RomoloTavani/iStock via Getty Images

Co-produced with Hidden Opportunities

The U.S. economy has constantly been tested by a combination of negative factors that have led to increased awareness, better laws, tighter regulations, better risk management, and other aspects to protect the system and its stakeholders. Global economies have seen a lot in the past century – wars, depressions, bursting bubbles, natural disasters, and other significant crises. The U.S. has been led by leaders who have demonstrated a great deal of integrity, as well as those part of several scandals. Despite numerous challenges that the U.S. economy has faced, one aspect has clearly stood out – the U.S. has shown consistent economic leadership.

“In its brief 232 years of existence, there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking.

We retain our constitutional aspiration of becoming “a more perfect union.” Progress on that front has been slow, uneven, and often discouraging. We have, however, moved forward and will continue to do so. Our unwavering conclusion, Never bet against America” – Warren Buffett (Berkshire Hathaway 2020 shareholder letter)

Our economy is rapidly recovering from the COVID-19 pandemic. We recently saw one of the most significant declines in unemployment in history. The U.S. unemployment rate dropped to 3.6% and is close to the pre-pandemic levels. Average wages are higher, and job creations are ahead of estimates. In fact, the biggest “problem” that seems to be facing the U.S. economy today is that there are far more companies looking for workers than there are workers.

What does this mean? It means that U.S. companies are looking to expand at an unprecedented pace. There are concerns about high inflation and the Fed’s rate increases, but remember that the economy is never near perfect for investors. Consumers remain strong, with relatively low levels of debt and higher than historical levels of savings.

We primarily invest in corporate America – the more popular, large, and mega-cap companies that touch several aspects of our everyday lives, either through index funds and ETFs or individual stocks. Interestingly, the middle market (the segment of American businesses with annual revenues roughly in the range of $10 million to $1 billion) is responsible for nearly one-third of private-sector GDP and employment but presents barely 3% of all U.S. businesses. It would be the fifth-largest global economy if this were its own country!

The middle market is the backbone of our economy, and the opportunity is largely unknown and often restricted to very high net worth individuals and large institutions. Even if you could access them through private equity funds, these tend to be opaque and have significant lockup periods.

Today, we present to you two publicly-traded picks that provide you up to 8% yield through diversified exposure to the driving force of our economy – the middle markets. These two BDCs (Business Development Companies) provide vital capital for American companies that are generally a little too big for credit cards or bank financing but not quite big enough to go public via an IPO.

Pick #1: CSWC, Yield 8.2%

Capital Southwest Corporation (CSWC) was formed in 1961 and elected to be regulated as a BDC in 1988. But it makes sense to evaluate this company from 2017 since there was significant restructuring through a spinoff and dissolution of a wholly-owned entity to form the organization you see today.

CSWC invests through middle market debt positions, mostly first lien (91%) and second lien (7%), with an equity kicker. This combination permits high-interest collection and provides significant upside as the portfolio companies grow. The BDC currently maintains investments in 56 portfolio companies.

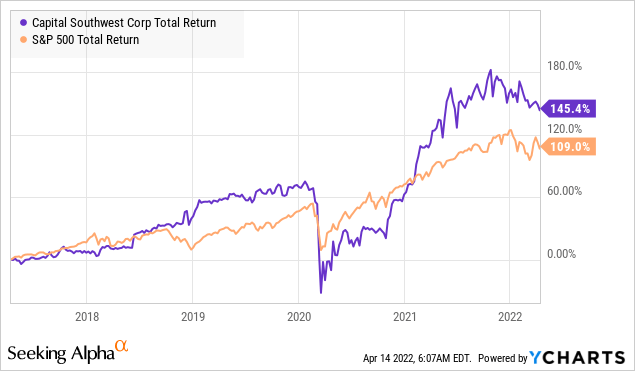

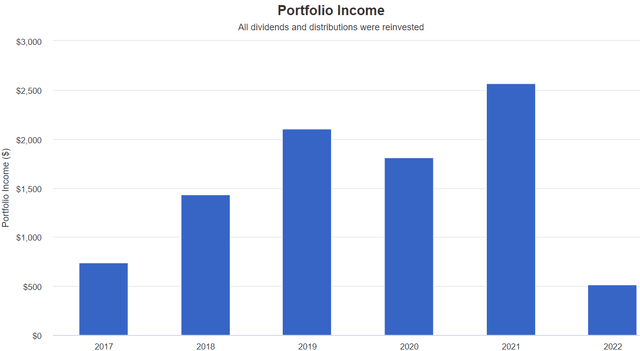

$10,000 invested in CSWC in 2017 would have produced a well-covered $9,170 in total distributions to date, and you would be sitting on a ~45% share price appreciation.

During this period, this BDC has also outperformed the S&P 500 through a combination of large distributions and capital upside.

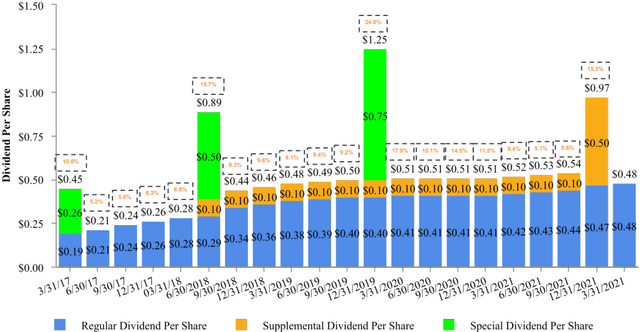

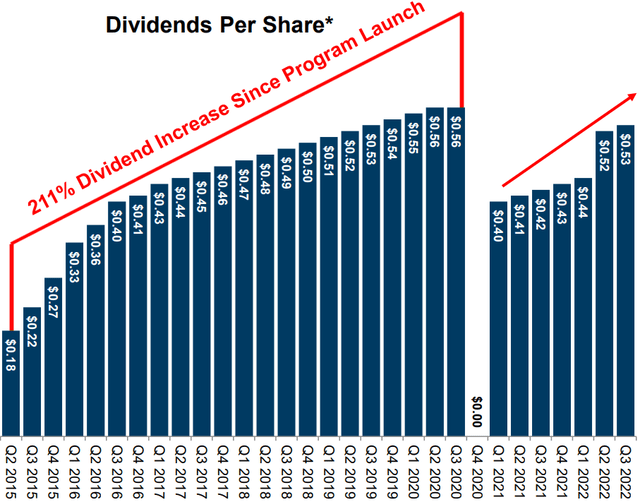

CSWC’s $0.48/share quarterly distribution calculates to an 8.2% annualized yield. However, the basket of goodies gets tastier since this BDC has consistently paid supplemental and special dividends through realized gains from the sale of their equity investments. (Source: CSWC Q3-2022 Earnings)

CSWC Q3 Investor Presentation (February 2022)

CSWC maintained a 105% dividend coverage in 2021, and the BDC’s portfolio continues to swell with capital gains from the improving health of its borrowers. During Q3 of fiscal year 2022, CSWC reported heavy volume in both origination and refinancing activity. Investors can expect a great year from CSWC with dividend raises and special distributions.

“Our investment portfolio continues to perform well, generating $700,000 in net realized and unrealized gains this quarter, bringing the net realized and unrealized gains over the past 4 quarters to $12.2 million. As Bowen mentioned, going forward, we intend to periodically distribute special dividends to our shareholders as we monetize the unrealized appreciation in the portfolio.” – Michael Sarner, CFO

Looking at CSWC’s 5-year dividend track record, I see everything we typically expect from a full-time job – regular paychecks, periodic raises, performance bonuses, and a growing equity position in the business. This makes CSWC an ideal passive income investment.

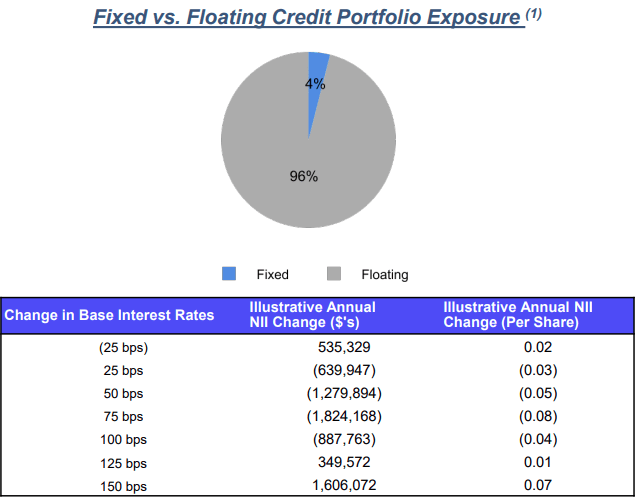

96% of CSWC’s portfolio is floating rate credit, meaning this BDC is well-positioned to get a boost from the Fed’s rate increases. Looking at CSWC’s NII projections, the BDC is set to see a positive impact from rate increases after the first 100 bps change.

CSWC Q3 Investor Presentation (February 2022)

CSWC is very selective in its investments. It chooses companies with a solid history of generating revenues, maintaining positive cash flow, established market positions, and proven management teams with strong operating discipline. This BDC is a solid pick to combat rising rates and swim in dividends from a booming economy.

Pick #2: SAR, Yield 7.9%

Saratoga Investment Corp. (SAR) is another BDC specializing in middle-market lending. SAR has investments in 42 portfolio companies and one CLO fund, with assets spread over 34 distinct industries with an increased focus on healthcare software, IT services, and education and healthcare services.

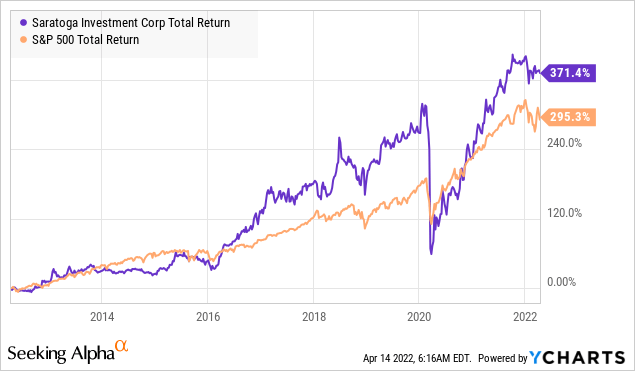

In the past ten years, SAR had massively outperformed the S&P 500, with the divergence accelerating since 2016 when the Fed began its first rate increase since the Great Financial Crisis.

About 97% of the BDC’s assets have floating interest rates, while its debt is primarily long-term at fixed rates. SAR has demonstrated that rising rates are a tailwind factor, and we look forward to history repeating itself in the coming quarters.

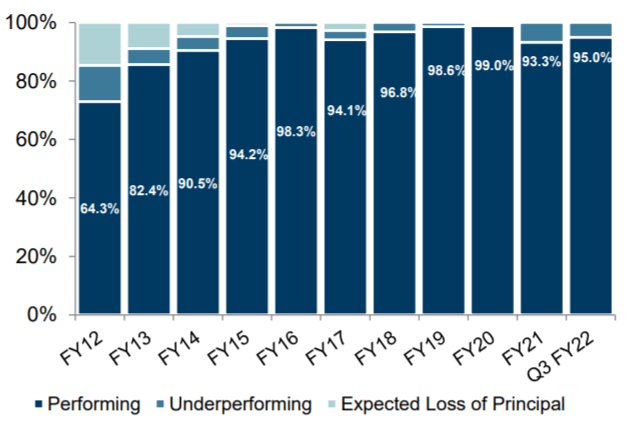

SAR made the unfortunate distribution cut during the beginning of the pandemic, a move intended to preserve the BDC’s balance sheet. During 2020, 93.3% of SAR’s loan investments were performing, indicating that the BDC did not have to eliminate the dividend during that dark quarter. Aside from that stain on its track record, SAR previously had 21 quarters of growing distributions. (Source: SAR Q3 fiscal year 2022 investor presentation)

SAR Q3 Investor Presentation (January 2022)

Since the subsequent quarter, SAR has been raising distributions rapidly, with a current payout just 3.6% below pre-COVID levels. SAR’s portfolio credit quality is quickly improving, with 95.0% of loan investments with the highest internal rating and zero non-accruals at the end of Q3.

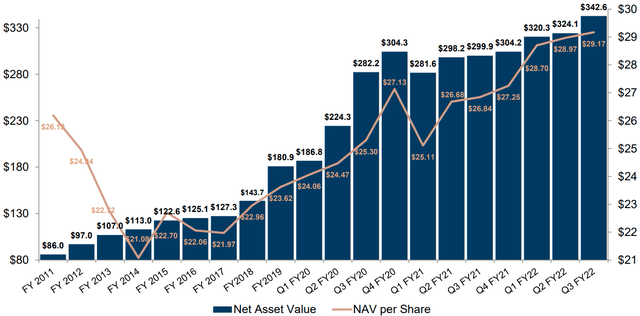

SAR Q3 Investor Presentation (January 2022)

The current distribution represents a 7.9% annualized yield, and investors can continue to expect raises in the coming quarters.

Looking at the NAV/share growth over the years, it is clear that the BDC is clearly earning its distribution payouts. Rebounding strongly from the impact of the 2020 bear market, SAR boasts a 6% higher NAV today vs. pre-COVID levels.

SAR Q3 Investor Presentation (January 2022)

Further, SAR’s dividend coverage stands at a respectable 106%, almost at par with the BDC median levels.

SAR trades at an attractive 6.4% discount to NAV, but this will disappear soon with continued improvement in its portfolio performance and rising rates. Remember, the last time rates began to rise, SAR’s book value discount vanished, and the fund was trading at a healthy premium on several occasions between 2007 and 2020.

Dreamstime

Conclusion

With much easier access to information, convenient ways to make trades, and significantly efficient modes of communicating with fellow investors and exchanging ideas, we live amidst the best times to be an investor. There will always be factors troubling the economy, causing skeptics to predict the worst and scare you into liquidating your equities.

Mr. Buffett, with more investment experience than most readers of this article, continues to believe in the American dream and is confident in its potential. So should you. If you are uncomfortable with the stomach-churning volatility in the markets, then the income method will best suit your needs. It brings reliable, consistent dividends from your equities, so the day-to-day change in the market price becomes less important.

The middle market presents the driving force of the American economy and is largely inaccessible to individual investors. Today, we bring two solid income picks from this economic powerhouse through publicly-traded BDCs. The two picks discussed in today’s article come with up to 8% yields and are well-positioned to benefit from rising rates. The American dream is alive and well, and it is time to push away those doubts and fears and build our income from this booming economy.

Be the first to comment