on the region as a whole. If we look at a current map of the conflict, we see it is widespread across the Ukrainian border and along shipping routes. To suggest this could not escalate beyond these territories in 2023 is naive at best:

Map of Russia-Ukraine Conflict (Al Jazeera English)

The thought here is to manage risk appropriately. I think BUI strikes a nice balance, but some investors may not want any European exposure in this space. I wouldn’t necessarily fault them for that and I will continue monitoring this unfortunate humanitarian disaster very closely going forward.

Utilities & Power Companies Not As Boring As They Used To Be

My final point touches on the continuing opportunity with the power grid/utility space. This is often thought of as a “boring” or steady sector. Utilities and power providers have long provided stability, consistent revenues, and above-average income streams. The idea is this heavily regulated space is a basic community necessity and served as a bond proxy in some respects. This used to be an area that investors looked for relative safety and income. Growth and/or excitement is not what this space is known for.

Now I am not going to sit here and propose that BUI is a “sexy” investment. But this is an area that has been undergoing fundamental changes. Simply put, this is not your grandfather’s utilities sector.

Specifically, these companies are on the front-lines of expanding, enhancing, and changing our nation’s power grid. With the sentiment clearly moving towards “clean” and more efficient energy sources, utility companies are positioned to help with this transition more than most. As investors look for “ESG” and other clean investment options, funds like BUI could draw investor dollars when they otherwise might not have.

Beyond just investor sentiment, these are companies that are set to garner federal tax dollars for their efforts. As Congress expands clean energy tax credits and other incentives, utility companies can use those funds to enhance, improve, and optimize their plants and grids with fewer shareholder dollars. Not only will they be accelerating the clean energy transition, they will be getting paid to do so. This is a win-win scenario and one that I want to be a part of as an investor.

Bottom-line

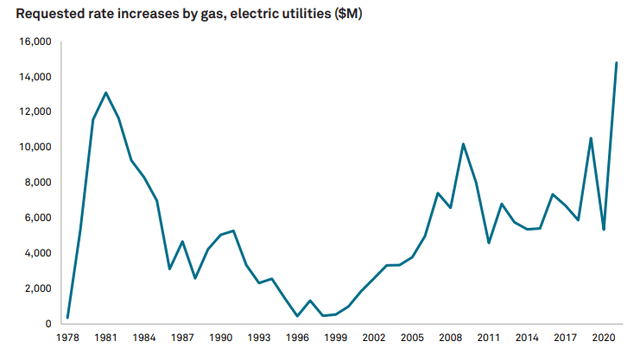

Utilities as a whole has been a reasonable place to hide out in 2022. BUI has been under pressure, but it still leads that S&P 500 and I see a similar scenario playing out in early next year. Beyond the stability and higher than average income stream, this is also a way to help manage inflation risks within a portfolio. Utility providers have been aggressively requesting rate increases and, while these are not guaranteed, are likely to secure a good chunk of them as federal funding for this sector continues to grow:

Requested Rate Increases (Aggregate) (S&P Global)

With all these factors in mind I think there is validity to shifting back to a bullish outlook on BUI. Therefore, I am changing my rating to “buy” and will look to add to my position in the weeks and months to come.

Be the first to comment