Bruno Vincent/Getty Images News

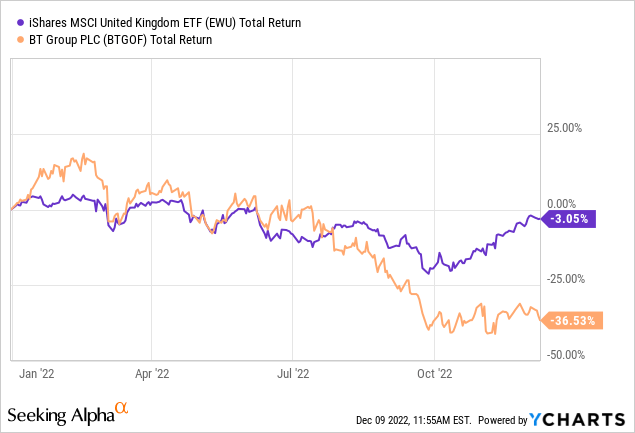

It has been another difficult year for BT (OTCPK:BTGOF) stockholders. Shares of the troubled British telecom giant are down around 30% year-to-date (with dividends) in GBP terms, and have fallen nearly 40% on the same basis since I last covered the firm with a ‘buy’ rating in February. The stock is down 26.5% (again with dividends) since I first covered it back at the end of calendar Q2 2021. (Note that performance in USD has been worse due to the weakness in sterling).

Clearly this has been another rough year for BT, with the firm badly underperforming domestic benchmark indices. What’s worse, YTD financial results haven’t actually been that bad given that revenue and earnings have both landed within consensus estimates. My guess is that two things have spooked the markets here: the company’s cash flow line and the broader macro environment, specifically inflation. Both are connected, of course, and with BT particularly sensitive to these issues the market’s reaction makes a bit more sense.

While the above does mean that the company may face a tougher outlook than before, the sell-off here is extreme and looks overdone. These shares are now trading at a material discount to my fair value estimate and may appeal to investors seeking deep value. Strong buy.

Results Largely In Line

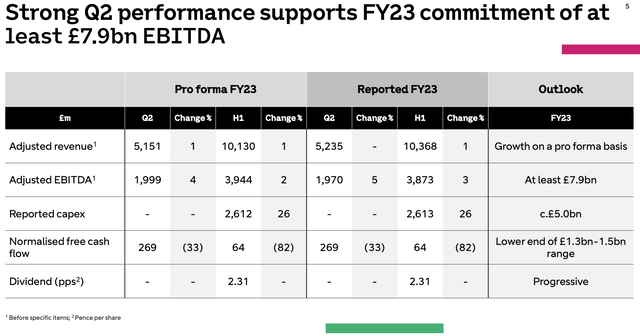

We already have a couple of FY23 quarters to digest given BT’s fiscal year ends next March, and as I said in the introduction the company’s top and bottom line performance has actually been okay. Revenue for the first half of FY23 was £10.4B, up 1% year-on-year and good for a small beat versus the sum of consensus estimates for Q1 and Q2. That was driven by good performance in the Openreach and Consumer divisions, where inflation-linked price hikes and unchanged low churn levels helped offset revenue declines in Enterprise and Global as well as the disposal of BT Sport.

Source: BT 1H23 Results Presentation

Adjusted EBITDA came in at just under £3.9B for the first half of the year, again slightly ahead of the sum of consensus estimates for Q1 and Q2. EBITDA margin was 37.4%, up over 100bps year-on-year. That was helped by strong operating leverage at Openreach, where EBITDA was up double-digits to £1.71B on a mid-single-digit increase in revenue, and Consumer, where EBITDA was up 20% on a 3% increase in revenue. Net income was £893m (~9.1 pence per share), again beating the consensus estimate.

Cashflow, Inflation Likely Pinning Stock Back

With revenue and earnings broadly landing in-and-around analyst estimates it is clearly other factors that are responsible for the sell-off. Those are likely to center on the company’s cashflow situation and the broader macro backdrop in the U.K., chiefly relatively high inflation.

With that, normalised free cash flow was a rather meagre £64m, way down on the £360m posted in the year-ago period and also far below consensus estimates. Followers of the stock and my previous articles will know that BT is facing no shortage of calls on its cash flow these days, with the firm in a CapEx-heavy spell right now as it rolls out fiber-to-the-premise (“FTTP”) and 5G across the country. Throw in the pension deficit and conventional debt load and you can see why the cashflow line is so closely monitored here.

Free cash flow was down on significantly higher levels of CapEx, which was up over 25% year-on-year excluding spectrum payments. That saw net debt rise to just over £19B, up from circa £18B at the start of FY23 and ahead of the consensus estimate of around £18.8B. At £13.5B, net financial debt (i.e. excluding lease liabilities) also came in higher than expected. While part of this was due to BT’s FTTP rollout coming in ahead of plan, with the firm now over one-third of the way toward its 25 million 2026 target, macro conditions, specifically inflation, are also to blame.

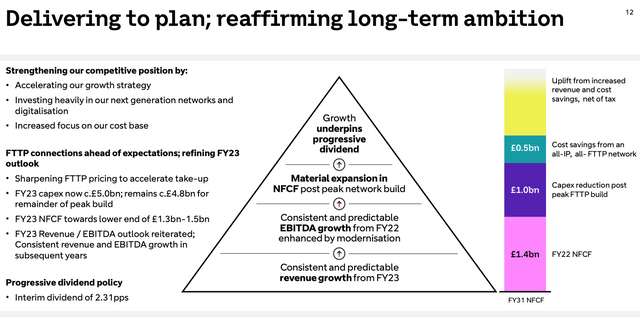

On that note, BT is particularly sensitive to inflation for a few reasons. Firstly, it is a very CapEx intensive business, more so right now due to its investment cycle. Secondly, with higher inflation comes higher interest rates, and refinancing its debt at higher yields could eat into operating margins. Finally, and like most firms right now, higher inflation is putting upward pressure on its cost base, with energy prices and labor costs particularly acute issues. The company does plan another round of inflation-linked price hikes next year to offset this, though whether it can pull this off without affecting churn rates remains to be seen. Management has also upped its cost savings program to £3B by year-end FY25, up from £2.5B previously (and £2B by year-end FY24), but again it remains to be seen whether it can achieve this.

Valuation Now Deeply Depressed

BT shares trade around the 113 pence per share mark at time of writing, putting them at around 6.25x consensus FY23 EPS estimates. The prospective dividend yield is 6.9%, again based on consensus estimates for FY23.

Despite the issues outlined in the previous section management is broadly sticking with its near and mid-term financial outlook. FY23 CapEx is seen at £5B, up from £4.8B previously but with the difference funded by a £200m tax refund. Normalised free cash flow is likewise still seen at £1.3B-1.5B, albeit guidance is now at the low-end of that range. Mid-term guidance regarding CapEx and post-build free cash flow remains unchanged.

Source: BT 1H23 Results Presentation

Plugging the above into my DCF model isn’t the easiest given the number of moving parts here (the pension deficit payment schedule, investment CapEx and so on), but the share price and valuation is now so depressed that BT can afford to materially underperform and still come out fine from an investment perspective. On conservative growth assumptions and normalizing free cash flow post-FTTP rollout I get a fair value of circa 215 pence per share, up slightly from my last piece. That’s around 90% above the prevailing price and should offer enough margin of safety for prospective value investors given the risks here. Strong Buy.

Be the first to comment